MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

I’m sitting in the Asiana First Class Lounge in Seoul, about to fly one of the newest and hopefully best First Class products in the world on the Asiana A380.

I booked the ticket for 70,000 United miles and around $150 all in because you can still book awards at the old pre-devaluation United award prices.

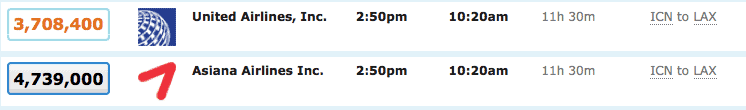

On a whim, I checked the cash price for the ticket. United is selling today’s Asiana flight for 3.7 million Korean won, about $3,560 one way in First Class.

I am actually surprised that the flight isn’t much more expensive. This year I flew Cathay Pacific First Class from New York to Hong Kong for 67,500 American Airlines miles and $27.50. A similar flight goes for $11,271 one way if you buy it from American Airlines (oddly $5,000 cheaper than buying the Cathay Pacific flight from Cathay Pacific.)

I am actually surprised that the flight isn’t much more expensive. This year I flew Cathay Pacific First Class from New York to Hong Kong for 67,500 American Airlines miles and $27.50. A similar flight goes for $11,271 one way if you buy it from American Airlines (oddly $5,000 cheaper than buying the Cathay Pacific flight from Cathay Pacific.)

These eye-popping prices made me think: How rich would I need to be before I bought these flights with cash?

- How rich would you need to be before you bought First Class with cash?

- Why do I redeem miles for First Class instead of economy?

How Rich Would I Need to Be?

In a hypothetical world in which I’m a millionaire (awesome!) and frequent flyer miles do not exist (no!), how much money would I need to have before I bought international First Class for 4-5 figures per flight.

The number I arrived at is that I’d be willing to spend no more than 0.1% of my wealth on a First Class ticket one way. I’m pretty frugal and prefer to protect wealth instead of spending it, so I’m sure some people would purchase these tickets more aggressively if they were rich, but that’s the number I came up with.

That means I’d have to have $3.6 million to fly Asiana First Class today and $11.3 million to fly Cathay Pacific in February.

How rich would you need to be to buy First Class flights in a world without miles?

Why Do I Use Miles for First Class?

- Because I can

- Because it’s fun

- Because I have enough miles for all the trips I want to take (because I fly economy on a lot of awards)

When I figure I’d need $11 million to feel rich enough to buy a Cathay Pacific First Class seat, it seems a bit wasteful that I’ve flown Cathay Pacific First Class (plus Lufthansa, Singapore, Emirates, Thai, Malaysia, American, and United.)

I do it because I enjoy it and because I have plenty of miles for all the trips I want to take.

Even though I travel a ton, my style of travel doesn’t take many miles. Last year I spent nine months outside the US, and this year, it will be about five. But that’s over very few, very long trips. On short hops during a trip, I have no trouble flying economy.

For instance, on this trip to Asia, I am flying about 18 hours of economy and 12 hours of First Class. I conserved miles with all those economy awards because those planes featured unimpressive premium cabins (and I got a full row in economy to myself on two flights.)

Through my travel style, willingness to fly economy, and aggressive opening of new credit cards, I have more miles than I need. I’m happy to spend them for an occasional First Class splurge.

How to Get into First Class

If you want to fly First Class, make sure you collect AIRLINE MILES or points that can be converted to airline miles. Do not collect BANK POINTS that can only be used for a fixed value toward any redemption, since, as mentioned, First Class flights are extremely expensive with cash.

The best airline miles for First Class at the moment are American Airlines miles, Alaska Airlines miles, and US Airways miles.

We know that the US Airways® Premier World MasterCard® will no longer be offered as soon as the US Airways and American Airlines frequent flyer programs integrate, some time in early 2015. That means that the chance to earn 40,000 bonus miles after first purchase will disappear soon. Check out all the places you can go with just the sign up bonus.

The best bank points for economy are Arrival miles. The Barclaycard Arrival PlusTM World Elite MasterCard® comes with 40,000 bonus miles after spending $3k in the first 90 days. Meeting the sign up bonus earns $500 worth of free travel including any flight with no blackouts, any airbnb or hotel stay, and even the taxes on First Class award tickets.

Back in Seoul

The lounge food options were few but delicious. I just finished my meal with some Haagen-Dazs and I’m heading to the showers for a quick shower and shave before departure. Even without $3.7 million to my name, I’m really going to enjoy this next flight.

What an interesting idea. I burned quite a few United miles last year pre-devaluation, to fly a trip that included Air China first class, that would have cost me about $15,000 per person without miles. How rich would I need to be to spend that much? At least $8M I think.

Doesn’t your 0.1% calculation seem low? Assuming you have a net worth of 200k (being generous here, the median american has only 50k), that means you’d be willing to spend a max of $200 for this top-tier international first-class, while many of us spend a lot more on economy.

If I’m a millionaire, I’d think in terms of wealth preservation and the opportunity cost of spending money versus investing it. If I’m a $200k-aire, I’d think more about cash flow from my income versus spending. So I’d definitely spend more than $200 on Int’l First if I had a $200k net worth.

But why would you buy these flights with cash when you can buy Lifemiles at 1.5 cents apiece and get Asiana First for just around $1200? Anyone who pays full fare for First class really is…

Agree there’s rarely a need to pay for First Class because one can buy miles. That’s why I specifically said miles don’t exist for this thought experiment.

@Jeff, he was imagining a world in which there were no frequent flyer miles (perhaps the mysterious world in which Chris Elliott exists), so it was a thought experiment that disallows your strategy, which indeed makes a lot more sense in the real world than spending on such a ticket.

Just came through Asiana’s First Class Lounge in Seoul Scott, as I was travelling on a 1st ticket heading home. I was surprised that this lounge didn’t seem any different than the ‘regular’ business one as far as amenities and food offerings. It was a pretty simple and limiting spread, which I also found the case for ANA in Tokyo. Basically, just a different large space.

Yeah, but without the riffraff.

Agree and agree. It was nice, but hardly opulent. I gave my full thought’s in today’s trip report –> https://milevalu.wpengine.com/asiana-a380-first-class-seoul-los-angeles-trip-report/

Or you can just work for a company who comps first/business class. The theory then becomes a little distorted since you can factor in your educational or professional background required to gain a position where you can fly that free on the company dime.

Yes, that would be quite hard to model.

I’ve got an Emirates A380 first class Suite booked JFK-DXB for 90k Alaska miles and ~ $16. Retail price (I also priced it out) was $20,540 one way. Booking this was an aspiration of mine when I got into this game. I was able to actually do it with only 6 months in!

Congrats! Enjoy that shower!

[…] to bloggers like Milevalue, you should be able to fly first class if you collect a lot of airline points and use them […]

[…] to bloggers like Milevalue, you should be able to fly first class if you collect a lot of airline points and use them […]