MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

If you’re anything like us, nearly every moment of this pandemic has been spent dreaming of travel. Especially as we try to avoid nauseating headlines like “Corona” being on the rise for baby names. With U.S. residents barred from entering Europe for the foreseeable future, now is the time to focus on feasible travel.

In this three-part series, we are looking at the basics of the cheapest domestic awards. This encompasses frequent flyer programs spanning all three alliances:

- Oneworld – British Airways, Iberia, and American Airlines

- Star Alliance – Avianca, Turkish Airlines, and United (this post)

- SkyTeam – Air France/KLM and Delta

In this article, we’ll see how we can use Avianca Airlines and Turkish Airlines miles to book U.S. domestic travel on their Star Alliance partner United Airlines. While it may seem counterintuitive, sometimes the cheapest award tickets can be booked using foreign partner airline miles rather than using miles of the airline you’ll be flying on.

Let’s move about the domestic cabin and take a look.

Avianca Airlines

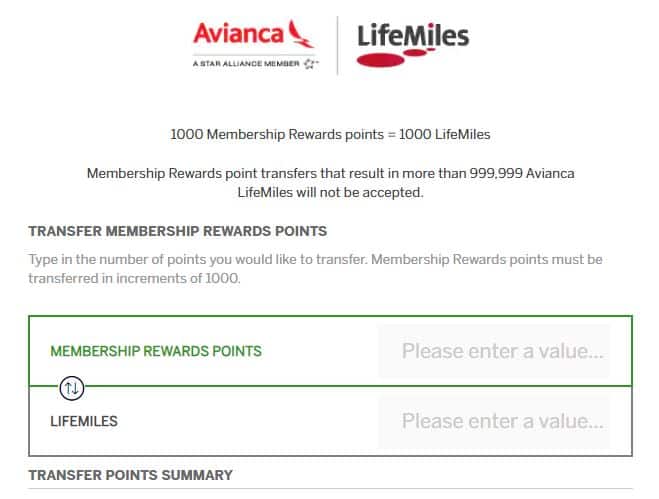

Avianca’s mileage program is called LifeMiles and the associated points or miles are referred to by the same name. You can transfer credit card points to LifeMiles from the following programs:

- American Express Membership Rewards at a 1:1 ratio

- Citi ThankYou Points at a 1:1 ratio

- Capital One Points at a ratio of 2 Capital One points to 1.5 Lifemiles

- Marriott Bonvoy at a ratio of 3 Bonvoy points to 1 Lifemiles

Key Points

- LifeMiles charges based on a rough distance-based calculation. Dan’s Deals has figured out the calculations, as LifeMiles does not publish a concrete chart. You may find some exceptions, but in general the costs are as follows (in economy class):

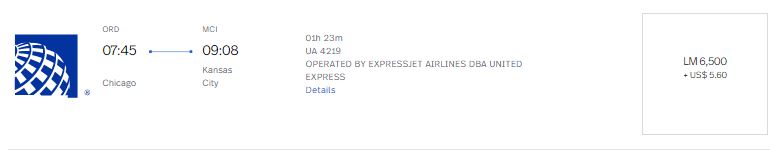

- Flights under 500 miles = 6,500 LifeMiles

- Flights from 500 – 799 miles = 7,500 LifeMiles

- Flights from 800 – 1,199 miles = 10,000 LifeMiles

- Flights over 1,200 miles = 12,500 LifeMiles and up

- LifeMiles does not impose surcharges. The taxes you’ll pay will be low. Keep in mind, however, that a $10 – $25 fee per passenger is not included in the figure you see on the search page. This fee will be added on the confirmation page. LifeMiles agents sometimes call it a “Star Alliance award booking fee” and it is non-refundable if you later cancel the reservation.

The “Star Alliance award booking fee” is added once you click “continue.”

You can sign up for a free LifeMiles account on their homepage in order to search for award flights. LifeMiles can usually handle up to one or two connections. More complicated trips may not show availability. If you can find the segments individually, emailing LifeMiles to request a manual booking is an option.

Sweet Spot – Short U.S. Domestic Routes

Much of the time, especially for routes under ~1,200 miles, it will be cheaper to book through LifeMiles than with United miles.

Routes between 500 – 799 miles cost 7,500 LifeMiles in economy and generally around 15,000 LifeMiles in business class. United sometimes charges the same 7,5000 miles in economy, but 12,500 miles is also very common on many routes. And in business class, United usually charges a minimum 25,000 miles.

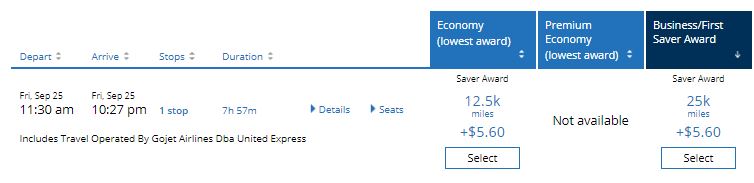

For example, United charges 12,500 miles in economy and 25,000 miles in business for the short 570 mile flight from Newark to Cincinnati:

Meanwhile, LifeMiles charges just 7,500 miles in economy and 15,000 miles in business class for the exact same flight:

For the 400 mile hop from Nashville to Chicago O’Hare, United would like you to part with 7,500 of your miles for economy, or once again 25,000 miles for business class:

LifeMiles asks only 6,500 miles for the same seat in economy, or 15,000 miles for the same seat in business class:

For U.S. domestic routes, LifeMiles can be one of the cheapest ways to book. If you have access to both LifeMiles and United miles (United is a transfer partner of Chase Ultimate Rewards), do compare. As we’ve mentioned before, also compare with the respective travel portal when applicable, especially for economy flights.

Cards Which Earn & Grant Access to Avianca LifeMiles

There are plenty of options, with American Express, Citi, Capital One, and Marriott all being transfer partners.

A Note on Avianca’s Current Situation

Due to the effects of COVID-19, Avianca has filed for bankruptcy. This does not mean your LifeMiles and award reservations are in danger, yet. Airlines file for bankruptcy in order to obtain help with restructuring the company and to negotiate with creditors. The airline continues to operate during this time.

Should the airline fail to resolve during restructuring, then the airline will liquidate. That is when flights stop and the airline ceases to exist.

LifeMiles is actually a separate company from Avianca. It is possible that even if Avianca liquidates the LifeMiles program could survive, though this is debatable. If LifeMiles were to liquidate as well, then award reservations may not be honored for travel which has not yet taken place.

So… what should I do?

The general feeling in the aviation community is that Avianca (and LifeMiles) will not liquidate and may receive a bailout. Time will tell, but for now all miles and reservations are safe. Your level of comfort with this situation will determine how far out you want to book LifeMiles awards. To be on the safe side, we would say to book LifeMiles awards for travel that is sooner rather than later. At least until Avianca’s future becomes clearer. Though, at the time of writing, Amex is not allowing transfers to LifeMiles, so do check before diving in too far.

Turkish Airlines

Travelers can look to the flag carrier of Turkey in order to secure some outstandingly cheap awards within the US. Turkish Airlines’ mileage program is called Miles and Smiles, and the miles are referred to as miles.

You can transfer credit card points to Miles and Smiles from the following programs:

- Citi ThankYou Points at a 1:1 ratio (transfers generally take ~1 day)

- Marriott Bonvoy at a ratio of 3 Bonvoy points to 1 mile (transfers take 1-3 days)

Key Points

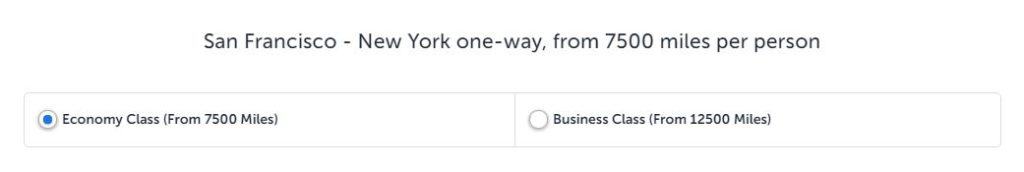

- Whether it is a direct flight or an itinerary with connections, Turkish charges just 7,500 miles each way in economy and 12,500 miles each way in business class within the U.S. This includes Alaska and Hawaii!

- Turkish awards can be placed on hold. If you are booking at least 7 days in advance, you can request the award to be placed on hold by calling in. The hold will be good for 48 hours, which should be enough time to transfer points from Citi and usually Marriott as well.

Sign up for a free Miles and Smiles account to search for awards. When searching for United flights, or other Star Alliance partner flights, you will not be using the main search page. Instead, you’ll need to navigate to the Star Alliance search page:

- Click on your name in the upper right corner and click on “Miles Transactions”

- Under the “Star Alliance award ticket” box to the right, click on “Book now”

Now you are ready to search. Note that on the results page, you can flip between economy and business class by selecting the appropriate option:

Sweet Spot – Any U.S. Domestic Route, Especially Transcon

As the first key point gave away, absolutely any U.S. domestic (United) flight can be had for 7,500 miles in economy or 12,500 miles in business. This includes routes with connections:

Therefore, if Lifemiles or United are charging more than that, or you don’t have access to those currencies, then Miles and Smiles is the ticket (pun intended). And Turkish will always have them beat when it comes to longer routes, such as transcontinental flights.

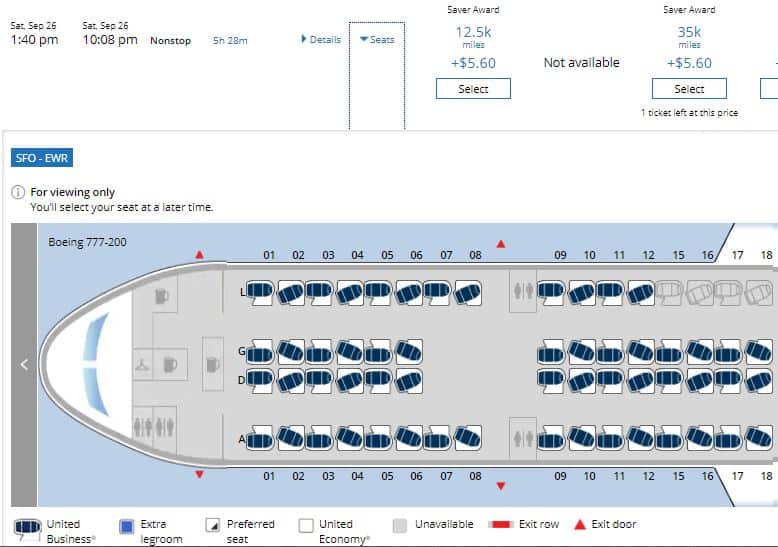

Let’s take San Francisco (SFO) to Newark (EWR) as an example. United asks you to hand over 12,500 miles in economy or minimum 25,000 in business class:

But please welcome Miles and Smiles to the stage:

K2 Top Tip: Keep an eye on the type of aircraft listed. You may be able to snag United’s updated Polaris business class. One way to find out is to run the search on United’s website. Find your flight option and click on “seats” to reveal the seat map. If it looks like the following image, or in a 1-1-1 layout, you’ve found the new Polaris cabin:

Sweet Spot – Hawaii and Alaska

We’ll give everyone a break from listening to us going on and on, as Scott Grimmer has all the details on routing between the contiguous U.S. and Hawaii.

In a nutshell, anywhere in the U.S. to/from Hawaii costs 7,500 miles each way in economy or 12,500 miles each way in business class.

Important note: Hawaii has a mandatory 14 day quarantine for all arriving visitors, in place through July 31. So if you choose to travel to Hawaii you must self-isolate for the first two weeks. Beginning August 1, visitors will be required to get a valid COVID-19 test within 72 hours of their trip, and to show proof of a negative test result at the airport, to avoid the 14-day quarantine.

A Note on Searching Miles & Smiles

Turkish has it quirks like any program. And sometimes the search decides to go for some Turkish delights and simply not bother with showing available space.

To hedge against that, we usually search the Turkish site as well as the United site at the same time. If you see United Saver availability on United’s site, then that award should be bookable via Turkish:

But if the Turkish site is not showing this same space, you’ll need to call or email in order to book. Sometimes agents are not able to find the space either. If that happens, employ HUCA (Hang Up, Call Again). Sometimes this will need to be repeated multiple times, even over several days, until the right agent is able to get it done.

Remember that Turkish can place awards on hold. As point transfers from credit card programs usually take around a day, we recommend calling to place the award on hold first, and then initiate the transfer. That way, the award space will not disappear or be taken while waiting for the points to hit the account.

Cards Which Earn & Grant Access to Turkish Miles & Smiles

Turkish is a transfer partner of Citi and Marriott Bonvoy, so cards in either of those portfolios are viable.

Final Approach

In the Star Alliance family, look to Avianca LifeMiles and Turkish Miles & Smiles for cheap domestic awards. These two programs have you covered, from short hops to long transcon, even over half an ocean to Hawaii or crossing the Great North to Alaska. Both are transfer partners of Citi ThankYou Points with LifeMiles also having the American Express Membership Rewards powerhouse on their side.

And a friendly K2 reminder on some award redemption tactics to keep in mind:

- Always confirm award space is available before transferring miles.

- Award space is fluid. Search every day. Flexible travel dates can be paramount to making a successful award booking.

- Always compare with travel portal if that’s an option. If cash prices are low, sometimes it can be even fewer miles to book through the Chase or American Express travel portal (in particular Chase, depending on what Ultimate Reward card you have) rather than through an airline’s program. When booking through the portal, you’ll also be able to earn miles on the flight(s).

Have you booked flights through LifeMiles or Miles & Smiles? Please share in the comments below!

Cheers and search on.

My question would be will your status pass through? Does Turkish have a box to add your FF#?

I’m Gold for life on United and wondering if United would see that if booked with Turkish Miles.

Hi Buzz! Yes, your status should be honored. Include your UA freq flyer number during the booking process and/or afterwards via “manage booking.” As the flight will be on United, you’ll also have access to the reservation on United’s site. Make sure it is showing on your United reservation. If any trouble adding it, reach out to United and an agent should be able to add it. Or as a last resort, they should be able to at the check-in desk at the airport. Thank you for reading and for the question!

I just booked a flight on United using Lifemiles for my son. Using the confirmation code given by Avianca, the flight doesn’t show up on United.com. My son doesn’t have FF# for either Lifemiles or MileagePlus. Will he ever be able to monitor the flights on United.com?

You’ll have to use the Avianca confirmation code on the Avianca website to check the status on Avianca.com. You might also be given a separate United confirmation code/#. If you get that, then you can use that # on united.com to monitor the status.