MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Fact: I check eight frequent flier blogs daily. (Just dropped a ninth…)

One of those eight is Mileage Saver by Paul Walia. I love it because his posts take, on average, 10 seconds to read, and he covers all the easy ways to earn miles. The other day, he had a post on how to earn 400,000 Hilton Points in Five Steps.

Some of the cards mentioned in his post are Hilton cards, but some just feature miles that can be transferred to Hilton points. On my last credit card churn in March, I picked up the Virgin Atlantic card from American Express. I met the minimum spend by my number one trick to increase credit card spending by $10,000 per year.

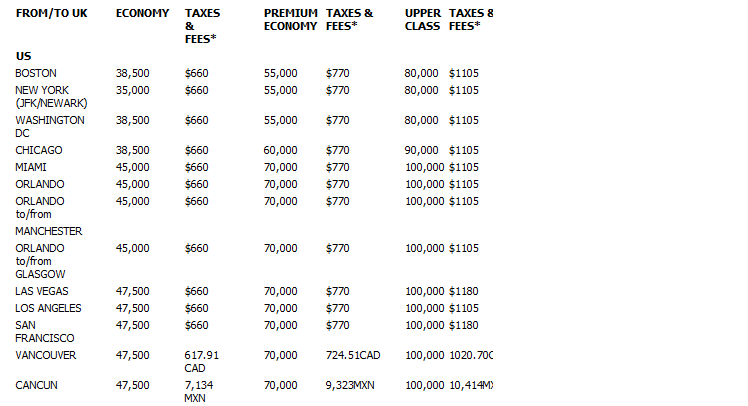

Virgin Atlantic miles can be used for flights or transferred to Hilton. Which is a better deal? This is the Virgin Atlantic award chart:

You are reading that correctly. A roundtrip coach redemption from the USA to the UK costs miles plus $660. Since I value a roundtrip from LA to the UK at about $800, I would be getting less than 0.3 cents of value per mile because of that crippling surcharge. (Actually I would probably be getting negative value since if I bought an $800 ticket, I would be earning thousands of frequent flier miles for flying a paid itinerary.)

You are reading that correctly. A roundtrip coach redemption from the USA to the UK costs miles plus $660. Since I value a roundtrip from LA to the UK at about $800, I would be getting less than 0.3 cents of value per mile because of that crippling surcharge. (Actually I would probably be getting negative value since if I bought an $800 ticket, I would be earning thousands of frequent flier miles for flying a paid itinerary.)

What about the premium redemptions? They all have surcharges of $1,105! Since I only value the chance to fly Upper Class from LAX-LHR at $1,200 or so, I would be getting 0.1 cents per mile redeeming 100,000 miles plus $1105. (Again, I’d actually be getting negative value because of the foregone miles when flying an award ticket instead of a paid ticket.)

I recognize I have idiosyncratically low valuations for these trips to Europe. But your valuation would have to be over $2,105 just to get 1 cent of value per mile. I like to get 2 cents per mile on redemptions, so I would have to value the Upper Class awards at $3,105 to get that kind of value.

Since using the Virgin Atlantic miles is out, I decided to transfer them to Hilton. I’ve seen people value Hilton points between 0.4 and 0.7 cents. So transferring the 45,000 Virgin Atlantic miles to 90,000 Hilton points means I’d be getting $360 to $630 worth of value from the points. That’s certainly more value than I could get out of redeeming the miles for flights based on the above surcharges.

Here’s how the process of transferring Virgin Atlantic miles to Hilton points works.

- You have to call Virgin Atlantic’s Flying Club at 800-821-5438. Have your Virgin Atlantic account number and Hilton account number ready. I called June 23. I spent five minutes on hold, and I spoke to the agent for two minutes, for seven minutes total.

- You must transfer a minimum of 10k miles, and your transfer must be in increments of 5k. I transferred 45k, since that was the maximum I could transfer with an account balance of 48k.

- The agent tells you that the names on the two accounts must be the exact same, so you can’t combine your and your wife’s miles into one Hilton account for instance.

- The agent tells you the points will post within 30 days. The next day, on June 24, 45k miles were deducted from my Virgin Atlantic account. Five days later, June 28, 90,000 points appeared in my Hilton account.

If anyone has any other data points on how long this transfer took or how long any of the other transfer opportunities in Paul’s post take, please leave that info in the comments. I’m not going to go for 400,000 Hilton points, but this 90,000 sure beats the heck out of 45,000 Virgin Atlantic miles, which for me had a negative value.

what are the other seven blogs you read daily?

Ditto. I’m curious to know as well.

No comment, but it may be possible to guess based on careful reading.

I just got the VA CC yesterday. The earning rate is basically 3 HHonors for each dollar that you spend. I might even keep their card for another year because I’ll earn another 30,000 HHonors for my second year.

It’s a better card than I thought it would be.

mine transfer took 11 days if i remember correctly! if you added an authorize user you could have gotten another 5K.

I don’t trust anyone.. Yeah I’m leaving miles on the table. Maybe my brother and I should start adding each other at sign up.

Since Virgin Atlantic miles seem pretty much worthless, that’s been near the bottom of my list of potential credit card apps. I also value Hilton points lower than most other hotel brands. Are there any uses of VA miles that aren’t ruined by the surcharges, such as with airline partners that don’t have the insane surcharges, or in some other part of the world?

Here’s the list of partner airlines, http://www.virgin-atlantic.com/en/us/frequentflyer/fcpartners/airlines/index.jsp, but for each airline, it says call to make a reservation without listing the cost. So there probably is a gem in there, but I’m not going to call and ask for the rates on each airline today. Maybe in the future.

I read something similar on milliOnmilesecret

Y is there a sudden interest in Hilton points?

I thought you were a couch or hostel guy, no?

My brother and I got into an argument about hostels in Peru. I’m hoping to use the Hilton points with him in Australia.

I’d also like to know what are the other seven blogs you read.

milevalue and mileagesaver are 2 of my new faves. i’ve been getting tired of the old bloggers for a while. hilton points are great when you redeem axon awards at some of their best hotels like in the maldives. keep up the great work!

That is definitely an incredible aspirational award.

that’s cool, but I gotta be honest getting cards for hotel points is kind of a waste in my opinion. I’d rather save it for airline miles. I just don’t think the value is even close. There are plenty of opportunities to get cheap hotel rooms, not so for cheap business or first class airfares.

I do have the SPG card, but only because the transfer to airline miles is awesome.

definitely true that airline miles are more valuable than hotel points, but…

after a few years of applying to a dozen or so cards per year, most people will accrue more miles than they are able to spend with the amount of vacation time they have. at that point, hotel points make a lot of sense because even cheap hotel rooms cost some money.

plus, there are plenty of destinations, such as the downtown area of expensive capital cities, where you can’t find a cheap hotel room or hostel bed or at least one that your’e comfortable travelling alone in (especially for a woman). there are also destinations where you’re not sure about the safety of the neighbourhoods or area and it is comforting to be in a nicer hotel.

agreed

Ur not finding priceline booking hotels to be cheaper?

I am not saying having free hotel points to book free stays isn’t a better option.

Just wondering how your approach to booking accommodations seem to be changing lately.

Sometimes good hotels priced cheap can still be found on hw or pl

For sure, I’m going to look into that for the Australia trip. I don’t think my approach has changed. Maybe I’ll use these points for the crazy resorts that can’t be booked effectively in other ways.

[…] why am I not flying it? Fuel surcharges. As I detailed last month, I transferred all my Virgin Atlantic miles to Hilton points at a 1:2 ratio because Virgin […]

[…] Hawaiian Airlines Miles transfer to Hilton points at a ratio of one Hawaiian Miles to two Hilton points. This is the same ratio as Virgin Atlantic miles transfer to Hilton points. […]

I transfered 30k Amex points to Virgin. I then called the # and asked to transfer 30k miles to my HHonors account. It took 2 days to come out of my Virgin account. Then on day 6, I had only 30k HHonor points. So I called both Virgin and Hilton to inquite why I didn’t receive 60k HHonor points. They are both currently looking into it. I’ll update later when it’s resolved.

Interesting. Update us when it’s cleared up.

I called Virgin back again today. They called Hilton and found out the miles got transferred over without a certificate number. So Hilton didn’t know where the points originated and didn’t know to double them. Or at least this is what the Virgin rep relayed to me. He said they are still researching it and should be resolved in 14(!) days.

My question is if they know what’s wrong, why can’t they fix it right then?

I’ll keep you updated.

Same exact thing just happened to me! I successfully transferred 40k VA to 80k HH in July then just recently I transferred another 15k VA to what should have been 30k HH…only 15k in the account. They are researching and will get back to me I guess.

I didn’t receive a follow up call or email, but the extra points posted yesterday!

Excellent!

[…] at a 1 mile to 2 Hilton points ratio, and I’ve described both processes in other posts. See Transferring Virgin Atlantic Miles to Hilton Points and Transferring Hawaiian Miles to Hilton […]

My sentiment about the outrageously high surcharges for VA bookings brought me to your blog. I’m also trying to find a way to get value from the miles I’ve acquired, now north of 100K.

In one of your comments you mention the airline partners as a possibility. Just wondering if you’ve looked deeper into it? Thinking maybe the US Airways partnership for R/T tickets continental or even to Hawaii (why not).

[…] Here’s an example. I currently have 7,640 Virgin Atlantic miles. Those miles might go orphaned. But I still have my Virgin Atlantic credit card for the next few months that earns me one mile per dollar. If I spend $2,360 on it, I’ll have 10,000 miles, which is the minimum amount I can transfer to Hilton points, as I explained in Transferring Virgin Atlantic Miles to Hilton HHonors Points. […]

Airline partners work great for Virgin Atlantic miles. Their mileage costs are similar if not identical to those parter airlines published reward rates, and I have never paid a fee (ie $0 redemption, no late booking fee, no fuel surcharges etc). Only catch is you need to call and ticketed flights need to be >7 days away. Example of recent redemption was Thanksgiving weekend first class SFO to ORD round trip for 40k miles on Virgin America ($1720 ticket value). I would never book a reward flight with Virgin Atlantic but have been pleased with other options so far.

This is a good point. I have started to look at partner redemption options more closely.

[…] Ultimate Rewards and Membership Rewards both transfer 1:1 to Virgin Atlantic. Virgin Atlantic miles transfer 1:2 to Hilton points, a transfer I’ve made before. […]

[…] Virgin Atlantic miles transfer to Hilton points at a 1 mile to 1.5 points rate. I’ve described transferring my own Virgin Atlantic miles to Hilton points in Transferring Virgin Atlantic Miles to Hilton HHonors Points. […]

[…] to Australia. I had 135,000 Hilton points sitting in my account after getting 90,000 from a Virgin Atlantic miles transfer that I wanted to […]