MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The Hilton Honors Card from American Express is offering 80,000 bonus points after spending $2,000 in the first three months. It has no annual fee.

The Hilton Honors Surpass Credit Card from American Express is offering 100,000 bonus points after spending $3,000 in the first three months. It has a $75 annual fee.

Meeting the minimum spending requirements on both and paying one $75 annual fee in the next three months will garner 195,000 Hilton points, enough for up to 48 free nights at Hiltons worldwide.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

How to Get 48 Free Nights

Here’s the Hilton Honors Amex earning rates and category bonuses:

- 7 HHonors Points for every $1 spent on hotel stays within the Hilton Portfolio

- 5 HHonors Points for every $1 spent on restaurants, supermarkets, and gas stations

- 3 HHonors Points for every $1 spent on all other purchases

So after meeting the minimum spending requirement of $2,000, you’ll have at least 86,000 HHonors points.

And here’s the Hilton Honors Surpass Amex earning rates and category bonuses:

- 12 HHonors Points for every $1 spent on hotel stays within the Hilton Portfolio

- 6 HHonors Points for every $1 spent on restaurants, supermarkets, and gas stations

- 3 HHonors Points for every $1 spent on all other purchases

So after meeting the minimum spending requirement of $3,000, you’ll have at least 109,000 Honors points.

109,000 + 86,000 = 195,000

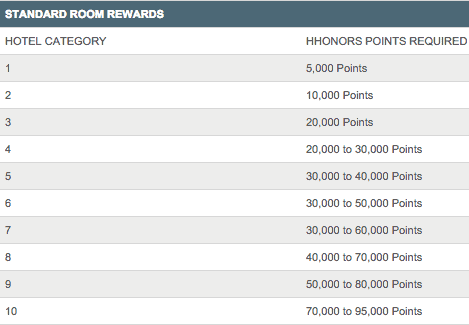

There have been some changes to the Hilton Honors program. They no longer, technically, have hotel categories nor a published award chart–you can read more about that here. The main takeaway though is that no Hilton’s award price per night will exceed the top price of it’s previous category…

So the lowest level Hiltons will remain 5,000 points (or possibly be less if the cash price of the room is cheap). At 5,000 points a night, you could book 39 nights at the cheapest Hiltons.

But both Amex Hilton cards confer automatic elite status (the Hilton Honors gives Silver and the Hilton Honors Surpass gives Gold)–the 48 number comes from the fact that Hilton elites get the 5th night free on awards. You can take a five-night stay at what used to be a Category 1 hotel for 20,000 points. You can take nine five-night stays (for 180,000 points), and then three more at 5,000 points each. That’s 48 total nights.

Where to Get 48 Free Nights

Here are some of the previous Category 1 hotels that catch my eye:

Hilton Salalah Resort (Oman)

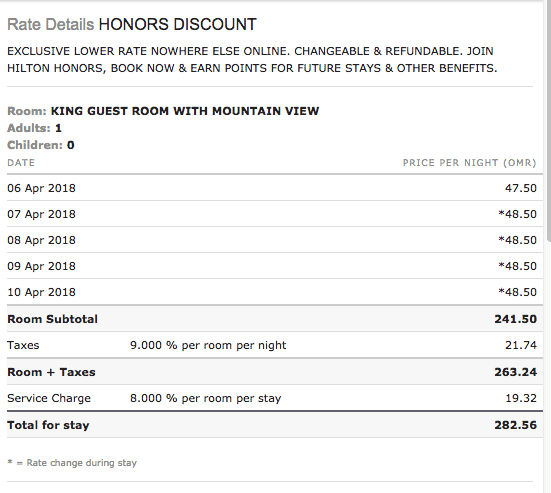

You can enjoy a luxurious Indian Ocean Resort with a huge pool for only 4,000 points per night on average instead of the 48 OMR ($125) cash price.

Reviewers rave about the staff, food, and nearby beach.

Several also single out the pool as excellent.

Several also single out the pool as excellent.

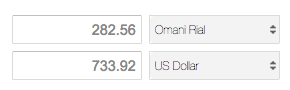

Five nights would cost $734 or 20,000 points with the fifth night free.

Hilton Alexandria Corniche (Egypt)

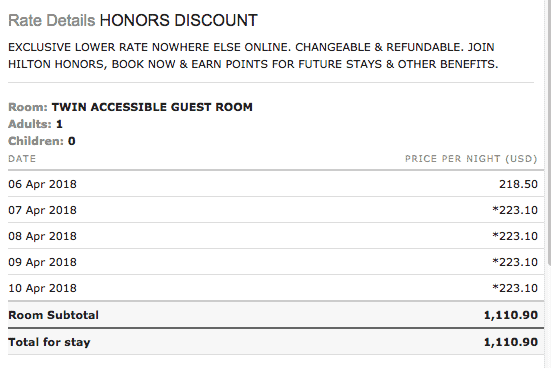

You can enjoy a central and beautiful seaside location in Alexandria, Egypt for an average of 4,000 points per night instead of the $223 per night cash price.

The glowing reviews describe the fantastic views of the Mediterranean Sea…

The glowing reviews describe the fantastic views of the Mediterranean Sea…

…and the dedicated staff that provide meticulous service.

Five nights would cost $1,100 or 20,000 points with the fifth night free.

Here are some other properties that catch my eye that used to be Category 1 Hiltons, because they are resorts or in interesting locations:

- Hilton Garden Inn Bali Ngurah Rai Airport (Indonesia)

- Hilton Hurghada Resort (Egypt)

- Hilton Hurghada Plaza (Egypt)

- Hampton by Hilton Krakow (Poland)

- Hilton Garden Inn Tucuman (Argentina)

- Hilton Sharm Dreams Resort (Egypt)

- Hilton Sharm Waterfalls Resort (Egypt)

- DoubleTree by Hilton Hotel Sighisoara – (Romania)

There are also a number of prior Category 1 properties in Mexico, Turkey, Colombia, and China, and a couple in the United States.

Bottom Line

The Hilton Honors Card from American Express is offering 80,000 bonus points after spending $2,000 in the first three months, and the Hilton Honors Surpass Credit Card from American Express is offering 100,000 bonus points after spending $3,000 in the first three months.

Getting both cards and spending $5,000 collectively on both is enough for up to 48 free nights at prior Category 1 Hiltons (5k points a night hotels) if you maximize the fifth night free benefit.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

[…] The Citi® Hilton HHonors™ Visa Signature® Card offers 75,000 bonus HHonors points after spending $2,000 on the card in the first three months. You can turn $2,500 or less of spending on the card into 20 free hotel nights, worth over $1,500. […]

Absolutely the best use of hilton points!! I went to Egypt for over a month this spring on miles and honestly I picked it due to realizing the crazy value in these cat 1’s!!! If you look at the hotels, and I’m sure you did – they’re almost all resorts!! The pool complexes in general were super awesome. With Hilton Gold status and the fact that tourism is way down in Egypt – I got upgraded to suites at every single hotel, and the hilton pyramids resort outside Cairo I got the presidential suite which was CRAZZZYYYYYYYY huge. Like a mansion!! The Alexandria hotel was for sure the most modern and best location. Also loved the Hilton Ramses Cairo. For 20k points for 5 nights in a suite with breakfast, internet, and lounge access how can you go wrong?! Keep in mind that’s a month for only 120k points. You can move in!! The all inclusive hotels are also only 20k points a night in Egypt but no 5th night free. The buffets were really weak though and you do NOT get cocktails! That was a let down. Overall Hilton, and all other chains have AMAZING point values in Egypt though…

Thanks for the first hand knowledge.

[…] The Citi® Hilton HHonors™ Visa Signature® Card offers 75,000 bonus HHonors points after spending $2,000 on the card in the first three months. You can turn $2,500 or less of spending on the card into 20 free hotel nights, worth over $1,500. […]

Any idea when this offer will expire, based on previous experience and limited time offers from Citi/Hilton? Doesn’t seem to say anything on the application website. Trying to leave 90 days between my last credit card application and this one….but this offer is pretty tempting…not sure it will still be around in 30 more days!

The 50k offer only lasted a few weeks. I have no idea, but I should learn about the end of the offer a few days beforehand. Keep checking here.

[…] Award stays start at 5,000 points per night. With the fifth night free, 80,000 Hilton points can book 20 free nights (as four five-night stays)! […]

[…] the Hilton card could be better for you if you use it optimally, for Category 1 and 2 Hilton stays. The card offers a strong value proposition for a card with no annual fee […]

[…] category bonuses discussed below.) Eighty thousand points are enough for 20 free nights in a Hilton Category 1 hotel, 10 free nights in Category 2 Hiltons, or 5 free nights in Category 3 Hiltons. I stayed at an […]

[…] the Citi® Hilton HHonors™ Visa Signature® Card for Hilton points and use 80,000 Hilton points for 20 free nights at these great hotels. Get the Citi ThankYou® Premier Card to transfer the ThankYou Points as needed among the 12 […]

[…] points are great for low category hotels and Points and Money […]

[…] points are great for low category hotels and Points and Money […]

[…] Great uses of Hilton points […]

[…] 75,000 bonus HHonors points after spending $2,000 on the card in the first three months. You can turn $2,500 or less of every day spending on the card into 20 free hotel nights in Category 1 Hilt… or 10 free hotel nights in Category 2 Hiltons worth over […]

[…] are my top picks for the best Category 1, Category 2, and Category 3 hotels if pursuing this […]

[…] can turn $2,500 or less of every day spending on the card into 20 free hotel nights in Category 1 Hilt… or 10 free hotel nights in Category 2 Hiltons worth over […]

[…] cost $37 if you used the same processing company, but with 75,000 HHonors Bonus points, you can get 20 free hotel nights in Category 1 Hiltons, worth over $3,600, 10 free hotel nights in Category 2 Hiltons worth over $2,000, or five free hotel nights in […]

According to the Hilton list, I only see 2 cat 1hotel in the US – Cleburne, TX and Columbus, GA.

Correct. If your strategy is to maximize the amount of category 1 Hilton hotel nights you can get, you’re best off looking outside the US.

Also cat 1 is DOUBLETREE BY HILTON HOTEL SIGHISOARA – CAVALER in Romania. Very popular location in Transylvania.

That does look like a nice property in a beautiful place. Thanks for the input.

[…] 20 free nights at Category 1 Hilton hotels […]

[…] Free night awards start at 5,000 points per night and because the card gives you free Silver status, cardholders get the fifth night free on all awards. […]

[…] 20 free nights in Category 1 Hiltons […]

[…] Free night awards start at 5,000 points per night and because the card gives you free Silver status, cardholders get the fifth night free on all awards. […]

[…] Category 1 properties would be $25 per night (my favorite Category 1 properties) […]

[…] Category 1 Hiltons […]

[…] 46 free nights at Category 1 Hiltons […]

[…] 46 free nights at Category 1 Hiltons […]

The link to the map of Category 1 Hiltons doesn’t work

[…] Category 1 Hiltons (max 5,000 points per night = at least 48 free nights if you maximize the fifth night free benefit) […]

[…] can turn $5k or less of every day spending on the two cards into 48 free hotel nights in Category 1 Hi… or 23 free hotel nights in Category 2 […]

[…] How to Get 48 Free Nights at Hiltons Worldwide from Two Credit Cards […]

[…] the card within three months. Then you can use your 195,000 Hilton points to book to book up to 48 free nights at Category 1 Hiltons, 23 free nights at Category 2 Hiltons, or 11 free nights at Category 3 Hiltons. Technically […]

[…] in a free night certificate is staying at a Category 9 or 10 property, the value with points is a Category 1 or 2 property. I stayed at an awesome Category 2 in Kuala […]

“The main takeaway though is that no Hilton’s award price per night will exceed the top price of it’s previous category…” I have booked same hotels and this is NOT true. They exceed the former category quite regularly. You were misled.

Do you remember which properties?