MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

My last trip was February 2020. My wife and I returned home from an awesome week-long stay at Scrub Island Resort in the British Virgin Islands not knowing that it would be our last trip for a long time. We had tons of trips all over the world planned for 2020 that we would slowly begin cancelling one-by-one: 3 weeks in South Africa, a trip to Chile and Argentina, a few trips to Europe, and tons of domestic trips as well.

Like many of you, we’ve been pretty cooped up for the last year or so. We’re eager to return to travel, but patiently waiting and waiting for things to become safer to do so. And while we aren’t there yet, there are certainly reasons to feel positive about travel returning in the not too distant future.

So when I saw the headline on December 8th that Hawaiian Airlines was adding four new routes in 2021, my curiosity immediately arose. My wife and I had casually been talking about making a return trip to Hawaii once it felt safe to do so.

And while we don’t know what the next few months between now and our travel dates will bring with the state of things, with airline and hotel cancellation policies being as flexible as they currently are, there is very little risk to us booking.

Here’s how we made it happen.

Points and Miles Breakdown

TL;DR: we used a bunch of points and miles to book our first trip in awhile. Here’s the full breakdown.

Finding Award Space

Living on the East Coast, the news that Hawaiian was adding additional service to Long Beach (LGB), or new service to Ontario (ONT) didn’t really help me.

New non-stop service to Austin (AUS)? Hmm, that could be interesting.

New non-stop service to Orlando (MCO)? Jackpot.

Knowing that a brand new route that was now available for immediate booking meant a ton of award availability, I immediately began searching to see how I could book our first post-COVID trip by putting together a trip to Hawaii.

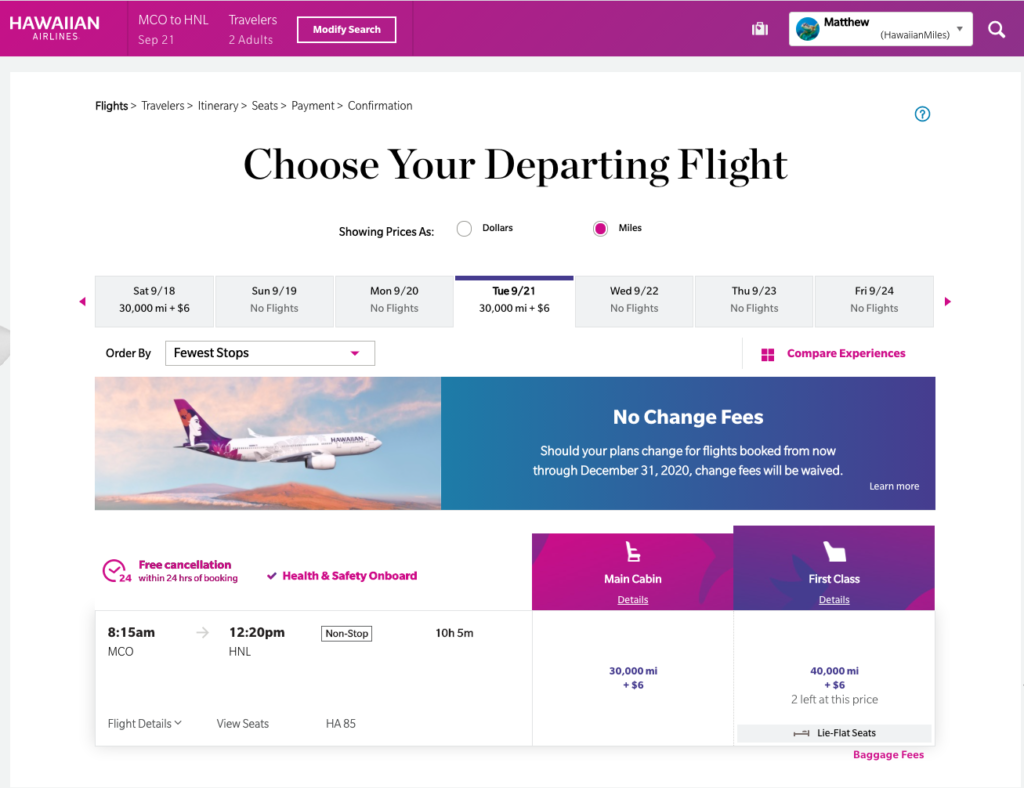

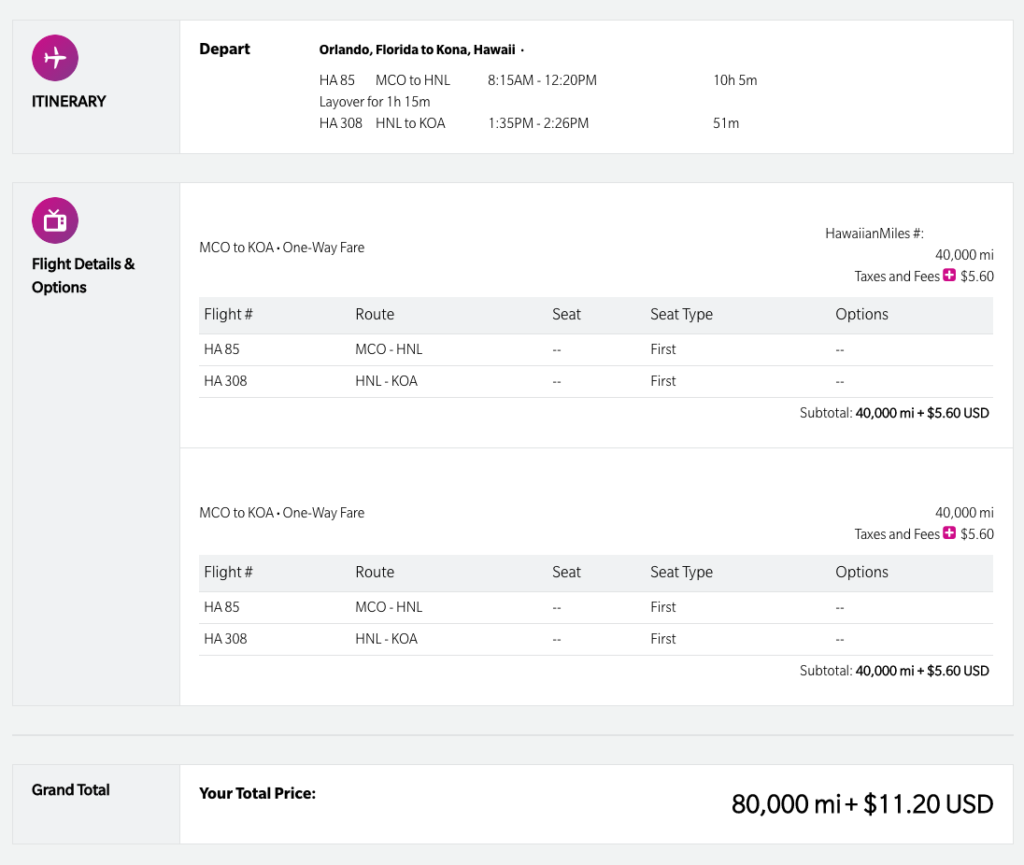

And as luck would have it, I found a number of days throughout May, June, July, August, September and more with multiple first-class seats priced at the saver rate of just 40,000 Hawaiian Miles one-way per person.

I’ve looked at booking Hawaiian Airlines before and finding first-class seats for 40,000 miles historically has felt like finding a needle in a haystack. To see multiple dates with multiple first class saver seats available was a great find since Hawaiian prices their first class at 40,000 for saver, or 130,000 miles for standard pricing. That’s an enormous difference, and in almost all cases, not worth it unless you can book at saver pricing.

I found it even more ironic that these first class seats were priced at only 10,000 more HawaiianMiles than they were charging for economy flights on this 10+ hour flight.

Transferring Membership Rewards

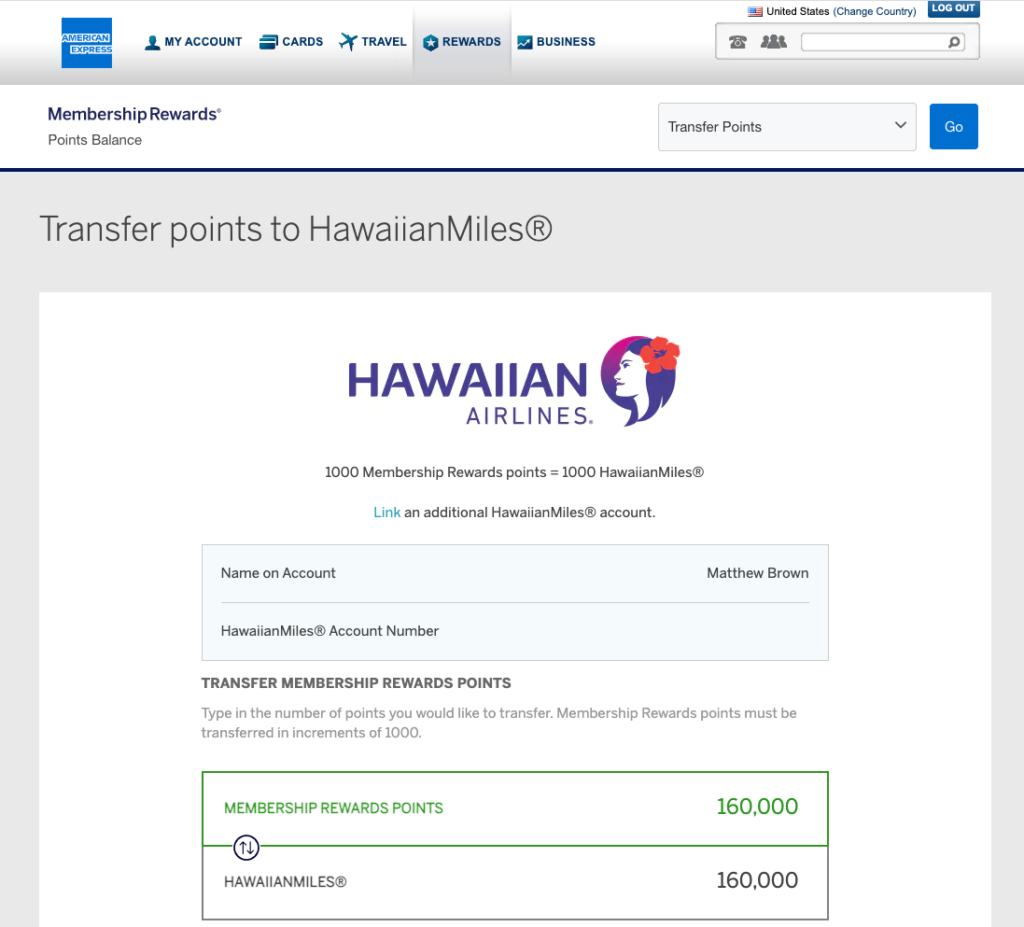

I’ve never earned a Hawaiian Mile in my life. But having a healthy stash of American Express Membership Rewards, of which HawaiianMiles is a transfer partner, means that isn’t a problem.

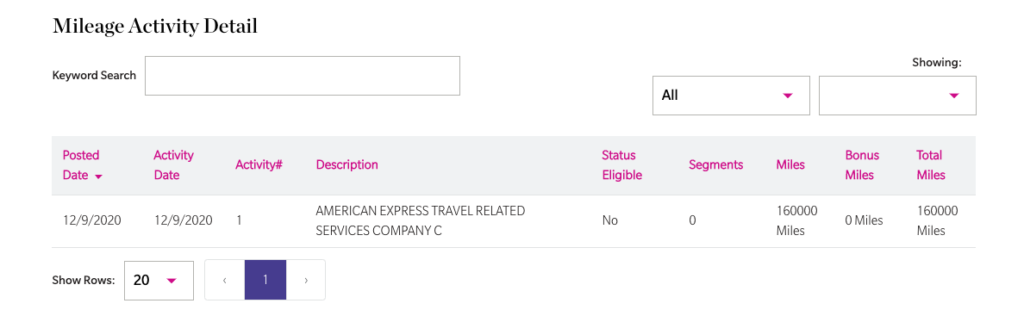

Membership Rewards points transfer 1:1 to HawaiianMiles, so after again confirming the availability for round-trip tickets for 2 at saver pricing before making any moves, I then transferred 160,000 Membership Rewards to my HawaiianMiles account.

The points transferred instantly. As soon as the Amex site showed a successful confirmation of the transfer, I simply logged out of my HawaiianMiles account and logged back in and the points were there.

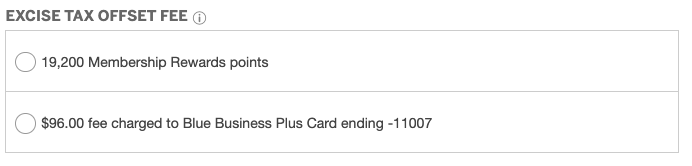

One thing I was excited to find – I wasn’t charged an Excise Tax Offset Fee for transferring the Membership Rewards points. Normally, this fee is charged anytime you transfer Membership Rewards points to a U.S.-based airline’s frequent flyer program, such as Delta, Hawaiian or JetBlue.

But I then remembered that American Express previously announced that they were waiving all excise tax offset fees through December 31, 2020. They cited COVID-19 and the CARES Act being passed as the reason for doing this.

With the excise tax offset fee normally costing 0.06 cents per point ($6 per 10,000 points transferred) with a maximum of $99 for a single transfer, this alone saved me $96. Boom.

American Express® Gold Card

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Booking

After transferring 160,000 Membership Rewards to HawaiianMiles, I quickly booked the flights that I had previously found the space for.

Our routing for the trip is:

- RDU-MCO (positioning flight – booking separately)

- MCO-HNL-KON

- KON-LIH (inter-island flight – booking separately)

- LIH-HNL-MCO

- MCO-RDU (positioning flight – booking separately)

The Product

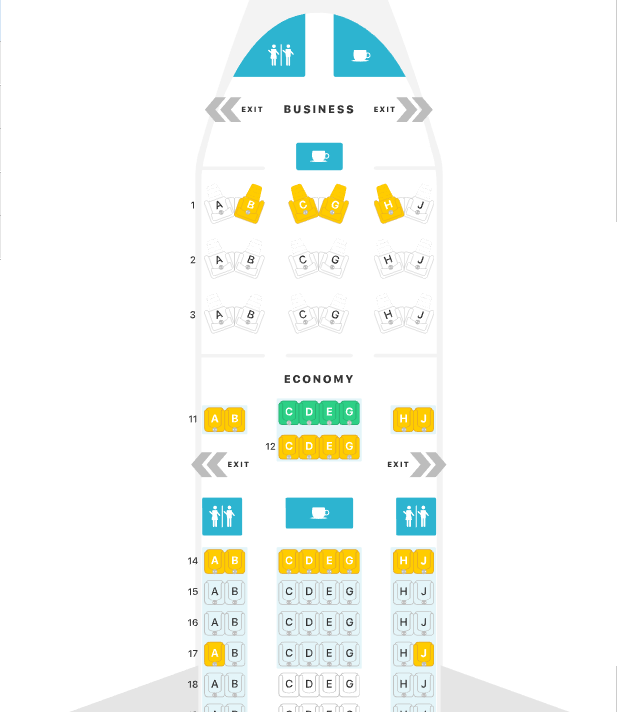

Admittedly, Hawaiian Airlines doesn’t have the best hard product in domestic first class on their Airbus A330-200’s. Their first class cabin consists of 18 first-class seats arranged in a 2-2-2 configuration.

I’ve flown Hawaiian Airlines inter-island before on their Boeing 717s before from Honolulu to Kona, but never on any of their A330s that they use for a lot of their flights from the mainland to the Hawaiian Islands.

From reading other reviews, the hard product shouldn’t knock my socks off. Yes, they have lay-flat seats which are excellent for a 10+ hour flight. However, they don’t seem to have a ton of privacy. But, they sure knock the socks of most of the other domestic first class options to Hawaii, so I’ll stop complaining.

The lack of Wi-Fi on a 10+ hour flight in 2021 is mind-blowing to me. While I’ll enjoy the disconnect, it would be nice to have the ability to have some amount of connection and check in on the world as we embark on a long-needed vacation.

I’m really excited for the soft product though. Everything I’ve read has indicated that Hawaiian’s First Class service is spectacular, and that the crew makes you feel like you’re in Hawaii as soon as you step on the plane.

Positioning to Orlando

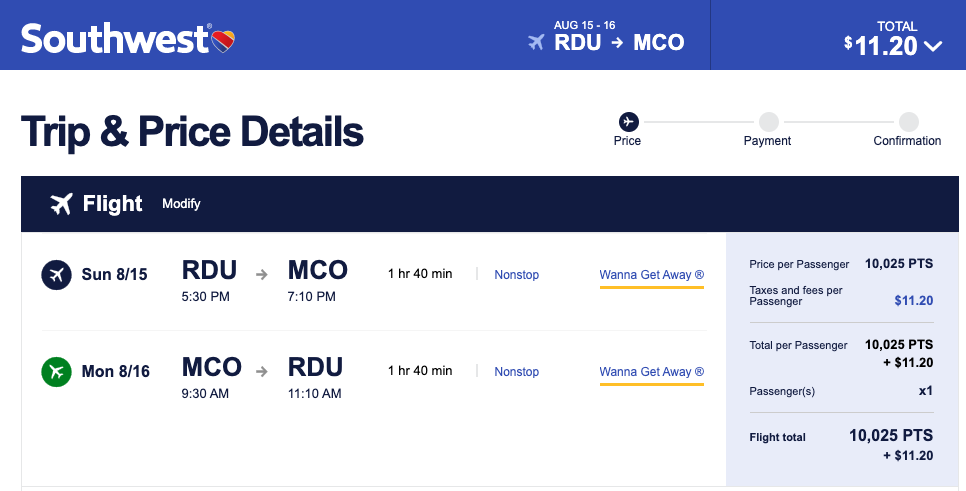

We have to position ourselves to Orlando in order to start and end our trip. In the grand scheme of things, this is super easy from where I live in North Carolina. We can fly a number of airlines from both Charlotte and Raleigh nonstop.

Since we have a Southwest Companion Pass, we will likely use that to book one of the nonstop Raleigh to Orlando flights that are blocked at 1:40.

The Southwest schedule isn’t open for booking during our travel dates just yet, but some of the nonstop flights a few weeks before during the dates open for booking are priced at just over 10,000 Rapid Rewards points round-trip, making for an excellent deal.

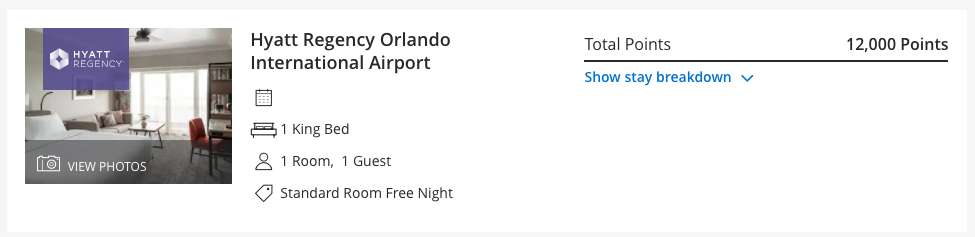

We’ll likely arrive the evening before our departure, and overnight at the Hyatt Regency that’s located in the airport. This way if we’re delayed or anything, we still have a great chance of making it to Orlando in time for our departure the next morning.

The World of Hyatt Credit Card

Earn 2 Free Nights

after you spend $4,000 on purchases in the first 3 months from account opening. Plus, earn 25,000 Bonus Points after you spend $12,000 on purchases in the first 6 months from account opening.

Cash rates are about $200 per night, or 12,000 Hyatt points. I’ll likely use one of my Category 1-4 free night certificates that comes with The World of Hyatt Credit Card, which translates into over $200 of value for a card with a $95 annual fee. I wish I could get a 2:1 return on investment in many more areas of life like I regularly can with hotel cards.

Where We’re Staying

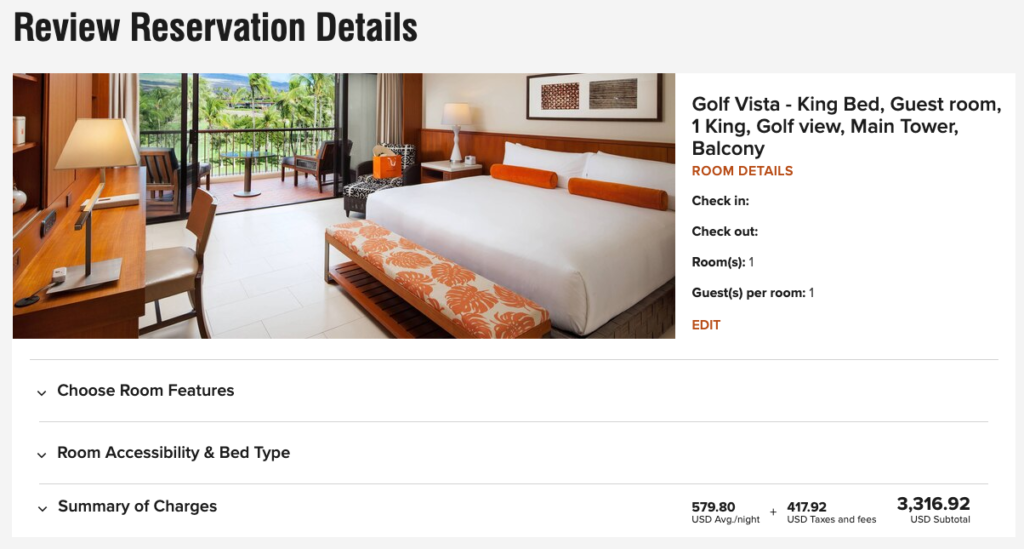

I’m looking forward to returning to Mauna Kea Beach Resort, an Autograph Collection hotel on the Big Island’s golden Kohala Coast. My wife and I stayed here for a week in 2019 as my last SPG points redemption using a Marriott Hotel + Air Package. At the time, it was a Category 6 hotel, requiring 50,000 Marriott points per night.

Now, Mauna Kea is a Category 7 Marriott, meaning the standard award rate is 60,000 Marriott points per night.

However, due to COVID-19, a majority of the 2021 award calendar at Mauna Kea has been pricing at 50,000 Marriott points per night, off-peak pricing, at the time when I booked.

This meant it was a perfect use of the five free night certificates worth up to 50,000 points each that I earned in October by opening the Marriott Bonvoy Boundless® Credit Card.

Cash rates end up running ~$663 per night during our travel dates, making this an outstanding redemption of the free night certificates that I earned as a welcome bonus. To be able to redeem a welcome bonus for ~$3,317 when the minimum spend was only $5,000 is fascinating to me!

Whether it was just a snafu, or Mauna Kea expects travel demand to pick up with a vaccine on the horizon, I’m now seeing less off-peak award pricing dates in the second half of 2021 at Mauna Kea. But some dates do price at 50,000 points per night later this spring.

So if you have five free night certificates from the Bonvoy Boundless welcome bonus, see if you can find some dates that work for you for redeeming them at Mauna Kea.

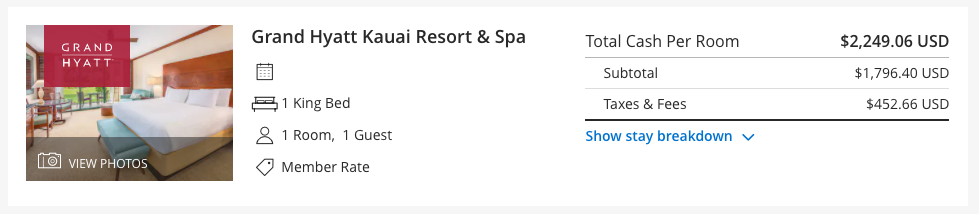

After our five nights at Mauna Kea, we’re heading over to Kauai for four nights at the Grand Hyatt Kauai Resort & Spa. I was able to have a Globalist friend book my stay using Hyatt’s Guest of Honor, which means I’ll be eligible for all Globalist perks and benefits during my stay.

This hopefully will translate into most, if not all, of the following benefits:

- Unlimited Room and Suite Upgrades when available

- Four Confirmed Suite Upgrades per year

- Club Lounge Access

- Waived Resort Fees

- Waived Parking Fees on Free Night Awards

- Guaranteed Late Checkout (up to 4pm)

Grand Hyatt Kauai is a Category 6 Hyatt property, meaning our stay will run 25,000 World of Hyatt points per night, or 100,000 for our four night stay.

Cash rates during our travel dates are about $563 per night, translating into an excellent points redemption.

Inter-Island Flight

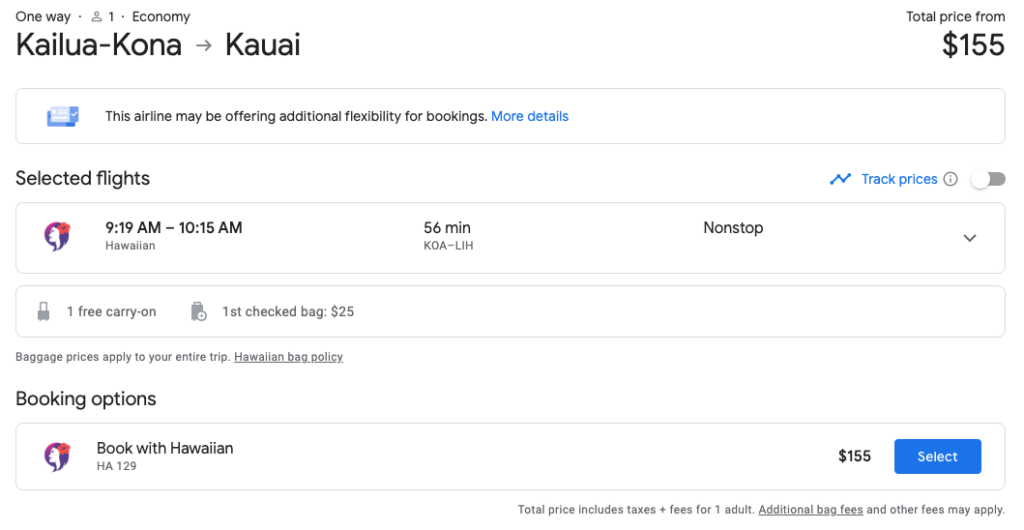

We have one inter-island flight to book from the Big Island to Kauai. Hawaiian offers only one 56 minute non-stop flight from Kona to Lihue, so we’ll book that to avoid having to travel for an additional hour along with a connection in Honolulu. 2+ hours of travel between Hawaiian islands just doesn’t seem like a fun way to spend vacation if you can avoid it.

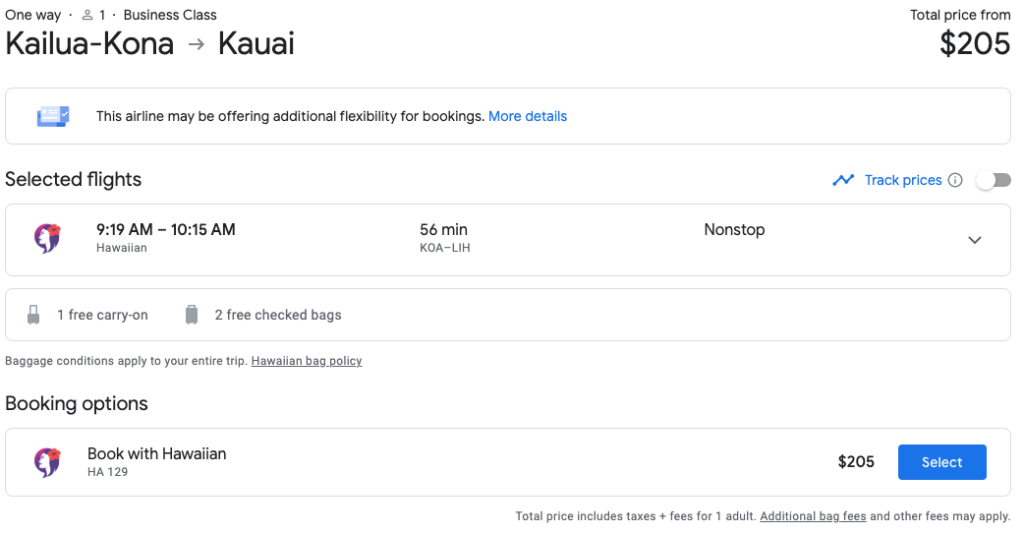

We’ll likely “splurge” to take this flight in first class as well. Even though it’s just a Boeing 717, it does have a bigger front seat and a little bit more legroom, which is always appreciated.

The biggest reason for booking first class is that it includes two free checked bags per person, whereas economy includes no checked bags per person, and each bag will cost $25 to check. For nine days, we’ll likely each check a bag just out of convenience even though we could do just fine in a carry-on, so we have to factor this in. I’ll likely even bring my golf clubs, which would be a 2nd checked bag for me.

Economy flights are running $155 per person.

First class flights are running $205 per person.

Subtract the $25 per person for our checked bags (and another $25 for my golf clubs), and it nets out to only a $25 difference per person (or the same for me when calculating my golf clubs) for first class over economy.

We’ll likely book this in the Chase Travel Portal using our Chase Sapphire Reserve®, which redeems at a rate of 1.5 cents per point, meaning this flight will run 13,667 Ultimate Rewards Points per person.

It’s not the snazziest of redemptions, but we’re doing pretty well on all of our other redemptions on this trip, so I don’t mind a potentially underwhelming redemption.

We could’ve done much better redeeming on Southwest for this inter-island flight with our Companion Pass, but it includes long layover options in Honolulu, which were worth the points savings for us.

Bottom Line

After being home for almost a year at this point, the prospect of having a trip booked is very exciting to me, even though it’s still months away and a lot has to get better in the world between now and the dates of travel.

With that in mind, I’m cautiously optimistic still about being able to travel in late summer/early fall for this trip to Hawaii. I do feel much better about it at this point than I did months ago.

Being able to get some really good redemptions including round-trip saver domestic first class rates on Hawaiian Airlines, redeeming my five free night certificates at Mauna Kea Beach Hotel, and exploring Kauai for the first time is really exciting.

My wife and I were eager to get back to Hawaii, and these great redemptions somewhat fell into our lap. This goes to show how having a stockpile of flexible rewards currencies is so important because things like this can come up, and you’ll be armed and ready to book without thinking twice.

Have you been to Hawaii? If so, how did you book it? Have you flown Hawaiian Airlines, or stayed at Mauna Kea or the Grand Hyatt Kauai? Sound off in the comments below.

Nice Trip !!! Been there 8x in 4 years .Look @ a condo rental for a month ($2k, 4*) then trip from there. I Never stayed more than 3 weeks so never looked. I’ll be living in Waikiki like 5/2022 a great Deal .

Thanks! Yeah looking forward to getting out of town for the first time in awhile!

Even though you did not go, I would like to hear more about the trip you planned to Chile and Argentina. I have never been, and I would like to take my family (kids are in high school).

We had a loose itinerary planned for both Chile and Argentina, exploring Buenos Aires, Chilean Patagonia, Mendoza, and down to Ushuaia as well. Hopefully we can try it again in a few years!

You missed out on Alaska airlines BOGO to Hawaii!! We got a ticket for 325 out of our small small small airport for 325 each to head out in May. Moscow pullman WA/ID to seattle, seattle to Kauai RT

It’d be about 13-14 hours in economy from where I live in NC. So while that’s an awesome deal for eastern WA/western ID, I know how pretentious it sounds, but it’s way too far and too long for me to fly in economy. 😉

I grabbed that BOGO as well. $250RT from Eugene to Kona; a steal.

Ur trip is all how u plan it like 2 years ago . Perfect cheap seats 52 hrs of flying over a month $200 total. HNL, AUS 2 stops, New Zealand 1 . My longest flt 12 hrs and every lounge there was Free for a short stop. I lost 20ibs for the Trip.

Thank u Scott Grimmer my Hero.

Cheers

great times! but the catch is this: you said you got 5 free night certificates at 50k each worth that you used ? I looked at this card now and it only gives 1 free night certificate per year, so either the card has changed its generous policy or ??!!

I noticed in order to use all 4 nights with redemption points to be able to get a 5th night free, that you have to either wait for the 100k offer of points that is not currently available or you have to go down tier and use 4 nights at 20k/night category stays which amounts to zero fun.

Sure thing Drew. Back in October, for a month or so, The Marriott Bonvoy Boundless card had a different signup bonus that award 5 free night certificates worth up to 50,000 points each. It was certainly a great promo if you could match it up with an awesome redemption. Read more about it here – https://milevalue.com/5-free-nights-bonvoy-boundless/.

You can’t use free night certificates and get the 5th night free with Marriott unfortunately. You can use 5 free night certificates and get 5 nights, or 4 nights of points and get the 5th night free.

While I understand this blog is all about points, I think many of us would agree that it makes sense to just pay for trips sometimes. In our case, we are also going to Hawaii and at $250RT to Kona from Eugene, there’s no way I would have used points at roughly only 1 cent each. We also booked on AirBnb. Why? Because under their rules, one can cancel as late as 48 hours before arrival and get a full refund. VRBO has no such rules and in some cases cancellation for a full refund isn’t even possible at any date. We prefer AirBnb to hotels, though of course use the occasional free night during layovers

For sure – with as many low cash fares as there are right now, paying cash and saving your points for future use can definitely be a smart move. Or using something like the Chase Travel Portal to redeem points at a fixed rate for the low cash fares if you’d rather not spend cash.

Awesome that so many folks are able to take advantage of the recent fares that Alaska has been offering. I agree not using points is a great call.

I hope you are able to make and enjoy your trip. Somehow 80k Amex points for RT business class to Hawaii pp seems a bit much to spend, considering that you can do it for 25k Citi TYP via Turkish (and flying United). Admittedly, availability for 2 will be tough to find.

Thanks! It’s definitely not the cheapest points wise we could make it RT in biz. But as you likely know, saver space for 2 up front is just about impossible to find. I’ve searched United off and on for 2-3 months and found exactly 1 date with outbound saver space and 0 date with in-bound (lie-flat, not angle).

Plus, I’ve been home for basically a year now earning points like crazy without anything to spend them on. So even if it feels like overpaying, in this circumstance I’m more than happy to do it!

Does not Kauai require mandatory 10 day quarantine no matter test results? Thanks

They do have restrictions currently, but our travel dates aren’t until late Summer/Fall so they’re likely subject to change by then.

Watch Ch 4 Hawaii 0830CST tells u the latest news. The more I look I think Greece is a dream for 9/1 maybe I’ll do Waikiki and do recon on the condo’s there.

So many points and no place to use them .

Just booked Hawaii by Singapore AL $11 rt for a month BUT no seat selection Hmmm.

Nice! Enjoy your trip!

Matt

Let’s hope we both make it. I have like 10 buddies who say no way, but they all don’t do award travel. I booked multiple air fits 9/1 hoping to get one that will be doable. Once it’s all open the costs will go super high.

I canceled the last 4 for free, and I have only 2 years on my Singapore points.

Send me ur email I got a deal for U.

CHEERs

Absolutely. I think it will be even better than it is now. Still likely will require testing, but more of a sense of normalcy, whatever that is.

Sure thing – matt(at)milevalue.com.

Thanks!