MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Virgin Atlantic-35% Bonus on Membership Rewards Transfers

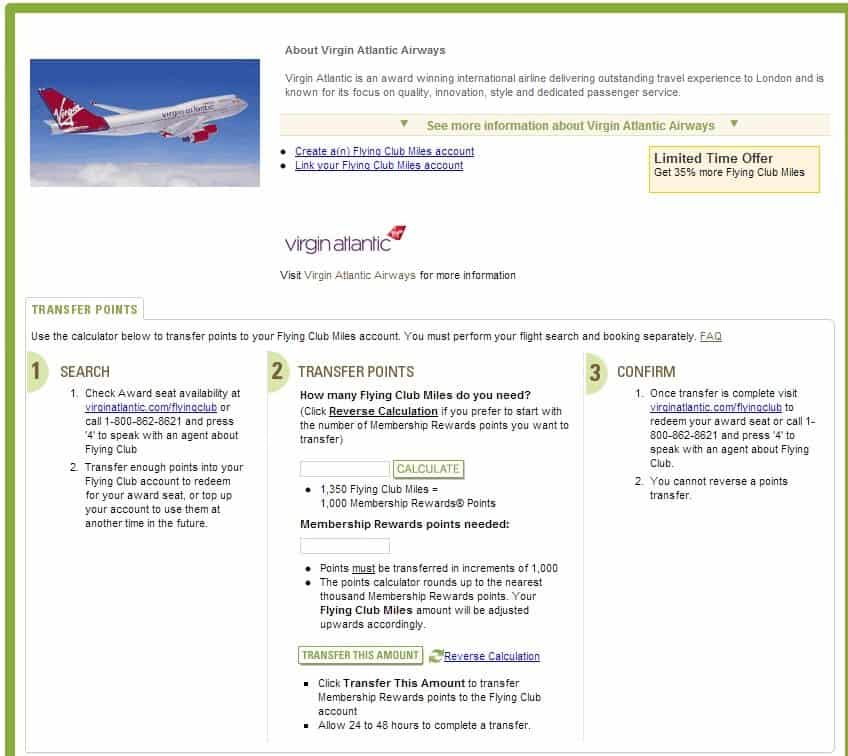

According to the American Express Membership Rewards website here, Virgin Atlantic is offering a 35% bonus when transferring Membership Rewards into Virgin Atlantic Flying Club miles.

This offer is available through December 29th. Transfers must be made in increments of 1,000 Membership Rewards. The minimum transfer will yield 1,350 Flying Club miles.

Is this a good deal?

Unfortunately not. Virgin Atlantic features an incredible onboard product and great club lounges. However, they impose extremely hefty fuel surcharges on flights…so hefty that it isn’t even worth a redemption for most travelers.

Scott has actually written several articles about Virgin Atlantic’s frequent flyer program in the past. In his post, Redeem for Virgin Atlantic Upper Class without Surcharges, he detailed how you could avoid those sky high surcharges by using Hawaiian Airlines miles to book Virgin Atlantic awards instead of Virgin’s own miles! There are several ways to amass Hawaiian miles quickly, including transferring Membership Rewards. In many cases it made sense to transfer to Hawaiian instead of Virgin to save hundreds of dollars out of pocket.

Sadly, as Scott detailed in his recent post, Hawaiian’s Virgin Atlantic Chart Devalued, the substantial increase in the amount of Hawaiian miles required to book Virgin awards really turns this into a poor use of Hawaiian miles.

So I should avoid Membership Rewards transfers to Virgin altogether?

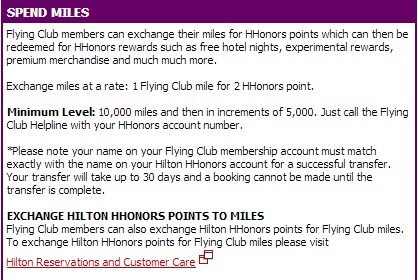

Not necessarily! Virgin Atlantic miles are still valuable. Virgin miles can be transferred to Hilton HHonors points at a ratio of 1:2. That means 1 AMEX point becomes 2.7 HHonors points during this Virgin Atlantic transfer bonus. Membership Rewards actually transfer directly to HHonors at a much worse 1:1.5 ratio.

We’ll be rolling out our hotel point valuations soon, but provisionally let’s value one Hilton point at 0.4 to 0.6 cents. At 0.4 cents, these transfers would value one Membership Rewards at 1.08 cents. That’s a pretty awful because Membership Rewards are worth much more than that.

At 0.6 cents, the the implied valuation of one Membership Reward is 1.67 cents, still too low, but getting reasonable if you are topping off for a specific AXON or GLON redemption.

For further reading, check out Scott’s post Transferring Virgin Atlantic Miles to HHonors Points. You can also read more about these transfers on Virgin Atlantic’s website here.

Keep in mind the minimum transfer is 10,000 Virgin Atlantic miles and they must be converted to HHonors in increments of 5K. If you are in desperate need of HHonors points, you will yield far more points by using Virgin Atlantic as the middle man in this transaction. Move your Membership Rewards points to Virgin Atlantic and then convert them to HHonors. Check out the math on a sample transfer below:

15,000 Membership Rewards –> 22,500 HHonors points OR

15,000 Membership Rewards–>20,250 Virgin Atlantic miles (with 35% bonus)

20,000 Virgin Atlantic miles–>40,000 HHonors points

By routing through Virgin Atlantic you net 17,500 more HHonors points! That’s a nifty 77% bonus!

How long does it take for Virgin Atlantic Miles to convert to HHonors points?

Virgin’s website states that transfers can take up to 30 days, but reports on FlyerTalk vary from a week to two weeks. If you have a specific hotel redemption in mind, be warned that this is not instantaneous!

I have tons of Membership Rewards points, where should I transfer them?

Scott actually tackled this question in a previous post, What to Do with an American Express Annual Fee Coming Up and Unused Membership Rewards. Membership Rewards are inherently valuable due to their flexibility. If you have a specific award redemption in mind, the ability to transfer to airlines such as Delta, Singapore, British Airways, or even Virgin Atlantic makes them much more useful than just holding, for example, only Delta Skymiles.

Your best option is to keep your Membership Rewards, but if you have to transfer due to an upcoming annual fee, British Airways Avios have some good sweet spot redemptions, especially on normally expensive short haul trips. For more reading, make sure to check out Scott’s posts, How Much Are Avios Worth? The Value of British Airways Avios as well his recent entry Avios Awards within South Africa.

Referencing the Mile Value Leaderboard, we value Membership Rewards at 1.79 cents. Avios are a slight step down at 1.70 cents, which is the option value lost when you transfer a flexible point to a specific program.

United Airlines to Raise Club Membership Fee By $25

According to this thread on FlyerTalk and United’s own website, United will be raising the price of all membership rates by $25, effective January 1st. Three year membership terms will also be discontinued. The new rates beginning next year are below.

As I’ve stated before, lounge access can be a huge benefit when traveling, especially in bad weather or when your flight experiencing mechanical delays or cancellations.

The fact that United is raising prices is a bit surprising. As I detailed in a previous post, Elite Status Offers for Delta/US Club Memberships, purchasing a US Airways Club membership actually allows you access to all United clubs (and vice versa). US Airways’ standard one year membership fee is $450, $25 cheaper than United’s new pricing chart. If you are looking for access to United lounges, buying a club membership with US Airways seems like an easy decision.

Recap

Virgin Atlantic is offering a 35% bonus on all Membership Rewards transfers. While this may seem like a great deal, Virgin has run transfer promotions in the past. 35% isn’t even the most generous bonus they have offered in the past, as they just wrapped up a 40% bonus in September.

Still, if you need to top off an account or potentially boost your HHonors balance, this might make sense. We aren’t advocating you transfer speculatively, though. Membership Rewards are valuable due to their flexibility–they transfer to a variety of carriers. Retaining that flexibility is important if you don’t have a specific redemption in mind at this time.

United is raising the price of their Club memberships by $25. The standard price for a one year lounge membership is $450 with the other three legacy carriers, so it will be interesting to see if they follow suit and nudge their prices upward. US Airways club membership remains $25 less expensive and includes access to United lounges as well. If you are in the market for a United Club membership, save the $25 and join up with US Airways.

I’m on the side of ignoring Virgin Atlantic’s program. The fuel surcharges destroy any interest I might otherwise have. And I put the Hilton points at the lower end of the range you suggest. I feel Avios are far too valuable as an MR transfer, especially when there’s a bonus, to pass them up for those inferior programs. And Avios are not only for true short-haul flights. I recently booked Dublin-Chicago one way for August for 20k Avios, with reasonable fees. No other program will get you from Dublin to Chicago for 20,000 miles in August.

I think the BA valuation is far too high. I mean, if you truly believe BA miles are worth 1.7 cents, then you also believe that everyone should transfer membership reward pts to BA during the transfer bonus. With the 30% transfer bonus coming up, that would make each membership reward pt worth 2.3cents if transferred to BA.

I get the short haul redemptions, and I live in a AA hub, but I guess I just don’t see it ?

Do you like to take any direct American Eagle flights from that hub? Those cost an arm and a leg. Do you like to travel within Australia, South America, South Africa? If not, your value will be lower.

You’re spot on in terms of relative value. My iPad is probably worth $1500 to me but I only paid $600. The value of my iPad is still $600, but I gain much more than that from it. This is like BA miles to you. I think a fair value is 1.2c per mile, but to you they are worh 1.7.

@LR, you’re absolutely right that valuations will vary significantly because it really depends on how you can and will use the program. I’ve had several excellent redemptions with Avios. For example, last spring there was a death the the family and I needed to book a flight with less than 24 hours’ notice. All fares were over $600 round trip, but a seats on AA were available with Avios for 9k round trip. This is a value of over 6cpm since I would have paid whatever I had to in order to make the trip (or used AAdvantage miles, but at 25k plus a hefty close-in booking fee, which BA, by contrast, does not charge. This kind of opportunity is one reason I value the Avios quite highly.