MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

About a year ago I excitedly opened a Citi Prestige card, ready for my 50,000 ThankYou point bonus and lounge access, among other things. Since the, the bonus has dropped to 40,000 ThankYou Points, but considering the myriad of other benefits the card maintained, it’s still worth getting if you haven’t had it yet. Read our full review of the Citi Prestige.

11 months into holding any card that’s got an annual fee, I do a cost/benefit analysis to figure out if I’m getting enough value from the card to keep it open. In the case of the Citi Prestige, there a lot of ongoing benefits to consider that help outweigh the $450 annual fee, like:

- $250 in travel statement credits every calendar year

- Priority Pass lounge access

- 4th hotel night free when booked through Citi Prestige Concierge

- 3x ThankYou points for travel, 2x on restaurants and entertainment

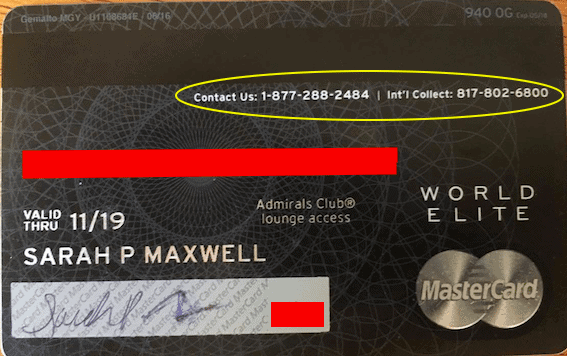

These are all automatic annual benefits of the card. But what people often forget about (or don’t realize they can do) is to call the phone number on the back of their card to negotiate extra incentive to keep a card open–a retention bonus.

Even if your card has enough automatic benefits to merit keeping open, if your card charges an annual fee, you should make a habit out of calling in before the next annual fee hits to negotiate a retention bonus as that’s the time that you have the most leverage.

Often representatives will offer incentives in the form of extra rewards triggered by more spending or a statement credit that somewhat or totally covers the annual fee. You never know until you try. Never done it before? I highlighted all the steps of what do to when calling in for a retention bonus in my post, the State of Retention Bonuses for Citi Cards.

Whenever I open a new card with an annual fee, I set a Google Calendar alert to email me a reminder 11 months past the date I opened it. The email arrived in my inbox a few weeks ago reminding me to call Citi in regards to my Prestige card.

What You Should Always Do to Prepare for a Retention Bonus Phone Call

Before calling Citi, I scanned Flyertalk for what other people were being offered as retention bonuses for their Citi Prestige. I recommend always doing this, as you’ll be better prepared for what the rep is going to say and can wait it out (thanks, that sounds good, but can you offer me anything else?) until you receive a good offer you’ve seen someone else get recently.

What I was Offered to Keep My Citi Prestige Card Open

I was given the following three offers before being told by a rep that they were not authorized to offer me anything else:

- Four additional ThankYou points per dollar for air, hotel, or car rentals (up to 35,000 ThankYou Points) for the next 6 months

- A $200 statement credit for spending $4,000 per month for three months

- 10,000 ThankYou points for spending $3,000 over the next six months

Four additional ThankYou points per dollar for air, hotel, or car rentals could be lucrative for a lot of people. If you could put $8,750 in spend towards those travel expenses to max it out, you’d get an extra 35,000 ThankYou points, which I value at about $665. Not bad, but not good enough for me either. Maybe if I had more spending power it would be worth it, but pretty much all my credit card spending goes towards meeting minimum spending requirements on new cards which gives me a better return than that.

A $200 statement credit for spending $4,000 per month for three months is a much worse return than the previous offer.

And 10,000 ThankYou points (which I value at about $190) for spending $3,000 is a little better than the $200 statement credit offer, but still not any better than the first offer.

My Decision

If you couldn’t tell already, I didn’t feel very incentivized by any of the retention offers. The automatic benefits of the card are nice, but I have other cards that offer similar perks, so those aren’t enough to make me want to pay another $450 annual fee. I decided to downgrade to Citi’s no annual fee ThankYou card, the ThankYou Preferred card, to maintain the age of the account for my credit score.

But I didn’t carry out the downgrade on the phone with rep. I accepted one of his offers. Why?

The following excerpt is from Flyertalk…

“Be aware that Retention Specialists are compensated based on the number/percent of card holders they can retain and to some extent based on the offers they use. These are people with jobs who can be helpful but have little discretion in what is available although some discretion in which offers they tell you about. Unless the Retention Specialist is being a complete &#*@%, you should probably accept an offer and then close via SM so that you don’t ding the rep for something over which they have little control.”

SM is shorthand for secure messaging, which you can access through your online account.

After accepting the rep’s offer, I signed into my Citi account online and downgraded to the ThankYou Preferred through the chat function.

But Wait, What’s Going to Happen to My ThankYou Points??

One detail I didn’t mention is that I have about 40,000 unused ThankYou points. Some were earned with my Prestige, and some were earned with my ThankYou Premier card. Months ago, I pooled the ThankYou points in my Premier account with the ThankYou points in my Prestige account.

Doing nothing with those ThankYou points when downgrading to a ThankYou Preferred would result in their severe devaluation, since they would turn into the type of ThankYou points earned by the Preferred which can only at best be redeemed for 1 cent each (they cannot be transferred to any of ThankYou’s airline/hotel transfer partners). I knew I could always transfer my points out to an airline loyalty program I use frequently, but I wanted them to maintain their flexibility.

If you are downgrading to a ThankYou Preferred but still have a ThankYou Premier open (or vice versa), first move your points from your premium ThankYou account you’re downgrading to your premium ThankYou account you’re keeping open. This is the best way to preserve the value of those ThankYou points as you’ll still be able to transfer them airline and hotel loyalty programs. It’s what I wanted to do, but I fudged up by pooling my accounts.

Like I said, a while ago I pooled my ThankYou points into my Prestige account because I needed more points than I had in my Prestige account for an award, and I wanted to spend my older points first. What I didn’t realize at the time is that I could have easily just shared the specific amount of points I needed instead of pooling them together. Pooling your points has a big downside–you can’t undo it. So while I have a ThankYou Premier open currently, and plan on keeping it open for at least another month before the next annual fee hits, I didn’t have the ability to move my Prestige points back to to my Premier account. If I hadn’t pooled my points, I could have moved them over, extending their life as versatile transferrable points for another month. Not a huge deal as it’s just a month, but you should learn from my mistake.

I transferred all my remaining ThankYou points to Singapore Airlines before downgrading to the ThankYou Preferred.

If you don’t have another premium ThankYou account to move your points over to, then pick the transfer partner whose miles you value the most and move them there.

And what would I have done if I had decided to cancel my Prestige? The same thing, eventually.ThankYou points expire sixty days after cancellation if you don’t move them to a ThankYou Premier account. ThankYou points, Ultimate Rewards, and Membership Rewards are not like airline miles–they expire when you cancel the card you earned them with. However if you have another card that earns them, they won’t expire.

Bottom Line

After almost a year of holding the Citi Prestige card it was time to take a look at whether or not paying another $450 annual fee was worth it. I called Citi to extract a retention bonus that would add extra incentive along with the cards’ other benefits to keep it open, as I’d rather keep a card open then cancel or downgrade. The offers weren’t valuable enough to me so I downgraded to the ThankYou Preferred card. Before doing so though I transferred my ThankYou Points to the airline transfer partner I value the most–Singapore. If I hadn’t, my points would have turned into ThankYou Preferred points, which (at best) can only be redeemed for 1 cent each on airfare. As Singapore miles I expect to get about 1.75 cents of value for each of them.

I went through a similar process earlier this year and made the same decisions, although I ended up forgetting to transfer the points out before downgrading. I was still able to transfer about a month later out to singapore, so there may be a lag in defining the different rules of the cards.

Great data point, thanks for sharing!

Sarah, I don’t have the Prestige yet. Can I get the Prestige bonus once I’ve hit the 2 year mark since opening my Premier card with the new Citi restrictions?

If your Premier is still open, then yes, two years after you opened the Premier you will once again be eligible for the Prestige bonus. If you’ve closed your Premier since then, then you’ll have to wait two years past the date you closed it to be eligible for the Prestige bonus. This is the official wording regarding the bonus eligibility: “Bonus ThankYou Points are not available if you have had a ThankYou Preferred, ThankYou Premier or Citi Prestige card opened or closed in the past 24 months.”

Good article, thanks! One comment and one question…

Comment: I believe the Prestige gives 3x for air travel and hotels as opposed to “travel” (which makes the TY Premier broader because it also includes gas, car rentals, etc.).

Question: Do the Singapore miles expire? That would affect my calculation if I don’t have a known upcoming use for the miles.

I got a letter a couple days ago stating that my af was going down to $350 and I would get a $100 stmt credit for this year’s fee. Then I got an email that the letter was sent to me in error. Only those that had a closer relationship with CITI should get this. Oops.

Sarah, I love your articles and have found them so useful!

I opened a Prestige a year ago—love the cards 4th night free benefit! $350 was my first annual fee since I opened Gold checking. I’m a little confused as to this years fee. A few months later I opened a ThankYou Premier card. I only use the Prestige card and don’t want to close it. What should I do to keep the game going. Do I open another Premier ThankYou card for points, then cancel the older ThankYou card? Do I open another Prestige card instead? I get confused on all these new 2 year rules.

I believe the Singapore miles expire in 3 years. Use or lose – no activity to keep going.

“Bank points (i.e. ThankYou points, Ultimate Rewards, Membership Rewards, and SPG points) are not like airline miles–they expire when you cancel the card you earned them with” is misleading and inaccurate IMO.

I am almost positive SPG points don’t expire if you cxl the credit card. It is a stand alone program that does not require a credit card. You can cxl a credit card and still keep Amex, Citi or Chase points as long as you have another credit card that earns that type of points. If you don’t have one when considering cxling, you could sign up for one.

You sound sure about canceling a citi card that pools points being bad? I have product changed a Prestige card for my Dad (to ATT) and he still pools fine with his Premier and bank points- did not lost anything when Prestige as the anchor pooling card. You may have some bad information from the Citi rep or things changed.

If you are getting 4X bonus points up to 35,000, that is just shy of $9,000 spend, not $5,000. The bonus offer should not effect the standard 3X on the Prestige.

Singapore miles do indeed expire after three years, despite any activity in your Krisflyer account.

Re the statement about bank points–thanks for pointing that out, I have updated the post with the correct info.

I’m not entirely sure what you mean by your third paragraph.

Re your final sentence, you are correct, post has been updated to reflect that.

Jedi, SPG points are just the starwood hotel points.. (Sheraton et al.) they’re not like Ultimate Rewards. They’re like HHonors (but more valuable 🙂 )

Thank you so much Sarah for this informative and helpful posting.

You did not address that by product changing you make yourself ineligible for a thank you point sign on bonus for 2 more years. If you kept you card and did not open or close another thank you point card you could have gotten a new card with a thank you point sign on bonus in a year. Also since Citi still prorates this annual fee you could have closed after your January statement and gotten 2017s $250 travel reimbursement and most of your annual fee refunded.

Good article that made me think about my Chase Southwest Premier and Business Premier. I got these cards and followed Scott’s recommendations and got the Companion Pass which is good through 2017! But how do I retain that status and how do I decide to keep these cards? Any strategies to know about?

I really enjoy these posts and articles and have learned so much.

4 points per dollar is a huge bonus, though, isn’t it? It would make a lot of “manufactured spending” outright profitable.

I just had the same conversation since I am coming up on my annual fee in January. I made the mistake last year of trying to get the card too late in 2015 to get the travel credit for 2015 and again in 2016 so ended up with only 2016. I got good use out of the card regardless using the $250 air credit, lounge access, and 4th night hotel option. I called today and got the same offers as Sara. For me the net fee of $200 is worth it for the premier lounge access which I used at least 10 times in Asia last year and the 4th night hotel bonus which I cashed in at least 3 times as well. I chose to go with the 4x bonus as I figured I could get more than the 10k points on 3k spend.

Thanks for the article, it was nice to know what I was likely to get offered ahead of time. I also got the letter about the $350 fee, thought maybe it was lowered due to the Admirals Club Access dropping, but then another letter correcting along with an apology and promise of 1k points.

I called Citi Prestige CC in the same way to cancel the card because of the Annual fee, however the person directly asked me to “please confirm again if you wish to cancel the card” .. he didn’t ask or route me to the retention team. I stop him by making an excuse of redeeming the points and will call tomorrow.

Thanks Sara for the information.

[…] I faced the dilemma myself last month over what do with my Prestige and leftover ThankYou Points. […]