MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

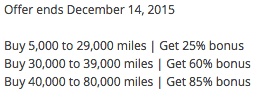

Through December 14, 2015, United is offering up to an 85% bonus on purchased miles. The maximum bonus is targeted with some people being offered 60% and 70% bonuses. Also the size of the bonus depends on the number of miles you buy, with the largest 60%, 70%, or 85% bonus kicking in at 40,000 miles purchased.

Log into your account here to see the bonus you are offered. I was offered the 85% bonus.

United miles normally cost 3.5 cents per mile plus a 7.5% tax, bringing the full price to 3.76 cents each. During the sale the bonuses are:

If you get the 60% maximum bonus, the cheapest miles are 2.35 cents each. If you get the 70% bonus, you can get miles for 2.21 cents each. If you get targeted for the 85% bonus, the cheapest miles are 2.03 cents each.

For those of us targeted for the 85% bonus, buying 40,000 miles–the fewest you need to purchase to get the biggest bonus–costs $1,505, which is 2.03 cents each for the 74,000 United miles you get.

Is This a Good Deal?

No, this is a bad deal for speculative purchases. Since United’s huge devaluation last year, I value United miles at around 1.5 cents. The bottom line on all mileage sales is that they’re a good deal if you have an immediate, high-value use and not a good deal otherwise.

There are a few United awards for which you’ll get more than 2.03 cents of value per mile, but even in those cases, you’d probably be better off buying LifeMiles for 1.5 cents each and redeeming them for the exact same award.

Math

To figure out if you have a high-value use, use this simple expression:

(A – B) / (C + D)

- A: Value of the award. Important: this is the lesser of the cash price and your subjective value.

- B: Taxes on the award

- C: Miles used on the award

- D: Miles you would earn if you purchased the award ticket with cash

This will spit out the dollar value you are getting for your miles. If that number is greater than 0.0203, and you have an 85% bonus, and you can book the dream award now, and LifeMiles somehow is offering a worse deal, buy during this promotion. Otherwise, don’t buy.

Bottom Line

You can buy 148,000 United miles for 2.03 cents each if you get targeted for the 85% bonus. That’s way too high to buy speculatively.

United sales are processed by points.com, so you do not get category bonuses on cards that bonus airline or travel purchases like the Citi Prestige® Card, which offers 3x on purchases from airlines.

Thanks for your succinct analysis as always. My 85% offer kicked in already at 30,000 miles. Nevertheless, in my opinion, still not worth it.

Thanks for your succinct analysis as always. My 85% offer kicked in already at 30,000 miles. Nevertheless, in my opinion, still not worth it.

Don’t forget to check your offer. I got this “Buy 20,000 to 75,000 miles | Get 100% bonus”

Fantastic

Don’t forget to check your offer. I got this “Buy 20,000 to 75,000 miles | Get 100% bonus”

Fantastic