MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Right now, if you sign up for Airbnb through this link, you’ll get $50 off your first qualifying booking.

Many moons ago, Airbnb started as a home sharing platform and turned into a full-fledged hospitality behemoth. Sure, you can still get a room in someone’s house, or even a bed in a shared room, but most travelers are now using Airbnb as an alternative to a hotel stay.

You get more space, a kitchen, a separate living space and whatever amenities your pocketbook can afford. There really is something for everybody on Airbnb, in all price ranges and in every corner of the world, from a tiny hobbit house in the woods to an eight bedroom villa with a fabulous pool.

Unfortunately for us travel rewards enthusiasts, Airbnb doesn’t have its own credit card, so you are either forced to pay cash or use one of the “travel eraser” cards, such as the Capital One Venture Rewards Credit Card. But despair not, there are a few ways to save on your Airbnb stay.

Negotiate with the Host

It never hurts to ask, right? If you are planning a last minute stay and see that your desired property is available, message the host and ask for a discount. Obviously, the host doesn’t have to agree, but it’s definitely worth asking.

If the host knows that otherwise their property will remain unsold, they might agree to let you have it at a discount. It goes without saying that guests should politely ask the host and explain why they are looking for a discount. And it wouldn’t hurt to mention why you love their property and want to stay there.

Some hosts might have a minimum stay requirement, but they might reduce it if the property is still available for your last minute booking.

Stay Longer

Planning to stay for a week, a couple of weeks or even longer? Look for hosts that offer monthly or weekly discounts – the savings could be substantial. If you are staying somewhere for six nights, check the weekly rate, since it might be cheaper to book seven nights instead of six and just leave a day early.

The same goes for monthly discounts. If you need a place for, let’s say three weeks, check the monthly rate. You might be able to save a substantial amount by renting for a whole month.

The place you are interested in doesn’t have weekly or monthly rates listed? It’s still worth a shot to try to negotiate a discount. And even if the host has long-term rates, ask for an additional discount. If it’s a slow season and the rental isn’t in a super popular location, the host might be flexible.

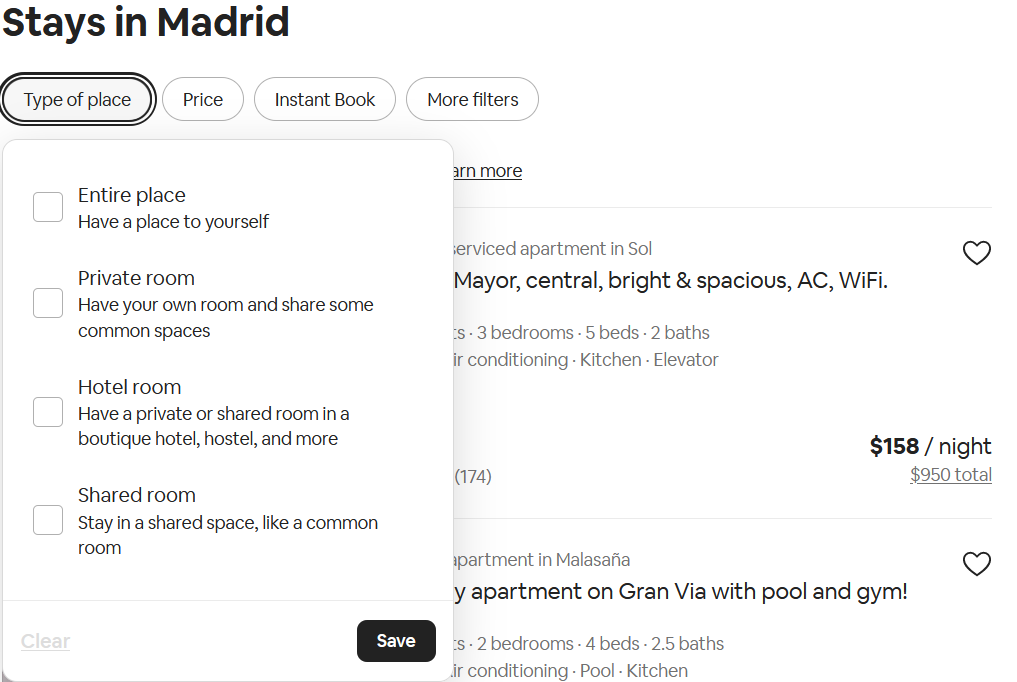

Stay at a Shared Apartment or House

Airbnb lets you filter the search results by the type of lodging. For someone on a very tight budget, a shared room could be an option, or a private room in a house might also be a good fit. And you never know, maybe you’ll make lifelong friends with the host or other guests and get a great insight into the locals’ lives.

Reading the reviews is always important, but when booking a shared space, you must read the reviews carefully and if you have questions, don’t hesitate to contact the host before you book.

Be Flexible

If you have some flexibility with your dates or your preferred neighborhood, you can save a lot of money. Depending on what else is going on during that time, some areas are more expensive on the weekend, and some are more expensive during the week.

If the price seems to be disproportionately high, check for local holidays or festivals, as there might be a big event going on, so it might be worth moving your trip by a couple of days.

And the same goes for the area where you want to stay. You can save hundreds of dollars by looking in a different neighborhood just a couple of blocks away.

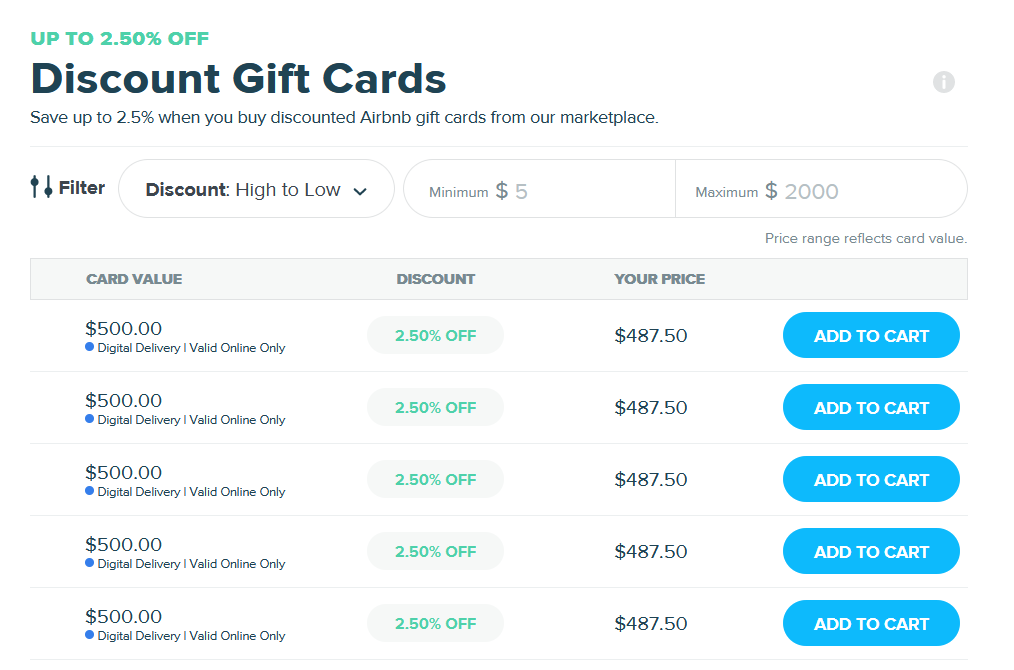

Buy Discounted Gift Cards

Sites like Raise routinely sell Airbnb gift cards at a 2-4% discount. Raise periodically runs additional sales, so watch out for these to save even more. And don’t forget to check the shopping portals to earn additional rewards or cashback.

Airbnb gift cards are also sold at grocery and office supply stores.

The best card to use at the office supply stores is the Chase Ink Business Cash® Credit Card card that earns 5X on all purchases at the office supply stores.

Chase recently introduced targeted spending bonuses on a number of co-branded credit cards. Check for your offers on a dedicated website and see if you are targeted for the 5X grocery spending bonuses. I’ve got the 5X offer on my Chase United℠ Explorer Card and the Marriott Bonvoy Bold® Credit Card .

So shop for the Airbnb gift cards at a grocery or office supply store and earn up to 5X. Plus if your grocery store has a fuel rewards program, you can earn a free, or nearly free, tank of gas in the process!

Just remember, Airbnb gift cards have to be loaded into your account before you make a booking. If you’ve already prepaid half for your reservation, you won’t be able to use a gift card to pay the balance.

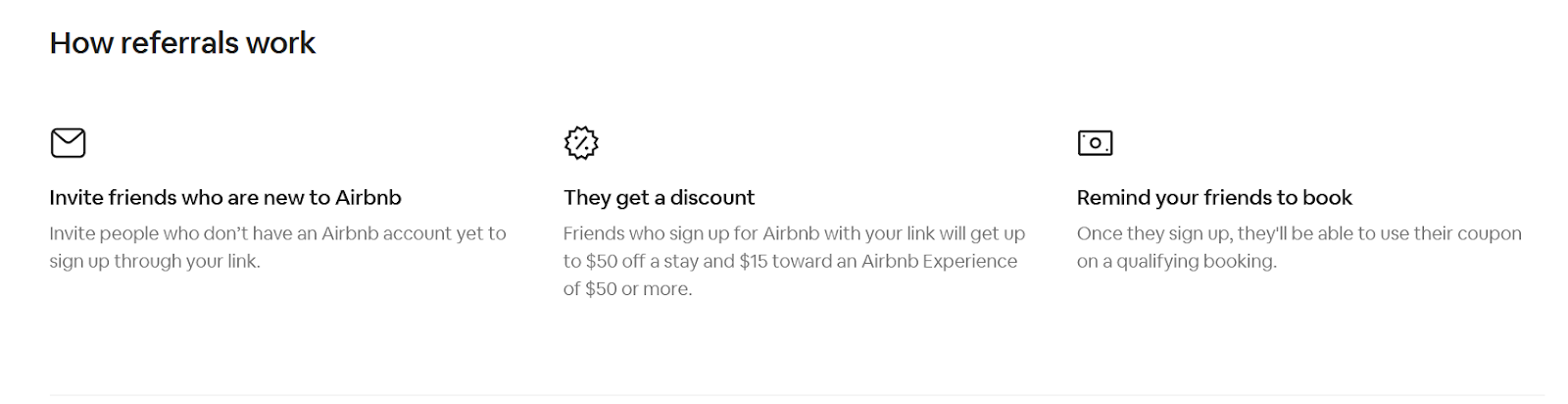

Get a Referral Link from Your Friends

Use Airline Shopping Portals

This isn’t really a straight up discount, but if you use the shopping portals, you’ll earn valuable airline miles that will save you money on flights.

Airbnb partnered with Delta and British Airways, which means you can earn extra miles just for making a reservation through their links. You’ll pay the same price whether you book through the portal or book directly with Airbnb.

Here’s what you’ll earn:

- Delta Airbnb portal – 1 Delta mile per dollar

- British Airways Airbnb portal – 3 British Airways Avios points per dollar

Use Points to Offset the Cost of Airbnb

Unfortunately, Airbnb isn’t a transfer partner of any “transferable currency”, such as Chase Ultimate Rewards points or American Express Membership Rewards. But there are a couple of ways to offset the cost of the cash booking.

Capital One Miles

Because Capital One miles can be used for almost all travel related purchases (including airfare, rental cars, cruises, trains, hotels and Airbnb), we can cash in Capital One miles to offset any Airbnb stays.

Each Capital One mile is worth one cent toward travel and you can earn Capital One miles with these miles earning credit cards:

- Capital One Venture Rewards Credit Card

- Capital One Spark Miles for Business

Chase Pay Yourself Back

There’s a relatively new way to redeem Ultimate Rewards points to offset certain purchases at a favorable rate. Using Pay Yourself Back, you’ll be maximizing the value of Ultimate Rewards points by up to 25% compared to cashing them out at one cent per point.

Let’s quickly review Pay Yourself Back. Cardholders receive up to 25% more value on eligible point redemptions at an increased value of up to 1.25 cents per point, depending on the card.

Unfortunately, there’s no way to pay yourself back for travel purchases, such as Airbnb bookings.

Some Ultimate Rewards earning cards, have other categories eligible for the Pay Yourself Back feature. So pay yourself back for purchases made in the eligible categories and then use the money you saved to offset your Airbnb stay.

Best Credit Cards for Booking Airbnb

If we have to pay for our Airbnb stays we might as well use the cards that earn the most points. These cards earn 3X on Airbnb purchases:

Final Thoughts

While there’s no direct way to use points for Airbnb, there are a couple of ways to make your stay a little cheaper. And by using the right credit card to pay for your stay and maximizing the portals, you’ll be able to earn valuable points and miles for future travel.

What strategies do you use to save on Airbnb stays? Share your tips in the comments.

Travel well,

Anna

[…] Save Money At Airbnb: A good alternative to expensive hotels is Airbnb. One drawback though is that you can only use certain currencies at a fixed value towards Airbnb stays. There are however several ways to save money at Airbnb and here’s how. […]

Hey Anna! – 1000% agree – can’t hurt to negotiate, worst thing they can say is no and then you play the full-price.