MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The world of credit card rewards programs can be confusing and intimidating. It may be daunting at first, but once you understand how these programs work, you will see just how valuable they are.

This article is intended to give you the basic tools you need to use one of the most powerful and versatile rewards programs out there: Chase Ultimate Rewards.

What Are Chase Ultimate Rewards Points?

Chase Ultimate Rewards points are a transferable loyalty currency that can be redeemed for cash back, flights, hotel stays, shopping and even exclusive experiences. Chase customers can earn points through welcome bonuses, spending on specific Chase credit cards and referral bonuses.

In the same way your local pizza shop offers you a free pizza after purchasing a set number to keep you coming back, Chase uses their Ultimate Rewards loyalty program to incentivize you to continue using their products. While a free pizza is nice, the Ultimate Rewards points you earn with Chase could be your ticket to an amazing vacation you’d never have thought you could afford.

Why Are Chase Ultimate Rewards Points So Valuable?

The biggest reason Chase Ultimate Rewards points are so valuable is that they are transferable. Most loyalty programs allow you to earn rewards from one specific company or brand. If you earn a free pizza from Pizza Hut, you can’t then turn around and walk into a Domino’s and redeem your free pizza.

However, if you had a transferable pizza loyalty card that allowed you to earn points and rewards at all pizza restaurants, you could simply apply your loyalty rewards to whatever pizza restaurant chain was most convenient for you at that moment.

While Ultimate Rewards points are not universally accepted, with 11 different airline partners and three major hotel partners, they give you a lot more flexibility to use your points where and when you need them.

Chase’s travel partners are:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- IHG One Rewards

- JetBlue TrueBlue

- Marriott Bonvoy

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

Chase Sapphire Reserve®

Earn 100,000 bonus points + $500 Chase TravelSM promo credit after you spend $5,000 on purchases in the first 3 months from account opening.

How Do I Earn Chase Ultimate Rewards Points?

Hopefully, you see the value in having such useful, transferable points, but now the question is, how do I get them?

Everyday Spending

You will earn a minimum of 1 Ultimate Reward point, oftentimes more, depending on bonus categories, for every dollar you spend using the following credit cards:

- Chase Freedom Flex®

- Chase Freedom Unlimited®

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Ink Business Unlimited® Credit Card

- Ink Business Cash® Credit Card

- Ink Business Preferred® Credit Card

- Ink Business Premier® Credit Card (non-transferable points)

One card may offer 3 times the points on gas while another offers 5 times the points on grocery purchases. It’s important to check the current categories for each card you hold to maximize your earning potential. Keep in mind that while some bonus categories remain relatively constant, others change quarterly.

It’s important to note that while all the above cards will earn you Ultimate Rewards points, points earned through the Ink Business Premier® Credit Card are non-transferable as this card mainly acts as a cashback card.

If you intend to transfer your points to airline and hotel programs, you’ll need to have either the Chase Sapphire Preferred® Card, the Chase Sapphire Reserve® or the Ink Business Preferred® Credit Card. These cards can also increase your redemption value to 1.25 and 1.5 cents per point, respectively, when booking through the Chase Travel Portal.

Chase Sapphire Preferred® Card

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Welcome Bonuses

The easiest way to rack up a large number of Ultimate Rewards points is through welcome bonuses. Offers will vary from card to card and time to time, but essentially, Chase will offer you a set number of points if you spend a certain amount of money during a designated term. A typical offer on the premium cards might look something like 60,000 to 80,000 Ultimate Rewards points if you spend $4,000 on the card during a three-month period.

Looking at this, you might think, “Why wouldn’t I just apply for a new card every three months and keep getting bonuses?” Well, Chase has a few rules you need to know to navigate this most lucrative earnings avenue.

The first thing to know is that you can receive a welcome bonus on a Sapphire card only once every 48 months. Other cards in the Ultimate Rewards ecosystem have restrictions of 24 months per welcome bonus.

The second, Chase doesn’t allow you to hold the Sapphire Preferred and the Sapphire Reserve cards at the same time. You have to close or downgrade one Sapphire card before you can open the second Sapphire card.

And finally, Chase’s 5/24 rule means that you won’t be approved for a new Chase card if you have applied for five or more consumer credit cards with any bank in the previous 24 months.

Referrals

As a Chase Ultimate Rewards program member, you can earn points when someone opens a new Chase credit card using your referral link. These referral bonuses are typically 10,000 to 15,000 points, but at times can be as high as 20,000 points.

To send a referral, log into your Chase Ultimate Rewards account and click on the Refer-A-Friend link. You will then need to enter your last name, ZIP code and the last four digits of your card. This will generate a link that you can then send to whomever you wish to refer.

Remember that you’ll receive the bonus only if the person applies through your link and is approved. Annual restrictions apply on the number of points you can earn through referrals.

Chase Ink Business Unlimited® Credit Card

Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

How to Combine Ultimate Rewards Points

Maximizing your earning potential on daily spending by paying attention to bonus categories means that you’ll end up with Ultimate Rewards points in various accounts. If you hold more than one Chase credit card, at some point, you may want to consolidate the points you have earned.

Your reason may be as simple as needing a specific total for a redemption. Or perhaps you’re moving your points from a cashback card to a Sapphire card to take advantage of better redemption rates through the portal. Maybe you want to consolidate points before transferring to a travel partner. Whatever your reason, the good news is that it’s easy to transfer Chase Ultimate Rewards points instantly.

How to Combine Ultimate Rewards Points in Your Account

To combine Ultimate Rewards points from two or more accounts, first go to Ultimate Rewards and log in. You’ll then be asked to select the card you’d like to view. This will take you to the main dashboard for the card you selected.

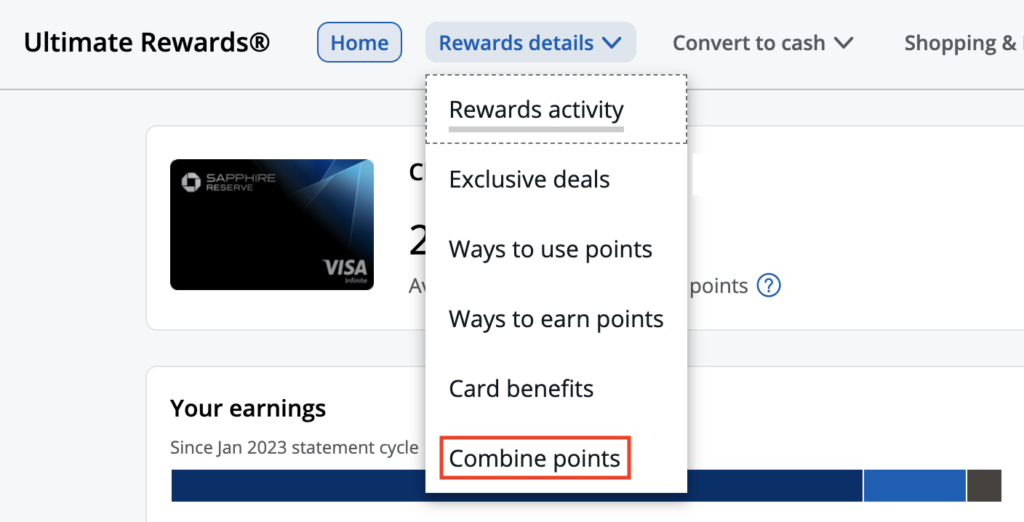

At the top, you’ll see “Rewards details.” Click on the drop-down arrow and then on “Combine Points.”

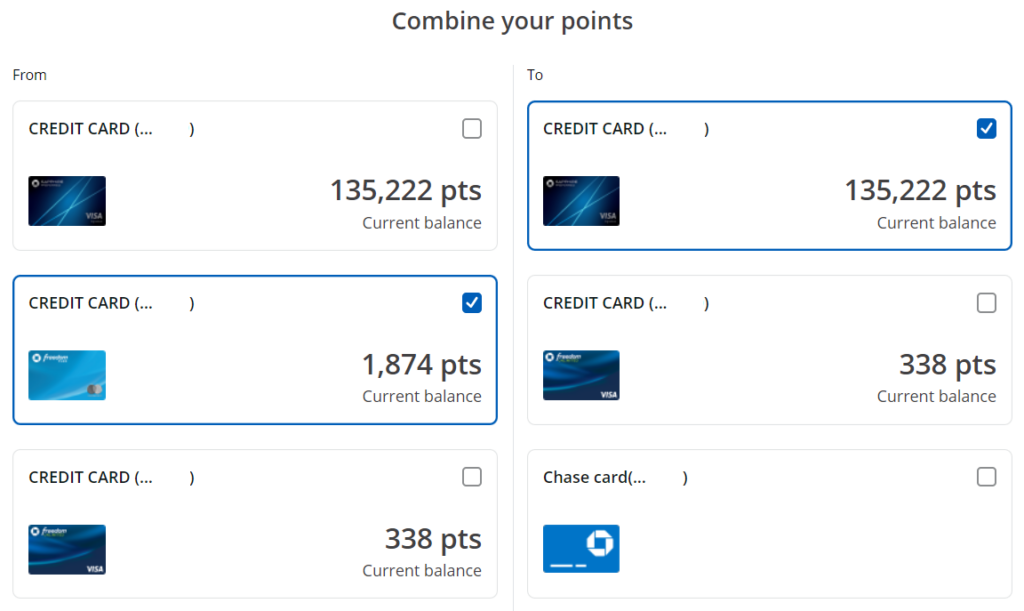

This will bring up a screen showing all your Chase cards. Simply select the card you wish to transfer points from on the left and the card you wish to transfer to on the right.

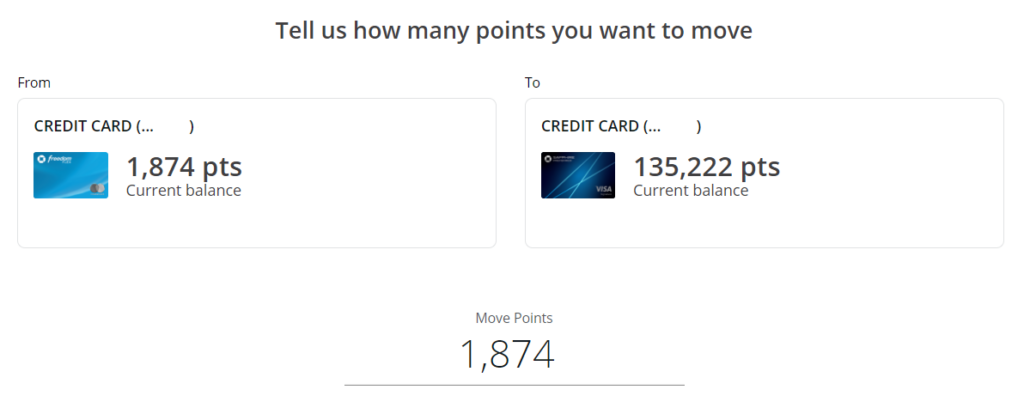

Once you’ve chosen the relevant accounts, you will be asked how many points you would like to transfer.

Transferring points between your Chase accounts occurs instantly, and after a confirmation screen, you’ll see the new points balance of the card you have transferred the points to.

How to Combine Ultimate Rewards with Another Cardmember

To transfer points to another person, the process is the same as transferring between accounts. The only catch is that Chase allows you to transfer your Ultimate Rewards points only to a member of your household or to an authorized user on the card.

Adding a household member to your list of available accounts to transfer to does require calling Chase to set up. Using the number on the back of your card, tell the customer service representative that you’d like to add a household member, and the agent will ask for the card number of the other person’s account.

Once this is set up, you’ll see your household member’s account in the right-hand column where it shows accounts to transfer to when you click on combine points. Thankfully, you need to call Chase only once to add the account and not every time you wish to transfer points, unless you need to change your designated points recipient.

Do Ultimate Rewards Points Expire?

Unlike many rewards programs out there, Chase Ultimate Rewards points don’t expire. That means even if you don’t have an immediate need for your points, you can keep earning points without having to worry about a deadline to use your rewards.

As long as you have at least one of the cards within the Ultimate Rewards family and your account is in good standing, your points are safe. If you have multiple Ultimate Rewards cards and are going to close one of the accounts, make sure you first transfer your points to the card you intend to keep.

Some reasons your account might fall into poor standing include misusing the rewards program in any way, failing to make payments or declaring bankruptcy.

How Much Are Ultimate Rewards Points Worth?

Think back to the first time you heard about credit card points and miles. What was the very first question you asked? I’m willing to bet you wanted to know, just as I did when I started the points and miles hobby, how much are the points and miles worth? Invariably, the somewhat frustrating but true answer you probably received is some version of “It depends.”

The most straightforward way to value your points is to consider what they would be worth if you simply exchanged them for cash. Chase Ultimate Rewards Points can be exchanged at a rate of 1 cent per point, meaning every 10,000 points are worth $100.

However, to calculate the true value of Chase Ultimate Rewards points, you have to consider how you use them. The redemption rate of 1 cent per point is the lowest value you should place on your points, and luckily there are many ways to increase that value.

Ways to Redeem Chase Ultimate Rewards Points

Redeeming Ultimate Rewards Points for Cash Back

Short of extreme circumstances, cashing out your points at a rate of 1 cent per point is not advised, considering the many better options you have to boost their value. However, if you have bills to pay or are in desperate need of funds, cash back is always an option.

Redeeming Ultimate Rewards Points for Gift Cards

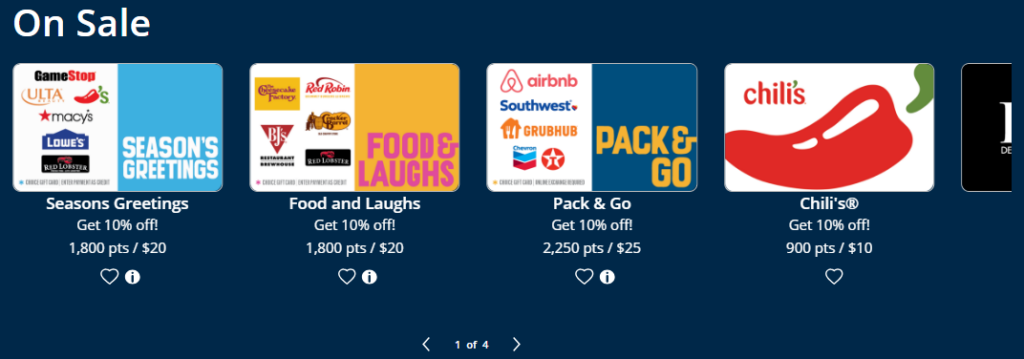

Chase Ultimate Rewards offers a large variety of gift cards that can be purchased using your points. While most gift cards are available at the same value of 1 cent per point as you would receive for cash back, Chase often puts certain gift cards on sale. The “On Sale” section typically offers 10% off and boosts your redemption rate to 1.1 cents per point.

Pay Yourself Back

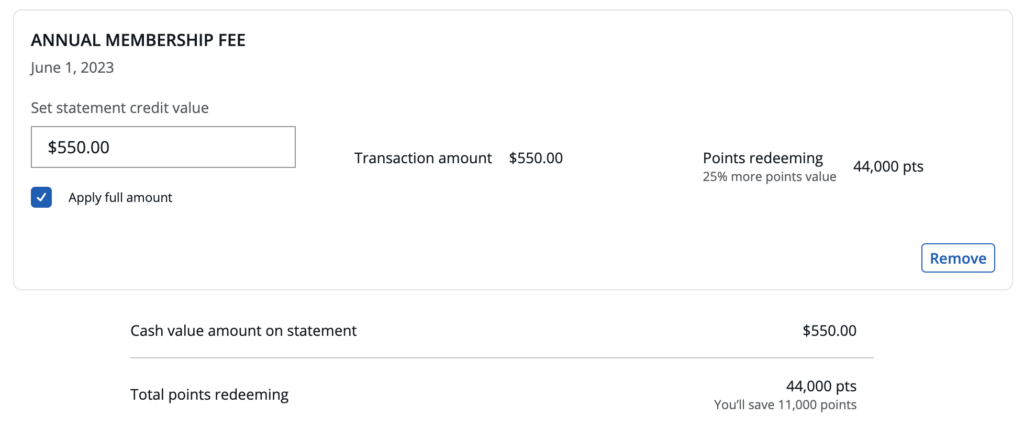

Chase’s Pay Yourself Back program allows you to erase all or part of select purchases using Ultimate Rewards Points sometimes at a higher rate than the 1 cent per point you get from redeeming your points for cash back. You can even use the program to offset annual fees associated with the Chase Sapphire Reserve®.

To use the program, sign into your Ultimate Rewards account and click on the “Convert to cash” dropdown menu and select “Pay Yourself Back®.” This will bring you to a page showing your current eligible categories. These categories rotate, so make sure you check current offers if you plan on using this feature.

As with many things in the Ultimate Rewards ecosystem, it matters what cards you hold and what cards you use. In the chart below, you can see that using the Pay Yourself Back feature for gas station and grocery purchases on the Chase Sapphire Reserve®, would give you an added 0.25 cent value while all other cards only provide a benefit with select charities.

| Chase credit card | Eligible spending category | Redemption value on select categories |

| Chase Sapphire Reserve® | Gas stations, groceries, annual fees and select charities | 1.25 cents(Charities 1.5 cents) |

| Chase Sapphire Preferred® Card | Select charities | 1.25 cents |

| Ink Business Preferred® Credit Card | Select charities | 1.25 cents |

| Ink Business Cash® Credit Card | Select charities | 1.25 cents |

| Ink Business Unlimited® Credit Card | Select charities | 1.25 cents |

| Chase Freedom Flex® | Select charities | 1.25 cents |

| Ink Business Premier® Credit Card | Select charities | 1.25 cents |

| Chase Freedom Unlimited® | Select charities | 1.25 cents |

In addition to the current categories, donations to the following charities are eligible for Pay Yourself Back at a rate of 1.5 cents per point on the Chase Sapphire Reserve® and 1.25 cents per point across all other Ultimate Rewards cards. (Valid through Dec. 31, 2023.)

- American Red Cross

- Equal Justice Initiative

- Feeding America

- GLSEN

- Habitat for Humanity

- International Medical Corps

- International Rescue Committee

- Leadership Conference Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Out & Equal Workplace Advocates

- SAGE

- Thurgood Marshall College Fund

- United Negro College Fund

- UNICEF USA

- United Way

- World Central Kitchen

Below the list of current eligible categories associated with the account you’re viewing, you’ll find a list of all of your eligible purchases as well as how many days you have left to offset the purchase. If you want to use the Pay Yourself Back option, you must use it within 90 days of purchase, and statement credits will be applied within three business days.

To use Pay Yourself Back, click on the purchase you wish to reimburse and hit continue at the bottom of the page.

Next, you can select the amount you would like to receive as a statement credit. You’re allowed to offset the full or partial purchase amount. Keep in mind that you can redeem points only once for an individual purchase.

In the below example with the Chase Sapphire Reserve®, you can see that the cost of offsetting the annual fee of $550 is 44,000 points, a rate of 1.25 cents per point.

Ultimate Rewards Travel Portal

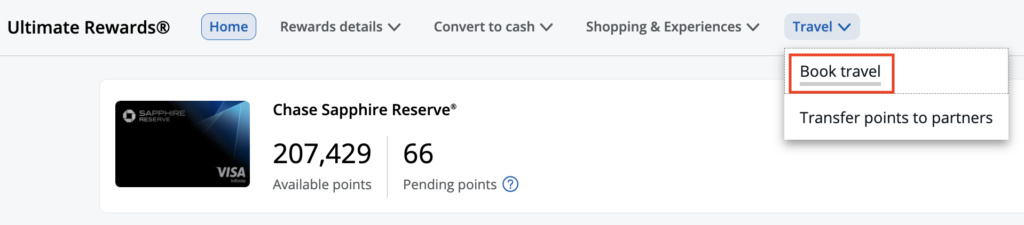

Redeeming Ultimate Rewards points through the Ultimate Rewards travel portal is just as easy as planning a trip through any other third-party travel service. Simply go to Ultimate Rewards and log in with your username and password.

Once logged in, you will see a list of all the Chase credit cards associated with your account. This is an important step because different Chase cards will give you different redemption rates.

| Chase credit card | Redemption rate |

| Chase Sapphire Reserve® | 1.5 cents |

| Chase Sapphire Preferred® Card | 1.25 cents |

| Ink Business Preferred® Credit Card | 1.25 cents |

| Ink Business Cash® Credit Card | 1 cent |

| Ink Business Unlimited® Credit Card | 1 cent |

| Ink Business Premier® Credit Card | 1 cent |

| Chase Freedom Flex® | 1 cent |

| Chase Freedom Unlimited® | 1 cent |

Of course, you want to get the best value possible when redeeming your points for travel, so make sure to select the card that will give you the best bang for your buck.

Remember that you can freely transfer your points between your cards. For example, if you have earned 75,000 points with your Ink Business Unlimited® Credit Card but you also have either the Chase Sapphire Reserve® or the Chase Sapphire Preferred® Card in your wallet, you would want to move the points before making a redemption.

Now that you have selected your card, click on the “Travel” dropdown arrow and select “Book travel.”

Next, choose the type of travel redemption you are looking for. You can choose among hotels, flights, cars, activities and cruises.

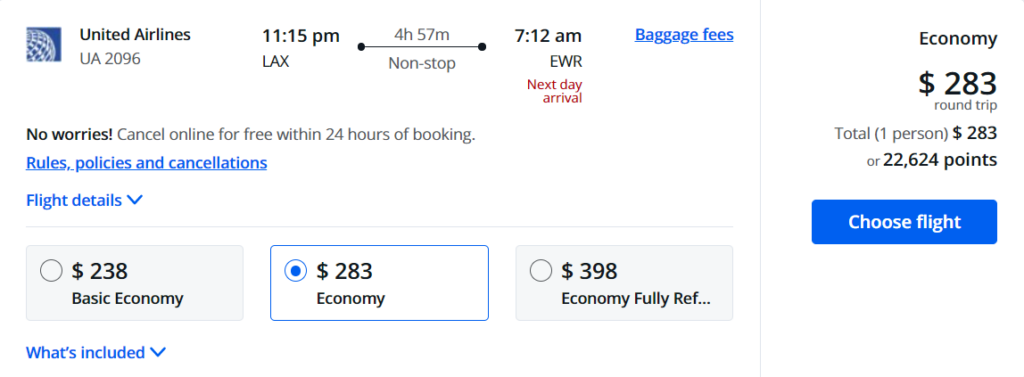

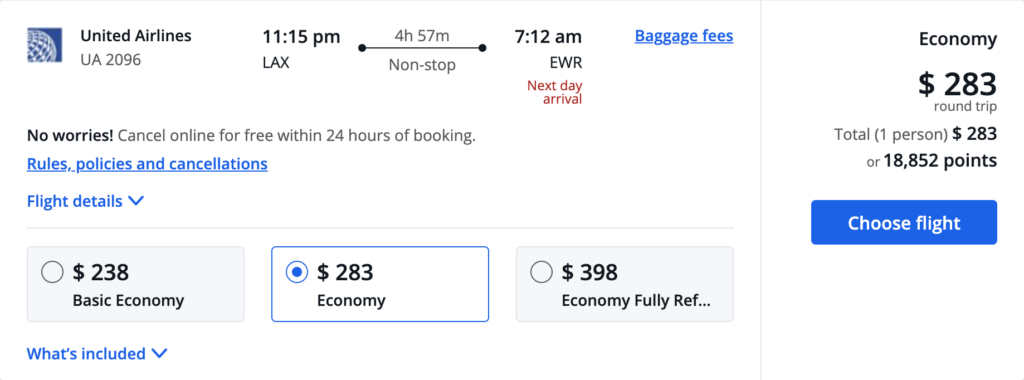

Let’s look at an example of a flight redemption through the Ultimate Rewards travel portal. Enter the airports and dates you need just as you would on any other site, and you’ll be shown the cost of the flight in dollars and in points.

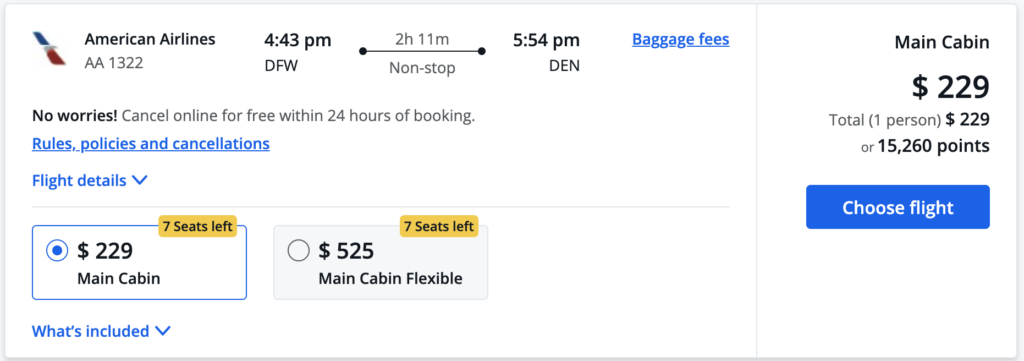

In the above image, the cost in points for economy class is 22,624 points. This search was done using the Chase Sapphire Preferred® Card. However, if we do the same search with the Chase Sapphire Reserve®, you can see that you need just 18,852 points because the points are worth 1.5 cents each.

As you can see, booking through the Chase travel portal can increase your points value depending on the card you use. However, these multipliers are fixed at either 1.25 or 1.5 cents per point. To really maximize your points’ value even further, let’s look at Chase’s transfer partners.

Transfer to Travel Partners

As mentioned above, Chase has 11 airline partners and three hotel partners. This is where the real opportunity to increase the value of your points lies.

If you hold the Chase Sapphire Reserve®, the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card, you can transfer points to any of the 14 travel partners, often with a bonus. As a reminder, you can freely transfer points from other Ultimate Rewards accounts you hold to one of these three cards (except for the Ink Business Premier).

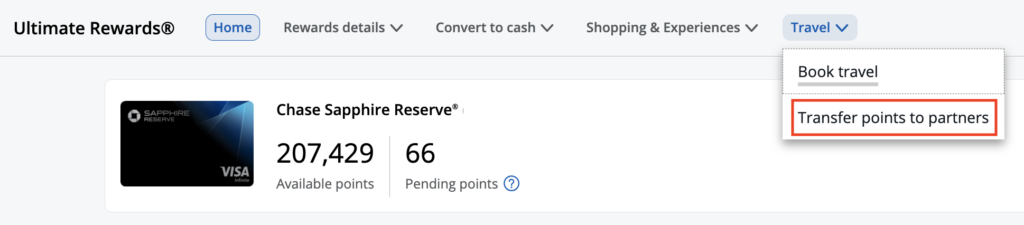

Log in to your Ultimate Rewards account and click on “Transfer points to partners.”

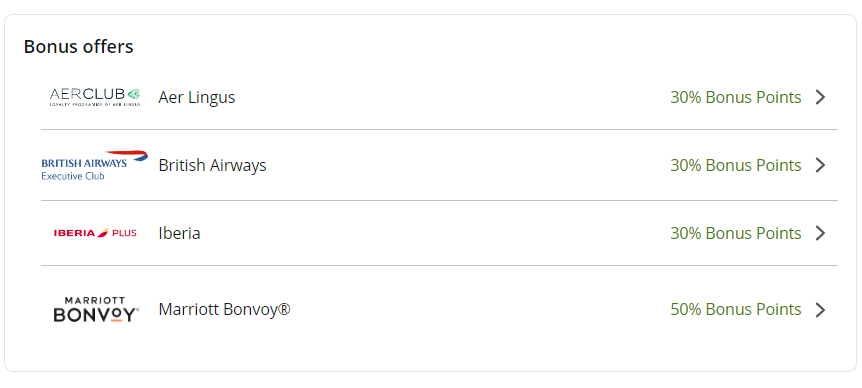

At the top of the next screen, you’ll see the current bonus offers available.

Right off the bat, you can see the huge potential to increase your points’ value. In this example, British Airways is offering a 30% bonus on transfers. This means that for every 1,000 Ultimate Rewards points you transfer, you’ll receive 1,300 Avios, the British Airways loyalty program’s currency.

Say you needed 35,000 Avios to book a flight. Thanks to the current bonus offer, you would need to transfer only 26,923 Ultimate Rewards points. Partner transfers must be completed in units of 1,000, so you’d actually need to transfer 27,000 points.

These bonus offers change frequently and without notice, so make sure you double check the current offers before finalizing any travel plans.

However, the added value potential for partner transfers doesn’t stop at transfer bonuses. Let’s now look at a real-world example to see how high we can get this redemption rate.

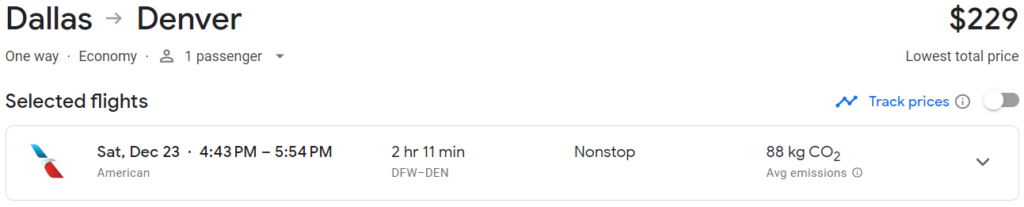

Let’s say you live in Dallas and want to head to Denver around Christmas to visit family. You hop on Google flights and see a flight that fits your schedule for $229.

You could just pay cash for this flight, but around the holidays, you decide you’d rather use your Ultimate Rewards points and save your money for gifts. At a cashback rate of 1 cent per point, you could simply cash in 22,900 points and offset the cost of your trip.

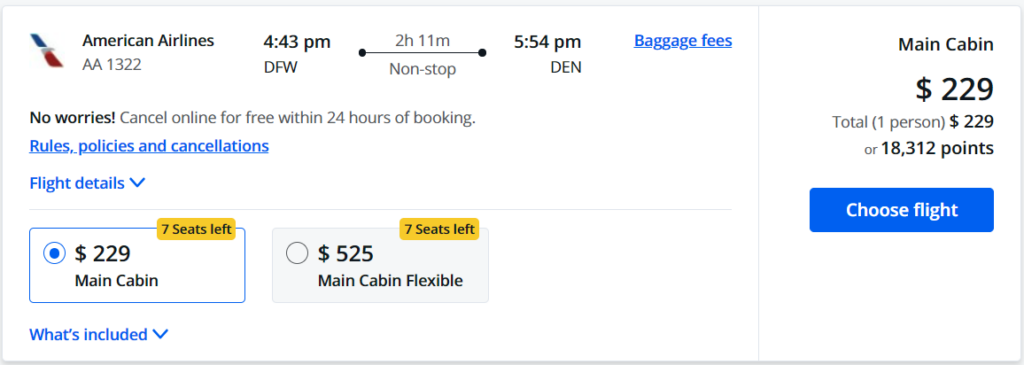

However, you already know about the Chase travel portal and decide to see how many points you’d need to book this flight through the portal. You log into your Chase Sapphire Preferred account and find that you’d need 18,312 points since your points are worth 1.25 cents apiece when redeemed through the portal.

Then you remember that your spouse has the Chase Sapphire Reserve card and re-run the search to find the same flight listed for 15,260 points.

Since it’s free to transfer points to a member of your household, you could just move the points to your spouse’s account and book the flight at the rate of 1.5 cents per point.

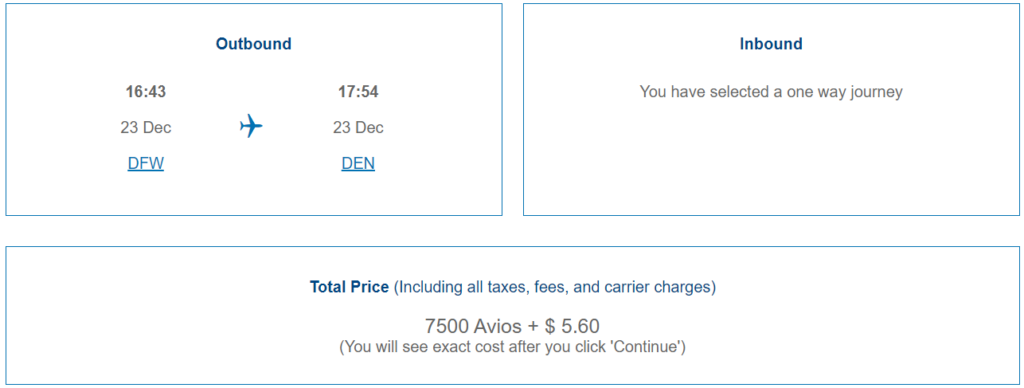

So where do the transfer partners come in? The flight you want is operated by American Airlines, which is not a transfer partner of Chase. However, the carrier is part of the Oneworld alliance along with British Airways, which is a Chase travel partner. Since you can book American Airlines flights with British Airways Avios, provided the award space is released to partners, you decide to see how much the flight would cost on BA.com.

A nice surprise awaits you—the exact same flight would cost you only 7,500 Avios + $5.60 in taxes. You run the quick math on that and realize that this would give you a redemption rate of 2.97 cents per point.

That’s looking pretty good, but then you remember you can only transfer in increments of 1,000 Ultimate Reward points. So now, you’d need to transfer 8,000 points to Avios. At 8,000 points, your redemption rate drops to 2.79 cents per point, but you’re still way ahead of your other options.

But wait, there’s more. When you go to transfer the points to British Airways, you find a 30% bonus offer. This means you would need to transfer only 6,000 Ultimate Rewards Points to get the 7,800 Avios to cover your trip. Now, all of a sudden, your redemption value has increased to 3.72 cents per point, and Christmas is saved!

Final Thoughts

Learning all the ins and outs of Chase Ultimate Rewards may be a bit time consuming but hopefully you have seen just how valuable they can be. Whether it’s the vacation of a lifetime or just offsetting an unexpected expense, Chase Ultimate Rewards’ versatility is a real game changer.