MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The card offer described in this post has expired. To see the latest top travel credit cards with big bonuses that will save you tons, check out our Top 10 List for Consumers and Top 10 List for Small Businesses.

The Barclaycard Arrival Plus is a tool every frequent flyer should have in their wallet, especially big spenders and families. In essence, the card earns 2.1% back toward travel on all purchases. (Not to mention the sign up bonus worth $400 toward travel after spending $3,000 in the first 90 days on the card.)

With Arrival miles, you can book any flight on any airline with no blackouts and no need to search for award availability. You can even use the rewards to pay for the taxes and fees on other airlines’ award redemptions.

For a complete breakdown and analysis of the Arrival Plus, make sure to check out my comprehensive review here.

This post is a simple walk through of how to redeem your Arrival miles for travel purchases, as well as some pitfalls to avoid when doing so.

- How do you redeem Barclaycard Arrival Miles on travel?

- When do you receive your 5% rebate?

- Can you use Arrival miles as partial payment towards a charge?

- Is the redemption process simple?

- How do you avoid lower value redemptions?

When I got the Barclaycard Arrival Plus, I met the $3,000 minimum spend quickly, and the bonus miles posted.

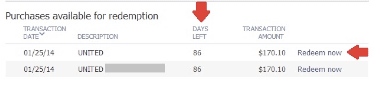

I then used the card to pay for the taxes and fees associated with two United awards I booked. You absolutely have to use your Arrival Plus to charge whatever travel expense you want to redeem your miles for.

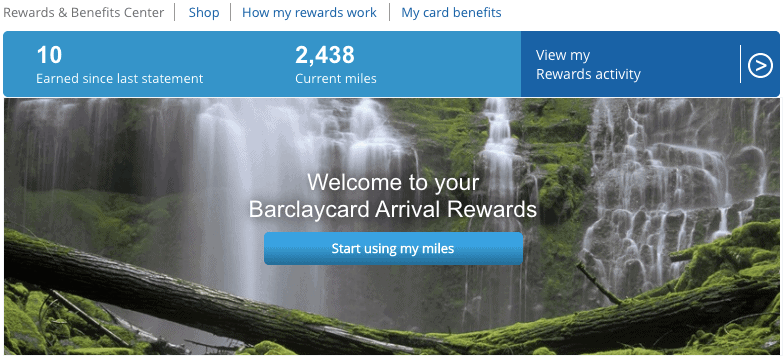

The first step in redeeming is to log into your Barclaycard account and to click on the “Rewards & Benefits Center.” Then click “Start using my miles.”

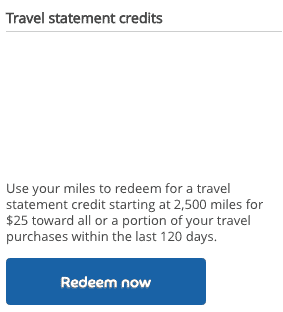

Next select “Redeem now” under “Travel statement credits.”

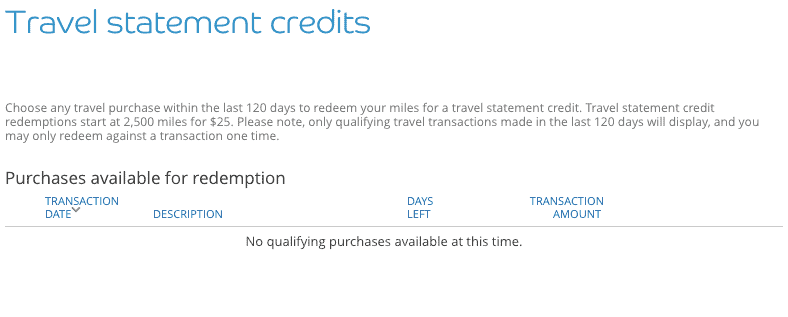

Next select “Redeem now” under “Travel statement credits.” There you’ll find any qualifying travel purchases you’ve made in the last 120 days.

There you’ll find any qualifying travel purchases you’ve made in the last 120 days.

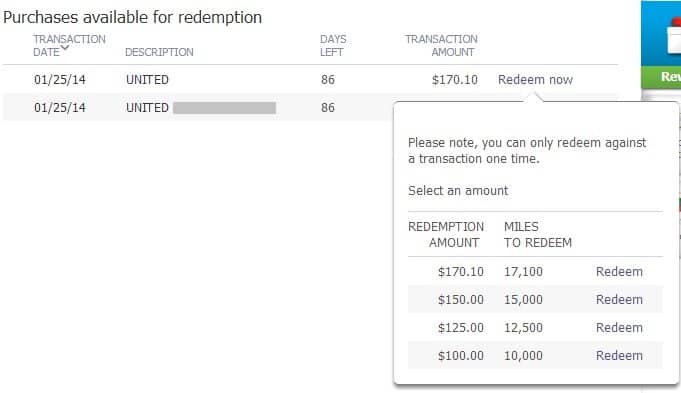

When you have eligible purchases, you see how many days you have left to redeem them, and you see a button to “Redeem now.”

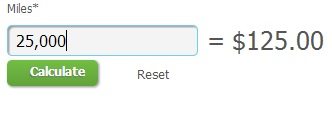

New cardholders can redeem for the full amount or partial amounts down to 10,000 miles for $100 off. (Older cardholders may be grandfathered into redeeming as few as 2,500 miles for $25.)

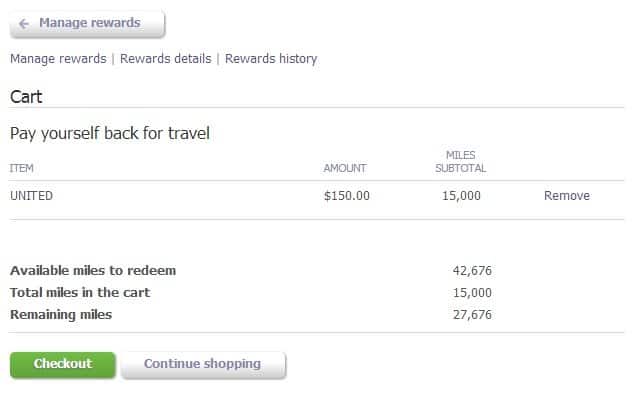

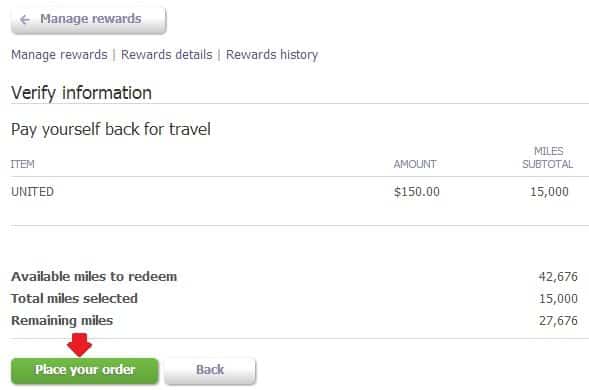

After you click the green “Checkout” button and was able to review my order before hitting the green “Place your order” button.

Immediately after placing the order, I received confirmation of the redemption. The best part is the 5% rebate happens automatically automatically, and the points are instantly credited back to your account!

A net redemption of 9,500 Arrival miles (10,000 – 500 rebate) saves you $100. That’s a rate of 1.05 cents per mile.

What about redeeming Arrival miles for cash back? Is that a good value?

I don’t recommend this redemption at all. You only receive 0.5 cents per point when requesting cash back, as opposed to getting 1.05 cents back when redeeming Arrival miles for travel related purchases.

Can you redeem Arrival miles for gift cards?

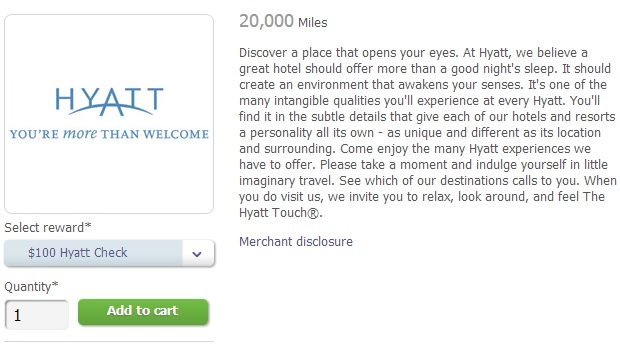

That’s also an ill-advised move, as you are again receiving 0.5 cents per mile in value. You would accrue Gold Passport points if using the Hyatt gift card for a hotel stay, but that’s a small consolation. Using Arrival miles on a Lowe’s or Outback Steakhouse gift card (two of the scarce available options) is a poor deal.

Recap

Redeeming your Arrival miles for travel related purchases (hotels, flights) is a simple process and the absolute best use of your miles. You get 1.05 cents per mile in value since the 5% rebate credits to your Arrival mile balance instantaneously.

Arrival miles are a fantastic way to be reimbursed for the taxes on traditional awards or to pay for cash tickets that still earn miles and status with the legacy carriers.

Do you know if Barclaycard will strictly go by the merchant category? I need to pay the final amount on a VRBO rental through PayPal. When I made the initial deposit payment, it showed up as “advertising services” even though it is a small B&B business. I would love redeem for travel here, but won’t use this card unless I can get the rebate.

Lynn, I encountered something similar–A tour operator that I used listed themselves as a direct marketing company. I called in the rep told me that they could open a case for a manual travel credit so that might be worth an shot for you. I would avoid using PayPal as an intermediary for travel expenses you might want to redeem for. I know that a lot of cc companies won’t give you category bonuses if you go through PayPal e.g. if you use your Ink card at an office supply store but use it through PayPal. (I think, not 100%, that PayPal becomes the merchant listed). Not worth it to me to take that chance if I want to redeem/get a bonus.

I looked over some travel that we did while qualifying for the initial miles using the Barkclaycard arrival+ card. Their categories all seem relevant (TRAVEL AGENCIES, DAYS INN, and ECONO TRAVEL MOTOR HOTEL) yet these do not appear on the “travel statement credit” page.

Has Barclay begun to disallow credit for travel done during the “initial spend” period?

Not that I’m aware of. Were the purchases you are looking at made within the last 120 days and for $100 or more? If not, then that’s your problem.

Lynn, I second Gaurav here. Barclay’s will only consider it a redeemable travel expense if the merchant code considers your B&B payment a “Hotel” or “Motel & Resort.” It’s risky to gamble on it unless you’re very comfortable only receiving the Arrival miles for the purchase and not redeeming if the merchant code turns out to be in another category.

Does anyone know if tickets purchased on http://www.raileurope.com/ are considered travel expense as far is Barclay is concerned?

Should be. Shocking if it weren’t. But it all comes down to the coding, so I can’t say for sure.

> it all comes down to the coding

Verbal evidence, via phone call explanation,

overrides the wrong coding, IME with this card.

Then it seems like a slam dunk!

My cc churn strategy is to:

a. achieve sign-up-spend bonuses

b. stop using cc start another cc

c. quit cc after ~8 mos

d. start (a) again after 1 yr if similar bonus

So if I’m travel-spending-down $444+,

& getting 10% added back each time,

there will always be miles sacrificed

at cc cancellation time, right?

(but a new $444 cycle after 1 yr)

Thanks!

Like all bank point cards, you lose the points if you cancel the card. Since you can redeem in 2,500 point increments, you should lose at most $25 worth of points.

Hi there,

I’m wondering if you could make a guide for newbies on how to plot (and plan) a round the world trip? I’ve seen posts on one world alliances/etc, but how does one actually go about planning it and actually figuring out the mile requirements/best ways to do it?

Please and thank you 🙂

I wrote a series on American Airlines Explorer awards, which are the best for RTW awards. Check out the first two posts:

https://milevalu.wpengine.com/american-airlines-explorer-award-the-rules/

https://milevalu.wpengine.com/american-airlines-explorer-award-planning-a-rtw-trip/

I think it would have been appropriate to list the $89 non-waived annual fee somewhere in this lengthy description of the Barclay Arrival card.

@ Miles, my annual fee was waived for the first year… as is the fee on the current offer. Did you have to pay a fee for your first year?

Oops, my mistake: I thought it was not waived. Thank you for the corrected information, Gaurav.

Oops, my mistake. Thank you for the corrected information, Gaurav.

Scott, do OTA’s like Expedia, Hotels.com, Booking.com etc show up as travel and therefore can benefit from the redemption ?

Yes!

Scott, thats great to know thanks. Does AIRBNB show the same way ?

Probably, but check Shock Shooter’s comment above:

“Verbal evidence, via phone call explanation,

overrides the wrong coding, IME with this card.”

It looks like even if it doesn’t, you can call in and redeem miles for it as a travel expense since it is a legit travel expense.

Yes, Airbnb shows up as redeemable– no call to customer service is necessary.

Do you know if there are any restrictions for getting statement credits back on the initial $1,000 spending requirement? For example, I’m interested in getting the card to book travel expenses for a trip this summer. I was planning on using those travel expenses to meet my $1,000 spending requirement and then pay myself back with the miles bonus.

That’s completely fine. Once you clear the $1,000, the 40K post to your account shortly thereafter. You can then use those miles to pay off the travel-related charges as normal.

Could a rental car booked through a site like expedia be a travel expense?

Yes!

[…] the redemption side, 1 Arrival mile is worth 1.11 cents on all travel redemptions (see How to Redeem Arrival Miles) while a FlexPoint can be worth 1.33 to 2 cents. Use the FlexPoints when they are worth close to 2 […]

[…] Then you can redeem your Arrival miles to eliminate the $100 from your statement. You would need to redeem 10,000 Arrival miles to remove a $100 charge from your statement. (See How to Redeem Barclaycard Arrival Miles.) […]

[…] that the points are worth 1.1… cents with the last 1 repeating forever. After all, you get an instant 10% rebate when you redeem Arrival miles online for any travel expense. (This is often stated as the points being worth 1.1 or 1.11 […]

Do any airline gift cards (e.g. AA) get flagged as a travel expense?

I too want to know that. I just got my 40k bonus points and dont have any travel coming up soon. I was thinking of buying TRAVEL gift cards (From AA.com or United.com) and using them at a later time. However – will these be tagged as TRAVEL and can be reimbursed ? I guess someone must have tried this out ?

I tried this with Southwest and the purchase of a Southwest gift card was tagged as travel and qualified for the reimbursement.

[…] The miles earned on the card can be used toward any flight, any time, on any airline without needing to search for award space. Redemption couldn’t be easier. […]

[…] I’d hop between the islands on cash tickets (usually about $80 per segment), with Arrival miles, or with 6k United miles on Hawaiian flights if cash prices are […]

If you need to close your card but still have points left to redeem before closing then you can use your card to buy gift cards from an airline’s website (I used Southwest.com to buy a Southwest gift card) and then go to the Barclays website and redeem your points for the purchase since they are considered to be in the travel category.

Great tip!

[…] I paid for the ticket with my Barclaycard Arrival(TM) World MasterCard® – Earn 2x on All Purchases, and I plan to remove part or all of the flight charge from my credit card statement by redeeming Arrival miles for the flight. (Here’s how.) […]

[…] How to Redeem Barclaycard Arrival Miles […]

[…] Redeem 24,200 Arrival miles to fully eliminate the charge from your credit card statement. Instantly receive a 10% rebate when using your Arrival miles towards travel purchases. The actual cost is only 21,780 Arrival miles (24200 – 2420) factoring in the 10% rebate. For more info on the simple redemption process, check out my post, How to Redeem BarclayCard Arrival Miles. […]

[…] For screen shots and more details, see How to Redeem Barclaycard Arrival Miles. […]

[…] Here’s how to redeem Arrival miles in detail. […]

[…] See how to redeem Arrival miles. […]

[…] That means buying them looks the same as buying airfare, which means you can redeem Arrival miles (here’s how) from the Barclaycard Arrival PlusTM World Elite MasterCard® for free […]

[…] best value is always the largest $25 increment available. (Tell us why in the comments; Bill told us why here.) You can do one redemption at a time or bunch several together at […]

You said that the statement credit does not count as a payment, so you must still make the minimum payment.

If the only thing I charge for the month is $400 in travel expenses, then

I Immediately apply a $400 credit, does this mean I must still make a payment even though my balance would be $0.00?

No, you would not have to make a payment if your balance were 0.

[…] At any point within 120 days of purchase, you could redeem Arrival miles to make that $300 charge go away. Here’s how to redeem Arrival miles. […]

Hi, Scott! Any idea if I could qualify to receive the bonus on this card second time? I currently have this card, but plan to close it, since the yearly fee approaches. How soon can I apply for it again? Many Thanks for your reply and for insightful articles!

I don’t know the answer. Sorry.

My 20K points were posted on account when I open this card; I woked hard to accumulate an additional points toward my June travel. Today, my account shows 36,400 points. I am need to redeeme them toward my account ballance, a what a surprize: I can only redeeme those poins that I accumulated have recently accumulated for previous travel to Arizona, or within 90 days for 10%, using 1,700 points which is less than required 2,500 for $25. Any advise?

I don’t understand your question.

[…] you can redeem Arrival miles for a statement credit to offset the price of the ticket. For 59,900 miles, you can get a $599 Mint […]

So I can book a flight on Jetblue and pay for it with this credit card?

If the charge on Jetblue is $500, I can cover it with 50,000 points?

[…] flight, book it with your Barclaycard Arrival PlusTM World Elite MasterCard®, so that you can redeem Arrival miles to make the flight free. Meeting the minimum spending requirement of $3,000 in 90 days on the […]

[…] Book your ticket with your Barclaycard Arrival PlusTM World Elite MasterCard® and you can redeem Arrival miles to offset the cost of the flight, meaning you can potentially book these flights for zero cash. Here’s how to redeem Arrival miles. […]

[…] Book your ticket with your Arrival Plus and you can then remove the taxes and fees from your statement by redeeming Arrival miles. […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes, fees, and fuel surcharges with the Arrival Plus then redeem Arrival miles to remove the […]

[…] for your cheap flights intra-country with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your summer trip to Hawaii with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your Uber rides with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your La Companie (or any other) flights with the Arrival Plus. Book your ticket with the card then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] – I'll have to dig a bit to provide concrete evidence. Here is an example from early 2014: https://milevalu.wpengine.com/how-to-rede…arrival-miles/ I have to admit that I was focused on the redemption amount not being an even increment of 2,500 […]

Could you explain how to know which travel award accounts require that you pay the entire amount of a travel purchase with points or whether you can redeem points even if you do not have enough to cover the entire amount of the travel amount? e.g. If I have enough points to cover $1500 of a $3000 purchase, can I apply the $1500 or do I have to wait until I would have enough points to cover the entire $3000 purchase? Thank you for all the help you provide to so many of us!

The Arrival card allows partial redemptions. I don’t know about other programs.

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your the taxes and fees on your mysteriously-priced awards with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] Use your Barclaycard Arrival PlusTM World Elite MasterCard® to book the hotel stays. The card comes with 40,000 bonus miles after spending $3k in the first 90 days. Just meeting that minimum spending requirement means you’ll have 46,000 Arrival miles, which are worth more than $500 in free flights on any airline with no blackouts, any hotel stay, any car rental and more. Book your hotel stays with the Arrival Plus then redeem Arrival miles to remove the charge. […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] the award taxes on a United Dreamliner redemption with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your China Airlines award taxes and fuel surcharges with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] (If you don’t know what I’m talking about, the Arrival Plus earns 2 miles per dollar on all purchases, and you can use the miles to redeem for any travel purchase at a rate of 1.14 cents per mile. Here’s how redemption works.) […]

[…] can redeem Arrival miles from the Barclaycard Arrival PlusTM World Elite MasterCard® to eliminate the cost of your […]

[…] It means you can purchase LifeMiles, then use your Arrival miles for an offsetting statement credit. […]

[…] cardholders get a 10% rebate on miles redeemed to offset travel purchases (How to Redeem Arrival Miles). That will drop to 5% for new cardholders. This drops the value of an Arrival mile from 1.14 cents […]

[…] It means you can purchase American Airlines miles, then use your Arrival miles for an offsetting statement credit. […]

[…] That means buying them looks the same as buying airfare, which means you can redeem Arrival miles (here’s how) from the Barclaycard Arrival PlusTM World Elite MasterCard® for free […]

[…] It means you can purchase LifeMiles, then use your Arrival miles for an offsetting statement credit. […]

[…] It means you can purchase LifeMiles, then use your Arrival miles for an offsetting statement credit. […]

[…] Redeem 24,200 Arrival miles to fully eliminate the charge from your credit card statement. Instantly receive a 5% rebate when using your Arrival miles towards travel purchases. The actual cost is only 22,990 Arrival miles (24200 – 1210) factoring in the 10% rebate. For more info on the simple redemption process, check out my post, How to Redeem BarclayCard Arrival Miles. […]

[…] Arrival miles in your online account. A $99 flight would be 9,900 Arrival miles. Here’s How to Redeem Arrival Miles. The card currently comes with 40,000 bonus miles after spending $3,000 in the first 90 […]

[…] It means you can purchase American Airlines miles, then use your Arrival miles for an offsetting statement credit. […]

[…] I told him that his best bet was to book a Singapore miles award to Baltimore or Boston (see previous answer) and then a WOW Air flight to Iceland with 9,900 Arrival miles. […]

[…] It means you can purchase American Airlines miles with your Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit. […]

[…] Arrival Plus earns bank points that can be redeemed like cash toward any flight or other travel expense at a rate of just over 1 cents […]

[…] How to Redeem Barclaycard Arrival Miles | … – Redeem 24,200 Arrival miles to fully eliminate the charge from your credit card statement. Instantly receive a 10% rebate when using your Arrival miles towards travel … […]

[…] If you didn’t follow that, check out How to Redeem Arrival Miles. […]

[…] It means you can purchase LifeMiles with the Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit. […]

[…] The Barclaycard Arrival PlusTM World Elite MasterCard® earns 2 miles per dollar on all purchases, which is worth 2.28% back toward travel. In May, Barclaycard expanded the definition of travel, so that you have a ton of options to redeem Arrival miles for statement credits. […]

[…] It means you can purchase American Airlines miles with your Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit. […]

[…] Airline can be booked with cash, which means you can use Arrival miles or the $250 Air Travel Credit on the Citi Prestige® Card to pay for the flight. I couldn’t […]

[…] See how to redeem Arrival miles. […]

[…] are ways to book any flight on any airline for free. Use Arrival miles or the $250 Air Travel credit on the ThankYou […]

[…] the redemption side, 1 Arrival mile is worth 1.11 cents on all travel redemptions (see How to Redeem Arrival Miles) while a FlexPoint can be worth 1.33 to 2 cents. Use the FlexPoints when they are worth close to 2 […]

[…] How to Redeem Barclaycard Arrival Miles […]

[…] best value is always the largest $25 increment available. (Tell us why in the comments; Bill told us why here.) You can do one redemption at a time or bunch several together at […]

[…] I paid for the ticket with my Barclaycard Arrival Plus™ World Elite MasterCard®, and I plan to remove part or all of the flight charge from my credit card statement by redeeming Arrival miles for the flight. (Here’s how.) […]

[…] you can redeem Arrival miles for a statement credit to offset the price of the ticket. For 59,900 miles, you can get a $599 Mint […]

[…] flight, book it with your Barclaycard Arrival PlusTM World Elite MasterCard®, so that you can redeem Arrival miles to make the flight free. Meeting the minimum spending requirement of $3,000 in 90 days on the […]

[…] pay the taxes and fees with my Barclaycard Arrival PlusTM World Elite MasterCard®, so I could redeem Arrival miles for an offsetting statement […]

[…] can redeem Arrival miles for a statement credit to offset the price of the ticket. For 59,900 miles, you can get a $599 Mint […]

[…] You can use 46,000 Arrival miles for $460 in free flights or $450 off a more expensive flight. (Plus when you make the redemption you’ll instantly get back 4,600 Arrival miles worth another ….) […]

[…] The total cost of the three discounted awards is 40,000 American Airlines miles, 20,000 Flying Blue miles, and $186.08. You could even redeem Arrival miles to eliminate the $186 out of pocket. […]

[…] One cool thing about Arrival miles is how they are redeemed. You put any travel expense on the credit card including airfare, hotels, car rentals, and much more, and then you have 120 days to go online and redeem Arrival miles for a full or partial credit to offset that travel expense. (Redeeming is super easy. Here’s how.) […]

[…] your award taxes and fees with the Arrival Plus then redeem Arrival miles to remove the […]

[…] book awards to Tahiti. To get anywhere else in French Polynesia, you need to book a paid flight (or redeem Arrival miles) to Mo’orea or Bora […]

[…] Book your ticket with your Arrival Plus and you can then remove the taxes and fees from your statement by redeeming Arrival miles. […]

[…] It means you can purchase LifeMiles, then use your Arrival miles for an offsetting statement credit. […]

[…] It means you can purchase LifeMiles, then use your Arrival miles for an offsetting statement credit. […]

[…] time you redeem Arrival miles for travel, you instantly get 5% of the points you just redeemed rebated back to your […]

[…] You could redeem 29,100 Arrival miles to get a free $289 ticket on any airline. You’d still earn Delta miles on the flights, and you’d even get 1,450 Arrival miles back upon redemption. More on redeeming Arrival miles. […]

[…] can of course use the $250 Air Travel Credit on your Citi Prestige® Card, Arrival miles, or ThankYou Points to get the flight for […]

[…] You could redeem 43,500 Arrival miles to get a free $435 ticket on any airline. You’d still earn Delta or United miles on the flights, and you’d even get 2,175 Arrival miles back upon redemption. More on redeeming Arrival miles. […]

[…] It means you can purchase LifeMiles with your Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit. […]

[…] It means you can purchase LifeMiles with your Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit. […]

[…] or Bora Bora with miles? You’ll have to go to Tahiti first and then pay for a flight (or redeem Arrival miles) […]

[…] It means you can purchase LifeMiles with your Barclaycard Arrival Plus™ World Elite MasterCard®, then use your Arrival miles for an offsetting statement credit. […]

[…] One cool thing about Arrival miles is how they are redeemed. You put any travel expense on the credit card including airfare, hotels, car rentals, and much more, and then you have 120 days to go online and redeem Arrival miles for a full or partial credit to offset that travel expense. (Redeeming is super easy. Here’s how.) […]

[…] went through the steps to Redeem Arrival Miles, and his only three travel purchases in the last 120 days were […]

[…] Arrival miles in your online account. A $195 flight would be 19,500 Arrival miles. Here’s How to Redeem Arrival Miles. The card currently comes with 50,000 bonus miles after spending $3,000 in the first 90 […]

I wanted to buy disneyland entrance ticket using expedia.com/ orbitz.com. Has anyone done this before with theme park tickets? Will Barclay considered that as “travel” and hence get reimbursed for it? Thanks!

I think it would count as a travel expense. The wiki in this Flyertalk thread has reports of purchases from expedia.com, orbitz.com, and a general Disneyland ticket all counting.

[…] After signing into your Barclaycard account, you’ll see Manage Rewards where your Arrival miles balance is shown. If you’ve met the minimum spending requirement, your balance should be 56,000+ Arrival miles. Read more about the specifics of redeeming Arrival miles. […]

If I buy true blue points or AA miles, will it count as TRAVEL so I can use my Barclay card miles to pay for it?

Example: Buy 8000 AA miles for $300.

I can use 3,000 Barclay card miles to “pay” for this purchase?

Yes, you can redeem Arrival miles on AA miles. I’ve seen data points that prove you can. As for JetBlue miles, I’m not sure. I can see on their website that TrueBlue miles purchases are processed by Points.com, a separate third party that is not JetBlue and will not show up as JetBlue on your Arrival Plus statement. That makes me second guess whether or not the charge would categorize as travel. It might, but I don’t see any evidence of it in the wiki of this Flyertalk thread.

[…] You should buy this ticket with the Barclaycard Arrival Plus. The card comes with 50,000 Arrival miles after spending $3,000 on the card in the first three months. Arrival miles can be redeemed for 1 cent each toward any travel expense, so the bonus alone will more than cover this roundtrip to Iceland. Learn How to Redeem Arrival Miles. […]

[…] Buy this ticket with the Barclaycard Arrival Plus. The card comes with 50,000 Arrival miles after spending $3,000 on the card in the first three months. Arrival miles can be redeemed for 1 cent each toward any travel expense, so the bonus alone will more than cover this roundtrip to Oslo. Learn How to Redeem Arrival Miles. […]

[…] flights to other islands (including Bora Bora and Mo’orea) that you can purchase with cash or redeem Arrival miles on. Or you can take a ferry to some […]

[…] You should buy this ticket with the Barclaycard Arrival Plus. The card comes with 40,000 Arrival miles after spending $3,000 on the card in the first three months. Arrival miles can be redeemed for 1 cent each toward any travel expense, so the bonus alone will more than cover this roundtrip to Hawaii. Learn How to Redeem Arrival Miles. […]