MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

I’m going to talk about a dilemma I rarely face–where to credit the miles earned by flying a paid ticket. I rarely face this dilemma because I rarely buy tickets; I almost always fly for free (plus tax) with miles.

If I’m flying a paid ticket, it’s probably a mistake fare–$238 roundtrip to Peru or $170 roundtrip to Central America–or just generally too cheap of a flight to make using miles a good deal–$36 oneway to Vegas is better than 4,500 Avios and $1,100 roundtrip to East Africa is better than 80,000 United miles.

Some people fly more paid fares, often because someone else is doing the paying. And on most paid fares, there is a decision to be made: where do I credit the miles earned from flying this itinerary?

Flying earns two types of miles, redeemable miles and status miles.

Redeemable miles are the fun kind that you use to book dream awards like a flying bed to Australia. You earn them by flying paid fares, signing up for credit cards, and a ton of other ways.

Status miles cannot be redeemed for anything. They are simply a counter that airlines use to determine whether you qualify for status. Different airlines call status miles different things. United calls them Premier Miles; others call them Elite Qualifying Miles or Medallion Qualifying Miles. Status miles are mainly earned by flying paid fares (although some credit cards offer some status miles.) Certain expensive fares earn bonuses; certain cheap fares only earn a fraction of the miles actually flown.

Every time you fly a member of one of the three alliances, you have the option to credit the miles earned to any of the alliance partners. And even when you fly an airline that isn’t part of an alliance, you sometimes have the option to credit your miles to one of several programs. How should you choose where to credit your miles?

The first step is knowing all your options. Each airline maintains a page on its website with all its airline partners listed on which you can earn miles. Generally the page can be found by clicking “earn miles” then “airline partners” or something similar inside the airline’s loyalty program section. United’s page looks like this:

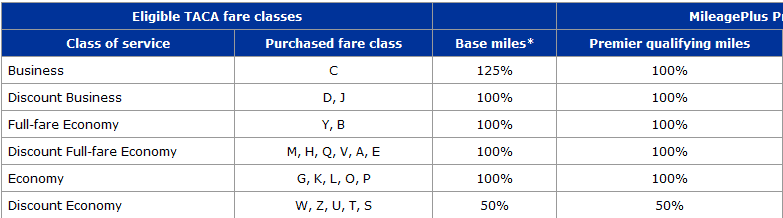

Each airline logo is a link that takes you to the information on earning miles on that airline. Remember how I said certain fares earn a bonus and certain only earn a fraction of the miles flown? Clicking on an airline will give all those details. For instance, here is TACA’s page:

Each airline logo is a link that takes you to the information on earning miles on that airline. Remember how I said certain fares earn a bonus and certain only earn a fraction of the miles flown? Clicking on an airline will give all those details. For instance, here is TACA’s page:

This chart shows how many United miles–both redeemable, labeled “base,” and status, labeled “premier qualifying”–you would earn from paid TACA fares in each possible fare class. Since I never buy paid business class, my eyes head straight to the bottom of the chart. As you can see, certain fare classes only earn 50% of the flown miles as redeemable miles and status miles. When you purchase a ticket, somewhere its fare class should be listed. If not, you can call the airline to ask.

The mistake fare I booked to Lima for later this year was fare class U, so for the 8,504 miles of flying, I could earn 4,252 redeemable miles and 4,252 status miles from United. Since TACA is now in the Star Alliance, I could also credit the miles to US Airways. How many miles would I get there?

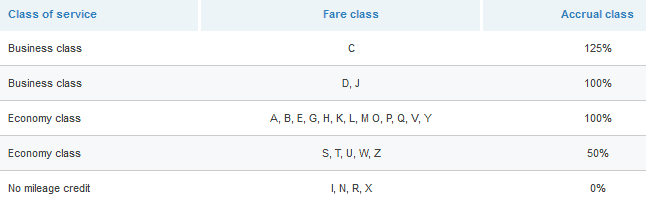

I would earn the same 4,252 redeemable and status miles from US Airways. In most cases, the miles earned are the same on US Airways and United, but not always, so it’s always worth it to check.

Once you’ve checked the airline’s accrual charts, you should make a decision based on where you will get the most value from status miles and redeemable miles. You have to pick one airline on which to accrue both the status miles and the redeemable miles for your trip, so pick the airline that offers the best combination of value.

Redeemable Miles– If status is far from your mind because you mainly fly short, one-carryon-bag-no-checked-bag domestic flights and international premium cabins, like I do, then you should mainly focus on where you want to earn redeemable miles. If you have specific future redemptions in mind, choose to earn miles in the program you will use for the redemption. If you don’t have a specific future redemption in mind, choose the airline whose miles you value the most in general.

Status Miles- Status miles get more valuable the more you earn on one airline generally. 25,000 status miles earned on United is better than 12,500 on United and 12,500 on American, for instance, because the latter earns no status while the former earns United Premier Silver.

50,000 on one airline is also better than 25,000 on two airlines because one mid-tier status is generally reckoned to be much more valuable than two low-tier statuses.

Pick at the beginning of the year which airline’s status you would most like, and try to funnel your travel to that airline and its partners. And when flying its partners, credit the miles to the account of the airline whose status you want.

An example I gave a few weeks ago was my earning United Silver status this year. I saw that I was flying 25,000 miles on Star Alliance members on two itineraries this year, so I decided to credit all the miles to United because I value United status more highly than US Air status.

A lot of times people contact me to book an award for them and when they list their mileage balances, they have a random few thousand in a Singapore or Lufthansa account. That should basically never happen. Credit your miles to an account where you might earn status, or at least to an account where you will get enough miles eventually to redeem them for an award.

Recap:

Carefully strategize where to accrue miles from paid flights. Consider where you want the redeemable miles, and where you want the status miles, then choose the program that gives you the best combination of value from those two types of miles earned from paid flights.

In general, you should try to credit all paid flying to one airline or, at most, one airline per alliance. If you do that, you’ll maximize status benefits, and you’ll ensure that your redeemable miles aren’t orphaned in worthless accounts.

Can you offer any thoughts on crediting to AS over DL? I have several upcoming DL flights (not enough for status), and I just cleared out my account after FINALLY being able to book an award. Thanks for any analysis you can offer.

DL miles are the least valuable redeemable miles, so if you don’t think you’ll earn status in either program, credit to Alaska as long as you don’t think you’ll orphan them there. (Orphaning DL miles is unlikely since they are a transfer partner of Membership Rewards.) The one thing in favor of crediting them to DL is that DL miles rollover to next year if you are over your status level, so earning 37,500 status miles doesn’t waste 12,500 status miles, it rolls them over to start your status quest off for next year.

Good post. I was also going to mention Alaska, like David did above. If you split your flying between AA and Delta, you can bank to Alaska and get elite status for benefits on both (not major benefits, but still better than none). Alaska has some interesting redemptions possible, too.

“A lot of times people contact me to book an award for them and when they list their mileage balances, they have a random few thousand in a Singapore or Lufthansa account. That should basically never happen.”

There are a few times it does make sense. Singapore Airlines has fare classes where the fares are the cheapest, but they earn 0% in partner programs and 10% in Krisflyer. Same thing with Lufthansa – some intra-Europe fares earn 0% with partners, but 50% with 500-mile minimums in Miles&More. Getting some miles makes more sense than getting no miles, especially since you can build up a program like SQ’s with AMEX points. I basically view these flights as flights that earn 0 miles, but still bank the miles to that orphan program since it may make sense down the road.

In my SQ example, it does make sense to see if buying up to a higher fare class is worth it: I’ve seen the difference as low as $85 for 22,000 miles in a partner program like United or US.

another reason some may have scattered miles in different accounts would be from non flying activities. I pretty much grab every free mile i can with the intention of filling in later through CC signups of transfer partners, so I have some accounts with only 500 or 1000 miles in them.

Since I got AA lifetime gold in December I guess i should never credit to AA as won’t fly enough to improve on that status. If I fly AA and credit to AS will I lose my AA elite benefits for that flight?

[…] This analysis doesn’t factor in the value to you of earning status through crediting paid fares. Your status goals may make your crediting decision for you. If you don’t know what the difference between redeemable miles and status miles are, see Choosing Where to Credit Miles Earned from Flying. […]

I booked a first class ticket with UA and when i asked to credit those miles to a partner they said it could not be done because I purchased from UA. is that true? If not how do i change who i credit these miles–online somewhere? thanks for the post. cz

That’s not right. Ask another agent to make the change for you.

[…] If you are an elite, you will also earn double redeemable miles during that time period. If you aren’t an elite, you will earn double redeemable miles during 11/16 – 11/26. Lost about the difference between elite qualifying miles and redeemable miles? See Choosing Where to Credit Miles Earned from Flying. […]

[…] I have more information about the difference between redeemable and status miles here. […]

[…] flown. Crediting to LifeMiles or Singapore earns 50% of mileage flown. Those are the only three partner accrual rates I checked. Add others in the comments if you check […]

I came across a new tool, it’s almost the same with wheretocredit but does a lot more. It shows award and status miles, you can personalize your searches by adding your memberships and status, includes elite bonus and also progress towards your next elite status level. It also shows which fares can be upgraded with miles. You can download it here https://chrome.google.com/webstore/detail/30k-frequent-flyer-miles/efpemjkcjaedejkodfdapnddegflnkkh