MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

There are two American Express Hilton credit cards with limited time increased sign up bonuses–the highest we’ve ever seen–that should catch your attention. One even comes with a free weekend night certificate, a totally new benefit included in the enhanced offer.

Sign up for both now and you’ll earn at least 195,000 Hilton points after spending $5,000 total in the next three months, enough for at least 48 free nights at what used to be called Category 1 Hilton hotels, but are now just the lowest tier since Hilton changed their pricing scheme.

The enhanced sign up offers end May 31, 2017.

I have never seen the bonuses higher on the Hilton Honors nor the Hilton Honors Surpass American Express cards. That is significant because of American Express’ once per product per lifetime bonus rule. The best strategy for signing up for Amex cards is to snipe them when the bonuses are historically high. This is that time for the Hilton Honors and Hilton Honors Surpass Cards.

The Offers

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

The Hilton Honors Card from American Express is offering 80,000 bonus points after spending $2,000 in the first three months. It has no annual fee.

The card earns at least 3x Hilton points per dollar spent, so meeting the minimum spending requirement earns 86,000 total Hilton points. Category bonuses are:

- 7 HHonors Points for every $1 spent on hotel stays within the Hilton Portfolio

- 5 HHonors Points for every $1 spent on restaurants, supermarkets, and gas stations

- 3 HHonors Points for every $1 spent on all other purchases

The Hilton Honors Surpass Credit Card from American Express is offering 100,000 bonus points after spending $3,000 in the first three months. It has a $75 annual fee.

It earns at least 3x points per dollar spent, so you will have at least 109,000 Hilton points after completing its minimum spending requirement. Category bonuses are:

- 12 HHonors Points for every $1 spent on hotel stays within the Hilton Portfolio

- 6 HHonors Points for every $1 spent on restaurants, supermarkets, and gas stations

- 3 HHonors Points for every $1 spent on all other purchases

The 86,000 from the Hilton Honors Card plus the 109,000 from the Surpass Card is 195,000 total Hilton points after spending $5,000 and paying one $75 annual fee in the next three months.

New Benefit of the Hilton Honors Surpass Credit Card

The Hilton Honors Surpass Card now comes, upon your first card approval anniversary, with a free weekend night certificate. It can be used at pretty much any Hilton (except these properties), so the obvious strategy to maximize the certificate would be to use it on an expensive Hilton property. It must be used within a year of issuance, which should be more or less the day you were approved for the card.

Read the Top 5 Hiltons Within the US For Redeeming Free Weekend Night Certificates for inspiration of where you could redeem your certificate.

Can You Get the Cards?

You are limited to getting the bonus once per lifetime on American Express personal cards. If you’ve gotten either of these exact cards before, you can’t get it again (publicly) with the bonus. If you are targeted for the offer, then you might be able to get it again.

How to Get 48 Free Nights

The Hilton Honors Card confers automatic Silver status with Hilton.

The Hilton Honors Surpass Card confers automatic Gold status with Hilton (which also comes with lounge access at select hotels, room upgrades, free breakfast at select hotels, and more).

Hilton elites get the fifth night free on award stays, which start at 5,000 points per night.

That means you can stay five nights for 20,000 points, nine separate five night stays plus three more nights with your remaining 15,000 points. That’s a total of (at least) 48 nights at what used to be called Category 1 Hiltons from the combined bonuses of those two cards.

Here are some of our favorite Hiltons, that were previously called…

- Category 1 Hiltons (max 5,000 points per night = at least 48 free nights if you maximize the fifth night free benefit)

- Category 2 Hiltons (max 10,000 points per night = at least 23 free nights if you maximize the fifth night free benefit)

- Category 3 Hiltons (20,000 points per night = at least 11 free nights if you maximize the fifth night free benefit)

Changes to the Hilton Program

Allow me to explain why I keep saying “what used to be called Category 1, 2, 3”. A few weeks ago, Hilton introduced a new pricing scheme along with a few other changes to their loyalty program.

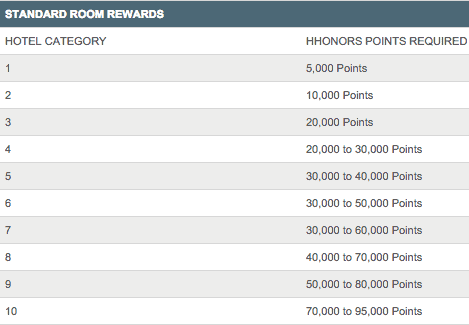

This is the old Hilton chart that will no longer–technically–apply.

Rooms now have variable rates that will fluctuate with supply/demand and the price of the room. Hilton has promised though that the point price of a room won’t rise higher than the top end of what its category was priced on this old chart.

Since our recommended strategy for redeeming Hilton points is to stick with Categories 1-3, these changes don’t affect the advice above. If anything (especially if it’s low season in the area of your hotel), the award price per Category 1, 2, or 3 Hilton could be lower than 5k, 10k, or 20k respectively.

So really, the new pricing scheme means you could potentially end up with more free nights!

Bottom Line

American Express offers two Hilton cards with temporarily increased sign up bonuses through May 31, 2017. You can get both and earn at least 195,000 Hilton points after meeting their combined $5,000 minimum spending requirements (and paying one $75 annual fee), which is enough for at least 48 free nights at Hiltons worldwide. The Hilton Honors Surpass Card has also added the benefit of a free weekend night certificate that more than outweighs the $75 annual fee even if you don’t spend much on the card.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Will those who already have the AMEX Honors Surpass card get the free night certificate on their card anniversary as well?

My exact question!

I’m not 100% sure but I highly doubt you’d get one as this is a limited time offer, not a permanent change to the benefits package.

Here are links to the new offers if you’d be willing to help me and my family out with the referral. Thanks in advance! :

Hilton Surpass -100k bonus + Free Night:

https://www.americanexpress.com/us/credit-cards/personal-card-application/hilton-hhonors-surpass-credit-card/100481-750-0-C1CD61DFC0ABFEEB0CD6FC327B6FAB23F630B68437904BAA-200949-5Nz*St+Csksa5AadFC3XVitjMi8=?cellid=MT111548&cellid=&om_rid=NufyAX&om_mid=_BY08sVB9ZVPsxP&om_lid=axp6

Hilton Honors Card – 80k bonus:

https://www.americanexpress.com/us/credit-cards/personal-card-application/hilton-hhonors-credit-card/100501-750-0-C1CD61DFC0ABFEEBAC23C4EAC56B2062F630B68437904BAA-200969-6N1jgJ5fyVZKZjSTJ3FJE7Q*hjQ=?cellid=MT111548&cellid=&om_rid=NufyAX&om_mid=_BY08sYB9ZVlmEK&om_lid=amex8

Hello MileValue folks!

A few questions, as I’m fairly new to travel card optimizations like this (past few years have been about airline miles) and curious how hotel points work.

– when you say 48 free nights, does that mean a nights stay at a Hilton property is only 4k points?

– rather using for hotel stays, can these 195,000 points from Hilton be transferred to airlines?

Thanks!

Joe: it’s 48 free nights if you stay at the lowest-tier properties and take full advantage of the “5th night free” feature. It’s the theoretical maximum number of nights you could get. Not likely to be attained by most users. The points can be transferred to some airlines but the transfer ratios are terrible (e.g., 10k Hilton points = 1k Alaska miles).

I have already had the Surpass card as an individual. Do you know if this card is available for a business?

Not that I’m aware of.

I’m looking at the listing of Gold benefits on the Hilton Honors page and I didn’t see mention of free breakfast. Is that definitely still a perk of Gold? Thanks!

Looks like you still do at select hotels (Conrad Hotels & Resorts, Curio – A Collection by Hilton, Hilton Hotels & Resorts, DoubleTree by Hilton, Hilton Garden Inn) but not all. To be specific, at those hotels you get to choose between a bonus of points or complementary breakfast. I’ve update the post to be more specific regarding the breakfast perk.

[…] current situation: You heard that there are two Hilton cards with lucrative limited time (through May 31) sign up bonuses– the Hilton Honors […]

[…] Record High Bonuses on Hilton Amex: 195k Points + Free Night Certificate | MileValue Mar 23, 2017 at 11:10 am […]

[…] you signed up for both cards and spent $5,000 on them collectively, you’d have at least 195,000 Hilton points without considering any category […]