MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Update 7/28/16: The Prestige’s offer has been improved to 40,000 bonus points after $4,000 in purchases in the first 3 months. Many of the other great benefits remain.

Application Link: Citi Prestige® Card

Full article on improved offer: New Prestige Offer: Citi Prestige 40,000 ThankYou Points, $250 Airfare Credit, Worldwide Lounge Access

—————————————————————

The Citi Prestige® Card comes with 30,000 bonus ThankYou Points after $2,000 in purchases made with your card in the first 3 months the account is open, $250 in airfare or airline fee credits per calendar year, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual fee.

It’s clearly an intriguing card that requires a lot of analysis because of its unique perks and high annual fee. I’ll tackle the benefits and drawbacks one by one, so you can see whether the Citi Prestige® Card makes sense for you.

- Sign Up Bonus: 30,000 ThankYou Points after $2,000 in spending

- Category Bonuses: 3x on air travel and hotels, 2x on restaurants and entertainment

- Air travel fee credit: $250 annual credit ($500 first year of cardmembership)

- Lounge access: Admirals Clubs lounges and Priority Pass lounges worldwide

- Free hotel nights: Get your 4th night free on all paid hotel stays (no blackout dates)

- Global Entry: $100 application fee credit

- Global Acceptance: Chip technology and no foreign transaction fees

- Annual Fee: $450 not waived, well worth it for some

Sign Up Bonus

The headline sign up bonus is 30,000 ThankYou Points after spending $2,000 in the first three months on the card. That’s solid, but it is frankly not the selling point of this card, which is more about the benefits of cardmembership.

Those 30,000 points are worth over $500 to me because I am very high on ThankYou Points, which transfer to 12 airlines and Hilton.

I recently transferred ThankYou Points to Singapore Airlines miles to fly from Colombia to Argentina in Business Class for half the price it would have been with United miles. Singapore miles are also the only way to fly Singapore Suites, cheaper than United miles to book United flights to Hawaii, and offer an amazing deal to Central and South America.

I also love Air France Flying Blue as a transfer partner because of its cheap awards to Europe, Israel, Hawaii and South America.

Beyond transferring ThankYou Points, you can also redeem them directly for cash flights at a fixed rate. When you do this, the airline sees your ticket as a cash ticket, so you earn miles on the flights.

ThankYou Points are redeemable for 1.6 cents each toward American Airlines or US Airways tickets, and 1.33 cents each toward tickets on any other airline.

Category Bonuses

- Earn 3x points on Air Travel and Hotels

- Earn 2x points on Dining at Restaurants and Entertainment

Notice that these are similar to the Citi ThankYou® Premier Card. My review of ThankYou Premier.

This card very clearly offers the biggest benefits to frequent travelers, since a number of its benefits like free hotel nights and lounge access will be most used by travelers. The category bonuses are no exception. If you buy a lot of airline tickets and hotel stays, and if you dine out while traveling, you will rack up a ton of extra points from these category bonuses.

Note that the 3x points on Air Travel and Hotels is worth at least 4.8% back toward travel on American Airlines and US Airways, since points are worth 1.6 cents each toward those flights. That’s an incredible return.

Air Travel Credit

Every calendar year, you get a $250 air travel credit to offset airline fees. “Airline Fees are defined as purchases made with airlines including Air fares, baggage fees, lounge access and some in-flight purchases.” (Emphasis mine.)

That means that you can buy airline tickets with this card, and the first $250 will be reimbursed each calendar year. Since I’m sure everyone reading this blog spends at least $250 on airfare each year, this is like straight cash to me and would greatly reduce the sting of the annual fee.

In fact, depending on when you get this card, this credit could be more valuable than the annual fee for your first 12 months with the card. This benefit is a calendar year benefit.

“Pending transactions that do not post in your December billing cycle will count towards the next year’s Air Travel Credit.”

If you get the card such that your first 12 statements post in 2015 and 2016, you should be able to use this benefit twice before paying the annual fee for a second time. In that case, you can get $500 in airline fee statement credits for your $450 annual fee. Even without considering the sign up bonus and other benefits, the card would already be a great deal.

Lounge Access

Having the Citi Prestige® Card gets you into any Admirals Club worldwide whenever you’re flying an American Airlines, American Eagle, or American Connection flight. In addition, you can bring in your family (spouse, domestic partner, children under 18) or up to two guests for free.

Citi Prestige® Card holders can also get a free Priority Pass Select membership. Priority Pass is the world’s largest independent airport lounge access program. Prestige Card holders get free Priority Pass Select membership, which entitles them to free access to hundreds of lounges worldwide (everything on the list except United Clubs).

I downloaded the app on my phone, so I can search for participating lounges by airport while I travel. I seem to find one or more options at most international airports and tons of domestic airports.

Just like into Admirals Clubs, you can bring in your family (spouse, domestic partner, children under 18) or up to two guests for free.

Lounge access costs about $50 per visit, but I value it at about $20 per visit. Heavy users of this benefit will quickly forget about the annual fee.

4th Night Free on Hotel Stays

From the terms and conditions of the benefits of the Prestige Card:

————————————————————————————————————————-

You will enjoy a complimentary fourth night with no black-out dates, when you book four consecutive nights at any hotel booked by a personal travel advisor designated by MasterCard (the “designated travel advisor” is Carlson Wagonlit Travel). Bookings made through other methods such as, travel agents, websites or directly with a hotel will not qualify.

To receive your complimentary night (via a statement credit) you must:

- Make a reservation for a minimum, consecutive four-night stay by contacting the Citi Prestige Concierge, to book directly with a designated travel advisor

- Fully pay for your stay with a Citi Prestige Card

Receive one complimentary night (room rate for the fourth night and applicable taxes only) for any consecutive four-night hotel stay booked directly with a MasterCard designated travel advisor. Hotel imposed fees and incidental guest charges are the Cardmember’s responsibility. The value of the complimentary night will be the actual rate, as provided by the designated travel advisor, on that fourth night of the reservation, even if the rate is different from the rate on other nights. Cardmember will be charged the total cost of the stay at checkout and will receive a credit to the credit card statement for the cost of the fourth night (and the applicable taxes). If the cardmember books a special “pre-paid” rate this may require upfront payment in full, at time of booking. Payment in full is defined as pre-payment for the total of all four consecutive nights. Only one complimentary night is eligible per room reservation. Rates provided will be equal to or lower than the lowest publicly-available fare at the hotel’s official website. The benefit can only be used by each primary account Cardholder. This benefit is available to all Citi Prestige Cardmembers worldwide.

For any Program related questions contact Citi Prestige customer service at 1-877-288-CITI.

————————————————————————————————————————-

If you book a lot of paid hotel nights, and the price being offered by Carlson Wagonlit is the same as you can get elsewhere, this will save you a lot of money. Using this benefit means foregoing booking the hotel through the hotel itself and earning andy bonus points and status for that.

I book zero four-night paid hotel stays per year, so this benefit is not for me, but it will be useful for many.

Global Entry Fee Credit

Prestige card holders are entitled to a $100 statement credit when they pay the $100 Global Entry enrollment fee with their Prestige cards.

Having Global Entry allows you to skip the immigrations and customs queues when arriving in the United States. Instead of spending time in line and talking to an agent, you tap a few buttons at a kiosk and get to the curb in a few minutes. Global Entry membership is valid for 5 years, and having Global Entry also lets you skip immigration queues in Australia and New Zealand.

There are two steps involved in obtaining Global entry: an application and an interview.

First, you need to fill out the online application. To do this as efficiently as possible, make sure you have on hand: Proof of Citizenship documents (I just used my passport); your driver’s license, if you have one; and both your address and work histories for the past five years. The online application process took me about 30 minutes to complete.

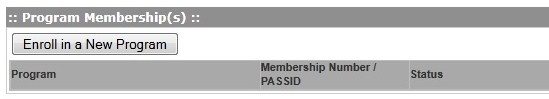

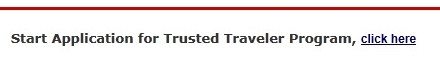

If you have never registered with GOES (the Global Online Entry System), you will be prompted to register when you click the online application link above.

Once you are registered with GOES, log in to the system. You will see that you are not a member of any programs. Click “Enroll in a New Program” to begin your Global Entry application.

Select the link that allows you to start the application for the trusted traveler program.

From here, you will have to fill out a variety of personal information. There are 16 categories of information.

Fill out all the sections and submit your application. You will be prompted to pay the $100 application fee–make sure you use your Citi Prestige to pay this in order to have the fee credited back to you!

Once your application is approved, you can use the GOES system to schedule your in-person interview, which will take place at any airport that participates in the Global Entry program.

I would pay the $100 in a heartbeat even if I only traveled abroad once a year. When you can get it for free, it’s a no-brainer. How and Why I Got Global Entry.

Chip and No Foreign Transaction Fees

It shouldn’t surprise that a card very clearly designed for travelers comes with Chip technology for global acceptance and zero foreign transaction fees. The only surprising thing is that not all cards have these basic features.

Annual Fee

The annual fee is $450 and not waived. That should be a dealbreaker if you don’t use the benefits of the card, but it’s a fair price to pay if you are maximizing the card’s perks.

If you apply for the card at a time that allows double use of the airline fee credit before the next annual fee, you can get all of this for the cost of the first annual fee:

- 30,000 bonus ThankYou Points

- $500 worth of airline fee credits ($250 per calendar year)

- $100 credit for applying for Global Entry

- Lounge access + 2 at Admirals Clubs and Priority Club lounges

- 4th night free on hotel stays with no blackouts

Those benefits clearly dwarf the $450 annual fee. After testing out the card and seeing how much you actually use the benefits, you’ll have a better idea going forward whether to keep the card for $450 per year in return for:

- $250 worth of airline fee credits

- Lounge access + 2 at Admirals Clubs and Priority Club lounges

- 4th night free on hotel stays with no blackouts

- 3x ThankYou Points on airfare and hotels; 2x on dining and entertainment

I plan on getting this card in the next few months. I am attracted by the sign up bonus, the $250 annual airline fee credit, the ability to use ThankYou Points for 1.6 cents each toward American Airlines and US Airways flights, and lounge access.

If you have a Citi Prestige, share your experiences in the comments.

I am glad this card is finally getting recognition. The benefits were recently changed to this new program; some good benefits were lost but overall it is a solid program. I have used the fourth night free already. I used it in hawaii where there are a lot of local hotels. I got the best rate available on the hotels website and was refunded the actual price of the fourth night a month after my stay. The price of the forth night was actually higher than previous nights which also worked in my favor. This is a card I plan on keeping.

That’s great, and that is mentioned in the T&C, that you will be refunded the actual price of the 4th night including taxes, not just 1/4 of the 4 night price. Also mentioned: you only get one free night even if it’s an 8+ night stay.

Also to add to my previous comment. You do not have to register for priority pass like with Amex platinum. It is automatically sent out. At least it was during the transition. I think overall it is a better product with less restrictions than the platinum card. One new feature that is bad is the location of the swipe strip. It is on the front of the card and I have to debate with cashiers where it is so it takes a little extra time at the register. This will probably be fixed if a lot of people complain. I hope.

Thanks for the info on Priority Pass. There are always things that only cardholders know that aren’t explained well in the T&C. I won’t be a cardholder for another few months, so I didn’t know that.

Scott–I’d be curious to see a comparison on your thoughts between this and the AX platinum product.

I was giving it to my friend on my balcony last night, so it shouldn’t be too much to put my thoughts into a post.

The AmEx Plat (which I have) comes with the Priority Pass Select membership as well HOWEVER the AmEx version does not have the, “. . .you can bring in your family (spouse, domestic partner, children under 18) or up to two guests for free.” benefit you cite, so I called Priority Pass to get the details. According to the Priority Pass rep,

The guest and family benefit is exactly as Scott cited it. The Citi Prestige Card is currently the ONLY way to get it. The rep said that Priority Pass classifies this benefit as “extremely valuable” since it can’t be purchased from them at any price!

It may be time to rethink the AmEx Platinum thing.

No free bags? Crazy. I realize their target market probably gets them anyway, not sure why it wouldn’t be included. Stinks for me as i book 20-30 AA/BA award tickets a year – but have no AA status

This isn’t an AA card. There are no non-airline cards that offer free bags. The airline fee credit can cover $250 in free bags per year.

Ahh- that makes sense – i just automatically made it a citi aa prestige in my mind when i read about the admiral access (without remembering the citi exec thats already in my wallet 🙂

I also got Hilton gold status through this card. It wasn’t stated anywhere when I applied it just came a month after I received the card. Not sure if this is still a benefit of the card.

Interesting. When was that?

I first got the card in May/June of 2013 Hilton Gold Status came a bit latter. I did not ask about it or request it. Simply came in the mail. I had read on talks that it was a stated benefit in the past. I don’t know what to think of it since it wasn’t stated or requested yet came in the mail. Since they just changed the entire program it could have changed though, but I still have gold status through them not through stays .

I got the card in November and immediately booked an airline ticket with it. On the first statement, I was credited with $250 (which was immediately applied against the annual fee) and this $250 credit has already reset. I flew in December and charged luggage fees on the card and was credited these fees on the recent statement. I also used the Priority Pass Select for lounge access for me, my wife, and 2 kids. I don’t expect to see any charges even though they asked for my PP Select card and asked for me to sign in.

On the annual fee, I am Citigold member and the fee drops to $350. When netted against the airline credit, the net annual fee is really $100.

On the signup bonus, if you sign up at a branch (and not on-line), the bonuses are much better. You get 60,000 points via 30,000 points after $3,000 in purchases within the first 3 months and 30,000 points after a total of $15,000 in purchases in the first 12 months (another $12,000 on top of the $3,000 to get the first 30,000 points). This is much better than the on-line offer of 30,000 points after $2,000 in purchases within the first 3 months.

This sort of card and bonus is not exciting to me. 30K signup is not a big deal compared to the previous 100K on the Executive card. If the bonus was 50-75,000 maybe it would make sense for some. I already have Global Entry and AA club membership.

$250 per year in free flights, and you can dump however you got your AA club membership.

[…] My enthusiasm is only tempered because I wanted to earn 3x on this card on dining and entertainment and 3x on my future Citi Prestige on air travel and hotels. […]

[…] If you don’t win, don’t forget that you can use your Citi Prestige® Card for free Admirals Club lounge access for you plus two guests. My full review of the Prestige’s benefits. […]

[…] lounge access is listed for London. If you have Priority Pass access from a Citi Prestige® Card, there is an OK lounge in […]

Additional cardholders cost $50. What benefit do they get besides their name on a card?

[…] Citi Prestige® Card: 30,000 bonus ThankYou Points after $2,000 in purchases made with your card in the first 3 months the account is open. The card also comes earns 3x points on airfare and hotels and has a host of benefits like lounge access and $250 in free airfa… […]

I closed my Citibank ThankYou Preferred account and one months later applied and opened a brand new CitiPresitge account. I was approved and received the card. I spent $ 5.000 for far and asked last month why have not gotten the 30.000 bonus points since I fulfilled my spending requirement within 3 months. 3 weeks ago I was told that it needs up to 2 statement cycles to give me these bonus points. Today on 3/11/15 I was told by a rude and snappy “Bruce” that I would get “ZERO” bonus points since I had a CitiGold checking relationship at the time I opened the account. Bruce added that they “might” consider giving me perhaps 10.000 points. My accounts are all full paid, my FICO is 833 and my relationship with Citibank dates back for 12 years.

Has anybody ever heard or come across anything like this before? The rep was uneasy and did not know what to say and he blamed my existing relationship w. Citibank – that is nowhere written in the card’s terms of business.

[…] Citi Prestige® Card with 30,000 bonus points, unmatched lounge access, and 3x earning categories (My review of the Citi Prestige Card) […]

[…] Citi Prestige® Card: 50,000 bonus ThankYou Points after $3,000 in purchases made with your card in the first 3 months the account is open. The card also comes earns 3x points on airfare and hotels and has a host of benefits like lounge access and $250 in free airfa… […]

[…] Prestige® Card offers the 4th night free on hotel stays booked through its travel provider and three free rounds of golf per calendar […]

[…] If you want to earn 3x ThankYou Points per dollar, use your Citi Prestige® Card, which also gets you $250 in free flights per year. See my review of the Prestige. […]

[…] Citi Prestige® Card: 30,000 bonus ThankYou Points after $2,000 in purchases made with your card in the first 3 months the account is open. The card also comes earns 3x points on airfare and hotels and has a host of benefits like lounge access and $250 in free airfa… […]

[…] The Citi Prestige® Card has a healthy 50,000 point bonus after spending $3,000 in the first three months and offers 3x points on air travel and hotels plus 2x points on dining and entertainment. But this card is really about the perks: American Airlines and Priority Pass lounge access including guests, $250 in airfare credits each cal… […]

[…] Citi Prestige® Card: 50,000 bonus ThankYou Points after $3,000 in purchases made with your card in the first 3 months the account is open. The card also comes earns 3x points on airfare and hotels and has a host of benefits like lounge access and $250 in free airfa… […]

[…] Citi Prestige® Card with 50,000 bonus points, unmatched lounge access, and 3x on air travel and hotels (My review of the Citi Prestige Card) […]

[…] Keep in mind that with the Citi Prestige® Card your annual airline fee credit is $250, that this credit does apply to ticket purchases, and that this credit applies to all airlines instead of just the one you select. My review of the Citi Prestige® Card. […]

[…] Read my full review of the Citi Prestige® Card […]