MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The card offer described in this post has expired. To see the latest top travel credit cards with big bonuses that will save you tons, check out our Top 10 List for Consumers and Top 10 List for Small Businesses.

Arrival miles are good for so much more than just airfare. You can also use them to offset fees that airlines charge or even the taxes on award tickets.

Any purchase you make from an airline should code as travel, which means you can redeem Arrival miles from the Barclaycard Arrival PlusTM World Elite MasterCard® to remove the purchase from your card’s account balance.

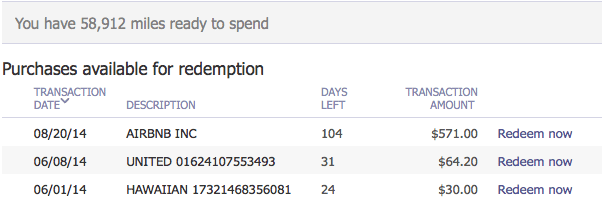

After my brother and I used his Arrival miles to get a $571 airbnb stay in Seoul for free, we looked at what was left in his account.

He had two other travel purchases that he could redeem miles against: $64.20 from United and $30 from Hawaiian Airlines.

The United charge was the taxes on his award ticket to Asia. The Hawaiian charge was the change fee on an interisland flight when he decided to cut short a trip to the Big Island.

Many programs like Ultimate Rewards, ThankYou Points, and FlexPoints allow you to redeem points for a free ticket on any airline. Arrival miles from the Barclaycard Arrival PlusTM World Elite MasterCard® go one step further allowing redemptions for any travel expense including these airline taxes and fees.

- How did we redeem his miles for the taxes and fees?

- What decision did I make to save him $1 (he owes me a Frosty!)?

- Does this mean you can use Arrival miles to offset the cost of buying airline miles during miles sales?

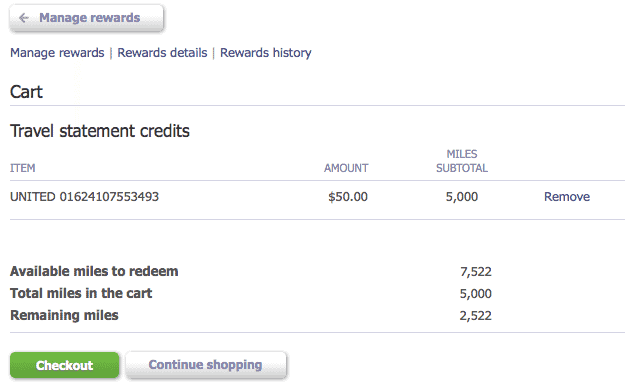

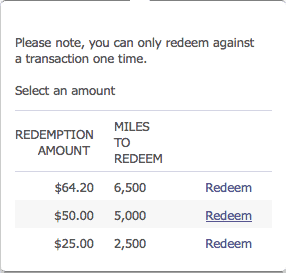

First, we decided to remove the cost of the taxes on his award ticket. On redemptions, Barclaycard rounds the number of miles needed up to the nearest 100, so redeeming 6,500 miles for the full $64.20 was a slightly worse deal than redeeming for 5,000 for $50 or 2,500 for $25.

We redeemed 5,000 miles for a $50 statement credit.

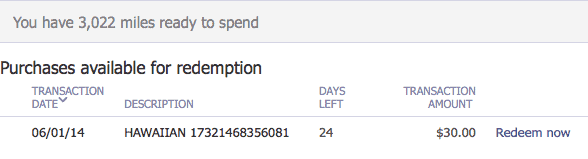

Instead of being left with just 2,522 miles, he was actually left with 3,022 miles after the instant 10% rebate on the 5,000 mile redemption.

Instead of being left with just 2,522 miles, he was actually left with 3,022 miles after the instant 10% rebate on the 5,000 mile redemption.

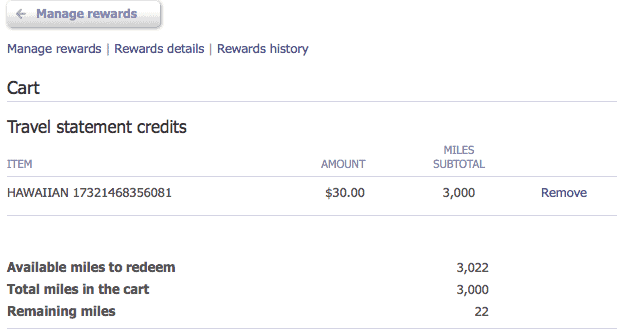

That was just enough miles to completely remove that $30 change fee from Hawaiian Airlines.

That was just enough miles to completely remove that $30 change fee from Hawaiian Airlines.

The 3,000 mile redemption bought him another $30 statement credit. And he got 300 miles back as a 10% rebate, leaving his account with 322 miles.

Bottom Line

Here are all the things considered travel for the purposes of redeeming Arrival miles:

- airfare on any flight on any airline with NO blackouts whether purchased from the airline or an online travel agency like Expedia

- taxes and fees on award tickets

- airbnb

- buying TACA/Avianca LifeMiles

- any hotel charges including meals and services on your bill

- motels

- hostels

- Bed & Breakfasts

- car rentals

- cruises

- trains

- buses

- taxis

- ferries

It even allowed me to redeem points for a Metrorail purchase. So, it even covers metro/subway tickets. I love the Arrival + card because it covers many incidental traveling expenses.

I wonder if city tour buses are also included. You know, those double decker ones. That’d be great because I enjoy hopping on those when I’m at a city (Rome, for instance) with a lot of different sites all over the place to visit. Does anyone have any experience with that?

Thanks! I love your site and I’ve learned so much from it.

Does this only work (getting full redemption) if you already have miles in your account to cover the entire cost of your purchase? I think I wiped out my Arrival miles.

No. You can redeem for up to 120 days after the purchase, so you have time to earn the miles even after the purchase.

[…] miles can be redeemed for any travel expense like any flight (no blackouts), taxes and fees on award tickets, hotels, airbnb, car rentals, cruises, and more. After the 10% rebate on all travel redemptions and […]

[…] Whether you pay the big taxes departing the United Kingdom or minimize taxes by starting on the continent, you can avoid a cash outlay altogether by paying your award taxes with a Barclaycard Arrival PlusTM World Elite MasterCard®. You can then redeem Arrival miles for a full statement credit equal to the taxes and fees on the award. […]

[…] taxes and fees on award tickets […]

[…] I have used my Arrival miles on a recent trip to book a motel and domestic flights like a $150 trip from Raleigh to Tampa that would have been a poor value with traditional miles. I also used my Arrival Plus recently to book myself a free Airbnb stay and to pay the taxes on an award booked with traditional miles. […]

[…] use my Arrival miles for Airbnb stays, the taxes on airline awards, or for flights on low-cost […]

[…] miles can be redeemed for any travel expense like any flight (no blackouts), taxes and fees on award tickets, hotels, airbnb, car rentals, cruises, and more. You also get a 5% rebate on all […]

[…] within 120 days of the purchase, like any flight (no blackouts. Examples of travel expenses are taxes and fees on award tickets, hotels, Airbnb, car rentals, cruises, etc. Here is How to Redeem Arrival Miles. The Arrival miles […]

[…] any travel expense of $100 or more made within the last 120 days, like any flight (no blackouts), taxes and fees on award tickets, hotels, Airbnb, car rentals, cruises, and more. You also get a 5% miles rebate on all […]

[…] miles are worth 1.14 cents each toward flights, car rentals, hotels, airbnb, the taxes on award tickets, and a lot more travel expenses. That means during the promotion I’d be getting 3.55% (3.11 * […]

I would actually say the points are worth far more than 1.14 when used for things there just was no other way to pay or use miles like cruises.

These are great for those regional flights in Europe where Avios or no program miles are available. Currently working on points needed for a cruise. Giving you 4 months to earn those points is pretty awesome. Probably will not make the spend, but trying.