MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

This card offer has expired. Click here for the top current credit card sign up bonuses.

The Citi® / AAdvantage® Platinum Select® MasterCard® is currently offering 30,000 bonus miles after spending $1,000 on the card in the first 3 months of account opening.

This is enough miles for two roundtrips within the mainland United States, Canada, and Alaska or one roundtrip to Europe, South America, or Asia.

I ranked the card #2 on my top ten list of the best cards for free travel this month because of

the massive sign up bonusAmerican Airlines’ cheap award chartthe fact that cardholders get a 10% rebate on the miles used to book American Airlines award ticketsthe $95 annual fee being waived the first 12 months

Beyond the benefits when award booking, the Citi® / AAdvantage® Platinum Select® MasterCard® also makes traveling American Airlines less stressful.

Cardholders are entitled to a free checked bag for themselves and up to four companions on the same ticket. That’s up to a $250 value per roundtrip.Cardholders get Group 1 boarding, so they’ll never have to gate check bags after the overhead bin space fills up.Cardholders get a 25% discount on purchases onboard (I recommend the pastrami sandwich!)

The American Airlines card is one of the best airline cards, but it is not right for everyone.

What types of people should get the American Airlines credit card and what types shouldn’t?What are the best uses of American Airlines miles?What about the American Airlines/US Airways merger?

Benefits of American Airlines Miles

Cheap Award Chart & Amazing Partners

American Airlines miles are the best miles for booking ultra-luxury trips because American Airlines miles can book:

Etihad First ClassQantas First ClassCathay Pacific First ClassQatar First ClassBritish Airways First ClassMalaysia First ClassJapan Airlines First Class

Delta miles cannot book international First Class. United gutted its award chart for partner First Class, so that its prices are almost double what American Airlines charges to fly some of the nicest products in the world.

United would charge 120,000 miles one way to fly from the United States to Southeast Asia via Asiana First Class. American would charge 67,500 miles via Cathay Pacific First Class, which is a better product in my opinion.

On the opposite end of the spectrum, American Airlines miles are the best for economy awards too. American features off peak dates with super cheap economy awards to:

Japan & KoreaEuropeSouth AmericaCentral AmericaCarribeanHawaii

Delta charges 70,000 miles roundtrip to Japan. American charges as little as 50,000 miles.

United charges 60,000 miles roundtrip to Europe or Southern South America. American charges as little as 40,000 miles.

American is cheaper than its competitors because they both devalued their award charts in the last year. American will likely release a new award chart in 2015 when it combines its AAdvantage program with the US Airways Dividend Miles program. I expect award prices to go up somewhat in 2015, but we still have months to book at current prices for flights throughout 2015.

10% Rebate on Awards

Folks who have the Citi® / AAdvantage® Platinum Select® MasterCard® can do even better than the award prices I just quoted. One benefit of card membership is a 10% rebate on the miles used to book American Airlines awards up to 10,000 miles rebated per calendar year.

That means a 40,000 mile off peak roundtrip to Europe is only 36,000 miles net. A 67,500 mile treat in Cathay Pacific First Class is only 60,750 miles net.

A cardholder who redeems 100,000 American Airlines miles each year (very doable for most people) gets back 10,000 American Airlines miles.

The process is automatic and the rebate posts within a few weeks. Here’s a post I wrote about the benefit in 2012.

Benefits When Traveling

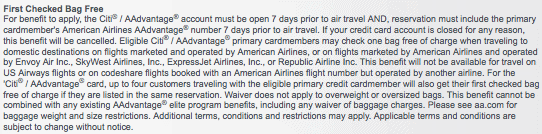

Free Checked Bag

Cardholders get a free checked bag on domestic American Airlines flights (everyone gets a free checked bag on international flights), and up to four companions on the same reservation get the same benefit. Since the first checked bag normally costs $25, a family of five could clean up with this benefit, saving $250 per roundtrip.

I used this benefit this week to save $25 on a one way ticket from Atlanta to Los Angeles when I had to check a tennis bag.

Group 1 Boarding

Since all the airlines started charging for checked bags, more people are carrying on big roll-a-boards that need to go in the overhead bin. When those fill up, you have to surrender your carry on for a dreaded “gate check.” I hate to gate check my carry ons because I have to wait around for 15 extra minutes to get the bag at baggage claim and because I lose access to everything in the bag during my flight.

The Citi® / AAdvantage® Platinum Select® MasterCard® gets you Group 1 boarding on American Airlines flight, so you will definitely secure overhead bin space and avoid gate checking. This came in handy for me last week to keep my big backpack on the plane and not under the seat in front of me.

Best Uses of American Airlines Miles

Here are the basics of the AAdvantage program and the award booking rules.

American Airlines miles are best used for:

International Premium CabinsOff Peak economy awardsAwards that are severely under-priced on the American Airlines award chart (here are five such awards)

American Airlines miles are almost never your best option for domestic economy awards.

Why not?

If there is MileSAAver award space on the flight you want, you can book it with British Airways Avios instead, almost certainly for fewer miles.

If there is not MileSAAver award space on the flight you want (only AAnytime space), you are almost certainly better off using Arrival miles to book the ticket.

Who Should and Shouldn’t Get This Card?

Look back at the previous section. Will you use the miles for a high value use? If so, this card with its 50,000 bonus miles and other benefits is a no-brainer.

Will you use the card for a low-value use? Skip the card and get the right card for your trip goal. (Fill out my Free Credit Card Consultation form.)

What about the US Airways Integration?

American Airlines and US Airways merged in December 2013, but they have not combined their frequent flyer programs.

A few days ago, I said I expected that an announcement about the integration of AAdvantage and Dividend Miles would come imminently and the combination would occur is 2015. I still believe that.

Hopefully we’ll know soon when American Airlines and US Airways miles will be combined and whether they will be freely transferable between the programs in advance of that date.

Citi issues the Citi® / AAdvantage® Platinum Select® MasterCard® and Barclaycard issues the US Airways® Premier World MasterCard®, so anyone can get both, which is a good idea if you are serious about collecting American Airlines miles.

Offer Details

For a limited time, earn 50,000 American Airlines AAdvantage® bonus miles after making $3,000 in purchases within the first 3 months of account opening*Your first eligible checked bag is free*Group 1 boarding and 25% savings on eligible in-flight purchases*Double AAdvantage® miles on eligible American Airlines purchases*Earn 10% of your redeemed AAdvantage® miles back – up to 10,000 AAdvantage® miles each calendar year*

Application Link: Citi® / AAdvantage® Platinum Select® MasterCard®

Hi! I cancelled my AA VISA Platinum two months ago. If I apply for this AA M/C do you think I’d be eligible for the bonus?

It’s usually 18-24 months between applications. I’ll let you know if I read different reports.

VSR

CALL and ask IF that’s how I got my THIRD INKer card (70K).

Thanks Scott

God Bless Citi AA did 2 trips to Paris or London will work too 40K points a piece which was non-stop like 5/13 to 30 so I got a point break ..Got another one in July for 50k easy No-brainer Flt.. for Rookies ..

Miss my Cave

I’m confused by the comment above. If we have the Visa are we still eligible for the MC bonus?

There you go Mike. The question is if you had the Visa (already cancelled), are you then eligible to get the MasterCard bonus as they are two different products. One is a Visa and one is a MasterCard.

Just a quick note to other loyal readers like myself: I applied and was turned down – the small print says “This Citi® / AAdvantage® card offer is only valid for new applicants for a Citi® / AAdvantage® account made pursuant to this offer and is not available to existing cardmembers or recent applicants for a Citi® / AAdvantage® credit card.”

Scott – do you know of any way around this?

Steve

For the personal card, usually not having gotten a new one for 18-26 months makes you a “new customer” regardless of closure date, but it is not consistent for everyone and other personal cards like the AA Executive count toward this time limit.

[…] Right now the Citi® / AAdvantage® Platinum Select® MasterCard® is offering 50,000 bonus miles after spending $3,000 in the first three months. The card also comes with other awesome benefits like a 10% rebate on miles used for award bookings. […]

[…] personal card bumped its public sign up bonus from 30,000 to 50,000 American Airlines miles in October 2014. Here was my full review at the time. I never expected it to last six […]

[…] Right now the Citi® / AAdvantage® Platinum Select® MasterCard® is offering 50,000 bonus miles after spending $3,000 in the first three months. The card also comes with other awesome benefits like a 10% rebate on miles used for award bookings. […]

[…] Right now the Citi® / AAdvantage® Platinum Select® MasterCard® is offering 50,000 bonus miles after spending $3,000 in the first three months. The card also comes with other awesome benefits like a 10% rebate on miles used for award bookings. […]

[…] you have the Citi® / AAdvantage® Platinum Select® MasterCard®, you get an automatic 10% rebate on the award that is deposited into your account in a few weeks. That makes the net cost only […]

[…] you have the Citi® / AAdvantage® Platinum Select® MasterCard®, you get an automatic 10% rebate on the award that is deposited into your account in a few weeks. That makes the net cost only […]