MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Loyal reader Drew sent along an amazing targeted offer he received to continue spending on his Barclaycard AAdvantage Aviator Red Mastercard (which is what US Airways cards turned into after the US Airways/American Airlines merger.)

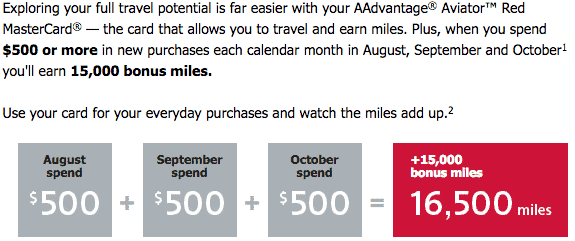

If he spends $500 per month on his card in August, September, and October, he’ll get 15,000 bonus miles!

That means for a total of $1,500 in spending, he will earn 16,500 miles, which is 11 American Airlines miles per dollar!

The email came to Drew with the subject “Earn 15,000 bonus miles with your card!” Check your email for a similar offer if you have a Barclaycard American Airlines card.

Barclaycard seems to recognize that fact that its US Airways card (now American Airlines card) is not great for ongoing spending and offers frequent promotions to encourage us to get in the habit of regular spending on the card. These offers are targeted, but it seems like everyone eventually gets targeted for one or more:

- Earn 20% bonus miles (1.2 miles per dollar) on all purchases between July 1 and August 31, 2014.

- Earn 2x-10x US Airways miles in select categories from January 1 – March 31, 2014. I was offered 5x in grocery stores, movie theaters, and utility bills.

- Drew got the same offer for his US Airways card last year.

Is This a Good Promo?

Yes, Drew should definitely take advantage of earning 15,000 bonus American Airlines miles for spending $500 per month for three months. It works out to 11 miles per dollar, which is on par with meeting the minimum spending requirements on some of the best sign up bonuses.

These aren’t just any old miles either. American Airlines miles are my favorite miles because they are great for super-cheap economy awards and ultra-luxury First Class awards.

Similar Promos on Other Barclaycards

Barclaycard also puts out similar targeted and frequent bonus offers on its other cards like the Barclaycard Arrival Plus™ World Elite MasterCard® (up to 7x on certain categories for a few months) and Premier Miles & More® World MasterCard® (15,000 bonus Lufthansa miles after spending $750 in three consecutive months.)

How Can You Get Targeted?

I asked Drew some follow up questions to see what might have triggered his targeting.

He told me that he got his US Airways card in August 2013 and didn’t really use it after his first purchase.

He was offered this promotion in 2014 right when his annual fee was due in August, and now he’s being offered it again right when his annual fee is due in August 2015. I see a pattern!

Don’t cancel your card early. Hold it until just before the annual fee is due to see if you’re targeted.

Recap

The AAdvantage Aviator Red Mastercard has a targeted offer for 15,000 bonus miles after spending $500 per month in the next three months. If you’ve been targeted, take advantage.

If you haven’t, keep checking for the frequent targeted bonus mile offers this card offers for ongoing spending.

Some credit card offers in this post have expired, but they might come back. If they do they will appear –> Click here for the top current credit card sign up bonuses.

If you don’t have the AAdvantage Aviator Red Mastercard, you can NEVER get it. It is a vestige of Barclaycard’s relationship with US Airways and the US Airways/American Airlines merger. You can, however, get the Citi® / AAdvantage® Executive World Elite™ MasterCard®, which offers 75,000 bonus American Airlines miles after spending $7,500 in the first three months.

i got this offer as well. it’s a no brainer. i will also get 10k anniversary miles… this game is too easy. 😉

i got this offer as well. it’s a no brainer. i will also get 10k anniversary miles… this game is too easy. 😉

Has anyone called and tried to get this offer and was successful. My card is up today and nothing yet. I will wait for them to bill me and then cancel the card if I do not get this opportunity. Comments.

Has anyone called and tried to get this offer and was successful. My card is up today and nothing yet. I will wait for them to bill me and then cancel the card if I do not get this opportunity. Comments.

I closed my Aviator account on July 30, just before the annual fee was due. They offered to waive the fee or change my account to a no fee card, but I declined. I wasn’t aware of the 15k renewal bonus or I would have taken that. Oh, well…

It’s not guaranteed this is a renewal bonus, but it is working out that way for Drew.

Why would you cancel if they offered to waive the fee?!?

I closed my Aviator account on July 30, just before the annual fee was due. They offered to waive the fee or change my account to a no fee card, but I declined. I wasn’t aware of the 15k renewal bonus or I would have taken that. Oh, well…

It’s not guaranteed this is a renewal bonus, but it is working out that way for Drew.

Why would you cancel if they offered to waive the fee?!?

I’ve had my card for about a year. I called them a few weeks ago to cancel when the fee became due and they waived the fee. I kept the card, but have not received this offer to date. I hardly have used the card for the last year.

I’ve had my card for about a year. I called them a few weeks ago to cancel when the fee became due and they waived the fee. I kept the card, but have not received this offer to date. I hardly have used the card for the last year.

I too have an AA Red CC and I called to ask about the 15,000 bonus. I was told there was no such bonus. I don’t know if it was a special bonus for some and not others but certainly not for me. Too bad!

Calling up won’t help. You’ll either be targeted or not. Keep an eye on your mail or email.

I too have an AA Red CC and I called to ask about the 15,000 bonus. I was told there was no such bonus. I don’t know if it was a special bonus for some and not others but certainly not for me. Too bad!

Calling up won’t help. You’ll either be targeted or not. Keep an eye on your mail or email.

Drew better check the spend… my husband and I were both targeted for this promo earlier this year and you need to spend $501 dollars not just $500 for the three months in order to qualify. It’s not clear from the flashy cover (we got it in the mail) but the fine print makes it clear.

Drew better check the spend… my husband and I were both targeted for this promo earlier this year and you need to spend $501 dollars not just $500 for the three months in order to qualify. It’s not clear from the flashy cover (we got it in the mail) but the fine print makes it clear.

What do they mean by “new” purchases? Would recurring purchases count? (i.e. gas bill, gym membership, etc?)

Yes

What do they mean by “new” purchases? Would recurring purchases count? (i.e. gas bill, gym membership, etc?)

Yes

[…] August, September, October – annual fee due in August 2013 […]

[…] August, September, October – annual fee due in August 2013 […]

I got targeted for this offer as well, in mid-November, just before my annual fee was about to post again in the December billing cycle. I definitely would have cancelled (haven’t used the card AT ALL since getting it last year just prior to disappearing altogether), but I’m hanging on to it now – at least for the next few months!

I got targeted for this offer as well, in mid-November, just before my annual fee was about to post again in the December billing cycle. I definitely would have cancelled (haven’t used the card AT ALL since getting it last year just prior to disappearing altogether), but I’m hanging on to it now – at least for the next few months!