MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Whether it’s eating a croissant near the Eiffel Tower, skiing in the Alps or riding in a gondola across Venice canals, Europe offers a lot of reasons to visit. In fact, France, Spain, Italy, Germany and the United Kingdom were in the top 10 most visited destinations by international travelers in 2019, according to the United Nations World Tourism Organization.

It’s no wonder that many travelers seek award flights to Europe. If you collect points and miles, consider the following loyalty programs for traveling to the continent.

ANA Mileage Club

If you haven’t heard of the Tokyo-based All Nippon Airways or its frequent-flyer program, Mileage Club, we’re going to change that right now. The airline is part of the Star Alliance, and it’s one of the best programs to use for award flights between the United States and Europe.

How to Book with Mileage Club Miles

The Mileage Club is a region-based program, which means that you’ll redeem a predetermined number of miles based on the two regions of your flight departure and arrival.

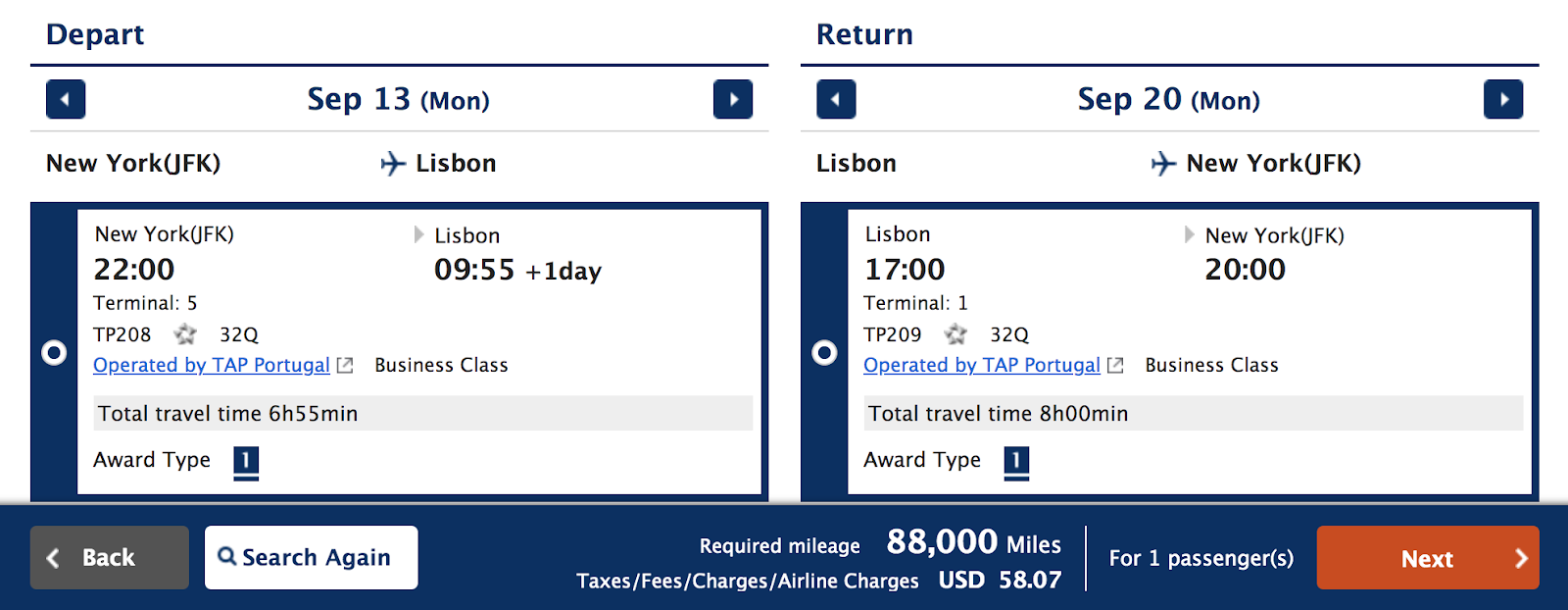

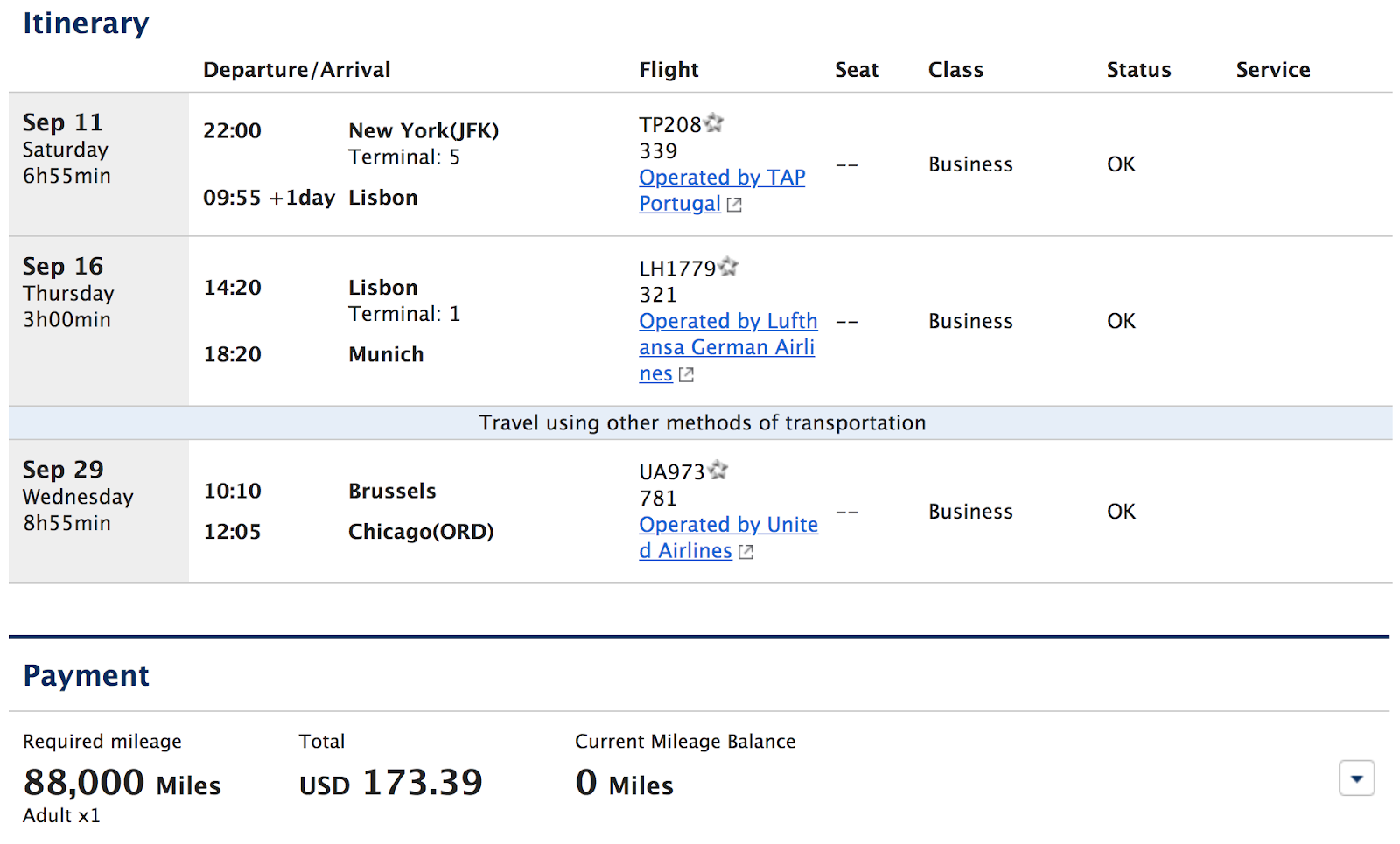

Keep in mind that ANA doesn’t allow booking one-way awards on partners. Only ANA-operated flights can be booked on one-way journeys. You’ll see the following award rates for flights from the U.S. to Europe based on a round-trip booking:

- Economy: 55,000 miles

- Business: 88,000 miles

- First: 165,000 miles

With ANA Mileage Club, you can even add a stopover and an open-jaw for the same number of miles as if you booked a regular round-trip ticket, which adds a lot of value to the program.

Be aware of the high fuel surcharges that are passed on with some bookings, such as on Lufthansa- and SWISS International Air Lines-operated flights. To avoid having to pay high fees, look for flights on Air Canada, TAP Air Portugal and United Airlines, to name a few.

To search for available award space, you must be logged in to your ANA Mileage Club account. As mentioned above, one-way partner redemptions aren’t possible. You must find availability on a round-trip journey to be able to fly Star Alliance airlines to Europe.

How to Earn ANA Mileage Club Miles

ANA Mileage Club is a transfer partner of the American Express Membership Rewards program. You earn Membership Rewards by swiping The Platinum Card® from American Express, the American Express® Gold Card or The Blue Business® Plus Credit Card from American Express. With these cards, you can earn anywhere from 2X to 5X points per dollar in popular spending categories.

Miles transfer at a rate of 1:1, but the process isn’t instant. It can take a few business days for the point transfer to go through.

You may be eligible for as high as 175,000 Membership Rewards® Points after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the

Card, your score may be impacted.

Another way to top up your Mileage Club account is with the help of Marriott Bonvoy. Marriott points can be converted to ANA miles at a ratio of 3:1, and if you transfer in 60,000-point chunks, you’ll receive another 5,000 miles on top. In other words, for every 60,000 Marriott points transferred, you’ll end up with 25,000 miles.

Etihad Guest

Again, this loyalty program might sound obscure to some of you, but it’s worth learning about as it provides some great redemption rates from North America to Europe.

How to Book with Etihad Guest Miles

Etihad is a non-alliance partner of American Airlines, and Etihad miles can be used to book AA-operated flights from North America to Europe at the following one-way redemption rates:

- Economy off-peak: 20,000 miles

- Economy peak: 30,000 miles

- Business: 50,000 miles

- First: 62,500 miles

To book these flights via Etihad Guest, you must find availability on your own—on AA.com, BA.com or with ExpertFlyer—and call Etihad Guest Service Center at 877-690-0767 to complete booking.

How to Earn Etihad Guest Miles

You can get your hands on some Etihad Guest miles by transferring American Express Membership Rewards to the program 1:1. If you hold any cards that earn Membership Rewards, personal or business, you’re all set.

Transfers are instant, but if you want to book an American flight to Europe using Etihad miles, you have to do so at least 14 days in advance.

Citi ThankYou Points are another transferrable currency that can be converted to Etihad miles. Points transfer instantly 1:1. You can earn Citi ThankYou Points with the Citi Prestige Card, the Citi Premier® Card and the Citi® Double Cash Card, whose cash back can be converted to ThankYou points in conjunction with one of the premium credit cards.

If you hold the Capital One Venture Card or the Capital One Spark Miles for Business Card, you can transfer your Venture Rewards to Etihad Guest at a ratio of 2:1.5. These transfers aren’t instant, but they usually process within 24 hours.

If you’re desperate, you can transfer your Marriott Bonvoy points to Etihad Guest at a ratio of 3:1. As usual, for every 60,000 points converted to 20,000 miles, you’ll get a bonus of 5,000 miles.

Air France-KLM Flying Blue

Another great option to consider is Air France and KLM’s joint frequent-flyer program, Flying Blue. Both of these airlines fly to multiple U.S. cities offering you a chance to fly nonstop (or with domestic connections on Delta Air Lines) to Europe.

How to Book with Air France-KLM Flying Blue

Flying Blue doesn’t have an award chart anymore, and its redemption rates vary for specific city pairs. Yet the program still offers reasonable redemption rates to flyers. Although rates are dynamic, which means they can fluctuate based on demand, Flying Blue makes low-level awards somewhat easy to find, as long as you’re flexible with travel dates.

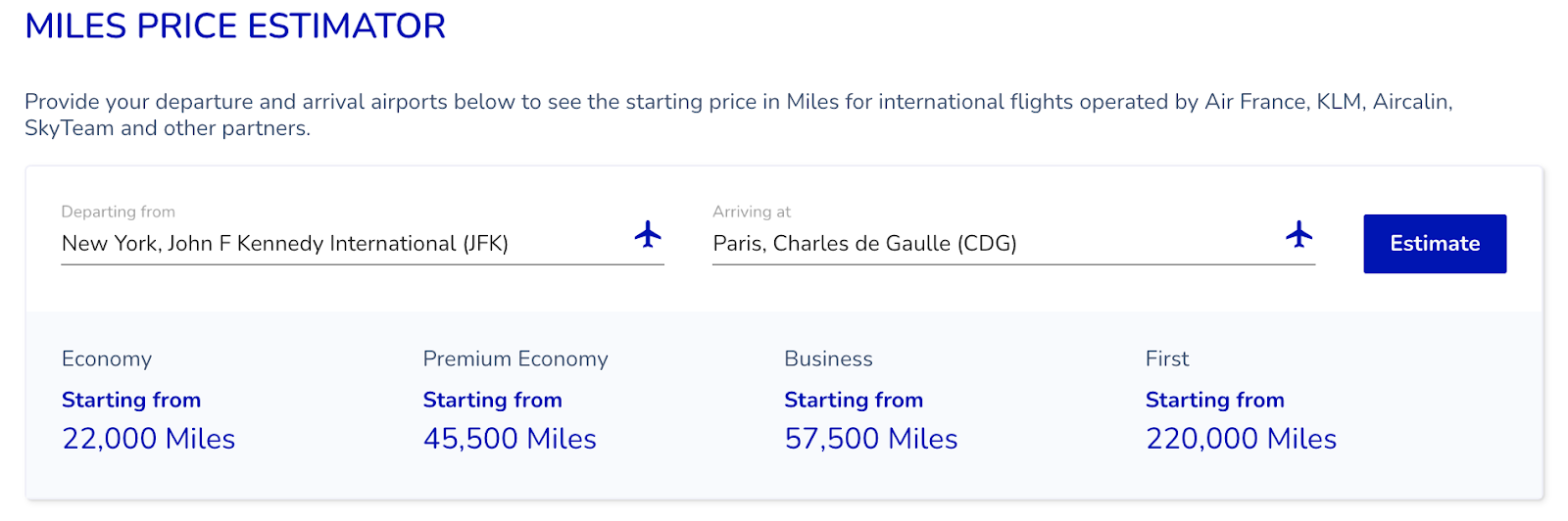

First of all, to know exactly how many miles you need for a specific route, use the Miles Price Estimator. Enter your two airport codes and estimate the lowest possible redemption rate.

In this example, a one-way flight from New York City (JFK) to Paris (CDG) should cost the following number of miles for each class of service:

- Economy: 22,000 miles

- Premium economy: 45,500 miles

- Business: 57,500 miles

- First: 220,000 miles

Keep in mind that these are just the starting redemption rates, and the actual cost in miles can go up for any reason, such as peak travel dates, high demand or favorable flight schedule.

These rates are specific to this particular route. Use the Miles Price Estimator to determine the lowest-level redemption rates for other itineraries.

As mentioned above, Flying Blue makes these low-level awards somewhat available, and you don’t have to play too many games when searching for a flight to Europe.

Another thing you have to remember is the fact that Flying Blue tacks on hefty fees to Air France- and KLM-operated flights. You’ll be shelling out hundreds of dollars on top of miles to book award tickets on these airlines, but the relatively low redemption rates can still make it worthwhile.

To search for award space, you must be logged in to your Flying Blue account.

How to Earn Flying Blue Miles

Flying Blue miles are some of the easiest to obtain, thanks to its partnership with all the major transferrable point programs.

If you have American Express Membership Rewards, Capital One Venture Miles, Chase Ultimate Rewards or Citi ThankYou Points, you can get Flying Blue miles without issues. All of these points can be transferred to Flying Blue at a rate of 1:1, with the exception of Venture Miles that transfer at a rate of 2:1.5.

American Express® Gold Card

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Of course, Marriott Bonvoy points are still in play, and you can transfer those to your Flying Blue account at a ratio of 3:1.

Additionally, if you still can’t get enough Flying Blue miles, Bank of America issues a co-branded Air France KLM World Elite Mastercard to U.S. flyers.

Turkish Miles&Smiles

Once again, the best loyalty programs to utilize for flights from North America to Europe aren’t U.S.-based programs. Turkish Airlines Miles&Smiles is a fantastic program to use in this case, especially if you live in a city where Turkish Airlines flies.

How to Book with Turkish Miles&Smiles

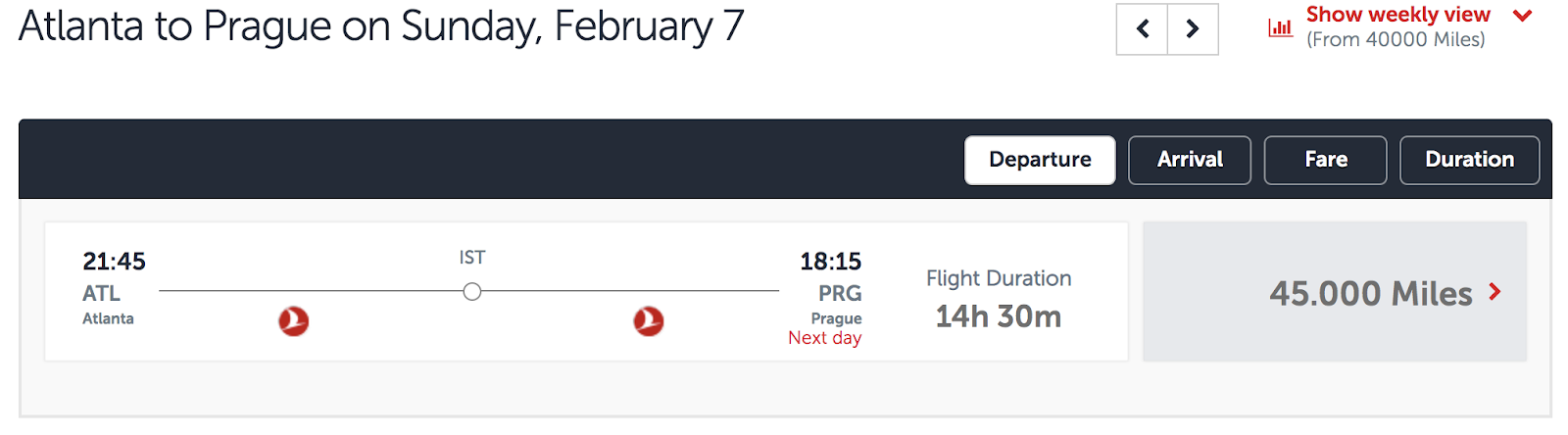

Create a Miles&Smiles account and log in to look for availability. If a seat is bookable with miles, you’ll need to redeem for one-way flights at the following rates:

- Economy: 30,000 miles

- Business: 45,000 miles

You’ll need the same number of miles to book a flight to Istanbul or to another European destination.

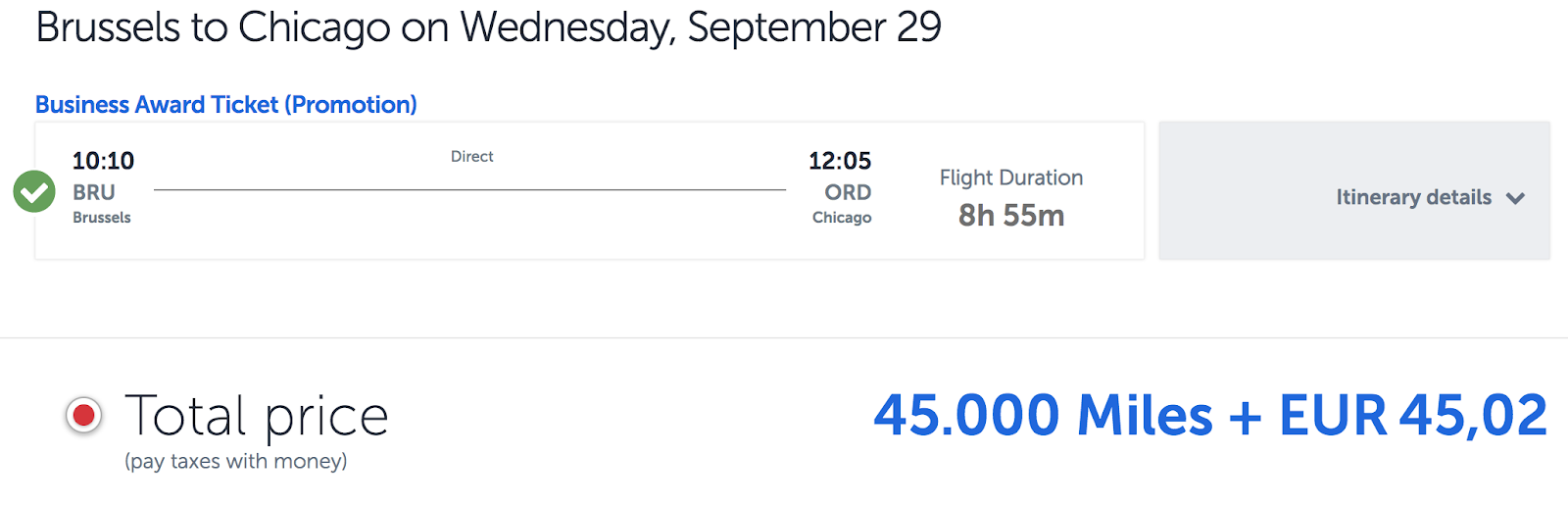

If you’d rather not fly Turkish because of a long layover, for example, or another reason, you can book awards on Star Alliance partners at the same rates. Here, we have a direct flight between Brussels (BRU) and Chicago (ORD) on United Airlines for 45,000 miles in business class.

For other Star Alliance searches, meaning flights not operated by Turkish Airlines, go to this page. You must log in to perform a search.

If for some reason a flight isn’t showing up in the search, but you know for a fact that it should be bookable with miles (confirmed with ExpertFlyer), call the reservations office for help, and one of the agents should be able to piece an itinerary together.

One thing you need to remember when booking award flights for a group of travelers or for someone other than the account holder, the first award ticket you book with the Miles&Smiles program must be for the primary member. This is done to make sure no one else is draining your account of miles.

How to Earn Turkish Miles

Citi ThankYou Points is the only transferable currency that can be converted to Turkish Miles&Smiles. Make sure to keep the Citi Prestige Card or the Citi Premier® Card in your portfolio for the option to transfer points to Miles&Smiles. Transfer rates are 1:1, but the process isn’t instant. Points can take up to one day to post.

Marriott Bonvoy points can come in handy here for those who don’t hold any Citi cards. Points convert at a ratio of 3:1 with a 5,000-mile bonus for every 60,000 points converted.

Iberia Plus

This particular option to fly to Europe with points is more of a niche option because it only benefits those who live in specific cities, but it’s a great one if you can make it work.

How to Book with Iberia Plus

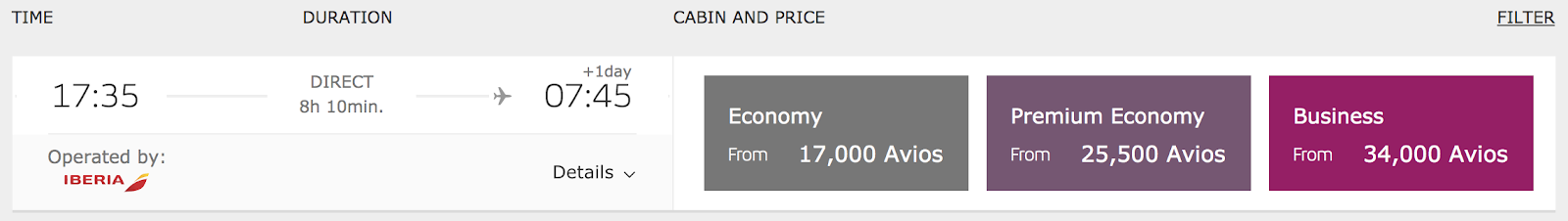

Iberia Plus is a distance-based program, which means the longer your flight is, the more miles you’ll need for a redemption. The airline also implements peak and standard pricing to its flights, based on travel season.

Boston, Chicago, New York City to Madrid (standard / peak):

- Economy: 17,000 Avios / 20,000 Avios

- Premium economy: 25,000 Avios / 35,000 Avios

- Business: 34,000 Avios / 50,000 Avios

Los Angeles or Miami to Madrid (standard / peak):

- Economy: 21,250 Avios / 25,000 Avios

- Premium economy: 31,750 Avios / 43,750 Avios

- Business: 42,500 Avios / 62,500 Avios

San Francisco to Madrid (standard / peak):

- Economy: 25,500 Avios / 30,000 Avios

- Premium economy: N/A

- Business: 51,000 Avios / 75,000 Avios

Travelers who live in New York City, Boston and Chicago have access to some of the best redemption rates in the industry, especially on standard, or off-peak, dates. Flying from North America to Europe in business class for just 34,000 miles each way is almost unheard of…until you hear of Iberia Plus.

Keep in mind that these redemption rates apply only to nonstop flights to Madrid. If eating tapas and drinking wine isn’t your thing, you can continue on to somewhere else, but your final rate in miles will increase along with the total travel distance.

How to Earn Iberia Avios

Iberia Plus is a transfer partner of American Express Membership Rewards and Chase Ultimate Rewards. Points transfer 1:1 from both programs. While Chase points transfer instantly, American Express points can take up to 48 hours to transfer.

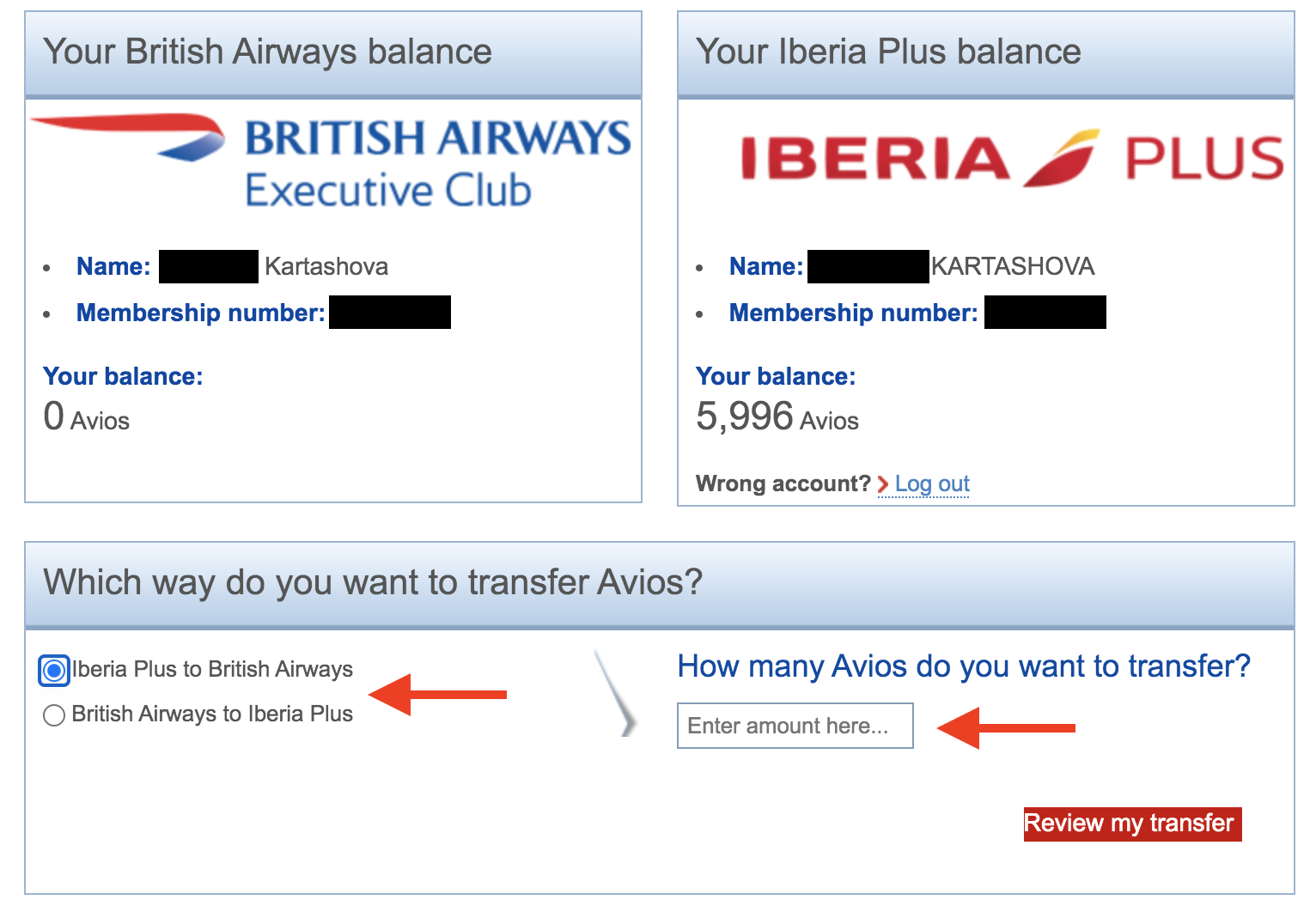

The other option is to transfer your Avios between British Airways and Iberia. If you have Avios in one account but not the other, you can freely move them between accounts for free.

If you need more Iberia Avios, Chase issues a co-branded Iberia Plus Visa Signature Card. It’s worth mentioning that it’s only available to applicants who have opened four or fewer new credit cards in the last 24 months.

Finally, Marriott is here to help you out again. Bonvoy points can be converted to Iberia Avios 3:1, and Marriott will throw in another 5,000 Avios if you transfer 60,000 Marriott points.

Final Thoughts

With so many great redemption options, Europe seems so much closer, doesn’t it? Now we need to get travel restrictions and quarantine requirements lifted so we actually can travel there. Here’s to hoping that 2021 is the year safe trips to Europe resume.

Excellent blog. I knew you could dig deeper and you did. There are some excellent points in this blog on how to make the most of our points. Thanks

Thank you for reading. 🙂

Hi Anya, I had a couple questions:

1. With regards to the Etihad option, isn’t AA TATL award availability quite poor?

2. With regards to the Iberia option: What does the business class pricing look like if you are flying from one of the other major East Coast cities. For example Philadelphia or Washington DC?

Iberia doesn’t operate service to Philadelphia. When I tried D.C., I couldn’t locate nonstop flights, either. Could be a pandemic cut, not sure, but only connecting flights were available. Where do you typically fly out of?