MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Chase Sapphire Preferred® Card gets a lot of love in the world of points and miles, as it should: it’s the best card for beginners to get 99.95% of the time.

With its valuable sign-up bonus, combined with a very reasonable annual fee of $95, whether you’re new to the game or a seasoned professional who’s had it before and want to get it again, the Sapphire Preferred continues to be a terrific card for practically every cardholder.

Chase Sapphire Preferred® Card

Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

So hat can you do with all of these points?

Well, the options are literally endless. To help give you some ideas, the MileValue team has pulled together a few options for you to consider.

Anna Zaks

Chase Ultimate Rewards points are one of my favorite transferable currencies, and when I asked myself what I’d do with 60,000 points, my brain started firing in all directions. With so many great transfer partners, spending 60,000 points shouldn’t be a problem. So here are just a couple of examples.

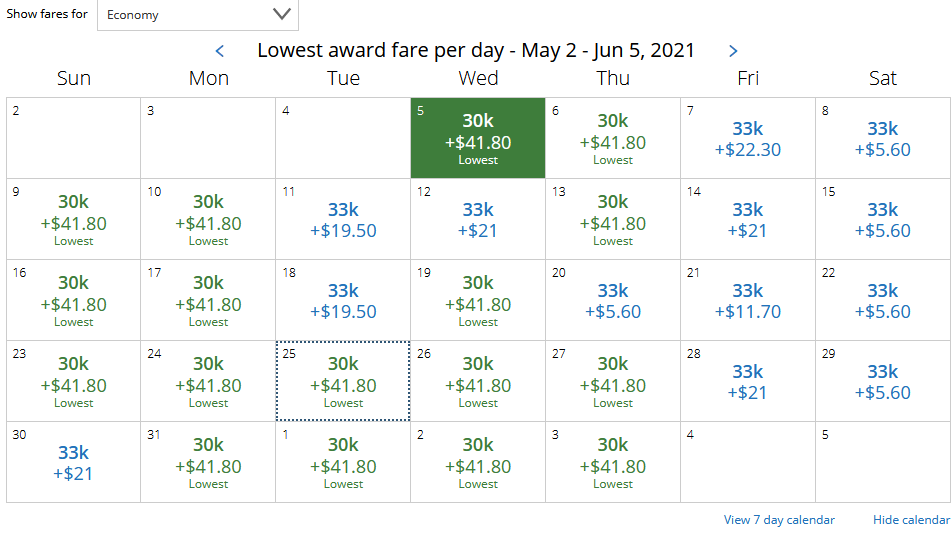

If you, like me, are dreaming about the time when we can travel to Europe again, 60,000 Ultimate Rewards transferred to United are just enough to book a roundtrip ticket from the U.S. to Europe in economy.

Lately, I’ve been a bit obsessed with Central and Eastern Europe, so my first stop would be either Budapest or Vienna, I haven’t decided yet, but the number of miles required for a roundtrip ticket to either of these beautiful cities would be the same.

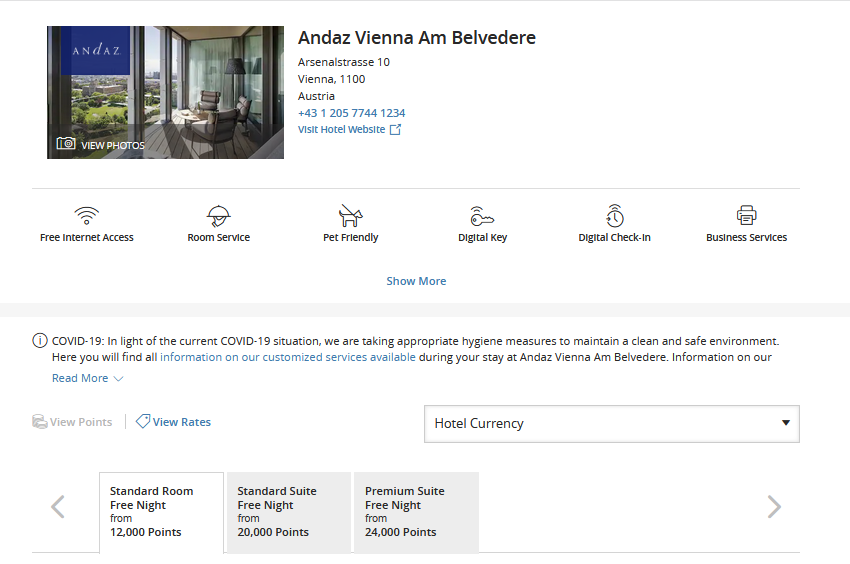

If we continue with our European theme, 60,000 Ultimate Rewards points transferred to Hyatt is enough for a five-night stay at Andaz Vienna Am Belvedere hotel. Andaz hotels are usually hip, modern and very cool, and at 12,000 points per night this is an amazing deal. The cash rates at this property usually start at $250 plus tax.

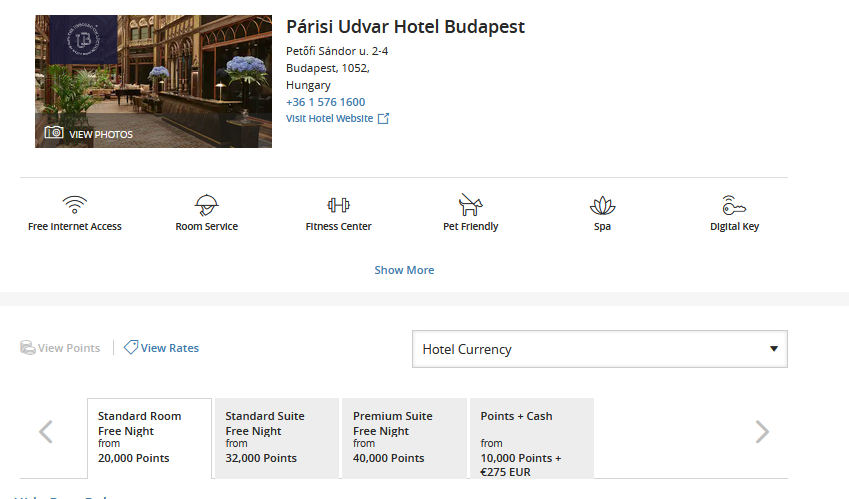

If I am going to Hungary, I’ve had my eye on Parisi Udvar Hotel Budapest for a couple of years. In fact, I have a reservation there for May of 2021 (which I had to reschedule a couple of times already), and I can’t wait to stay there. Cash rates at this property in the summer are close to $500, so three nights at this majestic hotel covered with just one welcome bonus? That sounds like a great deal! Budapest is a truly majestic city, and as soon as Hungary opens its doors, you’ll find me there!

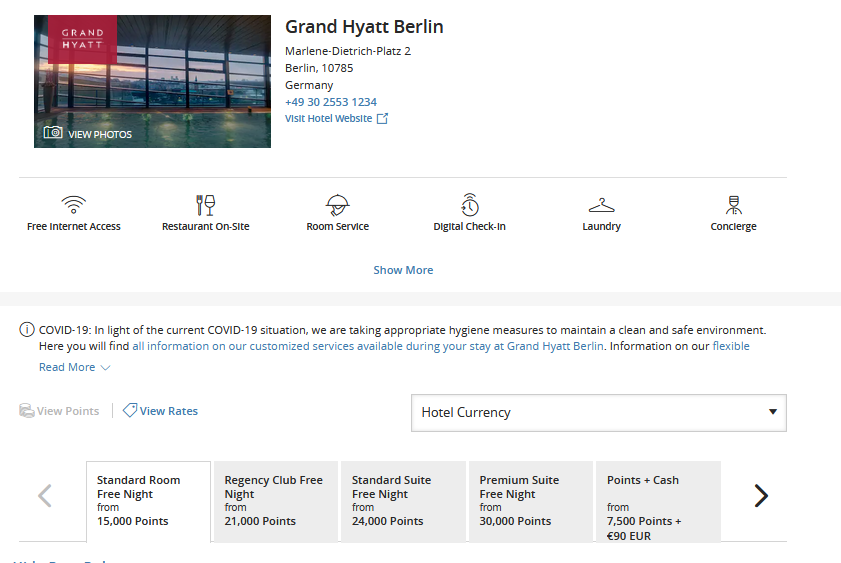

Another European city on my must revisit soon list is Berlin. On a previous visit there I’ve stayed at a different property, but this time I’d really like to stay at Grand Hyatt Berlin. It’s a Category 4 property, and your welcome bonus is enough for four nights there — just enough to explore the major highlights of this fantastic city.

I hope this gives you a couple of ideas on how to use this most versatile transferable currency.

Anya Kartashova

I’m like Anna and can’t get enough of Ultimate Rewards points.

Although I don’t shy away from a transfer or two to World of Hyatt, I prefer to redeem my Chase points on flights. Because I fly economy most of the time, I like to hunt for deals.

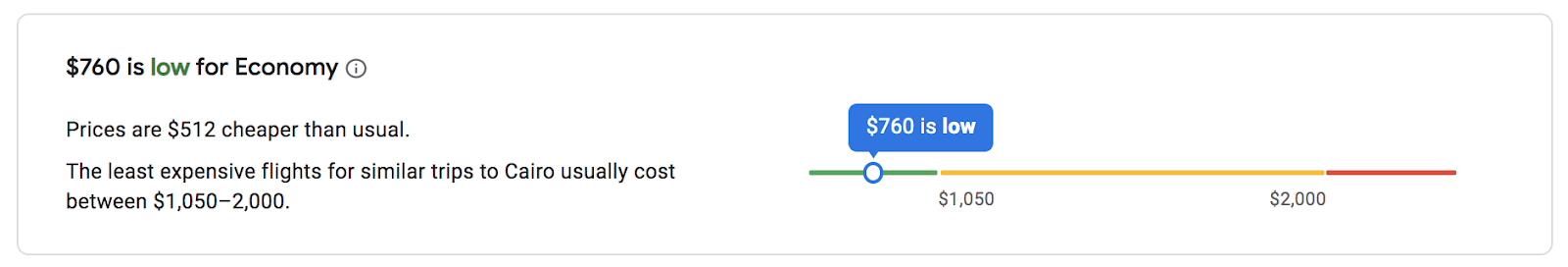

I’ve been toying with the idea of traveling to Egypt in the upcoming months. I’ve never been to the country, and right now, cash flights cost a reasonable amount. For example, this particular flight on SkyTeam partners from Salt Lake City to Cairo and back is going for about $760, which is about $500 cheaper than the usual price, according to Google Flights.

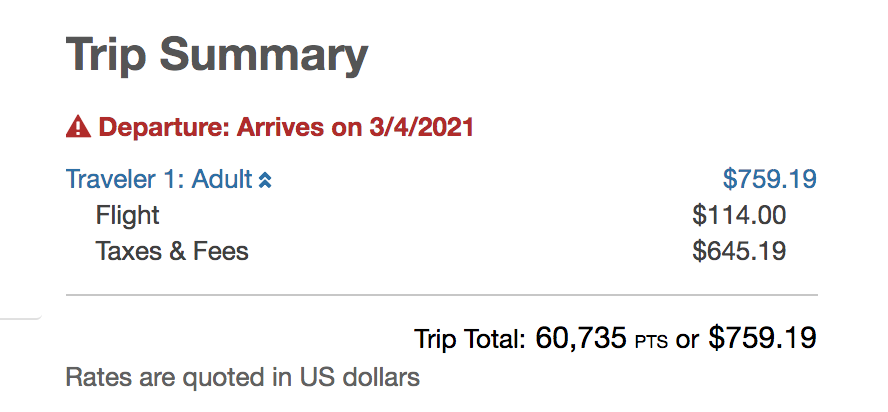

A similar itinerary is available via the Chase Travel portal for about 61,000 Ultimate Rewards points all in (at a rate of 1.25 cents per point in conjunction with the Chase Sapphire Preferred® Card). If I had a Chase Sapphire Reserve®, I could redeem about 51,000 points for the same flight (at a rate of 1.5 cents per point).

If I were to transfer miles to a partner, let’s say Air France-KLM Flying Blue, it would cost me more. A similar flight requires 42,000 miles plus $132 in taxes one way, and I’d still need to book a return. Flights booked via the portal are round-trip and already include taxes. Clearly, redeeming points via the portal is a better deal in this case. It saves me cash and points vs. a partner booking.

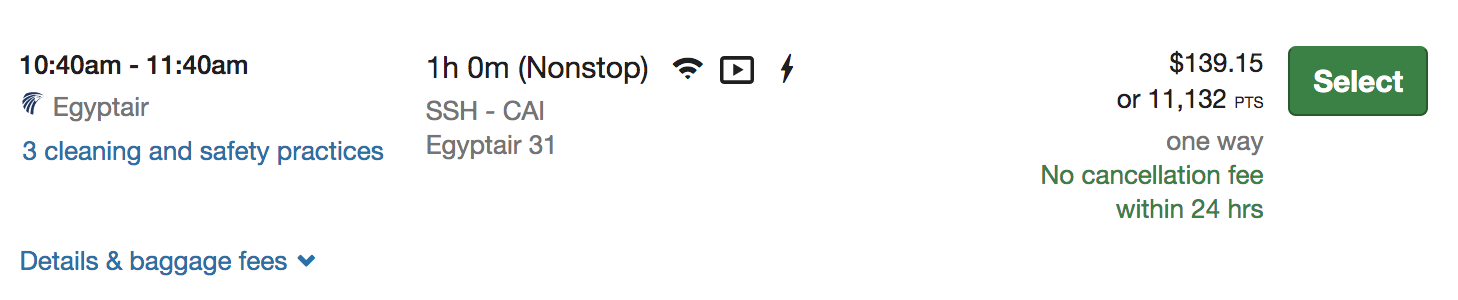

Egypt is a big country, and I assume a trip there would require some internal flights to save time getting from place to place. I’d use the remainder of the 60,000 points to book an internal flight to reduce the overall cost of the trip even further.

And if I’m short on points, it’s not a big deal. The Chase Travel Portal allows redeeming as many points as I want whether I’d like to cover the entire trip with rewards or a partial cost.

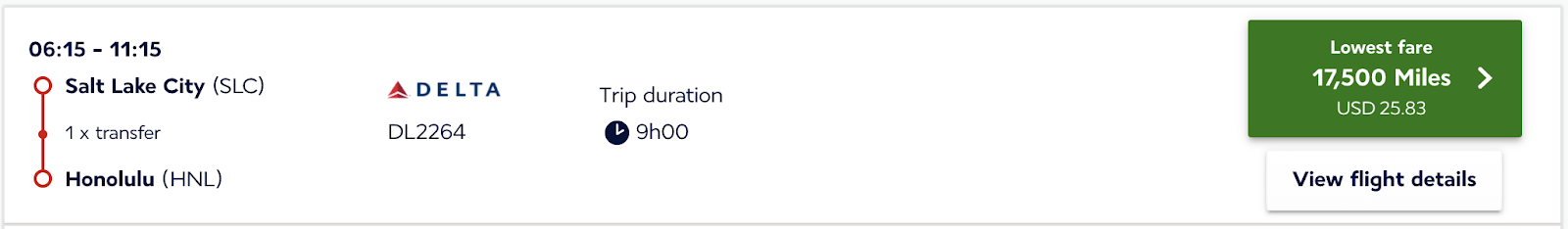

Another redemption option I’m considering is for a flight to Hawaii this fall. My friend is getting married there (if COVID allows it), and I’m going to celebrate her wedding on beautiful Oahu.

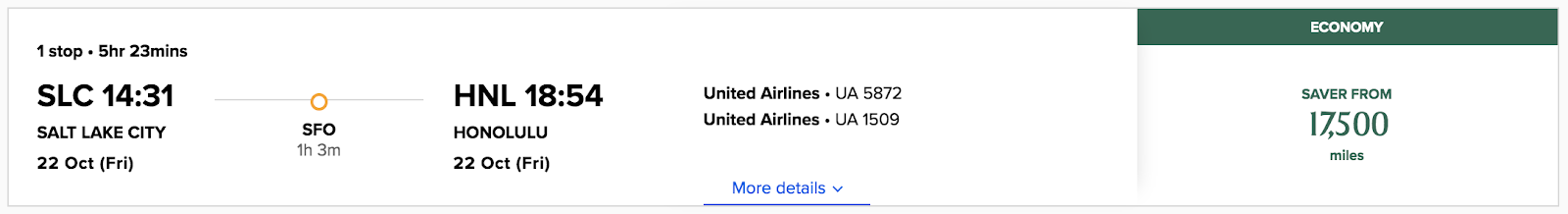

I have a couple of options for an award flight there. I can transfer Chase points to either Air France-KLM Flying Blue and fly on Delta Air Lines or to Singapore KrisFlyer and fly on United Airlines. Both programs require 35,000 miles for a round-trip flight in economy class from the mainland United States to Hawaii.

I’d prefer to fly nonstop from Salt Lake City to Honolulu, but that flight option isn’t available on my preferred travel date. I set an alert on ExpertFlyer, so hopefully award availability opens up before the wedding this fall. If not, I’ll book a United flight using KrisFlyer miles.

In this case, I’d have 25,000 Ultimate Rewards points left over. I could transfer another 10,000 points from my American Express Membership Rewards account to either Flying Blue or KrisFlyer and book my husband’s ticket on the same itinerary.

Travis Cormier

I must say, Anya put some good options out there. I’ve used Ultimate Rewards to fly from Salt Lake City (SLC) to Honolulu (HNL) on Delta myself! Even more obscure, on my recent trip to Egypt, I flew on that exact Egypt Air flight from Cairo (CAI) to Sharm el Sheikh (SSH).

However, that’s not how I’d use my Ultimate Rewards. The vast majority of my Chase Ultimate Rewards end up going towards hotels. With the bonus from the Chase Sapphire Preferred® Card, that would still be my plan.

Chase partners with Hyatt. Other than earning World of Hyatt points directly, Chase Ultimate Rewards are the only points that can transfer to Hyatt. I can transfer other points to airline partners, so I prefer to use my Hyatt points for unique stays.

With 60,000 points, I’d be eyeballing some great long weekend getaways.

One of my favorite Caribbean islands is Aruba. The Hyatt Regency is a category 6 Hyatt, meaning it would require 25,000 points per night. Although that only gets you two nights, that’s perfect for a long weekend!

Miryea, my wife, has been begging me for a weekend in Savannah. While we aren’t traveling much right now, we’ve had our eye on the Andaz Savannah. This Category 4 Hyatt only costs 20,000 points per night, making it a great choice for an extended long weekend.

I’ve said it before and I’ll say it again, the Texas Hill Country is an often overlooked, but must visit destination in the U.S. The Hyatt Regency Hill Country Resort & Spa is a perfect location to set up for your extended weekend. You can get four days with your Sapphire Preferred bonus.

Although these are all some long weekend trips, the great thing about Ultimate Rewards and Hyatt is the flexibility. If you wanted a week long urban getaway you could look at some great Category 1 Hyatt hotels located in the heart of the U.S.’s urban centers. The Hyatt House Houston/Galleria is a great option to explore an underrated food city.

Okay, I might be a bit biased Texas, but trust me on the Hill Country and the food.

You could stay a whole week for only 30,000 points. Category 1 Hyatt hotels cost only 5,000 points per night, helping you get an extended stay. With the remaining points you can transfer to partners like Southwest to bundle your urban getaway all from one sign-up bonus.

Whether you’re looking for a weekend getaway, or a week long stay in one of the many cities with Category 1 Hyatts in prime location, the sign-up bonus from the Chase Sapphire Preferred® Card is a good way to make it happen.

Final Thoughts On The Sapphire Preferred Bonus

With so many of us at home for the last few months, it’s hard not to still get excited about the possibilities of what we can do with some of our points once the world looks to reopen hopefully sometime in the near future.

And as you’ve seen, the welcome bonus from the Sapphire Preferred provides a ton of valuable opportunities. From exploring Eastern Europe, Africa, The Caribbean, Hawaii, Texas and more, the bonus from the Sapphire Preferred can literally take you all over.

How would, or did, you use the Sapphire Preferred bonus? Comment below and let us know and we’ll send you a free MileValue t-shirt. Seriously.