MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

I tweeted this deal first from @MileValueAlerts. Follow @MileValueAlerts on Twitter and follow these directions to get a text message every time I tweet from that account. I tweet from @MileValueAlerts only a few times a month because it is designed to be used only for the best and most limited-time deals–like mistake fares–so that you aren’t bombarded by text messages.

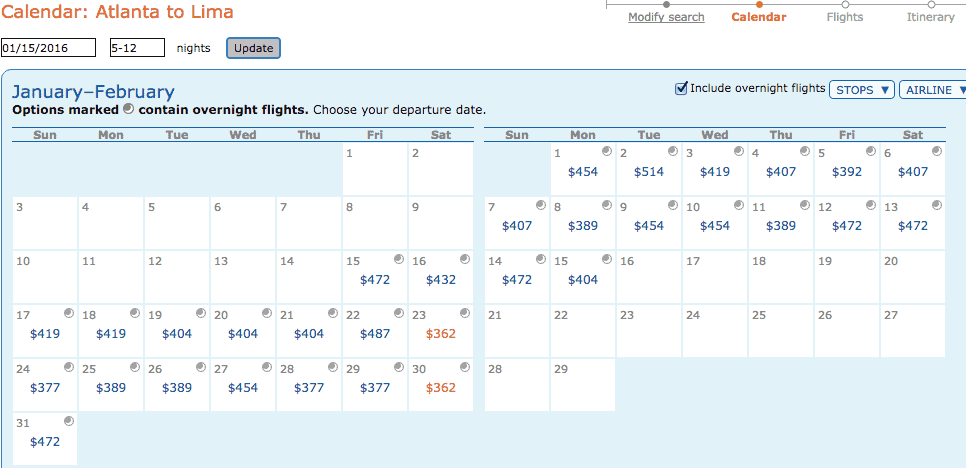

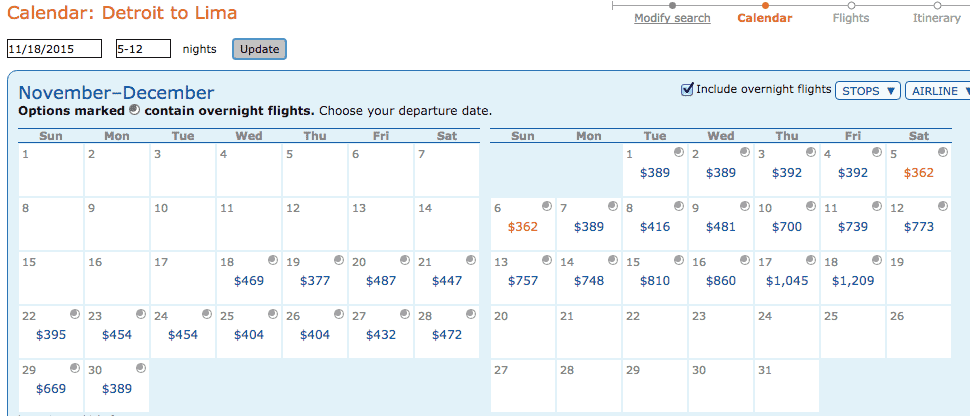

Travel from Minneapolis, Detroit, Cincinnati, and Atlanta to Lima, Peru for $362 roundtrip on American Airlines from November through February 2016.

Contents:

- When are the $362 fares?

- Mileage Earning

- Best Credit Card to Buy the Ticket

$362 Roundtrips from USA to Lima

These fares are from Delta hubs–Atlanta, Minneapolis, Detroit, and Cincinnati–to Lima and being offered by American Airlines. I also checked Delta hubs New York and Los Angeles, but didn’t find cheap fares on American or any other carrier. I also checked United hubs and didn’t find cheap fares on United or any other carrier.

Search on ITA Matrix by calendar of lowest fares for acceptable trip lengths.

There are only a handful of $362 roundtrips from each city that exist between now and February 2016.

Hover over a date with $362 roundtrips. Select the number of nights you’d like the roundtrip to be.

You cannot book on ITA Matrix. Instead note the dates and search on aa.com.

Mileage Earning

American Airlines still awards one mile per mile flown, plus bonuses if you have status. The number of miles you’ll earn varies based on your starting city and whether you connect in Dallas or Miami. You can find the miles you’d earn on Great Circle Mapper.

Best Way to Buy the Ticket

Buy your ticket with the Citi Prestige® Card, since it comes with a $250 Air Travel Credit every calendar year that will offset part of the purchase of this ticket.

Even if you’ve already used your $250 credit for this year, the card offers 3x on all airfare purchases.

See my review of the Citi Prestige Card which explains its many benefits like its annual $250 Air Travel Credit, 40,000 point sign up bonus, and access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels.

My second choice would be the Barclaycard Arrival Plus™ World Elite MasterCard®, which comes with 40,000 bonus Arrival miles after spending $3,000 on purchases in the first 90 days.

You could redeem 36,200 Arrival miles to get a free $362 ticket on any airline. You’d still earn American Airlines miles on the flights, and you’d even get 1,810 Arrival miles back upon redemption. More on redeeming Arrival miles.

Some really good deals to Lima from other cities as well on copa using the 25% discount code. Tampa-Lima for example is $408 many days over the next several months. Booked a ticket a couple days ago for $333 after the discount. Hopefully my matched platinum status gets me an upgrade or something.

Some really good deals to Lima from other cities as well on copa using the 25% discount code. Tampa-Lima for example is $408 many days over the next several months. Booked a ticket a couple days ago for $333 after the discount. Hopefully my matched platinum status gets me an upgrade or something.