MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Update: Several–if not all–of these offers have expired. For the current best offers for free travel, see Best Credit Cards Offers.

When signing up for a credit card, I think there are four factors to consider:

- What is the value of the sign up bonus?

- What is value of putting my pattern of spending on the card? (category bonuses and the value of the base point earned)

- What are the benefits of holding the card? (lounge access, free checked bags, discounted awards, etc)

- When is the deal disappearing?

All things equal, you should apply for a card with a limited time sign up bonus over one that is stable. You can get the stable card next time.

What are the top nine credit card offers that are about to disappear? When are they disappearing? And how much worse will the upcoming offers be?

I don’t have inside information on when all credit card offers will end, and I certainly don’t know for sure what the new offers will be. All the information on this list is compiled based on cards’ historical sign up bonuses, and a little bit of inside info I do have. I’ve ordered the list by how much I would expect someone to lose by waiting until it’s too late to get the best current offer.

Nothing in this post should be construed as a suggestion to apply for a credit card now, or a guarantee that the offer will drop in the future. Don’t rush to get a card if you can’t meet its minimum spending requirement or use it responsibly. You are responsible for decisions that affect your credit.

1. Lufthansa Premier Miles & More World MasterCard with 20,000 Miles & More miles after first purchase (the 50k bonus mile offer did disappear 6/30 as originally predicted in this post)

- Normal offer is 20k miles

- Waiting until July 1 did cost 30k miles

- My full analysis of the Lufthansa program and offer

Full offer details:

- Earn 20,000 award miles after your first purchase or balance transfer

- Earn an additional 30,000 award miles when you spend $5,000 in purchases within the first 90 days of account opening

- With 50,000 award miles you can redeem for a round-trip award flight to Hawaii, Europe or the Caribbean!

- Cardholders receive a Companion Ticket annually

- Enjoy 2 award miles per $1 on Miles & More integrated airline ticket purchases and 1 award mile per $1 spent everywhere else

- No mileage expiration with monthly qualifying purchases

- No foreign transaction fees

2. US Airways Premier World MasterCard® with 30,000 US Airways miles after first purchase

- Card will disappear entirely when merger with American Airlines is complete

- Merger expected to close in third quarter of 2013

- Citi will be the issuer of cards from the new American

- Waiting until the third quarter of 2013 (July 1 to September 30) could mean missing out on 30k US Airways miles that would be converted to American Airlines miles at the merger

Full offer details:

- Earn up to 40,000 bonus miles on qualifying transactions

- EXCLUSIVE: Redeem flights for 5,000 fewer miles

- Zone 2 boarding on every flight

- Enjoy 2 miles per $1 spent on US Airways purchases

- Earn 1 mile per $1 spent everywhere else

- Annual companion certificate good for round-trip travel for up to 2 companions at $99 each, plus taxes and fees

- First Class check-in

- Please see terms and conditions for complete details

3a and 3b. and 3c and 3d. Southwest cards with 50k Rapid Rewards after spending $2k in three months

- No end date known for the 50k offers

- The offer for the cards has alternated between 50k and 25k

- As long as you can earn a companion pass from 110k points earned from credit cards, you may be better off getting these cards late 2013 to earn the bonuses in 2014 and have a companion pass until the end of 2015

Full offer details and links are in the FlyerTalk thread and at the individual applications.

4. Barclaycard Arrival World MasterCard – Earn 2x on All Purchases with 40,000 miles after spending $1k in the first three months

- No end date known for 40k offer

- Normal offer is 20k miles

- Missing out on the 40k offer and getting the 20k offer later would mean $222 less free travel

- My full analysis of the card

Full offer details:

- Earn 40,000 bonus miles if you make $1,000 or more in purchases in the first 90 days from account opening. 40,000 bonus miles equates to $400 off your next trip!

- 0% introductory APR on purchases for the first 12 months after account opening. After that, variable APR, currently 14.99% or 18.99%, based upon your creditworthiness.

- Earn 2X miles on all purchases

- No mileage caps

- No foreign transaction fees

- Exclusive Carry-on Miles – earn 10% of your miles back when you redeem for travel

- Use miles for a statement credit toward any airline purchase to any destination with no seat restrictions and no blackout dates

- Easily redeem your miles for statement credits toward flights, cruises, car rentals, hotels and more

- Complimentary subscription to TripIt Pro mobile travel organizer – a $49 annual value!

5. Dead

6. Citi® Platinum Select® / AAdvantage® World MasterCard® with 30,000 American Airlines miles after spending $3k in three months (as predicted, the 40k offer ended)

- Earn 30,000 American Airlines AAdvantage® bonus miles after $1,000 in purchases in the first 3 months of cardmembership*

- Your first eligible checked bag is free*

- Group 1 boarding and 25% savings on eligible in-flight purchases*

- Earn a $100 American Airlines Flight Discount every cardmembership year with qualifying purchases and cardmembership renewal*

- Double AAdvantage® miles on eligible American Airlines purchases*

- Earn 10% of your redeemed AAdvantage® miles back – up to 10,000 AAdvantage® miles each calendar year*

Full offer details:

- For a limited time, Earn 40,000 American Airlines AAdvantage® bonus miles after $3,000 in purchases within the first 3 months of cardmembership*

- Your first eligible checked bag is free*

- Priority Boarding with Group 1 privileges* and 25% savings on eligible in-flight purchases*

- Earn a $100 American Airlines Flight Discount every cardmembership year with qualifying purchases and cardmembership renewal*

- Double AAdvantage® miles on eligible American Airlines purchases*

- Earn 10% of your redeemed AAdvantage® miles back – up to 10,000 AAdvantage® miles each calendar year*

- *See full terms and conditions

7a and 7b. Chase Ink Bold and Ink Plus with 60k Ultimate Rewards after spending $5k in three months

- 60k offer ends June 22

- Normal offer has been 50k for months

See Sunday’s post on the offer with link to Chase’s public landing page.

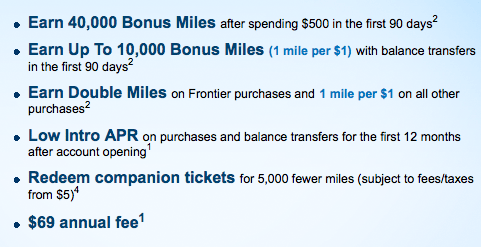

8. Frontier World MasterCard with 40k EarlyReturns miles after spending $500 in 90 days

- No information on when 40k offer ends

- Normal offer is 35k

- Waiting could cost 5k Frontier miles

- My full analysis of the card

Full offer details:

9. Business Gold Rewards Card from American Express OPEN with 50k Membership Rewards after $5k in spending in three months

- No information on when 50k offer ends

- The offer has bounced between nothing, 50k, and 75k this year a few times

- Waiting could mean the offer drops 50k, stays the same, increases 25k, or something else entirely

Full offer details and application link at this landing page.

YT. Another great post!!

Adding the AF would have made it even better.

My mom has been asking me which cards to get (she is a heavy card churner), so this post is very helpful. Trying to stay away from (most of) the $5K cards but will try to get all the lower sign ups.

A few $5k cards add up quickly. It’s a disappointing trend toward higher min spend requirements.

On the Barclay’s US Air card, one I’ve had for years, do you think that after the American merger, they will continue to give us 10k miles annually, except in American miles instead of US Air? I’ve found that to offset the annual fee nicely, but I’m not sure if they can change the conditions of a card if the airline it’s affiliated with disappears.

Almost certainly not. After the merger, Barclay’s will not be a partner of American, so they won’t have American miles to give. I think after the merger, the card will be converted to something else. My guess? It will be converted to the Arrival card mentioned here.

Do you think applying for the AA card now will preclude an application to a new post-merger AA card?

My gut and history say no. When Continental and United merged, a new product (MilagePlus Explorer Card) was released, and you could get it even if you’d had both the old Continental and United cards like I had.

Better US Air 35k offer application page appears to be alive.

http://www.fatwallet.com/forums/finance/1265523/

[…] says 40k offers end July 11: https://milevalu.wpengine.com/top-nine-credit…-to-disappear/ Any idea where he got […]

Where did you hear the Citi Platinum AA 40k deal will end July 11?

I can’t get my sources in trouble. I am operating like the deal will end July 11, but I can’t say that it will with 100% certainty.

You didn’t make mention of the US Airways Business credit card. Would you recommend that too? I already have the personal card… Any chance I can reapply for the personal card and have two at once?

Assuming that the US Airways card is automatically converted to the Arrival card following the merger, would that preclude one from separately applying for an Arrival card and receiving its opening bonus ? If so, the best bet may be to proactively cancel the US Airways card before such a conversion happens. Alternatively, if one already has an Arrival card at the time of the conversion, would the existing US Airways card be converted to a second Arrival card?

I don’t know the answers to these questions, but I agree it would be safer to cancel the US Airways card before it is taken away, so it is not converted to a card you might want to get later.

[…] on the heels of yesterday’s Top Nine Credit Card Offers That Are About to Disappear, American Express has increased the sign up bonus on the Platinum Delta SkyMiles Business Credit […]

[…] A few weeks ago I got the The Premier Miles & More World MasterCard to take advantage of its increased sign up bonus of 50,000 Lufthansa miles after spending $5k in three months. I wanted to get the offer before it expired next week, June 30. (See also: Top Nine Credit Card Offers that Are About to Disappear) […]

[…] 50,000 Lufthansa miles after spending $5k in the first three months offer expires on Saturday. (See Top Nine Credit Card Offers That Are About To Disappear.) I got the card a few weeks ago for one reason: as a way to conserve United […]

[…] Top Nine Credit Card Offers That Are About to Disappear […]