MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

My friend, Sarah Page, recently took a trip to Brazil to escape the dismal winter weather in Buenos Aires that drove me to Brazil and then Europe myself. She and her friends used tips they learned from this blog to save money and earn extra travel rewards on the trip.

I will go through those tips below so you can learn from their experience. (Ignore the fact that she started in Buenos Aires. Almost all the tips are relevant even if you start your trips in the United States.)

What She Did to Make Their Brazilian Vacation Cheaper & More Rewarding

- Found a cheap roundtrip flight to Rio de Janeiro via Kayak price alerts.

- Accrued Delta Skymiles for flying GOL.

- Charged the cash ticket on her Barclaycard Arrival Plus so she could redeem Arrival miles to make it even cheaper.

- Avoided the currency conversion fee on Airbnb by paying in Brazilian Reals instead of US Dollars.

- Negotiated lower price for Airbnb rental.

- Charged the car rental on her Citi Prestige to take advantage of excellent international rental insurance coverage.

- Received a $50 Airbnb credit for inputting a business email address into her account.

- Rented a car through American Airlines to earn extra miles.

- Used a Mastercard for all foreign purchases.

Found a cheap roundtrip flight to Rio de Janeiro via Kayak price alerts.

![]()

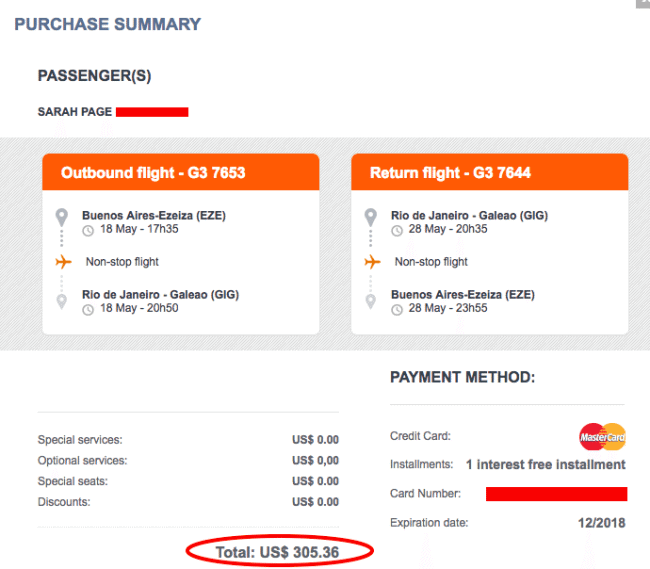

Over the last few years, I’ve saved hundreds of dollars by setting Kayak price alerts to track the price of a plane ticket I need to buy for a few weeks before booking when the price drops. That’s exactly what Sarah Page did since she couldn’t find a way to use her miles efficiently for travel between Buenos Aires and Rio de Janeiro.

She got her roundtrip tickets for sale for only $300. When I looked for tickets a few weeks earlier I was seeing them in the $600 range!

Kayak price alerts are an extremely simple tool that everyone should know about to save money on cash tickets for trips you know you are going to take in advance. To learn how to use them, read my guide about Hot to Set Kayak Price Alerts for Cheap Cash Tickets.

Of course, most of you reading this start your trips in the US, so you could probably find a more efficient use of use of your miles for a flight to Brazil. For example, it only costs 35,000 Asiana miles (no fuel surcharges) to fly a Star Alliance partner’s Business Class between the US and Argentina, Brazil, Chile, Paraguay, or Uruguay. Asiana is a 1:1 transfer partner of SPG points, and every 20,000 point transfer of SPG points to an airline partner gets a 5,000 mile bonus, so the Business Class award would actually cost 30,000 SPG points. Read Anatomy of an Award: USA to Chile in Business Class for 35,000 Miles to learn more.

United flies to Rio de Janeiro–Galeão International Airport (GIG) from Houston, and to São Paulo–Guarulhos International Airport (GRU) from Chicago, Houston, Newark, and Washington D.C., with connections on Azul to Rio de Janeiro–Galeão International Airport (GIG).

Accrued Delta Skymiles for flying GOL.

GOL isn’t a member of any alliance, but it has a one-off alliance with Delta that allows earning and redeeming of SkyMiles with GOL. Sarah Page input her Delta Skymiles account number when confirming her reservation on GOL. Just because you fly a paid ticket on a certain airline doesn’t mean you have to earn the miles in that frequent flyer program. You can choose to earn the miles with any of its partners instead. Usually all of an airline’s partners are displayed in a dropdown menu at some point near the ticket purchase screen.

Charged the cash ticket on her Barclaycard Arrival Plus so she could redeem Arrival miles to make it even cheaper.

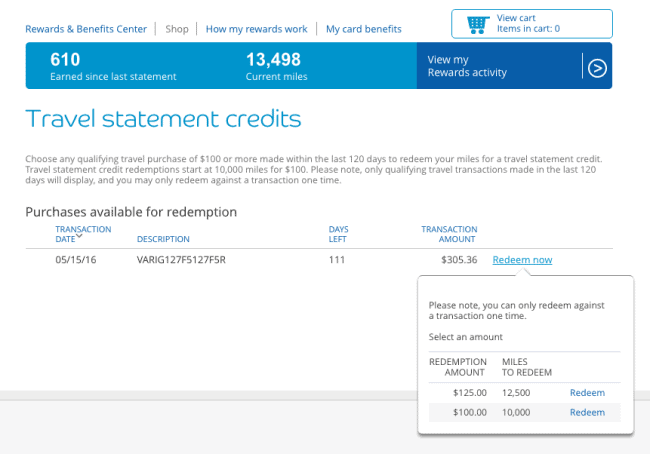

She got the Barclaycard Arrival Plus card last year and still had some Arrival miles leftover from the sign-up bonus, so she charged her GOL ticket on it and redeemed the remaining Arrival miles that she could for a statement credit of $125.

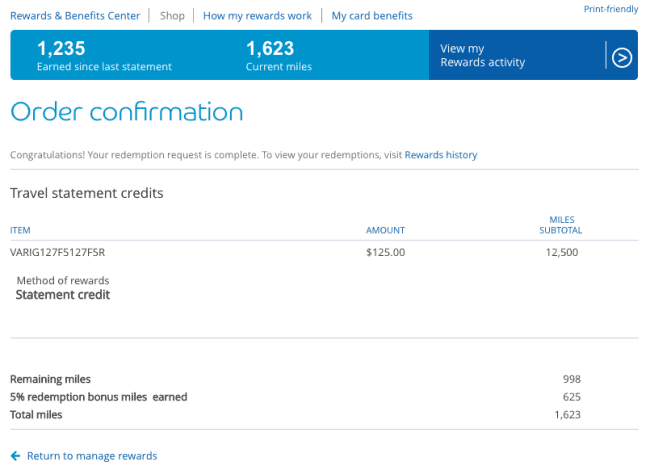

Below is the confirmation that shows the 5% rebate you get with every redemption.

Below is the confirmation that shows the 5% rebate you get with every redemption.

Read more details here about how to redeem Arrival miles for statement credits.

The Arrival Plus comes with 40,000 bonus miles after spending $3,000 in the first 90 days that can be used to book any flight, any hotel, any car rental, and a lot more. It is a great card when other types of miles would be inefficient like in this case.

If she hadn’t had any Arrival miles left, the best strategy would have been to use either of the American Express Gold cards, the Citi Prestige® Card, or the Citi ThankYou® Premier Card. All four cards offer three points per dollar on airfare spending (the business Gold only earns 3x if you designate it as your biggest spending category), and I value points from all three similarly. Read more here about the best card to use when purchasing air fare.

Avoided Airbnb’s 3% currency conversion fee by paying in Brazilian Reals instead of US Dollars.

Previously, you could change the payment currency on Airbnb to the host’s currency. That saved you Airbnb’s ridiculous 3% currency conversion fee. Then Airbnb scandalously took away that option. But you can avoid Airbnb’s 3% currency conversion fee with this trick, like Sarah Page and her friends did:

At the bottom of the Airbnb home page, you can change the currency to the currency of the host before searching.

They changed the currency to Brazilian Real and did a search in Brazil. Search results were in Real. When they selected a property and went to the payment screen, they were shown the price of the house in Reals instead of US Dollars.

They changed the currency to Brazilian Real and did a search in Brazil. Search results were in Real. When they selected a property and went to the payment screen, they were shown the price of the house in Reals instead of US Dollars.

Negotiated a lower price for Airbnb rental.

Prices for rentals on Airbnb are negotiable–don’t be afraid to undercut the listed rate. You should especially consider negotiating if you are booking last minute. If it’s not rented out already, perhaps the owner is willing to bargain in order to fill the rental. After all, some money is better than none. They ended up negotiating the price down by about 15% of the original listed amount.

Received a $50 Airbnb credit for inputting a business email address into her account.

After confirming the reservation, she was offered a $50 credit after taking an Airbnb business trip. The only condition was that she included a “work email” on her profile. This could be any email address that is not free (i.e. not Gmail).

This was not a targeted offer, anyone can access this Airbnb for Business promotion here.

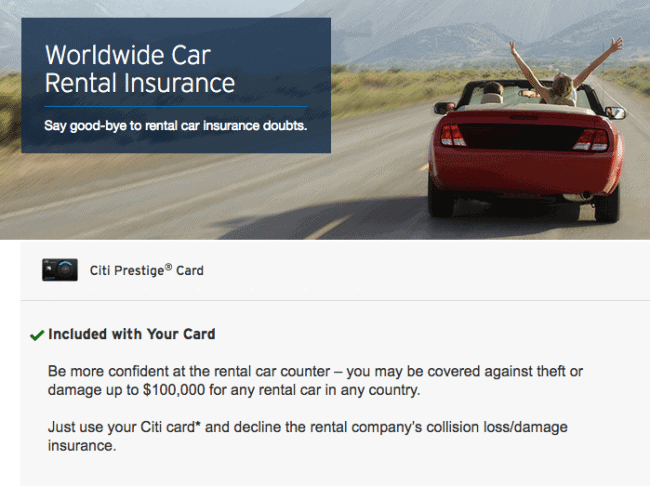

Charged the Car Rental on her Citi Prestige® Card to take advantage of its excellent international rental insurance coverage.

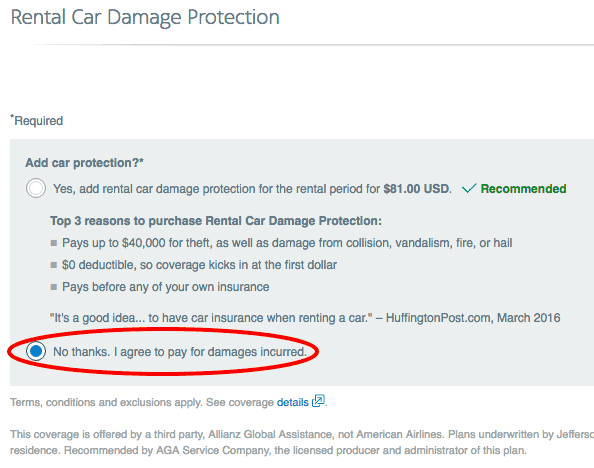

The Citi Prestige® Card comes with primary rental insurance when renting outside the United States, so she made sure to put the rental car on that card. All you have to do is decline the rental agencies insurance:

The primary international insurance is good for rentals of up to 31 consecutive days, and covers $100,000 in repairs or the cash value of the card, whichever is a lesser amount. Within the the US, the rental insurance offered is secondary.

The primary international insurance is good for rentals of up to 31 consecutive days, and covers $100,000 in repairs or the cash value of the card, whichever is a lesser amount. Within the the US, the rental insurance offered is secondary.

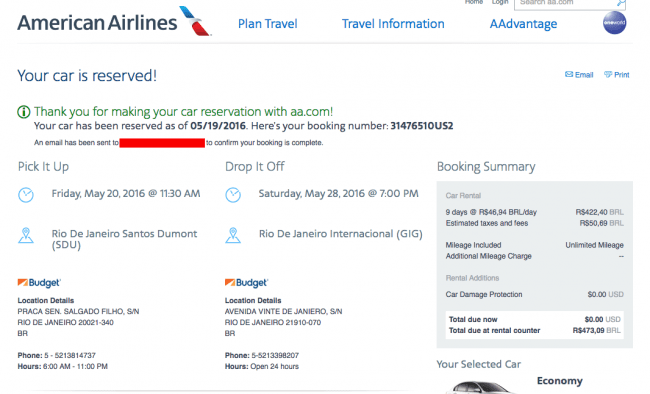

Rented a car through American Airlines to earn extra miles.

Did you know you can earn miles for renting a car, on top of whatever category bonus you might get from your travel rewards card? For example, here are the links to rent a car through:

Compare the airlines’ rental car quotes to ones you see off of sites like Expedia or Kayak to make sure they are the same (all the ones I checked I were), and then move ahead with booking it through the airline who’s miles you value the most.

Sarah Page rented a car through Budget using American Airlines’ portal (the link above). You simply fill in your AAdvantage account number when confirming the reservation.

Note that she did not fly American Airlines into the airport where she picked up the car (she actually didn’t even fly into that airport at all). That does not matter as far as eligibility to earn the extra miles.

Note that she did not fly American Airlines into the airport where she picked up the car (she actually didn’t even fly into that airport at all). That does not matter as far as eligibility to earn the extra miles.

She’ll earn at least 500 miles for renting through Budget:

Used a MasterCard for all foreign purchases

If you make a lot of purchases in foreign currencies and haven’t read my post about currency conversion fees, read it now. I assume you know enough to only use a card without foreign transaction fees on international charges, but even so you could be losing money if using a Visa instead of a Mastercard.

Currency conversion fees are separate from foreign transaction fees and are levied on every foreign purchase as they are built in via worse than market price exchange rates. MasterCard consistently beat Visa’s conversion rate by between 0.2% to 1.7% on the four currencies I checked.

Sarah Page followed my advice and only used her Citi Prestige® MasterCard while in Brazil.

Bottom Line

Brazil is gorgeous, I just traveled through it myself and loved it. Read more here about my experience spelunking and snorkeling in Bonito, Brazil.

But even if you don’t want to travel to Brazil, the tips Sarah Page and her friends used to save money and earn extra rewards could apply for travel anywhere. Miles are our main squeeze when it comes to saving big money, but don’t forget other strategies like Kayak Price Alerts and optimizing Airbnb bookings– these things can save you tons as well.