MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Right now the Citi Prestige® Card comes with 40,000 bonus ThankYou Points after $4,000 in purchases made with your card in the first 3 months the account is open.

Beyond the sign up bonus, the card competes with the American Express Platinum card by offering a host of travel benefits like:

Beyond the sign up bonus, the card competes with the American Express Platinum card by offering a host of travel benefits like:

- $250 in airfare or airline fee credits per calendar year

- $100 credit for applying for Global Entry

- 3x points on Airlines and Hotels, 2x on Dining and Entertainment

- American Airlines lounge access until July 23, 2017

- Priority Pass Select Lounge Access

It is these two lounge accesses that are the focus of this post.

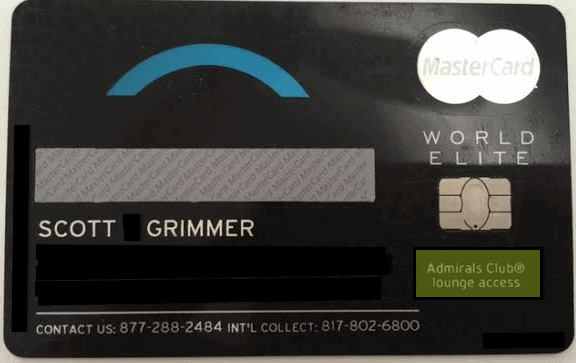

American Airlines Admirals Club Access

Prestige loses American Airlines lounge access on July 23, 2017. Until then…

Citi Prestige® Card offers American Airlines lounge access on any day you are flying American Airlines flights.

- You must present your Citi Prestige® Card and a boarding pass on American Airlines for a flight that takes off in the next 12 hours (or landed in the last 12 hours.)

- You can bring in your spouse and all your children under 18 for free, or you can bring in any two guests for free.

- Only the primary cardholder of a Citi Prestige® Card account receives the Admirals Club lounge access benefit. Authorized users on the same account do not.

Full Admirals Club membership, which costs $500, allows lounge access even when you aren’t flying American Airlines. This Prestige’s lounge access is a little less valuable since you need to be flying American Airlines to access the lounge.

Admirals Clubs feature free:

- Wi-Fi

- House wine, beer and spirits

- Light snacks as well as coffee, specialty coffee drinks, tea and soft drinks

- Personal use computers with Internet access*

- Cyber-cafes*

- Power outlets to help you stay connected

- Work areas with access to copiers and printers

- Shower suites*

- Children’s play areas*

- Personal travel assistance with your reservations

*only at select Clubs

My favorite Admirals Club is at Honolulu Airport with lots of food and overlooking the gardens. There are more than 50 Admirals Clubs worldwide.

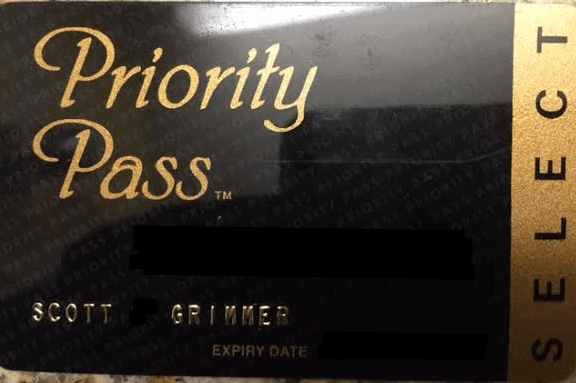

Priority Pass Select Membership

Within a week of your Citi Prestige® Card arriving, you should get a Priority Pass Select card in the mail.

You can use your Priority Pass Select membership for free access at over 700 lounges worldwide. Download the Priority Pass app to your phone or search for lounges here.

Just like with American Airlines lounge access, you get free access for your spouse and all children under 18 or free access for any two guests. Normally Priority Pass access costs $399 per year, and doesn’t allow for any free guests.

Priority Pass Select membership is available to the main cardholder on a Citi Prestige® Card account and all authorized users.

When accessing a Priority Pass lounge, it doesn’t matter what airline you’re flying. For instance, yesterday I accessed the LAN lounge in Bogota while flying American Airlines.

Bottom Line

The Citi Prestige® Card doesn’t just offer a huge sign up bonus and amazing statement credits, it also offers worldwide airport lounge access.

Until July 23, 2017, American Airlines lounge access is available to Citi Prestige® Card account holders and their guests when flying American Airlines. Priority Pass lounge access is available to Citi Prestige® Card account holders and authorized users and their guests all the time.

The sticker price of such lounge access is about $800 per year. If you fly a lot, the lounge access swamps the $450 annual fee.

Do we get lounge access with Priority pass even if flying domestic on any airline?

Almost all the Priority Pass Select lounges in the US are United Clubs, and this card doesn’t allow access to them. A very few lounges for departing international flights from the US exist. The only one I found outside security that appears open to all is at EWR. A complete list is available to the public at

https://www.prioritypass.com/lounges/lounge-details.cfm

Yes, I use my Priority Pass membership almost exclusively abroad and at Alaska Airlines Boardrooms.

You get Priority Pass Select lounge access no matter who you’re flying where.

Do we get lounge access with Priority pass even if flying domestic on any airline?

Almost all the Priority Pass Select lounges in the US are United Clubs, and this card doesn’t allow access to them. A very few lounges for departing international flights from the US exist. The only one I found outside security that appears open to all is at EWR. A complete list is available to the public at

https://www.prioritypass.com/lounges/lounge-details.cfm

Yes, I use my Priority Pass membership almost exclusively abroad and at Alaska Airlines Boardrooms.

You get Priority Pass Select lounge access no matter who you’re flying where.

The only issue with this card is the card its self. It’s constructed with the same plastic as a hotel room key. Also they put the magnetic stripe on the front, so I have to explain how to swipe it to every cashier I hand it to.

The only issue with this card is the card its self. It’s constructed with the same plastic as a hotel room key. Also they put the magnetic stripe on the front, so I have to explain how to swipe it to every cashier I hand it to.

is there a business version?

No

is there a business version?

No

Priority Pass and Citi have both told me that the Prestige only provides access to the cardholder plus two others…i.e., I can not bring my two teenage kids and my wife into the lounges with me without a $27 fee for the fourth person. An alternative is to pay $50 for an authorized user on the Prestige who can also take two guests into the lounges.

Any two guests OR your spouse and all kids under 18 are FREE. It says so right in the terms and conditions.

Priority Pass and Citi have both told me that the Prestige only provides access to the cardholder plus two others…i.e., I can not bring my two teenage kids and my wife into the lounges with me without a $27 fee for the fourth person. An alternative is to pay $50 for an authorized user on the Prestige who can also take two guests into the lounges.

Any two guests OR your spouse and all kids under 18 are FREE. It says so right in the terms and conditions.

ok I’ll bite with a question. for the priority select membership. If I add someone as an AU on my account they will receive a priority select membership, but will they also have the same benefit of getting to bring in spouse and children or two guest, or will their membership be limited to just themselves like the Platinum benefit with AMEX?

I believe the former.

ok I’ll bite with a question. for the priority select membership. If I add someone as an AU on my account they will receive a priority select membership, but will they also have the same benefit of getting to bring in spouse and children or two guest, or will their membership be limited to just themselves like the Platinum benefit with AMEX?

I believe the former.

?

There is no foreign exchange fee. Here is the full review of the card: https://milevalu.wpengine.com/citi-thankyou-premier-brand-new-50000-point-sign-up-bonus/

?

There is no foreign exchange fee. Here is the full review of the card: https://milevalu.wpengine.com/citi-thankyou-premier-brand-new-50000-point-sign-up-bonus/

What Scott said. Every time I use the card the clerk asks where the magnetic strip is.

What Scott said. Every time I use the card the clerk asks where the magnetic strip is.

[…] first $450 annual fee. I already come out ahead before factoring in my 50,000 bonus points, airport lounge access, $100 Global Entry credit, three free rounds of golf, and the fourth night free on paid hotel […]

[…] first $450 annual fee. I already come out ahead before factoring in my 50,000 bonus points, airport lounge access, $100 Global Entry credit, three free rounds of golf, and the fourth night free on paid hotel […]

[…] For me, that’s the Citi Prestige® Card, which I got for its 50,000 bonus points after $3,000 in spending in the first three months, its $250 Air Travel Credit that refunded my first $250 of airfare and award taxes this year, and its unrivaled airport lounge access. […]

[…] For me, that’s the Citi Prestige® Card, which I got for its 50,000 bonus points after $3,000 in spending in the first three months, its $250 Air Travel Credit that refunded my first $250 of airfare and award taxes this year, and its unrivaled airport lounge access. […]

I received an offer for the Citi Prestige card with all the perks listed above with exception that it offers a 100,000 sThank You Point sign up bonus. Has anyone else received this?

Wow! How did you receive it? What is the spending requirement?

I received an offer for the Citi Prestige card with all the perks listed above with exception that it offers a 100,000 sThank You Point sign up bonus. Has anyone else received this?

Wow! How did you receive it? What is the spending requirement?

[…] Access: Priority Pass Select Lounge membership (but no free guests like Citi Prestige offers) & free access to American Express Centurion lounges, which are far nicer than standard […]

the way I read the terms and agreements is yes you do get access to priority lounges but it only a standard membership and cost $27 a pop…..where are you reading you get prestige membership just because you have the credit card?

I have the Prestige. I know for a fact that when you get the Prestige, you are sent a Priority Pass Select membership card and you get free lounge access at Priority Pass lounges PLUS free access for any two guests or your spouse and all kids under 18.

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] 50,000 bonus ThankYou Points, $250 in airfare or airline fee credits per calendar year, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] wrote up all the details of the Citi Prestige® Card‘s lounge access in Complete Guide to Citi Prestige Lounge Access, including the fact that you can bring in free guests to Priority Pass and American Airlines […]

[…] For me, that’s the Citi Prestige® Card, which I got for its 50,000 bonus points after $3,000 in spending in the first three months, its $250 Air Travel Credit that refunded my first $250 of airfare and award taxes this year, and its unrivaled airport lounge access. […]

[…] American Airlines and Priority Pass lounge access […]

[…] the first 3 months the account is open, $250 in airfare or airline fee credits per calendar year, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, the fourth night free on paid hotel stays, three […]

[…] also Complete Guide to Citi Prestige Lounge Access and All the Lounge Access I Got from Citi Prestige on One […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] also Complete Guide to Citi Prestige Lounge Access and All the Lounge Access I Got from Citi Prestige on One […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] access to the American Airlines Admirals Clubs and Priority Pass lounges for you plus two […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] its many benefits like its annual $250 Air Travel Credit, 50,000 point sign up bonus, and access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and […]

[…] If you don’t win, don’t forget that you can use your Citi Prestige® Card for free Admirals Club lounge access for you plus two guests. My full review of the Prestige’s lounge benefits. […]

[…] the first 3 months the account is open, $250 in airfare or airline fee credits per calendar year, access to the American Airlines Admirals Clubs and Priority Pass lounges, the fourth night free on paid hotel stays, 3x points per dollar on air travel and hotels, and a […]

[…] Prestige® Card with 50,000 bonus points, unmatched lounge access, and 3x earning categories (My review of the Citi Prestige […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] the fee is worth it year after year because of benefits like free golf, free hotel nights, free lounge access, and a $250 Air Travel Credit per calendar year. Speaking of that $250 Air Travel […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] Prestige® Card offers American Airlines lounge access every time you fly American Airlines or US Airways, which would mean that every flight in this […]

[…] Prestige® Card offers me free American Airlines lounge access when I’m flying American, free Priority Pass lounge acces… no matter who I’m flying, and two free guests at any of those lounges. I only use this lounge […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] Prestige® Card with 50,000 bonus points, unmatched lounge access, and 3x on air travel and hotels (My review of the Citi Prestige […]

[…] Even if you don’t win this giveaway, there are credit cards that offer free airport lounge access every time you travel like the Citi Prestige® Card, which offers free American Airlines and Priority Pass lounge access. […]

[…] In Chennai, Etihad Business Class passengers have access to the Travel Club along with pretty much anyone else flying Business Class on a Middle Eastern airline or who has Priority Pass or many credit cards. That means I could have gotten in for free no matter which airline I was flying with my Priority Pass membership that is included with my Citi Prestige® Card. (More details on the Citi Prestige’s lounge benefits here.) […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] For further information including information on the Prestige’s AA lougne access, see Complete Guide to Prestige’s Lounge Access. […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] Even if you don’t win this giveaway, there are credit cards that offer free airport lounge access every time you travel like the Citi Prestige® Card, which offers free American Airlines and Priority Pass lounge access. […]

[…] Prestige® Card is the other premium Citi card that offers big time lounge access. It offers American Airlines lounge access when flying American Airlines that day, Priority Pass lounge …. Authorized users cost $50. They do NOT get the American Airlines lounge access, but do get the […]

[…] explains its many components like its annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] bonus, perks, and bonus categories. For some people, the Citi Prestige® Card‘s biggest perk is lounge access at all American Airlines and Priority Pass lounges worldwide, but for me the biggest perk is the $250 annual Air Travel […]

[…] explains its many components like its annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] For me, that’s the Citi Prestige® Card, which I got for its 40,000 bonus points after $4,000 in spending in the first three months, its $250 Air Travel Credit that refunded my first $250 of airfare and award taxes this year, and its unrivaled airport lounge access. […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 50,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]

[…] Full post on Citi Prestige Airport Lounge Access […]

[…] Card’s Priority Pass membership doesn’t include free guests. You pay $27 per guest. The Citi Prestige’s Priority Pass membership lets you bring two free guests or your spouse and childre… into Priority Pass lounges with you for […]

[…] which explains its many benefits like it annual $250 Air Travel Credit, 40,000 point sign up bonus, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual […]