MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Earlier this year, Citi introduced a unique benefit to its American Airlines credit cards. (Yes, cards plural; serious mileage earners get two at a time. See my Best Current Credit Card Offers.) Cardholders would get a 10% rebate on the miles used on AA awards up to a maximum of 10k AA miles rebated per calendar year.

In this post, I’ll explain how exactly the 10% rebate works and how to value it.

Unfortunately for me, the benefit was added after I used 62,500 AA miles to book Melbourne, Australia to LAX on a Qantas A380 in business class with a free oneway in AA first class to Tampa. That means that for 2012, I will not be able to max out this benefit by redeeming 100k+ miles on AA.

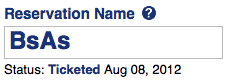

My only other redemption for 2012 was made August 8, when I redeemed 62,500 miles for a trip to Buenos Aires in First Class next February. LAX-DFW-MIA are early morning flights to get me in place to enjoy a nine-hour daytime first class experience down to EZE on this bird:

The 10% rebate process is automatic. There are no forms to fill out, no one to contact, and nothing to do. Just sit back and wait for the points to roll into your AA account.

For me, the process took exactly six weeks. On September 19, 6,250 miles posted to my AA account. The listed date of the miles being earned is the date I made the reservation–though they actually posted six weeks later.

![]()

Thepointsguy reported his miles posting “a few days [after]” he booked his award, so you certainly might get your miles faster than I did. The terms and conditions say you’ll get them in six to eight weeks.

Thepointsguy reported his miles posting “a few days [after]” he booked his award, so you certainly might get your miles faster than I did. The terms and conditions say you’ll get them in six to eight weeks.

How to value this perk

I value AA miles at 1.77 cents each. That means my rebate of 6,250 miles was like a $111 rebate–almost as valuable as the annoying visa I’ll have to get upon landing at EZE.

And if I had been able to max out the 2012 benefit by getting a 10k rebate, I would be getting a rebate worth $177, so this is a very valuable perk.

The rebate is so valuable that it could potentially tip an SPG-transfer decision. Imagine you have a ton of SPG points and a Citi AA card, but you don’t have any AA or US Airways miles. You want to take a roundtrip first class trip to Argentina.

Ordinarily it would cost 125k AA or US miles to fly from the US to Argentina in first class. That would mean you would need to transfer 100k SPG points at the rate of 20k SPG to 25k miles rate. In the absence of this Citi AA card benefit, you would just choose the program that had the availability you wanted given your preferred dates and airline preference.

But because of the 10% rebate, your options are different. If this would be your only AA redemption for the year, you would be rebated a full 10k AA miles if you went the AA route. Now it’s either 125k US miles or 115k AA miles, a noticeable difference.

Other Considerations

If I had multiple trips redeemed in a calendar year totaling 250k AA miles, I would still only earn the maximum 10k rebate. In that case, I would average out the 10k rebate across all 250k miles I spent and see that I got a 4% rebate (10/250). For each trip in this instance, I would consider the rebate 4% off the miles price.

Terms and Conditions

You do not need to use your Citi AA card to pay for the taxes and fees on your award to get the rebate. That is not in the T & C, and I did not use my Citi AA card for my award that earned a 10% rebate.

Many of us have two or more Citi AA cards. Despite that, I haven’t seen reports of anyone getting more than one rebate per award or more than 10k AA miles total per year.

Full T & C:

For benefit to apply, your Citi® / AAdvantage® account must be open and active at the time of redemption. The American Airlines AAdvantage® bonus miles you earn through this benefit will be based on 10% of the total AAdvantage® miles you redeem each month during the calendar year. The maximum number of AAdvantage® bonus miles you can earn annually from this benefit is 10,000 AAdvantage® bonus miles per calendar year, regardless of how many AAdvantage® miles you redeem in that calendar year. This benefit only applies to AAdvantage® miles redeemed from the primary cardmember’s AAdvantage® account. Discover all the ways to redeem AAdvantage® miles at www.aa.com/redeem. Please allow 6-8 weeks after your redemption for the American Airlines AAdvantage® bonus miles to post to the primary cardmember’s AAdvantage® account.

could you redeem and then cancel, and still get 10% credit for the redemption? let’s say you have a year that is about to pass and you have no redemptions. It could be worth it to redeem and pay the cancellation fee if it is less than the value of the 10k miles.

The cancellation fee is $150, so that would be very marginal if it worked. But they might claw back the miles.

Also may make sense to delay multiple high mileage bookings if we are late in the year (ie: book 1 trip in late December and book other in early January). Of course there is a risk but may be worth it.

suprised it took 6 weeks to post. I did a 122K booking and got 10K credited within a week. Awesome perk. Probably the best airline card out there right now.

Last week, I booked a flight for my buddy and his wife using 150k miles from my account. Do these still qualify for the rebate?

Yes. If it’s your account, and you are a Citi AA cardholder.

Based on info in this article, I secure msged Citi and asked why I did not get 10% bonus for redemption I made on 12/24/2011. She said that since i was only enrolled in April 2, 2012, hence I am not eligible.

However, i thought this benefit comes with the AAdvantage credit card? Since I got my credit card in August, 2011, shouldn’t I be enrolled in Aug’11 already?

Thanks for your help!

The benefit didn’t exist until 4/2/12, and it only applies to redemptions made after 4/2/12.

Is this only for the Personal card or business card as well?

I don’t think that 10% rebate is a benefit of the business card.

[…] The benefit is automatic, no enrollment necessary. Here’s my experience with the rebate last year. […]

[…] keep me holding on to the card. One that will come into play if you book an Explorer Award is that cardholders get a 10% miles rebate on awards booked up to 10k miles rebated per calendar year. Booking a single Explorer Award […]

[…] Beyond the sign up bonus, the other huge benefit that cardholders get is a 10% rebate on all American Airlines award redemptions up to 100k miles redeemed/10k miles rebated per year. Example: You book Cathay Pacific First Class from San Francisco to Hong Kong for 67.5k miles. In a few weeks, you’ll get 6,750 miles rebated to your account. […]

[…] card offers a 10% rebate on American Airlines miles used for award bookings, up to 100,000 American Airlines miles redeemed, 10,000 rebated per calendar […]

[…] AA personal card offers a 10% rebate on redeemed miles up to 10,000 rebated miles per year. That benefit is worth $0 to $180 depending on how many miles you redeem each […]

[…] The benefit is automatic, no enrollment necessary. Here’s my experience with the rebate. […]

[…] A cardholder who redeems 100,000 American Airlines miles each year (very doable for most people) gets back 10,000 American Airlines miles. The process is automatic and the rebate posts within a few weeks. Here’s a post Scott wrote about the benefit in 2012. […]