MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

We received a tip from a reader to check out Rentler, a platform connecting landlords and tenants that (among other things) allows you to pay rent on your credit card with a 2.5% processing fee.

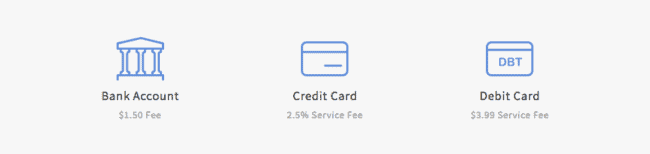

You can make payments via bank transfer or debit card as well:

But it’s obviously the credit card payments that interest us.

How Rentler Works

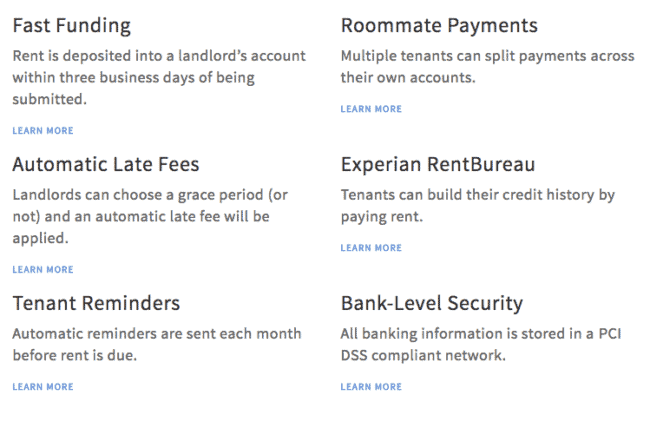

Both landlord and tenant need an account on Rentler in order to process the payment. Here’s more info for tenants, and here’s more info for landlords. Looks pretty simple to set up. You can invite your landlord to join Rentler here if they don’t already use it. The system looks to have many convenient features:

Here’s the FAQ for Rentler Payments.

So, the question on everyone’s mind: Is it worth eating the 2.5% fee to put rent payments on your rewards card?

Is it Worth the 2.5% Fee?

On the right cards and in the right circumstances, yes.

For example, the Discover it Miles Card earns 1.5% back on all purchases and Discover doubles that at the end of the first year of card membership, meaning you get 3% back. 3% >2.5% processing fee, so you definitely come out on top.

But you can do much better with your returns.

Often the effective rebate on meeting a minimum spending requirement is 20% or more. That means if paying your rent via Rentler and can meet more minimum spending requirements this , the 2.5% fee can be a drop in the bucket compared to the rewards you’ll earn.

If you’re not trying to reach a minimum spending requirement for a sign-up bonus, I wouldn’t use Rentler for payments on cards that earn 1 mile per dollar as we don’t value any miles at greater than 2.5 cents (for example, my highest valued point is SPG at 2.5 and highest valued mile is Virgin America mile at 2.3 cents each). I don’t think Rentler would count for a category bonus on any of the cards that we regularly talk about.

Meeting Minimum Spends for Sign Up Bonuses

For example, the Ink Business Preferred is a brand new business credit card issued by Chase, offering 80,000 Ultimate Rewards after spending $5,000 in the first three months. Ultimate Rewards transfer 1:1 to United, British Airways, Singapore, Korean, Southwest, Virgin Atlantic, Hyatt, and more. The annual fee is $95 and is not waived the first year if you apply online. If you apply in-branch then the annual fee will probably waived the first year.

If you paid $5,000 of your bills via Rentler on this card, the processing fee would be $125. We value Ultimate rewards at 2 cents each, so you’d essentially be paying $125 for $1,700 worth of points (85,000 Ultimate Rewards, which you’d earn from the sign up bonus and the 1x on spending it takes to get there).

That return is not too shabby.

Plastiq

Plastiq is an online bill payment processing system that also allows you to pay your rent, along with a lot of other types of bills, on your credit card for a 2.5% fee. Sometimes Plastiq will run promotions, like a when they offered a 2% processing for using your MasterCard in April of 2015, or when I received an offer via email for a 1.75% processing free for paying my taxes on a MasterCard this past year. Make sure to keep an eye on their promos and hunt for the lowest processing fee if you’re going to use these means to meet minimum spending requirements.

Bottom Line

Paying your rent on Rentler for a 2.5% fee could be worth it, if your cash back card (like the Discover it Miles Card during the first year) gives you more than 2.5% back. But the biggest returns will be using Rentler to meet minimum spending requirements you might not otherwise have enough spending power to meet. Be sure to check Plastiq before using Rentler though as they sometimes run promotions with processing fees lower than 2.5%.