MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

I tweeted this deal first from @MileValueAlerts. Follow @MileValueAlerts on Twitterand follow these directions to get a text message every time I tweet from that account. I tweet from @MileValueAlerts only a few times a month because it is designed to be used only for the best and most limited-time deals–like mistake fares–so that you aren’t bombarded by text messages.

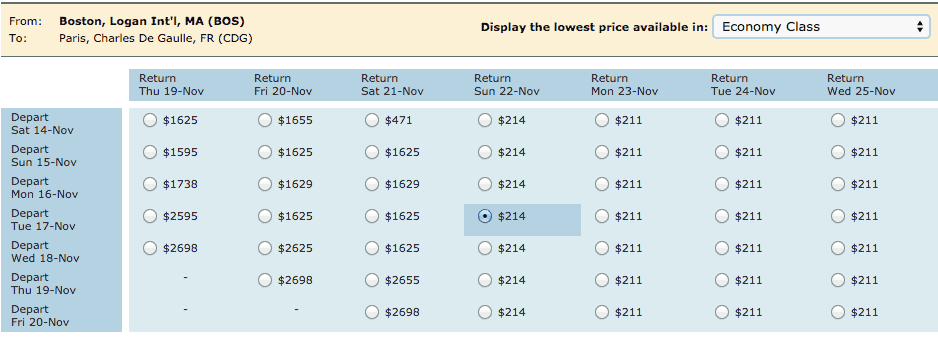

Travel from Boston to Paris on Air Canada for $210 roundtrip in November. New York to Paris is only $310 roundtrip. I haven’t checked all city pairs or dates, and I can’t because I am rushing out the door.

Contents:

- When are the $210 fares?

- Mileage Earning

$210 Roundtrip from Boston to Paris

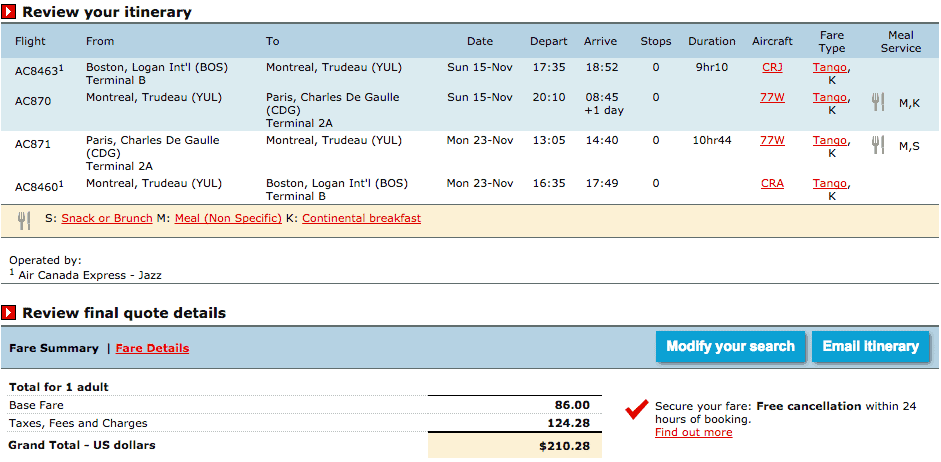

Sample Dates: November 15 to November 23 on Air Canada

I couldn’t find these fares on ITA Matrix, so just go straight to aircanada.com. I found these roundtrips for $210 in November. There may very well be $210 fares in other months.

New York to Paris is $100 more at $310 roundtrip. There may very well be other cheap city pairs. You should check yours and add them to the comments!

Mileage Earning

These book into fare class “K” on Air Canada. Crediting to United earns 25% of mileage flown. Crediting to LifeMiles or Singapore earns 50% of mileage flown. Those are the only three partner accrual rates I checked. Add others in the comments if you check them.

Awesome!

Awesome!

Looks already gone.

Looks already gone.

I couldn’t find these fares on aircanada.com, may be too late!

I couldn’t find these fares on aircanada.com, may be too late!

I think this is dead

I think this is dead

[…] you miss Friday’s $210 roundtrip fare from Boston to Paris? What about the $110 hotel rooms for $10 worldwide? You shouldn’t have. You could have gotten […]

[…] you miss Friday’s $210 roundtrip fare from Boston to Paris? What about the $110 hotel rooms for $10 worldwide? You shouldn’t have. You could have gotten […]