MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Capital One Miles are flexible currency earned with multiple Capital One credit cards, and Capital One’s program is similar to other banks’ flexible currency programs, such as American Express Membership Rewards and Chase Ultimate Rewards. A big advantage of flexible currency is that it provides multiple redemption options to cardholders.

One of the best ways to use flexible rewards is to transfer them to airline or hotel partners. To make the most of transferring Capital One Miles to partners, it’s helpful to understand more about specific partners, point transfer ratios and expected transfer times.

If transferring points and miles to airline and hotel partners is new for you, it’s pretty straightforward with Capital One. We’ll provide instructions, cautions and tips about transferring Capital One Miles.

How to Earn Capital One Miles

Several Capital One consumer credit cards earn miles directly, through new card welcome offers and spending on the card:

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One VentureOne Credit Card

Multiple Capital One business cards also earn miles directly:

Capital One Venture Rewards Credit Card

Enjoy a one-time bonus of 75,000 miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

Capital One Venture X Business

Earn 150,000 Bonus Miles

once you spend $30,000 in the first 3 months from account opening

Beyond welcome bonuses, several Capital One cards mentioned above are strong options for earning miles on regular spending without having to jump through hoops or constantly think about which card to use for particular purchases to get a solid return.

The Venture Rewards Card, the Venture X Rewards Card, the Spark Miles for Business Card and the Venture X Business Card each earn unlimited 2X miles per dollar spent on most purchases, with higher earning rates of 5X or 10X miles per dollar spent on Capital One Travel purchases.

Cashback rewards earned on other cards may be combined with and converted to miles. This capability exists for cards in the Quicksilver, Savor and Spark Cash card families.

Capital One allows an individual who has card(s) that earn cash back and card(s) that earn miles to “Combine Rewards” online from the cashback card to the miles earning card. Cash rewards convert to miles at a 1:1 conversion rate, where $1 in cash rewards becomes 100 miles.

Reasons to Transfer Miles to Partners

For many points and miles enthusiasts who have been earning and redeeming flexible currency for years, Capital One’s ascension into the big leagues of flexible currency programs, beginning around 2021, has been a welcome addition. Capital One joined American Express, Chase and Citi as major players in this space and now has a robust set of transfer partners and a sizable portfolio of credit cards that earn miles.

Transferring flexible currency to partners and using loyalty program points or miles to book flights or hotels often represents the highest value usage.

Without getting into too much math, the terms cents per mile (cpm) and cents per point (cpp) are used to measure and compare redemption value. Let’s consider two common redemption options with 100,000 Capital One Miles.

- Redeeming miles through Capital One Travel: Redemption value is fixed when using flexible currency through travel portals. Capital One Miles have a value of 1 cent each when used to book travel through Capital One Travel. Buying a $1,000 flight through Capital One Travel requires 100,000 miles.

- Transferring miles to partners: In contrast to the fixed value obtained through Capital One Travel, transferring miles to partners provides more upside potential. Points and miles enthusiasts sometimes say that they got 10 cpm in value by booking a first-class airline ticket through an airline loyalty program for 100,000 miles when the cash price for the ticket is $10,000. Ignoring the question of whether it’s realistic to value luxury travel at the full retail price, individuals knowledgeable about how to maximize points and miles often are able to get expensive airline tickets or accommodations by transferring flexible currency to partner loyalty programs and redeeming airline miles or hotel points for awards.

Transferring flexible currency to airline or hotel loyalty programs during a transfer bonus provides extra value. Capital One, like other bank programs, sometimes offers limited-time promotions where transfers to specific programs offer a more favorable transfer ratio than the regular ratio.

For example, the standard transfer ratio for Capital One Miles to Air France-KLM Flying Blue is 1:1. With a 25% transfer bonus,1,000 Capital One Miles become 1,250 Flying Blue miles.

Capital One Airline and Hotel Transfer Partners

Capital One has more than 15 transfer partners, including airline and hotel loyalty programs. Airline partners include airlines in each alliance. For most partners, 1 Capital One Mile becomes 1 unit in the loyalty program’s currency. The minimum transfer amount for all programs is 1,000 miles, and transfers above 1,000 miles can be in 100-mile increments.

You can transfer Capital One Miles to the following loyalty programs, which include options in each major airline alliance.

| Loyalty program | Airline alliance | Transfer ratio |

| Accor Live Limitless | Not applicable | 2:1 |

| Aeroméxico Rewards | SkyTeam | 1:1 |

| Air Canada Aeroplan | Star Alliance | 1:1 |

| Air France-KLM Flying Blue | SkyTeam | 1:1 |

| Avianca LifeMiles | Star Alliance | 1:1 |

| British Airways Executive Club | Oneworld | 1:1 |

| Cathay Pacific Asia Miles | Oneworld | 1:1 |

| Choice Privileges | Not applicable | 1:1 |

| Emirates Skywards | Non-alliance | 1:1 |

| Etihad Guest | Non-alliance | 1:1 |

| EVA Air Infinity MileageLands | Star Alliance | 2:1.5 |

| Finnair Plus | Oneworld | 1:1 |

| JetBlue TrueBlue | Non-alliance | 5:3 |

| Qantas Frequent Flyer | Oneworld | 1:1 |

| Singapore Airlines KrisFlyer | Star Alliance | 1:1 |

| TAP Air Portugal Miles&Go | Star Alliance | 1:1 |

| Turkish Airlines Miles&Smiles | Star Alliance | 1:1 |

| Virgin Red | Non-alliance | 1:1 |

| Wyndham Rewards | Not applicable | 1:1 |

Process to Transfer Miles to Partners

Unlike some other bank programs, Capital One doesn’t require customers to have a premium credit card to enable transferring miles to partners. Transferring Capital One Miles to airline or hotel partners is a straightforward process.

Begin by logging into your Capital One online account and clicking the button “View Rewards” in the tile labeled “Explore rewards and benefits.”

If prompted, select the desired credit card account when prompted and click the button to “View Account.”

On the rewards home screen, scroll down to see the different options for using Capital One Miles. Options available and order displayed may be different depending on which credit cards you have.

To transfer miles to partners, click on “Transfer Rewards.”

This will bring you to the list of transfer partners shown above. From here, do the following:

- Move to the section for the loyalty program to which you want to transfer miles (the example below uses Air Canada Aeroplan).

- Note that there’s a link to enroll in the program if you’re not already a member.

- Select the link “Transfer Miles” next to the program’s name.

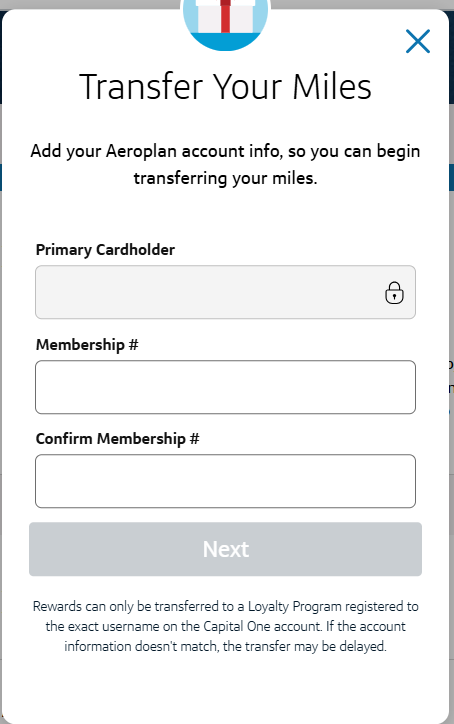

A pop-up window will appear with the primary cardholder’s name pre-filled (but editable) and areas to enter and confirm your loyalty program membership number. Capital One allows cardholders to transfer miles to their own loyalty program accounts only.

Keep in mind that if the name on the Capital One account doesn’t exactly match the name on the loyalty program account, the transfer may be delayed.

After entering your loyalty program information, click “Next.”

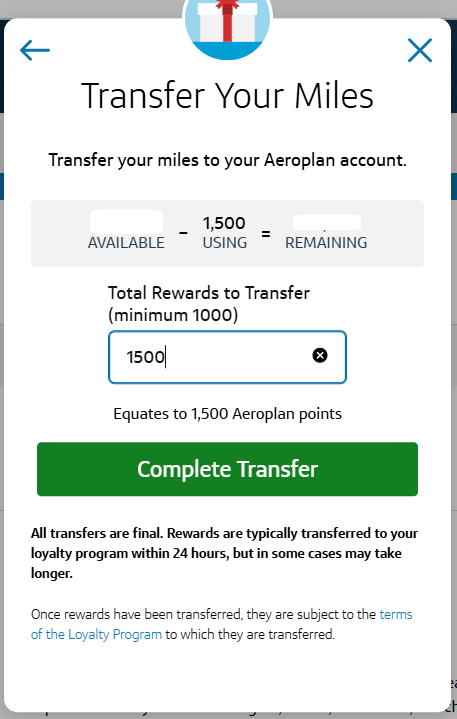

Another pop-up window will appear, and on this screen, you’ll see a box to enter the number of miles you want to transfer to the selected loyalty program. When done, click the “Complete Transfer” button.

Capital One sends a confirmation email once the transfer is complete. The communication notes the number of miles transferred and the loyalty program to which the points were transferred. It’s a good idea to check your loyalty program account to ensure that the transferred miles are reflected in the balance.

Common Questions About Capital One Miles Transfers

There are similarities and differences among the major flexible currency programs. When thinking about transferring points and miles to loyalty programs, some key questions to consider include whether it’s possible to transfer points to another member, how long the transfers take and whether transfers can be reversed.

Let’s review how things work with Capital One transfers and address some common questions.

Can I Transfer Miles to Other People?

While you can’t directly transfer Capital One Miles to someone else’s loyalty program account, you can share Capital One rewards with others before initiating a transfer to a partner loyalty program. It’s been widely reported on points and miles sites that Capital One allows individuals with separate credit card accounts to share miles, as described in the example below.

This is different from the online functionality to “Combine Rewards,” which is used for combining rewards from multiple Capital One credit card accounts held by the same individual. An example would be combining rewards from your own VentureOne Rewards Card and the Venture X Rewards Card.

The ability to combine rewards between cardholders isn’t formally documented and must be done by calling Capital One. There are reports of successfully sharing one cardholder’s cash rewards to another person’s card that earns miles.

Here’s an example of why and how two people might share rewards.

- Bob and Jane both have their own Capital One credit cards that earn miles.

- Jane wants to transfer 50,000 miles to a Capital One partner airline to book an award ticket, but she has only 44,000 miles.

- Bob agrees to share some of his miles with Jane.

- Bob can’t transfer Capital One Miles directly from his Capital One account to Jane’s loyalty program account, so he calls Capital One to initiate sharing some of his miles with Jane, giving the representative both account numbers.

- Jane receives 6,000 miles from Bob and subsequently transfers 50,000 miles to her loyalty program account.

Other than both individuals having an eligible Capital One credit card in good standing, there are no known restrictions on sharing miles. Capital One doesn’t charge fees or limit the number of miles that can be shared. Capital One also doesn’t require that individuals sharing miles are related to each other or live in the same household.

How Long Do Miles Transfers Take?

As is the case for all flexible currency transfers, there is variation in how long Capital One Miles transfers take. On the transfer page, Capital One notes that transfers to loyalty programs typically are completed within 24 hours. Our experience and data points reported elsewhere indicate that transfers to many programs occur instantly, and some transfers take longer.

Transfer times are an important consideration since longer transfer times increase the risk that award availability might change before you can book an award. For loyalty programs that allow award holds without having enough miles in your account to book, holding a flight is recommended to mitigate this risk. Many airline programs don’t allow award holds.

Here are estimated times for Capital One Miles to transfer to partners:

| Loyalty program | Estimated transfer time |

| Accor Live Limitless | ~ 0 to 48 hours* |

| Aeroméxico Rewards | Instant |

| Air Canada Aeroplan | Instant |

| Air France-KLM Flying Blue | Instant |

| Avianca LifeMiles | Instant |

| British Airways Executive Club | Instant |

| Cathay Pacific Asia Miles | ~ 1 to 5 days* |

| Choice Privileges | ~ 0 to 24 hours* |

| Emirates Skywards | Instant |

| Etihad Guest | ~ 0 to 24 hours* |

| EVA Air Infinity MileageLands | ~ 1 to 2 days |

| Finnair Plus | Instant |

| JetBlue TrueBlue | No data points** |

| Qantas Frequent Flyer | ~ 1 to 2 days* |

| Singapore Airlines KrisFlyer | ~ 0 to 48 hours* |

| TAP Air Portugal Miles&Go | Instant |

| Turkish Airlines Miles&Smiles | ~ 0 to 48 hours* |

| Virgin Red | Instant |

| Wyndham Rewards | Instant |

Notes:

*: Significant variation in transfer time estimates among sources

**: Partner added February 2025; data not yet available

Can Transfers to Partners Be Reversed?

Similar to other banks’ flexible currency transfers, Capital One Miles transfers to loyalty programs generally can’t be reversed. All transfers are final, according to Capital One.

What Airline Transfer Partners Are Good Options?

For the most part, individual circumstances and preferences dictate which loyalty programs are most useful. Each loyalty program has strengths and weaknesses.

Overall, Capital One has several strong airline transfer partners. Programs that points and miles experts identify as broadly useful often include Air Canada Aeroplan, Air France-KLM Flying Blue, Avianca LifeMiles, British Airways Executive Club, Singapore Airlines KrisFlyer, Turkish Airlines Miles&Smiles and Virgin Atlantic Flying Club.

Our series about Capital One airline partners provides more details about redeeming points and miles through each transfer partner.

Capital One airline partners collectively include:

- Programs in each of the three major alliances (Oneworld, SkyTeam and Star Alliance): This can be useful to book travel on an airline in a particular alliance that isn’t a Capital One transfer partner. An example is booking flights on United Airlines, which isn’t a Capital One transfer partner. You can transfer Capital One Miles to another Star Alliance program, such as Avianca LifeMiles, Air Canada Aeroplan or Turkish Miles&Smiles, and use these programs to book United flights if award space is available to partners. Having multiple options for booking the same flight also may allow you to cherry-pick the best option when award rates are different among programs.

- Partners outside of the major alliances (such as Etihad Guest or Emirates Skywards): This feature can be useful for leveraging unique redemption opportunities through these programs. Some of the best uses for Etihad Guest miles no longer exist since the program replaced partner-specific award charts with a single award chart for all partners. Etihad Guest miles still provide the most award availability for business- and first-class Etihad flights booked further in advance. Similarly, Emirates Skywards miles are useful for booking Emirates flights, because award availability typically is better through Emirates compared to booking through partner programs. In addition, Skywards has better award rates when booking round-trip awards—compared to rates for booking two one-way awards—for economy or business Emirates flights.

- Airline programs that also participate in several other banks’ programs: When points and miles can be transferred to an airline program from multiple flexible currency programs, it becomes easier to accumulate enough miles in an airline program to book desired flights if you have multiple types of flexible currency. For example, Air France-KLM Flying Blue and Singapore KrisFlyer also are transfer partners for American Express Membership Rewards, Chase Ultimate Rewards and Citi ThankYou® Rewards. So, if you want to book an award for 100,000 KrisFlyer miles, you could transfer 70,000 miles from Capital One and 30,000 points from Chase.

“Sweet-spot” redemptions often are discussed in the points and miles community. These are awards offered through specific loyalty programs that have low rates compared to other programs’ rates for similar awards. One example is booking United flights between the continental United States and Hawaii through the Turkish Airlines Miles&Smiles program for 10,000 miles per direction in economy or 15,000 miles per direction in first class.

Since most of Capital One’s airline transfer partners also are transfer partners with other flexible currency programs, you can find strong redemption options by searching for “sweet spots” or “best ways” to use miles or points for a particular destination and/or a loyalty program.

Another thing to keep in mind is that Virgin Red is a Capital One transfer partner, and most other programs partner with Virgin Atlantic Flying Club. Virgin Red is Virgin’s group worldwide rewards club, and members can spend Virgin points across the group, including redeeming for Virgin Atlantic Flying Club awards.

The ability to book through Virgin Atlantic Flying Club is relevant because the program has one of the most desired sweet-spot awards. Through Virgin Atlantic Flying Club, you can book one-way ANA business- and first-class flights between North America and Japan at good award rates. Despite back-to-back devaluations in 2023 and 2024, award rates are among the lowest compared to other airline programs.

Award rates per direction are:

- Between Japan and the western U.S. and Canada: 52,500 points for business class and 72,500 points for first class.

- Between Japan and central or eastern U.S. or Mexico: 60,000 points for business class or 85,000 points for first class.

- Between Japan and Hawaii: 37,500 points for business class or 57,500 points for first class.

While EVA Air Infinity MileageLands isn’t a bad program, and it offers good availability and reasonable award rates on EVA Air business-class flights to, from and within Asia, there are a couple of things to consider before transferring Capital One Miles to this program.

First, at 2:1.5, EVA Air’s transfer ratio is less favorable. That means that 1,000 Capital One Miles become 750 EVA Air miles. Beyond that, the program can be difficult to use, especially for booking multiple tickets. If transferring flexible currency to EVA Air makes sense for your situation, keep in mind that Citi ThankYou® Points transfer to EVA Air 1:1.

Transfers to JetBlue TrueBlue are at a less favorable ratio compared to other Capital One airline partners. When transferring to JetBlue, 1,000 Capital One Miles become 600 TrueBlue points. Better transfer ratios are available if transferring points from other flexible currency programs to JetBlue.

What About Transferring Capital One Miles to Hotel Programs?

Current Capital One hotel transfer partners are Accor Live Limitless, Choice Privileges and Wyndham Rewards. Everyone has different hotel preferences (basic, mid-range or luxury), and travel locations also may dictate the usefulness of specific programs.

Accor Live Limitless (ALL)

Capital One Miles transfer to Accor at a 2:1 transfer ratio, and Accor points are worth a fixed rate of 1 euro cent per point (cpp) toward cash rates at Accor properties. Given current and historic U.S. dollar to euro exchange rates, this is slightly better value compared to paying for an Accor hotel with a Capital One credit card earning 2X miles and getting a statement credit to reimburse the purchase. When U.S. dollars and euros are trading at par, the advantage of transferring miles to ALL disappears.

Choice Privileges

Capital One to Choice Privileges transfers are at a 1:1 transfer ratio. Several points and miles sources estimate the value of Choice Privileges points ranges between 0.6 and 0.8 cent each. Unless you have a particular stay in mind where it’s possible to get at least 1 cpp by redeeming Choice Privileges points or need a small number of additional points for an award, transferring Capital One Miles to Choice Privileges typically isn’t the best option.

There are situations where it’s possible to get good value from Choice redemptions, despite Choice increasing award rates in 2024 for some hotels in the Preferred Hotels & Resorts collection—Choice Privileges has a partnership with Preferred Hotels & Resorts—and some of its own hotels.

Options to consider for better value include:

- Participating Preferred Hotels & Resorts for travelers interested in higher-end properties

- Choice properties in Northern Europe because of generally expensive hotel prices there

If you’re interested in transferring points to Choice Privileges and have Citi ThankYou® Points, Citi’s transfer ratio to Choice is 1:2, so you’re better off transferring from Citi than from Capital One.

Wyndham Rewards.

Wyndham Rewards is a 1:1 transfer partner. Within the points and miles community, Wyndham Rewards points generally are valued in the range of 0.8 to 1.1 cents each.

Wyndham Rewards has fixed award rates, which provide opportunities for getting higher value compared to programs with variable award rates closely tied to cash prices.

Let’s summarize Wyndham award rates:

- Wyndham properties in the Hotels by Wyndham and Caesars Rewards Destinations collections fall into one of three tiers for Wyndham’s free night awards (7,500, 15,000 or 30,000 points per night).

- Fixed award tiers also apply to Wyndham Vacation Clubs, Vacasa Vacation Rentals and Cottages.com properties, but the award rates depend on the number of bedrooms.

- Wyndham Rewards Earner® cardholders get a 10% discount on free night redemptions.

- Wyndham also offers discounted nights with Points + Cash awards at 1,500, 3,000 or 6,000 points per night plus a variable cash copayment. These award tiers apply per room at Hotels by Wyndham and Caesars Rewards Destinations collections and per bedroom at Wyndham Vacation Clubs.

Wyndham redemptions through Vacasa Vacation Rentals and Cottages.com provide alternatives for individuals who prefer to stay in a larger unit like an apartment or home. Vacasa properties often are full homes, and award rates are based on the number of bedrooms at 15,000 points each. Most Cottages.com properties are located in Europe.

Final Thoughts

Capital One Miles often are most valuable when transferred to partner programs to obtain more than the fixed rate of 1 cent per mile realized when booking through Capital One Travel or using Capital One Miles for other purposes.

Transferring miles is a straightforward process, and many transfers are nearly instant.

Specific transfer partners and redemptions that are most rewarding largely depend on individual preferences and travel patterns.

Capital One Venture Rewards Credit Card

Enjoy a one-time bonus of 75,000 miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

Capital One Venture X Business

Earn 150,000 Bonus Miles

once you spend $30,000 in the first 3 months from account opening