MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The 50k mile bonus offer is back on the Lufthansa card mentioned in this post until 6/30/14. Get it now!

- Earn 20,000 award miles after your first purchases or balance transfer

- Earn an additional 30,000 award miles when you spend $5,000 in purchases within the first 90 days of account opening

- Earn 2 award miles per $1 on ticket purchases directly from Miles & More integrated airline partners and 1 mile per $1 on all other purchases

- Cardholders receive a companion ticket after first use of the account and annually after each account anniversary

- No Foreign transaction fees on purchases made outside the U.S.

- Redeem miles for flight awards and upgrades on Lufthansa, Austrian Airlines, Brussels Airlines, SWISS, Star Alliance member airlines and on other partners

- $79 Annual Fee. Please see Terms and Conditions for complete details

Application Link: The Lufthansa Premier Miles & More World MasterCard

———————————————————————————-

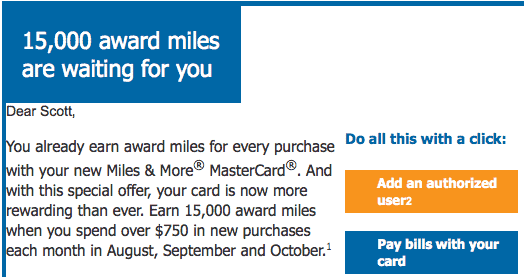

Two days ago, I got an awesome offer by email:

If I spend $750 per month during August, September, and October on my Lufthansa Premier Miles & More MasterCard, I’ll get 15,000 bonus Lufthansa Miles & More Miles.

What’s my analysis of the offer? Is it good enough that you should get the Lufthansa card? What were my spending habits on the card that generated the offer?

When I first skimmed the email, I thought I was being offered the promotion on my US Airways Premier World MasterCard because I’ve been offered the same promotion before on my US Airways card and seen dozens of reports of people being offered the same.

But this was very much for the Lufthansa card I opened two months ago when there was a 50k mile sign up bonus after spending $5k in the first three months.

On July 18, I made the purchase that put my spending over $5k on the card. But my next statement won’t close until August 17, so I haven’t actually received my entire sign up bonus.

From this one data point, it’s hard to draw a conclusion about what spending patterns you could follow to be offered this promotion. Perhaps meeting the minimum spending requirement is a prerequisite while perhaps most or all cardholders will be offered the promotion after having the card for two months. Please let me know in the comments whether you’ve gotten the same offer, and if so, what your spending pattern on the card has been.

Promo Analysis

The promotion is awesome, and the timing is convenient for me. If I spend $750 per month for three months, I’ll spend $2,250 on the card and receive 17,250 Lufthansa miles (2,250 for the spending + 15,000 bonus).

That works out to 7.67 miles per dollar on all purchases. 7.67 miles per dollar is higher than any category bonuses I am aware of, but it is less than the return from meeting the minimum spending requirement on most rewards cards. For instance, I earned 11 miles per dollar clearing the sign up bonus on this card. (55,000 miles after spending $5k.)

The timing is especially convenient for me because I don’t plan to open any new cards until October anyway. Instead of spending on 1x, 2x, or even 5x cards in the interim, I’ll enjoy 7.67 miles per dollar on at least part of my spending.

I think if you get this offer by email, it would be a huge mistake to miss out on fulfilling the conditions. If your current credit card spending doesn’t permit you to put an extra $750 of expenses on your Lufthansa card each month, consider these methods of putting more of your expenses on credit cards.

What Can You Do with 17,250 Miles

Here were the Six Best Uses and (Two Bad Ones) for Lufthansa Miles. These miles can go toward those uses.

One that I’ll particularly flag is that Lufthansa charges only 17,000 miles one way for the best cabin on United two-cabin domestic flights. That means you can fly from New York-JFK to Los Angeles or San Francisco one way on a flat bed on United’s p.s. service by participating in this promotion. I think that’s an incredible deal.

Should You Get the Current 20k Lufthansa Card Offer to Get the Later 15k Offer? Offer is Now 50k Again!

The 50k mile bonus offer is back on the Lufthansa card mentioned in this post until 6/30/14. Get it now!

- Earn 20,000 award miles after your first purchases or balance transfer

- Earn an additional 30,000 award miles when you spend $5,000 in purchases within the first 90 days of account opening

- Earn 2 award miles per $1 on ticket purchases directly from Miles & More integrated airline partners and 1 mile per $1 on all other purchases

- Cardholders receive a companion ticket after first use of the account and annually after each account anniversary

- No Foreign transaction fees on purchases made outside the U.S.

- Redeem miles for flight awards and upgrades on Lufthansa, Austrian Airlines, Brussels Airlines, SWISS, Star Alliance member airlines and on other partners

- $79 Annual Fee. Please see Terms and Conditions for complete details

Application Link: The Lufthansa Premier Miles & More World MasterCard

———————————————————————————-

Recap

Check your email for the 15k bonus Lufthansa miles offer I got. If I spend $750 in August, September, and October, I’ll get 15k bonus miles, which I value at at least $275. For me, this promo is a great deal. Are you going to participate?

Here were the terms and conditions of the email:

I got this same offer, but for the US Airways card. 15k points for 750 spend for aug/sep/oct

Very interesting! I haven’t received this offer and neither has my wife. My card met the min spend and all the bonus points posted and the other hasn’t yet met the min spend. Would be very interested in learning how I might be able to encourage this offer to come my way because I’d rather than burn SPG points topping off my Lufthansa accounts.

I just met the minimum spend today on my card, and it’s a month old yesterday. I got in on the 50k offer too. I’d love this because me and the fiancée will use it for Hawaii one way first class then my united for one way first class back for honeymoon. I’d love to experience the lie-flat for that 9-10 hour flight from Newark/Dulles. Maybe I’ll call and say I’m about to spend 1k each month and it’ll be an incentive to use that card 😉

I too met my MS just a about a week ago but have not received the offer. Eyes are peeled hoping it for it in the mail. I’m assuming it arrived “snail mail” not “email” correct?

Arrived via email.

Wow, this is the first report I’ve seen of this offer for the Lufthansa card. I just got the offer on my 2nd USAir card yesterday. I had always assumed it was a US promotion, but now it looks like it’s a Barclays promo.

I didn’t receive the offer. Any luck with calling?

Just got off the phone with them. They said that since I’m near the timeframe similar to “my friend” that received the offer and meeting the spend limit today that I should see it myself sometime soon. Sounded like she was talking to a supervisor in the background about it and his response was meet the spend and might show up. Can’t be under two promotions at the same time the lady informed me, which is odd since MileValue isn’t out of his current one it sounds.

Well I did meet the minimum spending requirement a week before getting this promo, but those miles haven’t posted.

I applied for the Miles&More card June 17th, and have not met spend yet. No offer present.

FWIW, I’ve held the US Airways card for a long, long time and never been offered their promo. Possibly it is because I made a mistake of manufacturing 1000 in spend on it a month before a bunch of people received targeted emails.

I emailed Barclays Cust Support via their website. No luck. Here was their reply:

“Your Miles and More World Elite account does not qualify for this offer at this time.”

this is a little OT, but I already have 2 US Air MasterCards from Barclays… has anyone ever held 3 at a time? I wonder if i apply for a third if I get shot down.

Thank you.

[…] since getting the card, I was offered another 15,000 bonus miles for spending $2,250 on the card, so my Lufthansa miles total is set to go over 72,000 miles from this card and its various bonuses […]

[…] met the minimum spending requirement on the card and almost immediately was offered 15k Bonus Lufthansa Miles for Spending $750 per month for three months. I just completed that, so I’ll soon have 73,000 miles in my Lufthansa account from $8,000 in […]

[…] card after calling reconsideration. After meeting the minimum spending requirement, I was offered 15k bonus miles for another easy spending challenge. I haven’t spent the 72,000 miles sitting in my account yet, but I’ve priced out dozens […]

[…] seen the standard 20k miles bonus jump to 50k only twice this year. Last time I got it–and was then targeted for another 15k bonus–and the current offer ends December 15, 2013 if not […]

[…] 15k Bonus Lufthansa Miles for Spending $750 Per Month for Three Straight Months […]

[…] many of us also were offered 15k Bonus Lufthansa Miles for Spending $750 Per Month for Three Straight Months on the […]

[…] Barclaycard also puts out similar targeted and frequent bonus offers on its other cards like the Barclaycard Arrival Plus™ World Elite MasterCard® (up to 7x on certain categories for a few months) and Premier Miles & More® World MasterCard® (15,000 bonus Lufthansa miles after spending $750 in three consecutive months.) […]