MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Tomorrow your miles will be worth money than today for two reasons:

- The price of paid tickets is rising.

- The knowledge of how to use miles efficiently is increasing.

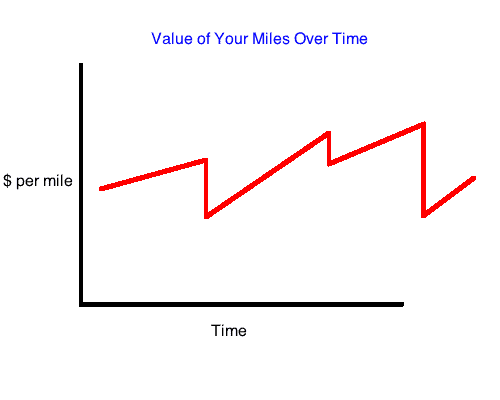

I see a lot of arguments that miles should be used now because they depreciate. I don’t see it like that. I see the value of miles basically following this pattern.

The default position of miles is to increase in value. Then every once in a while, they take a sharp drop. The drop can be caused by a devaluation of an award chart, a rule change, the end of a partnership, or something else that materially erodes the value of that type of mile.

For instance last fall when United’s partnership with Qatar ended, United miles lost one of their best business class redemptions and an incredible option to the Maldives, Middle East, India, and Africa. That caused an instant drop in the value of United miles. The next day the value started rising slowly again.

Or some time next year, we’ll lose the loophole of transferring Southwest points to AirTran credits that has raised the value of Southwest miles. When that happens Southwest points will fall back to their fixed value.

Southwest points will not rise in value after that because they are fixed in value. But the other four types of miles tend to rise in value.

Why do points at rest tend to rise in value?

The first big reason is that flights. In the last few years, their has been significant consolidation in the airline industry: Delta and Northwest merged, United and Continental merged, Southwest and AirTran are merging, American and US Airways are merging.

Less competition means higher prices. The reduction in capacity means higher prices. We will see higher prices in 2013 than we did in 2012 than we did in 2011. (Of course, in real terms, over the long term, flying has gotten much cheaper, but that doesn’t undermine my argument. See below.)

With prices rising and the number of miles you need for a route constant until the next chart devaluation, the value of miles in terms of dollars is increasing.

The second big reason miles are getting more valuable everyday is the spread of knowledge on blogs and forums. New knowledge is being created and disseminated daily here and other places that makes awards more valuable.

One example near to my heart is free oneways. The rules always permitted free oneways on American, Delta, United, and US Airways awards, but people didn’t know that free oneways were possible. People’s awareness of the ability to add free oneways to American, Delta, United, and US Airways grew immensely last year.

For instance, when I made my valuations of those four types of miles last March, I only knew free oneways were possible on American. The other three I discovered during the year, which made each type of miles much more valuable to me.

More recently Bill wrote about how to hold a United award for free, which makes those miles more valuable, and airlinehotelcreditcards added another way to do the same thing.

This knowledge accumulation makes miles more valuable over time until the next rule change starts the process over again.

If you agree with me that this is how mile values progress over time, what does it imply?

I think of everything as miles versus cash. When should I use my miles versus just buying the flight? When should I buy miles when they are offered for sale at discounted prices? These are the questions that led to the Mile Value Calculator‘s creation and the name of this blog.

So when I think about holding or spending miles, I am always thinking about doing those things compared to holding or spending cash. My analysis today doesn’t have a ton to say about when to use miles except that you should use them before big drops in value, which you could probably have intuited.

Luckily that isn’t very hard. The major airlines have a good, if not perfect, track record of warning us about pending changes to the programs and giving us time to book under the old rules or with the old partners. And in those cases, you can usually book up to 11 months in advance to lock in the old, better deals.

There is a limit to how many miles you can quickly use on efficient redemptions, though, so it is never wise to stockpile millions of miles when a major devaluation could wipe out a ton of their value.

The arguments above also lead to the conclusion that you should diversify your mileage balances. You should diversify your mileage balances for a lot of reasons. One of them is that programs tend to devalue at different times, so you spread your risk of all your miles being halved in value at once.

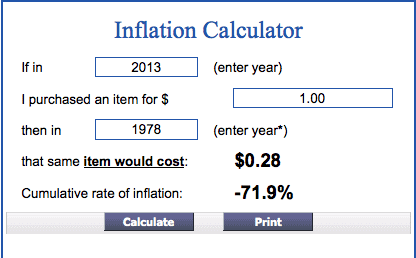

What the arguments in this post don’t address are the long term value of points versus cash. But I can give my take on that quickly. The real (term of art, meaning with inflation stripped away) value of miles has cratered ever since their inception. I couldn’t find the original American Airlines award chart from the year AAdvantage was introduced, but I think a roundtrip domestic economy flight was 5,000 miles. It is now 25,000 miles. That means the real value of an American Airlines mile fell 80%.

In those 35 years, the real value of a dollar also fell dramatically–72% according to usinflationcalculator.com.

But miles can’t be invested to earn interest while dollars can.

All that means that over long time horizons, holding miles is awful. Spend your miles, while saving and investing your cash.

But it doesn’t mean that miles are getting less valuable all the time. Most of the time, including now, they are actually slowly appreciating.

Make sure you use miles before big devaluations. But don’t worry about burning them now, now, now! Instead rationally approach each miles versus cash situation with a tool like the MileValue Mile Value Calculator.

An excellent corrective to those who promote the idea that miles always depreciate in value. If at the simplest level my 25,000 miles can buy a flight I could get for cash at $400 today, but which would cost $420 a year from now, my banked miles are really appreciating in value in tandem with the cash prices of the flights. They are a hedge against price inflation as long as the redemption levels stay stable. Of course redemption levels do not always stay stable – we’ve seen that abundantly in the hotel area in recent months – but all told I think you are quite fair in saying there can be and recently has been an upward trend in the value of miles, at least in quite a few programs.

Average airfares are up but that doesn’t mean the points are increasing in value. Remember that airlines still control the inventory allocations and there is no guarantee that higher fare tickets can be redeemed for. Also, the “free one-way award” existed before. Suggesting that somehow it is new of that somehow the points value has increased because of that is silly. In fact, the benefit used to be MUCH better on AA. Now it is worse than it was before. How is that an increase in value?

You getting smarter doesn’t make the points more valuable. It just means you get better and knowing how to maximize the value they hold. But the points themselves are still losing value as a general rule.

I can think of two or three specific instances where points have increased in value over the past decade. The rest of the changes to the programs have, across the board, decreased the value of points. Hoarding them is a foolish approach and will result in a poor return on the investment made.

As for the suggestion to just redeem before they are devalued, that can work if there is sufficient notice. But such notice is not always provided. And that still only works if you can actually make a trip at that time and find the seats/rooms and get away. I’d much rather keep my balances low, constantly redeeming when I have enough for the next trip without stressing over whether my “investment” is going to tank at any point in time. I get the best value possible without worrying about the minimal fungibility points present.

Interesting take, but not really accurate in a theoretical or practical sense.

Also, your use of real vs nominal (5k vs 25k AAdvantage miles) isn’t correct. You’re describing a nominal change there in value. The “real” change involves comparing what the 5k RT flight cost back then in cash to the 25k RT flight in today’s dollars

You need to define the kind of value you are referring to. If I were asked to appraise an item, I would need to determine whether I was defining the market value or the investment value of the item. In this case market value would consider all the possible redemptions and define the midpoint at which 50% of redemptions would be higher and 50% lower. Investment value is more personalized and only takes into account redemptions you would consider. So I would argue that market value generally drops over time while it is possible for your investment value to increase if your knowledge or use of the points is enhanced.

I totally agree with what you wrote; however I just envision the airlines using their powers, one way or another to devalue frequent flyer miles, i.e. eliminating a 20,000 mile frequent flyer award ticket for a short haul ticket, for say Newark to Cleveland; I hope I am wrong but let’s keep our fingers crossed.

I believe the original UA and AA domestic round trip awards were 50K in first class, 35K in coach (I think the 5K award was a domestic first class upgrade). But the original awards were much more valuable for other reasons – no capacity controls (which were introduced by UA in 1988), and stopovers allowed on domestic awards.