MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

In 2014, American Express made it so you could get the bonus only once per lifetime on personal cards, and in February 2016 that rule was extended to business cards.

But there might be a targeted exception. Reader g passes along a targeted offer he got for the American Express Platinum Card.

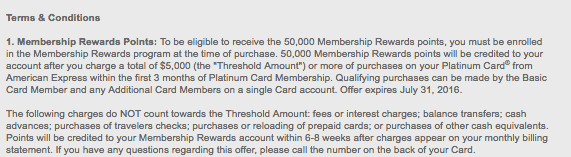

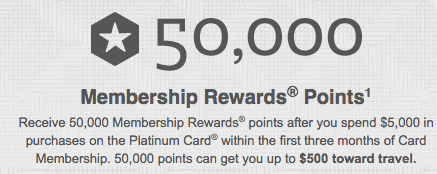

The offer is to open the American Express Platinum Card with 50,000 bonus Membership Rewards after spending $5,000 in the first three months. The offer is addressed to him and has unique offer codes to apply online or by phone.

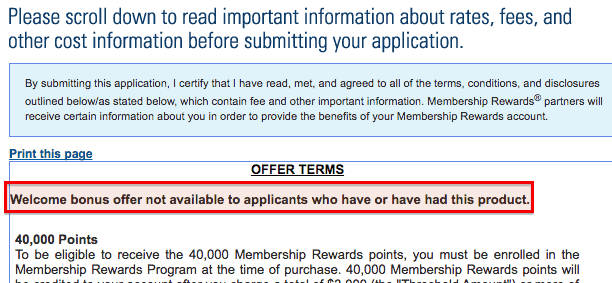

What’s interesting is that g has had the Platinum Card before and gotten its bonus, which should mean that he is ineligible for a new bonus. All the online Amex offers have language like this, which limit the bonus to new applicants. For instance, here’s the language on the public 40k Amex Platinum offer page:

But his offer doesn’t have that language.

Because he was targeted for the offer and the language excluding people who had had the Platinum Card was absent, g called the number in the targeted offer to ask if he could get the card and bonus even though he had the card and bonus before.

[The Amex rep] said my prior status did not affect my ability to tap into the MR bonus again! She did not speculate why the offer is being extended; however, the offer makes mention of the fact that I am also an EveryDay cardholder, which could mean that having/getting the EveryDay card (the no fee card I use to protect my MR points) is a prerequisite to accessing the offer. My guess is that the Citi Prestige with its greater club access, unrestricted travel credit and bonus point opportunities has really cut into AmEx’s premium card membership.

My Take

Phone reps can be wrong. I think there is a decent chance that if he applied for the card, he would not get the bonus automatically. But I’m not sure how he could be kept from getting it eventually when a phone rep said he was eligible and the application page doesn’t mention that previous cardholders are ineligible for the bonus.

I asked g to let us know what happens if he applies for the card.

Has anyone else recently been targeted for an Amex offer for a card they’ve previously had?

This would be huge news if the once-per-lifetime rule had an exception.

Also see: Issuing Banks’ Rules for Approvals and New Bonuses

I’ve received a bonus for upgrading my AMEX Gold card to a Platinum several years ago. I eventually downgraded back to a green card which I’ve kept as it is one of my oldest accounts.

I received an email for a 50,000 mile bonus to upgrade my card to Platinum, again. There was no writing in the targeted offer excluding those who have received a bonus before.

I completed the spending and received the bonus in my account within days. Besides the miles, it’s also nice to have back access to the Centurion Lounges.

I was targeted via email for the AMEX Premier Gold and I had it about 4 years ago. I applied and got the bonus. No issues.

We decided to have my husband apply since he had the card same time as me. He didn’t get a targeted email and they wouldn’t give him the bonus. I didn’t want to point out that I got the bonus again because I didn’t want them to take it away! Kicking myself for blowing a hard pull for him to get the card.

I have no idea why they sent me the targeted email and not him. I haven’t worked in 11+ years and we both have high credit scores..both over 800

Thanks for confirming you can get the bonus again if targeted.

I recently got a targeted AX offer for the Delta skymiles credit card which I had and received bonus for many years ago. There is no language about not receiving the bonus again. Thinking about applying! It’s for 35,000 miles … Would like to see if a 50,00 offer comes up soon

Yeah, I’d probably wait.

I received a promotion to move from my regular Amex card to a Schwab branded Amex card and received the full bonus. The agent was very clear about the policy.

I would consider this a different situation, since those are two different products.

I previously had Biz Amex Gold and got targeted for a 75k bonus through nearly weekly mailers for a different business with a different EIN. Because I was the one that signed up for both cards within an 11 month window (instead of waiting for 12), the second business was ineligible. Make sure you wait 12 months after the first card! They won’t give me the 75k!!!

Needless to say, I moved all my spending to Chase.

[…] can only get the bonus on a American Express personal card or business card once per lifetime (with the exception of a possible targeted offer). This is why you should choose which offer you sign up with carefully. The American Express […]

[…] The only exception is that sometimes you can get the bonus on the same Amex card twice if you receive a targeted offer. […]

[…] You are limited to getting the bonus once per lifetime on AMEX personal cards. If you’ve gotten this exact card before, you can’t get it again (publicly) with the bonus. If you are targeted for the offer, then you might be able to get it again. […]

[…] You are limited to getting the bonus once per lifetime on American Express personal cards. If you’ve gotten either of these exact cards before, you can’t get it again (publicly) with the bonus. If you are targeted for the offer, then you might be able to get it again. […]

[…] Targeted offers are known as the one loophole to getting a bonus on an American Express offer more than once in a lifetime. […]

[…] on the SPG Business Card before, you can’t get it again (publicly) with the bonus. If you are targeted for the offer, then you might be able to get it again. Due to this “once in a lifetime rule”, you should only snipe public Amex offers when they’re […]

[…] The only exception to Amex’s once in a lifetime rule is that sometimes you can get the bonus on the same Amex card twice if you receive a targeted offer. […]

1. Does the Delta bonus come from AmEx or Delta? In controversies people are told to contact Delta to see why their points haven’t hit.

2. Even though I had 2 personal Delta golds and 2 biz biz Gold’s 4 years ago, no one can find any record of them with AmEx. SO I got the Gold again and will try. Scared it’s linked to the Delta FF number.

I got the Delta Skymiles Platinum Business card in 2003. I started another business. Can I get the welcome bonus if I get that card for a new business?

Sure can. Amex seems to define “a lifetime” as 7 years. So since it’s been > 7 years, you’d be eligible for that bonus again.

But, let’s make sure that’s the best card for you though. There are a bunch of cards we rank much higher. Feel free to email me (matt@milevalue.com) and we can assess what cards you have and what makes the most sense for you.