MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Capital One—like American Express, Chase and Citi—issues credit cards that offer either cash back or flexible currency rewards.

Capital One’s flexible currency, referred to as miles, can be used in different ways, such as buying gift cards, reimbursing previous travel purchases, purchasing travel through Capital One’s travel booking site or transferring miles to partners.

Let’s look at Capital One’s flexible currency and ways to use it.

Capital One Miles

For many people in the points and miles community, Capital One Miles have become more relevant and valuable in recent years as Capital One improved its rewards program. Among key changes, Capital One:

- Launched two premium credit cards: the Capital One Venture X Rewards Credit Card and the Capital One Venture X Business Card.

- Added transfer partners.

- Improved transfer ratios to partners.

- Expanded cardholders’ ability to combine rewards between Capital One credit cards.

What Is Flexible Currency?

Capital One Miles are similar to American Express Membership Rewards, Chase Ultimate Rewards or Citi ThankYou® Points. They’re earned through several credit cards and offer multiple redemption options. The primary advantage of flexible currency is that it provides cardholders more choices about how they want to use their rewards.

How Do You Earn Capital One Miles?

The following Capital One consumer credit cards earn miles through new card welcome offers and spending on the card:

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

Several Capital One business cards directly earn miles including:

- Capital One Spark Miles for Business

- Capital One Spark 2X Miles

- Capital One Spark 1.5X Miles Select

- Capital One Venture X Business

Beyond generous welcome bonuses, Capital One credit cards are useful if you prefer cards with solid earning rates that apply to most purchases. In particular, the Venture Rewards Card, the Venture X Rewards Card, the Spark 2X Miles Card and the Venture X Business card all earn unlimited 2X miles per dollar on most purchases.

Exceptions are purchases through Capital One’s travel booking site, which earn 5X or 10X miles per dollar, depending on the specific card and the type of travel purchase.

Cashback rewards earned with other Capital One cards may be combined with and converted to miles. This capability exists for cards in the Quicksilver, Savor and Spark Cash card families, and the process is discussed below.

What Can You Do with Capital One Miles?

You can use Capital One Miles in the following ways:

- Redeem for cash back.

- Buy gift cards.

- Shop at Amazon.

- Redeem through PayPal.

- Purchase tickets to entertainment events.

- Make travel purchases through Capital One’s travel booking site.

- Get reimbursed for travel purchases paid for with an eligible Capital One credit card.

- Transfer to Capital One 15+ airline and hotel partners.

Capital One’s Travel Booking Site

Capital One’s travel booking site is available to Capital One rewards credit card holders in the United States. You can pay for travel bookings through Capital One’s travel booking site with miles, your Capital One credit card or a combination of the two.

The Capital One’s travel booking site generally works like any other online travel agency (OTA), such as Orbitz or Expedia. You can use the Capital One’s travel booking site to book flights, hotels and car rentals.

When Does Using the Travel Portal Make Sense?

There are different perspectives about whether booking travel through portals is beneficial, and many experienced travelers prefer booking directly with travel providers unless there’s a compelling reason to use an OTA.

This position is reasonable, since there are potential complications and risks of using any third-party service instead of booking directly with the travel provider. Some considerations include:

- It may be more difficult to deal with changes or cancellations when booking through an OTA, since an intermediary is involved.

- Hotels sometimes treat guests booked through a third-party travel agency less favorably, so there may be an increased chance of getting a bad room or no room at all if the hotel is oversold.

- Options may be limited compared to booking directly with the airline or hotel. For example, certain room types or rate plans might not be available through an OTA. For flights, certain fare types might not be offered through travel portals.

Let’s discuss some situations in which it may be beneficial (or necessary) to book through Capital One’s travel booking site.

Using the Venture X Travel Credit

The Capital One Venture X Rewards Credit Card and the Venture X Business Card include an annual $300 travel credit that is valid only for purchases made through Capital One’s travel booking site. The credit amount available is displayed when using Capital One’s travel booking site, and you have an option to apply the credit to pay for your booking.

If you hold one or both of these cards, make sure to spend $300 through the travel booking site each year (based on your card anniversary date) to get this credit.

Booking Flights

Many points and miles enthusiasts prefer booking flights, rather than hotels or rental cars, through travel portals.

Flights generally are priced the same (or close) regardless of booking channel, and the same benefits are provided based on the fare type booked and your airline program membership and status level if applicable. As long as your airline loyalty account information is included in the reservation, booking flights through a travel portal provides the same mileage earning and elite benefits as booking directly with the airline.

As discussed below, Capital One’s travel booking site also has some features built into its airline search tool that may help you save money on airline tickets.

Booking Hotels

There are two distinct disadvantages associated with making hotel bookings at chain properties with loyalty programs, such as Hilton, IHG and Marriott, through travel portals.

- Hotel bookings made through third-party travel agencies rarely earn points, and loyalty program members usually don’t get elite benefits that they would get by booking directly with the hotel.

- Travel portals typically don’t allow travelers to book special rates, such as AAA rates or corporate rates, that might be less expensive than standard rates.

For the reasons above, we recommend booking hotels through the travel portal only when one or more of the following conditions apply:

- Travel portal prices are lower when comparing direct booking and portal rates for the same room type and inclusions.

- There aren’t special rates available that would be advantageous for your booking.

- You want to use a Venture X travel credit.

- You wouldn’t lose meaningful elite benefits (for example, the hotel is an independent hotel or is part of a chain or brand where elite status or benefits don’t matter).

- The hotel doesn’t have a convenient direct booking channel.

Maximizing Rewards Earnings

In situations where costs are similar whether booking direct or through Capital One’s travel booking site and forgoing elite benefits isn’t an issue, an advantage of booking through Capital One’s travel booking site is that it’s a bonus category for eligible Capital One credit credits.

This allows you to earn significantly more rewards in certain travel categories. For purchases through Capital One’s travel booking site, you’ll earn:

- 10X miles on hotel and rental car bookings and 5X miles on flights with the Venture X Reward Card and the Venture X Business Card

- 5X miles or 5% cash back on hotel and rental car bookings with other Capital One rewards cards (including Spark and Quicksilver cards, Venture and VentureOne)

While earning extra miles is beneficial, it’s important to consider the trade-offs associated with booking through an OTA, as noted above.

Beyond earning bonus miles for booking through Capital One’s travel booking site, in the past, Capital One has offered limited-time targeted bonuses for booking flights or hotels through the travel booking site.

How to Use the Capital One’s travel booking site

Access options may vary depending on the types of Capital One account(s) you have and what you want to do, but this link to Capital One’s travel booking site is the most direct method for accessing the travel booking site to book flights, accommodations and rental cars.

To begin, use your Capital One account credentials to log in on the initial screen.

Note that the “Book a Trip” option from the main Capital One rewards home page also provides access to the travel booking site.

When redeeming Capital One Miles through Capital One’s travel booking site, the number of miles required is determined by multiplying the cash price by 100. That means a flight costing $300.75 requires 30,075 miles.

Capital One’s travel booking site offers price matching within 24 hours of booking a flight, hotel or rental car. If you find a lower price on another site, you can get a refund for the difference by calling 844-422-6922 to submit a price match claim with the customer support team.

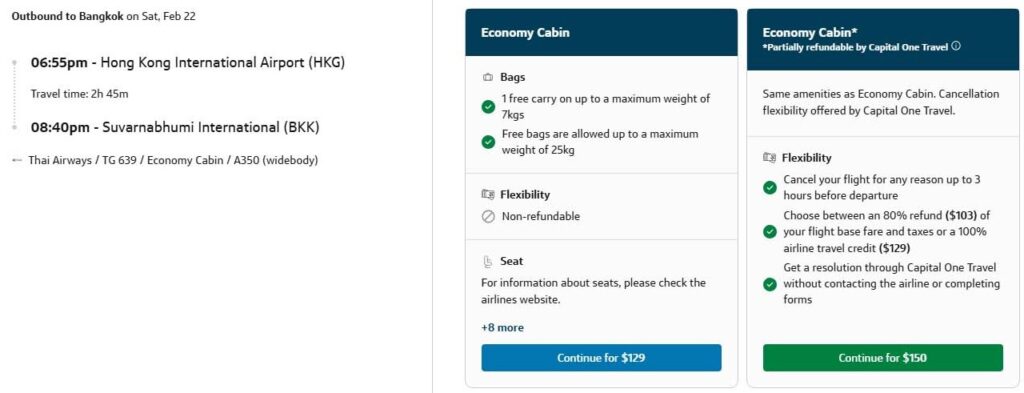

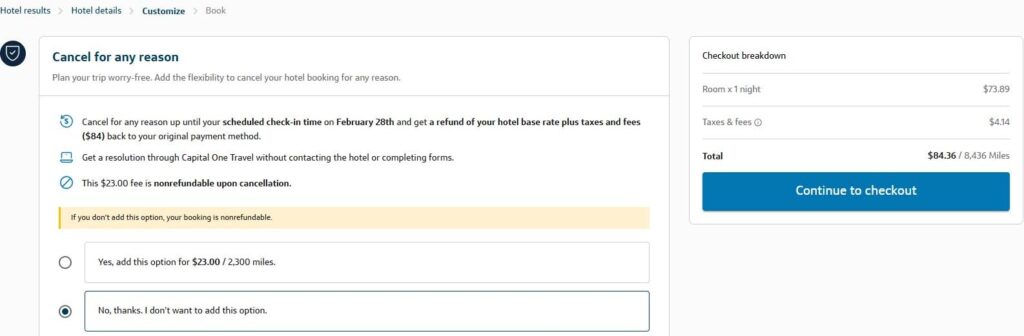

For some bookings, Capital One provides additional cancellation protection for a fee. This protection allows the purchaser to receive a partial (typically 70% to 90% of the price paid) or full refund if they cancel a flight or hotel booking.

For the flight example shown below, Capital One provides two refund options: 80% of the airline ticket price refunded to the original form of payment or 100% refunded as an airline credit.

For a nonrefundable hotel rate, Capital One offers an option to cancel for any reason with a full refund.

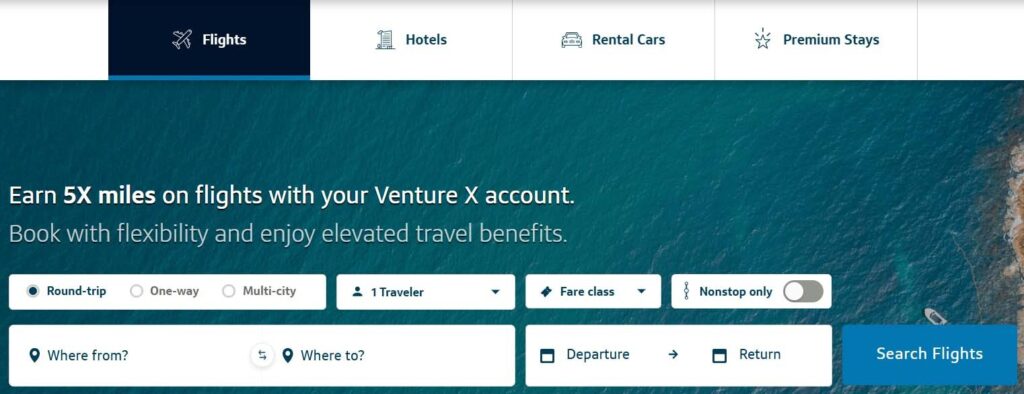

The first screen displayed after logging into Capital One’s travel booking site is the Hotels search page. To search for flights, rental cars or premium stays, click the link for these choices near the top of the screen.

Flights

Capital One’s travel booking site portal uses Hopper technology for flight searches, and it has some interesting features, including price prediction, price watch and price drop protection.

As described under Capital One’s travel booking site benefits, Capital One’s travel booking site provides free price drop protection if you purchase airfare when recommended. After purchasing the flight, Capital One’s travel booking site continues to monitor the price for 10 days after booking. If the price goes down during the monitoring period, you get travel credit for all or part of the price difference up to $50.

Additionally, Capital One’s travel booking site offers a fee-based option to allow customers to freeze the price of a flight for a limited time before purchase.

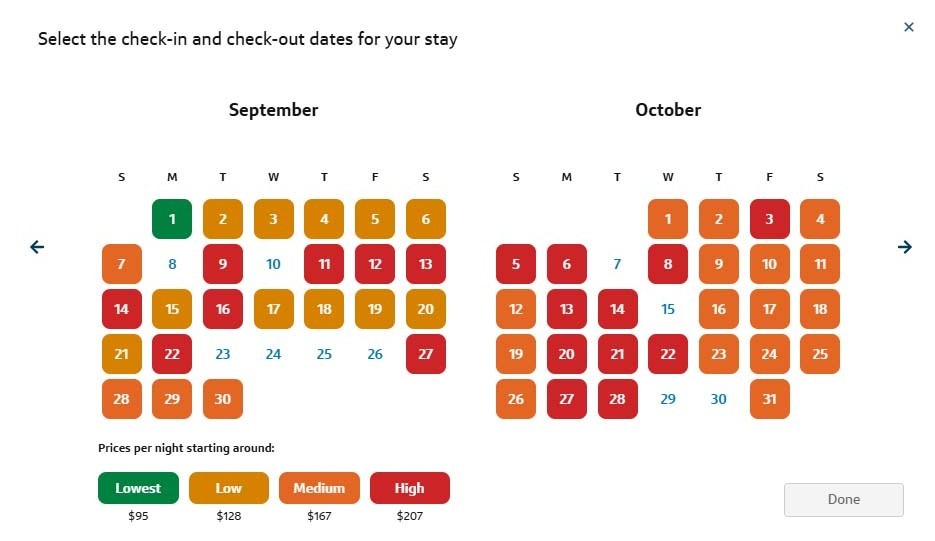

The flight search screen is displayed below. We noticed some improvements in flight search capabilities in the last two years with the addition of a multi-city search option and the ability to restrict results to nonstop flights at the beginning of the search if desired.

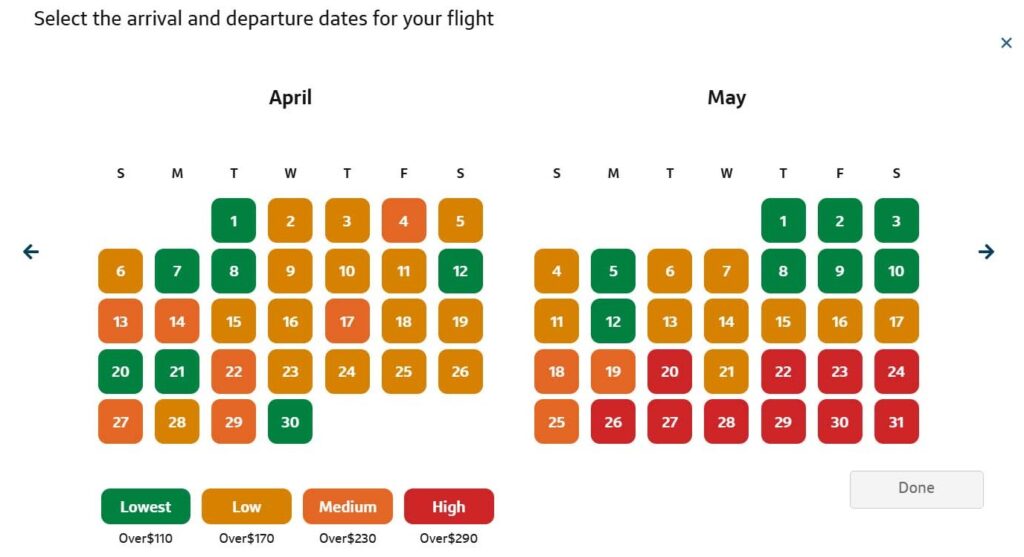

In the example below, we’re looking for flights about 3.5 months from the search date. When selecting dates, the calendar view shows which dates have higher or lower prices.

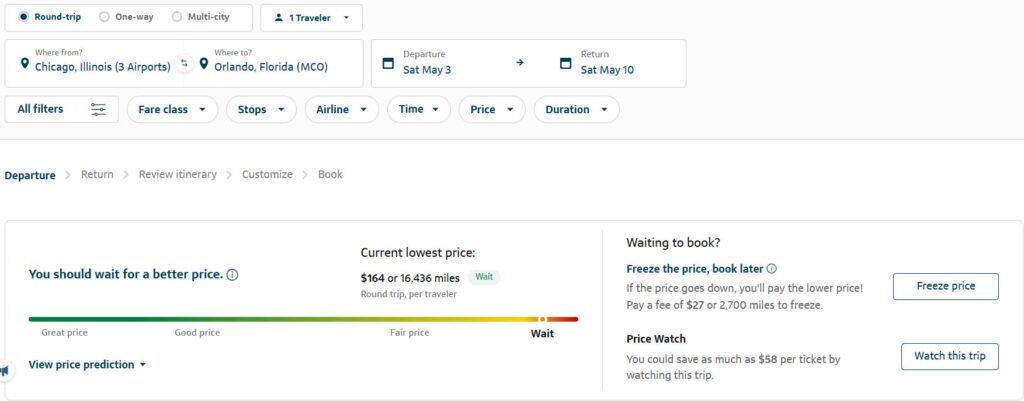

Initial search results are provided below. For the selected dates of May 3 to May 10, Capital One’s travel booking site recommends waiting for better prices. Since the search engine doesn’t recommend booking now, price drop protection isn’t offered. Capital One does show price watch and price freeze options.

The search tool also provides filtering and sorting capabilities. The default sorting option is “Recommended,” and alternative sort orders are price (low to high), stops (least to most), duration (shortest to longest), departure times (earliest to latest) and arrival times (earliest to latest).

In the example below, we limited results to nonstop flights. The results below are the three lowest-priced options.

There are filtering options for other parameters, including fare class, number of stops, specific airlines, specific airport (if departing from or arriving to a city with multiple airports), flight departure and arrival time windows, price and duration. Two other interesting filtering options are the ability to specify the flight number of a desired flight and to show or hide flights for which you would need to claim and recheck luggage on a layover.

Hotels

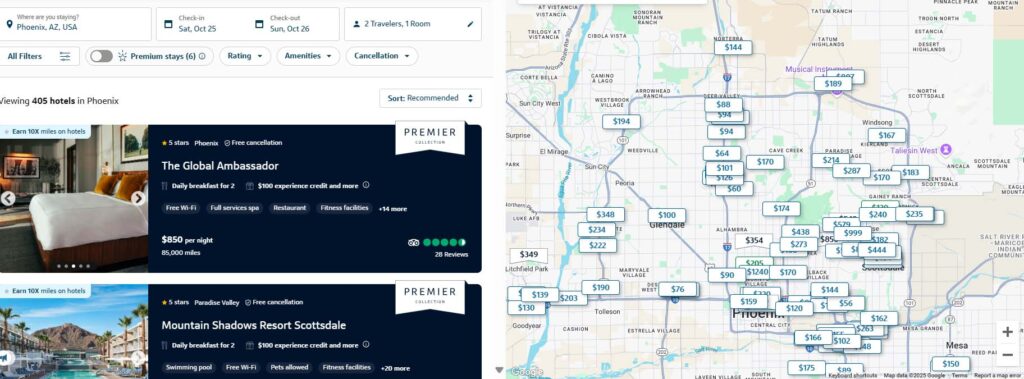

The following search parameters are for a one-night stay in Phoenix.

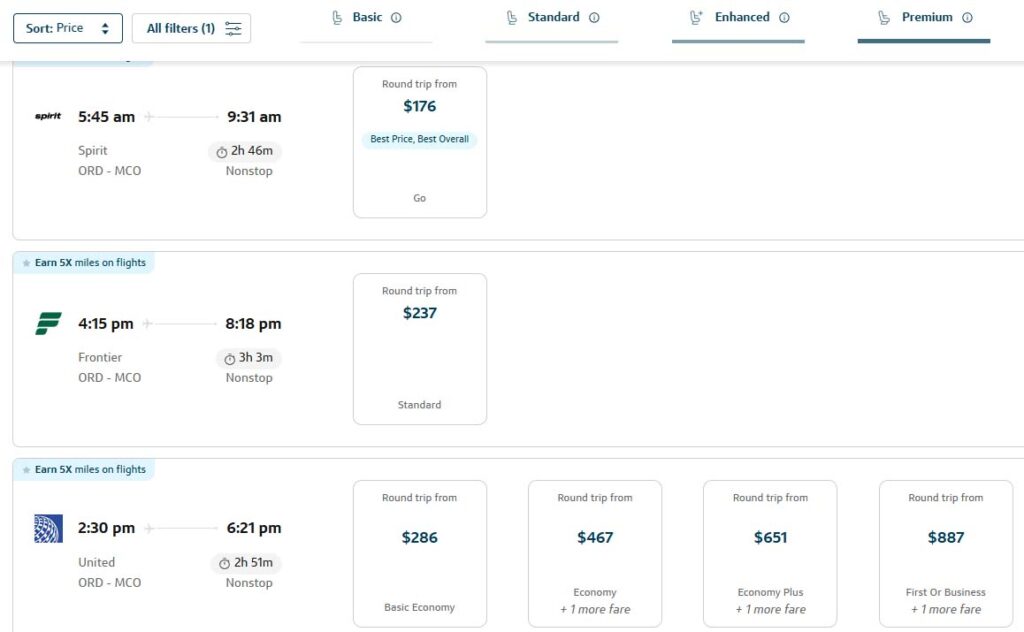

Like flight searches, when selecting dates, you see a calendar showing relative starting prices.

Similar to other hotel search engines, the results can be filtered and sorted to narrow down options. Results for the default sort of “Recommended” below shows Premier Collection hotels first. The default sort can be changed to price or star rating.

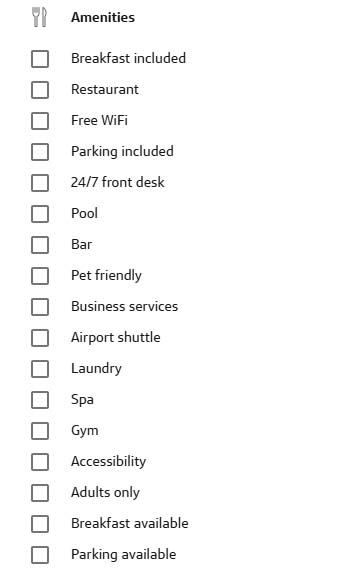

Other filtering options include star rating (one to five), maximum price, free cancellation, limited time promotions, specific hotel name and other features. You also can filter on desired amenities shown below.

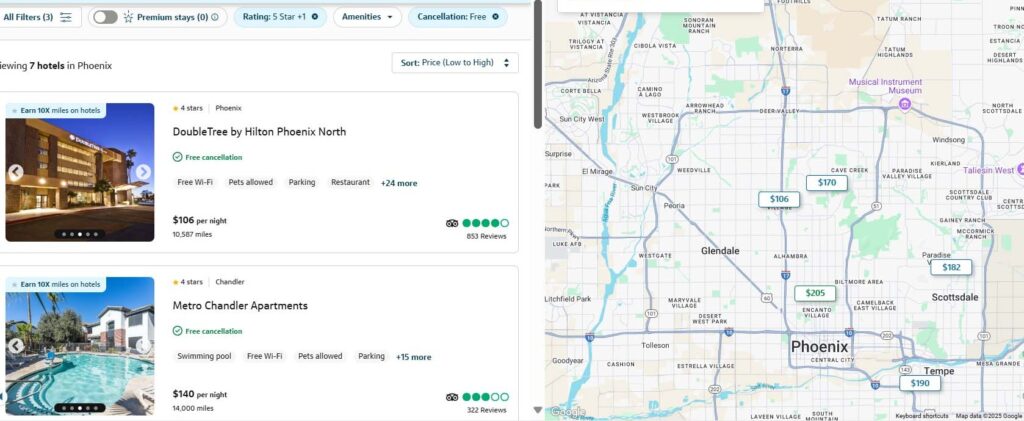

Results below are sorted by price, and filters are applied to maximum price, star rating and refundable rates.

Car Rentals

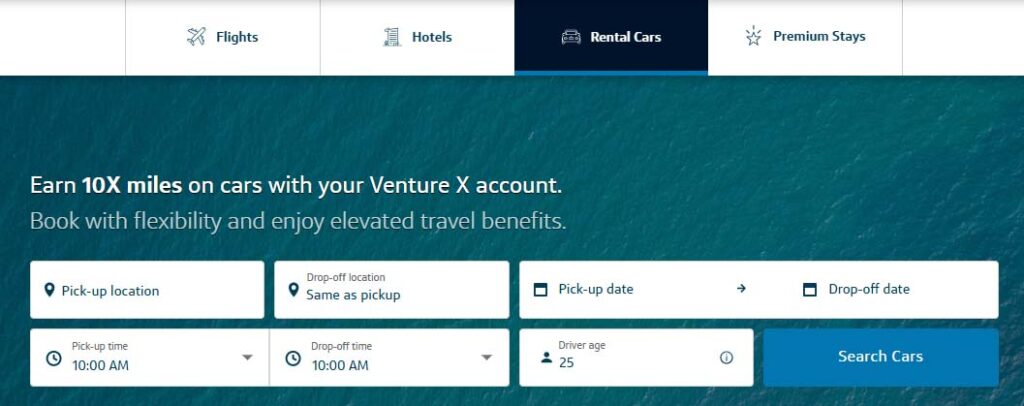

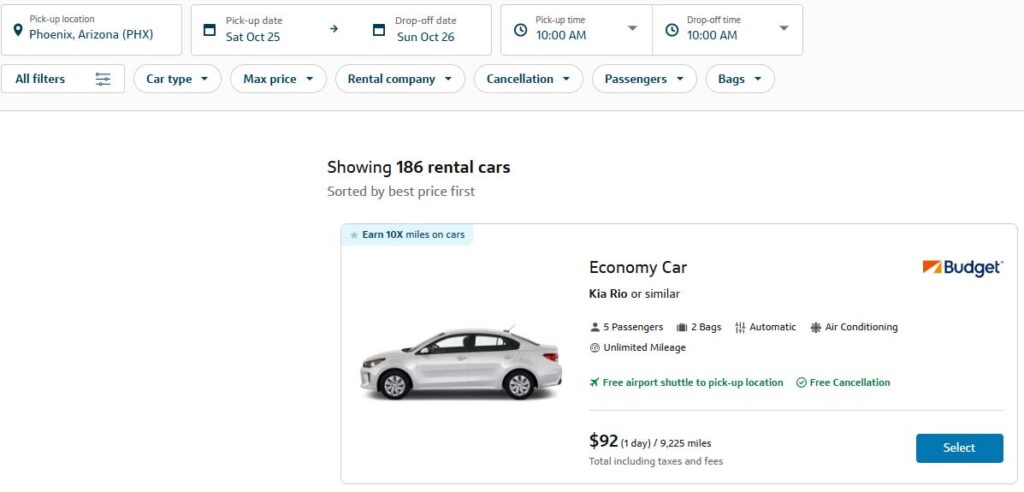

On the search screen for car rentals, enter the basic information including pickup and drop-off location as well as rental dates and times.

The search results screen allows further refinement of options by filtering for car type, rental company, maximum price, specifications (air conditioning, automatic transmission and unlimited mileage options), cancellation policy, number of passengers, number of bags and pick-up location (at airport or shuttle to airport).

Renting cars through Capital One’s travel booking site has similar limitations as discussed above for hotel bookings. In particular, you may not be able to book special rates and may not receive car rental loyalty program elite benefits.

Premium Stays

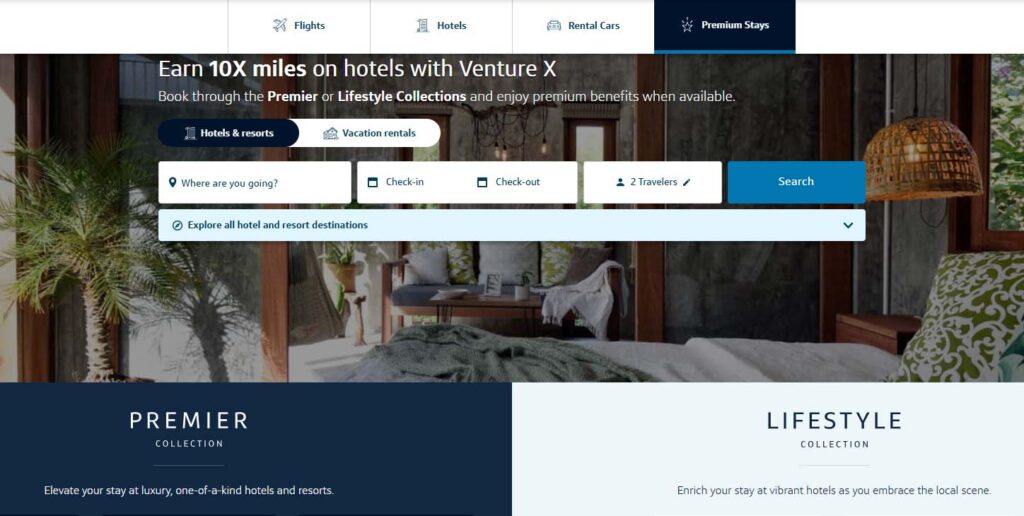

There’s another tab on Capital One’s travel booking site for “Premium Stays” that focuses on specific hotels that fall into two Capital One collections. Booking either option earns 10X miles per dollar and provides additional benefits such as room upgrades, early check-in and late checkout subject to availability. In addition:

- Premier Collection bookings include a $100 experience credit and daily breakfast. More details about the Premier Collection are provided on Capital One’s site.

- Lifestyle Collection bookings include a $50 experience credit. More details about the Lifestyle Collection are provided on Capital One’s site.

There are options to see all Premium Stay locations or search for a specific location and stay dates, like other hotel searches. Here’s the initial search page for Premium Stays.

Other Uses for Capital One Miles

To manage or use miles (for everything besides booking flights, hotels or cars through Capital One’s travel booking site), log into your Capital One online account and click the button for “View Rewards” in the account tile labeled “Explore rewards and benefits.”

Then, select the desired credit card account if prompted and click on “View Account.”

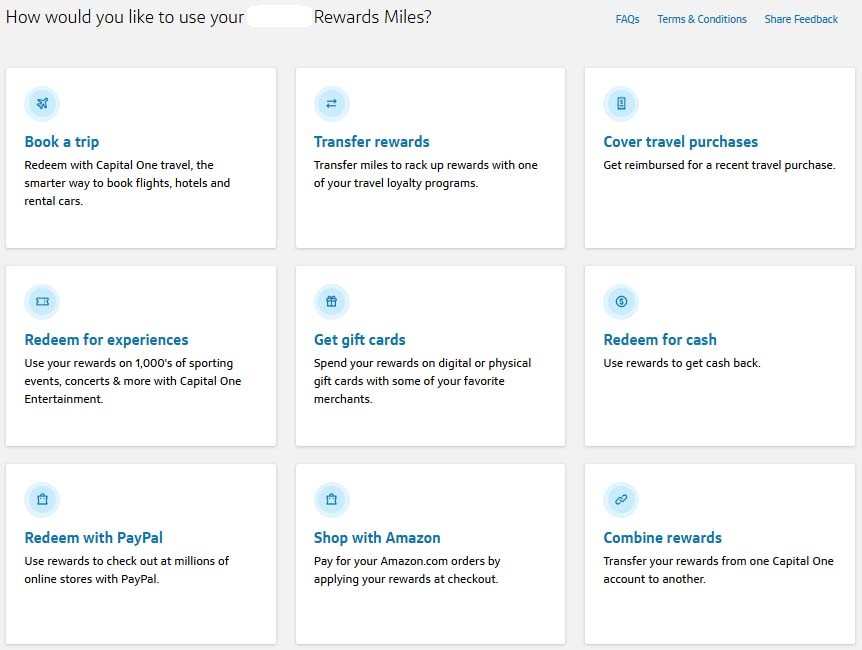

On the rewards home screen, scroll down to see the different options for using Capital One miles and select the desired option. The options available and their order may be different depending on which credit cards you have.

The example below, with nine choices, is for the Venture X Rewards Credit Card.

Book a Trip

This is the functionality discussed above for booking through Capital One’s travel booking site.

Transfer Rewards

This option is the mechanism for transferring Capital One Miles to a partner airline or hotel program. Many points and miles enthusiasts prefer transferring miles to partners and booking travel through partner programs because this redemption option provides the most potential value.

Capital One partners with more than 15 airline and hotel loyalty programs. For most partners, 1 Capital One Mile converts to 1 loyalty program mile or point. The minimum transfer for all programs is 1,000 miles. Current partners and transfer ratios follow.

| Loyalty Program | Transfer Ratio |

| Accor Live Limitless | 2:1 |

| Aeroméxico Rewards | 1:1 |

| Air Canada Aeroplan | 1:1 |

| Air France-KLM Flying Blue | 1:1 |

| Avianca LifeMiles | 1:1 |

| British Airways Executive Club | 1:1 |

| Cathay Pacific Asia Miles | 1:1 |

| Choice Privileges | 1:1 |

| Emirates Skywards | 1:1 |

| Etihad Guest | 1:1 |

| EVA Air Infinity MileageLands | 2:1.5 |

| Finnair Plus | 1:1 |

| JetBlue TrueBlue | 5:3 |

| Qantas Frequent Flyer | 1:1 |

| Singapore Airlines KrisFlyer | 1:1 |

| TAP Air Portugal Miles&Go | 1:1 |

| Turkish Airlines Miles&Smiles | 1:1 |

| Virgin Red | 1:1 |

| Wyndham Rewards | 1:1 |

Cover Travel Purchases

Selecting this option brings up a list of eligible travel purchases paid for with your credit card, and the website indicates how many miles are required to cover the charge.

Eligibility is based on the merchant category code for each purchase. Capital One notes that purchases from airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and time shares generally are considered to be travel purchases.

The reimbursement rate is 1 mile for 1 cent of charges, so a $100 charge would require 10,000 miles to reimburse the entire charge. Purchases made up to 90 days before can be reimbursed using Capital One Miles.

Follow these steps to get reimbursement for a travel charge:

- Select the purchase you want to cover.

- Confirm or change the number of miles to apply (redemptions for a portion of a purchase amount are allowed).

- Click the “Continue” button.

The corresponding number of miles will be deducted, and the reimbursed charge amount will be credited to your account. Capital One notes that account credits usually are applied to your balance within two to three business days.

Redeem for Experiences

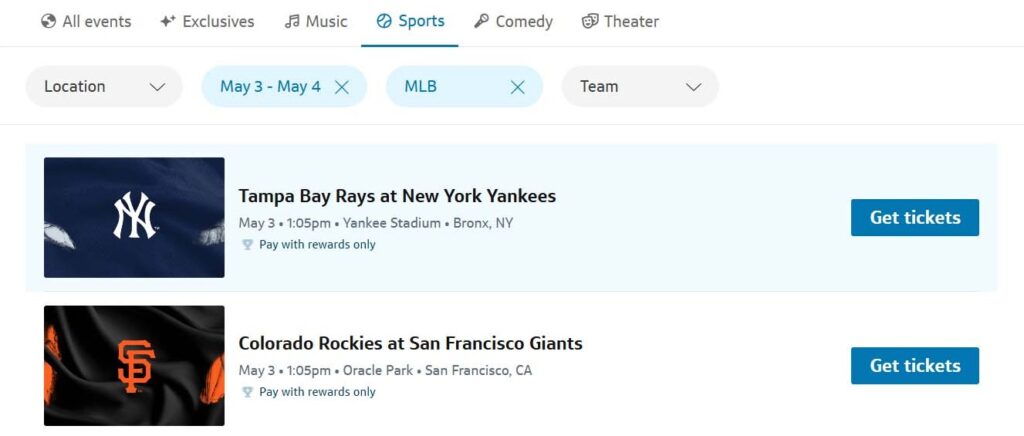

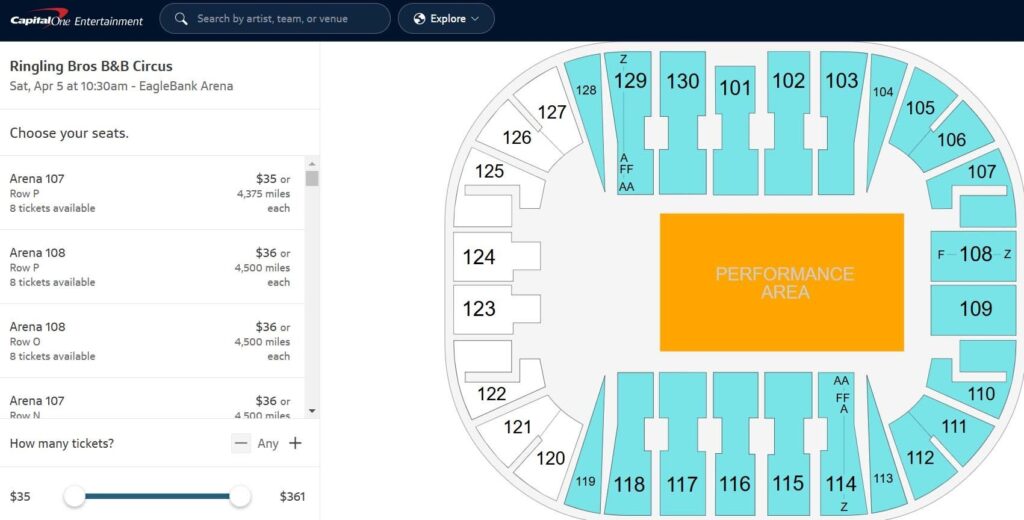

This option takes you to the Capital One Entertainment site, and you can search for Cardholder Exclusives and other events in the following categories: music, sports, comedy and theater. The site also provides options for searching for a specific event or selecting a geographic area and seeing local events.

Once you select an event, you can see ticket prices, usually listed in both cash and miles. In some cases, like Major League Baseball games, experiences are available using miles only.

In the example below for an event with cash or miles payment options, the redemption value using miles for an account with the Venture X Card is 0.8 cent per mile. We recommend paying with cash since you’d receive poor value using miles.

Get Gift Cards

Redeeming miles for gift cards requires two-factor authentication. Upon selecting this option:

- You’re redirected to a screen to select a verification method.

- After receiving and entering a verification code, another screen is presented for selecting from a variety of merchant gift cards.

Redemption value varies, depending on the credit card account used.

Checking a variety of gift cards—encompassing retail, restaurants and travel options— from a Venture X cardholder’s account showed a consistent ratio where 100 miles provided cents of gift card value. In other words, you can get a $25 gift card by redeeming 3,125 miles or a $100 gift card by redeeming 12,500 miles. As noted above, this rate of 0.8 cent per mile is a poor use of rewards.

For individuals purchasing gift cards with rewards from a cashback card, redemption rates for gift cards are reported to be 1 cent each.

Redeem for Cash

This option allows you to redeem miles for cash back (either as a statement credit or a check) but at a poor redemption value. With the Venture X card, redeeming 1,000 miles yields only $5, which is half the value of redeeming miles for travel. The 0.5 cent per mile redemption rate is the worst use of Capital One Miles, and we don’t recommend it.

Redeem with PayPal

Using Capital One rewards to pay with PayPal requires linking your credit card on PayPal’s site.

The redemption value when redeeming Capital One rewards with PayPal for travel rewards cardholders is poor. Credit cards that earn Capital One Miles require 125 miles for every $1 of the PayPal purchase price, which is a redemption value of 0.8 cent per mile.

Shop with Amazon

Using Capital One rewards to shop at Amazon requires linking your credit card on Amazon’s website and enabling shopping with points. The redemption value for travel rewards cards is poor at 0.8 cent per mile (like PayPal and gift card redemption values).

Combine Rewards

Capital One allows an individual who holds card(s) that earn cash rewards and card(s) that earn miles to combine rewards. You can convert cash rewards to miles at a 1:1 ratio, where $1 in cash rewards becomes 100 miles, by selecting “Combine Rewards.” However, it’s not possible to convert miles to cash rewards.

It’s been widely reported on points and miles sites that Capital One allows individuals with separate credit card accounts to combine rewards. The ability to share rewards between two cardholders’ accounts isn’t formally documented and must be initiated by calling Capital One.

Final Thoughts

Capital One’s flexible currency has become a valuable alternative for many individuals seeking to maximize credit card rewards.

In some cases, using Capital One’s travel booking site to book flights, hotels or car rentals makes sense and provides good value, but this depends on each situation.

Transferring Capital One miles to partners or using them to reimburse travel purchases paid for with your credit card may be a better option in some scenarios.

When deciding how to obtain and use Capital One Rewards including miles and cash back, it’s important to consider the differences in earning rates, redemption rates and redemption options among different Capital One credit cards.