MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Citi issues lots of cards that earn ThankYou Points, but not all of them earn a type of Thank You Point that can be transferred to airline and hotel loyalty programs partners like the Citi Prestige and Premier cards do. You can squeeze a lot more value out of the ThankYou Points earned by these premium cards–we value them at 1.9 cents each–than those earned by the Preferred, CitiBusiness ThankYou, or ATT Access & More Card which can only be redeemed for a maximum of 1 cent each.

Once you’ve had your premium ThankYou card for a year, you’ll be faced with the decision of whether or not you want to pay another annual fee. In the case of the Prestige, the amount is intimidating: $450. The Premier’s is $95. If you haven’t redeemed all those ThankYou Points earned by your Prestige or Premier at that point, then you’ll be faced even more decisions since ThankYou Points expire 60 days after cancellation of the card you earned them with.

I faced the dilemma myself last month over what do with my Prestige and leftover ThankYou Points.

I imagine there are quite a few of you who signed up for the Prestige and Premier cards back when each had 50k sign up bonuses, and are now finding yourself in a similar situation. In hopes of making that process a little clearer, I’m going to outline your options and the pros and cons of each below. If I missed anything important please let me know in the comments.

OPTION #1:

Cancel.

If you decide to cancel, no matter what you do your ThankYou Points will expire 60 days post cancellation.

PROS -> You’re off the hook for another annual fee, and you start the 24 month clock of being able to get the sign up bonus on a Citi ThankYou card again.

CON -> Your ThankYou Points will expire 60 days after cancellation.

OPTION #2

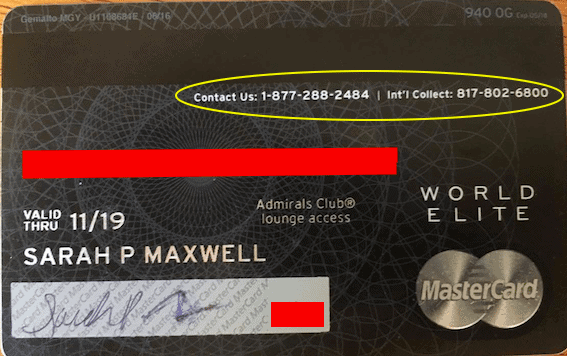

Call the number on the back of your card and negotiate a retention bonus that makes paying another annual fee worth it.

PROS -> Your ThankYou Points will maintain their full value for at least another year, you maintain the ability to earn 3x ThankYou Points on Travel and Dining expenses (category bonus on both the Prestige and Premier), and your credit score will remain preserved.

CONS -> You have to spend a little time on the phone negotiating.

Check this FlyerTalk forum (the wiki at the top has a summary) of offers others have received recently before calling, and be patient on the phone call. The first couple offers probably won’t be the best they can do. Be polite, and tell the rep their offers sound appealing but keep asking if they have any others for you to consider until you’ve exhausted all they’re allowed to offer you.

OPTION #3

Downgrade to a no annual fee ThankYou Point earning card (like the ThankYou Preferred or the CitiBusiness ThankYou Card).

PRO -> Your credit score won’t take as much of a hit.

CON -> ThankYou Points earned by the no annual fee cards are worth a maximum of 1 cent each. So downgrading will turn your premium ThankYou Points (worth rougly 1.9 cents each) into a different type of ThankYou Point that can only be redeemed for a maximum of 1 cent.

- OPTION #3A: If you have another premium ThankYou card you’re not planning on canceling, then you should be able to downgrade to a no-annual fee card and still be able to pool those points with your other premium account to preserve their value.

- OPTION #3B: If it’s been two years since you opened the premium ThankYou card in question, you could also try opening a new premium ThankYou card–this way your premium ThankYou Points preserve their value for at least another year.

- OPTION #3C: Transfer your premium ThankYou points out to a family member or friend with a premium ThankYou account who could book awards for you in your name in the future, and then downgrade your card–but your points will expire 90 days after transferring.

OPTION #4:

Transfer your ThankYou Points to the airline loyalty program that you’ll get the most value out of. Which program you choose is going to vary on the traveler. For me, that program is Singapore Airlines.

ThankYou Points earned by the Prestige and Premier transfer to all of the following programs…

- Cathay Pacific Asia Miles

- EVA Air Infinity MileageLands

- Etihad Guest

- Garuda Indonesia Frequent Flyer

- Qatar Privilege Club

- Singapore Airlines KrisFlyer

- Thai Airways Royal Orchard Plus

- Air France/KLM Flying Blue

- Malaysia Airlines Enrich

- Virgin Atlantic Flying Club

- Qantas miles

- Virgin America Elevate

- JetBlue TrueBlue

Click the links to read posts on basics and sweetspots of that program.

Bottom Line

If you have unredeemed ThankYou Points earned by the Citi Prestige or Premier card, they will expire 60 days after cancelling either. Don’t fall victim to wasted ThankYou Points–there are various ways to prevent expiration outlined in this post.

Another point to consider in this process is if you would like to collect the sign up bonus on your Prestige or Premier again in the future. You aren’t able to do so until at least 24 months after opening or closing a card within the same co-brand. We are unsure if a product change (i.e. downgrading a Prestige to a ThankYou Preferred) will reset this 24 month clock.

Hat Tip Frequent Miler

I don’t think 3a is correct. You can “combine” points with those on another card, but Citi remembers where those points came from, and they will still expire after 60 days. There are no real “good” solutions to this problem.

I’m curious why in 3a points must be moved over before downgrading. If you have the Prestige and Premier and downgrade one to a Preferred, you should still be able to combine the Preferred TY points into your remaining premium account…

You’re right. Post updated.

I think the real question on the downgrade is if it restarts the two year clock. Any idea?

Correct, that is an unknown…I think it might but have seen different data points. If anyone has any experience please share!

I tell ya, the clock starts ticking on points earned as soon as you cancel the card. Regardless if you combined them or not. I ended paying the AF on my preferred last year to give me more time to use them. I wish this worked like Chase or Amex, but it doesn’t.

Option 3 isn’t discussing what happens to ThankYou points after you cancel a card, rather what happens after you downgrade it. For example, if you have the Prestige and downgrade it to a Preferred, as long as you have a Premier open, you can still transfer those ThankYou points to airlines. If you cancelled your Prestige, then yes, your points would expire no matter what after 60 days.

The statement “ThankYou Points earned by the Prestige and Premier transfer to all of the following programs 1:1” is not quite right. ThankYou Points transfer to Virgin America at 2:1.

Edited, thanks.

We were in that boat. Transferred to airline and made a booking. Transfer was instant. Have less than 2k still sitting there. After Citi screwed us out of checking account bonus last year, we are done with them.

I didn’t TRANSFER my points, I COMBINED them (quite a while ago). I just downgraded the ThankYou Premier to the ThankYou Preferred, but I still have my Prestige card open. I was told I would keep my points, but are ALL of the points still transferrable to airlines? Or do you know of a way I could verify, other than calling and asking, which I don’t completely trust)? If not, apparently I still have a few more weeks to say NVM, I want to keep the ThankYou Preferred.

Thanks for the post!

Bill S is correct. They will expire at the same time whether transferred or not.

I suggest you correct the article.

ThankYou Points will expire 60 days after canceling a card, that is correct. But option 3, what Bill is referring to, refers to downgrading a card, not canceling it. Example: If you have the Prestige and downgrade it to a Preferred, as long as you have a Premier open, you can still transfer those ThankYou points to airlines.

Seems like transfer to a partner like SQ is a no brainer. Note that SQ has its own expiration clock (3 years?) and I believe there’s no way to extend their life. Not 100% on that since I use them regularly whenever I must fly United.

If they transfer to Virgin Elevate, then I think they could go to Alaska Airlines. Is that correct?