MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

You can share your Citi ThankYou Points with anyone else who has a ThankYou account completely free of charge. This is way better than Chase Ultimate Rewards and American Express Membership Rewards, which only allow sharing with a spouse.

I’ve already covered how to combine all your own ThankYou Points into one account. That way if you get both the Citi ThankYou® Premier Card and Citi Prestige® Card, which offers 40,000 bonus points after spending $4,000 in the first three months, you can combine points from both cards into one account. Sharing extends that even further. You can take your points and send them to anyone else’s ThankYou account.

How to Share

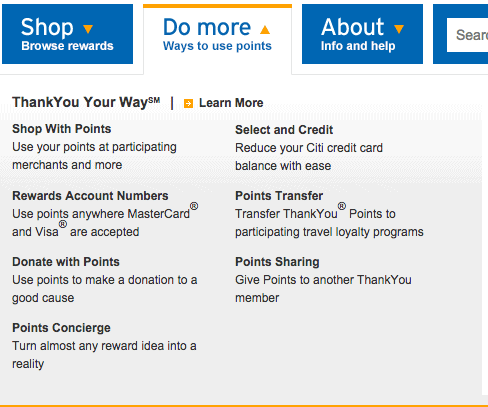

Right on thankyou.com, you select “Points Sharing” under “Do more.”

You have to know the recipient’s name and ThankYou account number. You can only share points earned on your credit card, not other ThankYou points like those from checking accounts.

What Restrictions are There on Sharing?

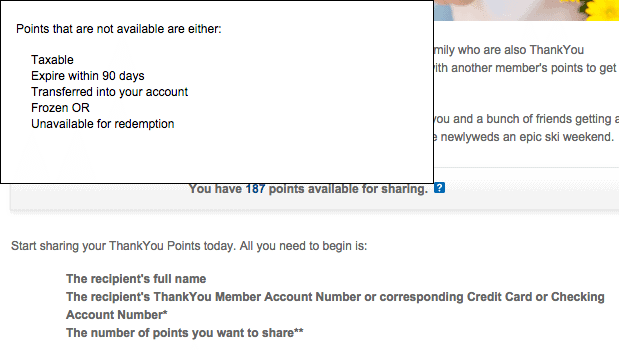

- You can only share points earned on your credit cards–not points earned from another banking product, points that expire within 90 days, points that were shared into your account, points that are frozen, or points that are otherwise unavailable for redemption.

- The points you share expire 90 days after you share them. The receiver has to redeem the ThankYou Points–by transferring them to airline miles or using them like cash toward any flight–before that 90 day period ends. He doesn’t need to do any actual flying in that 90 day period.

Other than that, go nuts. There are no minimum or maximum amounts you can share.

Why Share?

- To get your ThankYou Points into someone else’s frequent flyer miles account.

- If you have only a Citi ThankYou® Premier Card, your friend has a Citi Prestige® Card, and you want to book yourself an American Airlines flight using your ThankYou Points like cash toward the ticket.

Get Your ThankYou Points into Someone Else’s Airline Account

The best use of ThankYou Points is to transfer them to airlines miles like Singapore, AirFrance, or Virgin Atlantic miles. You can only transfer your ThankYou Points to airline accounts if your first and last name are a perfect match between the two.

But you can get your ThankYou Points into anyone’s airline accounts by sharing your ThankYou Points with the person who you want to have the miles. Then he can transfer his new ThankYou Points into his airline account.

Travel companions will almost certainly want to do this before a big trip. Imagine you and a friend each have 60,000 ThankYou Points, and you want to transfer them to Singapore miles to book roundtrip First Class tickets from the United States mainland to Hawaii on United flights. Instead of each transferring to your own Singapore accounts, and booking the tickets separately, one person should share his 60,000 points with the other. Now the account with 120,000 ThankYou Points should transfer to Singapore miles and book both tickets on the same record locator.

Get Someone with a Prestige to Use Your Points for an American Airlines Ticket

If you get a Citi ThankYou® Premier Card and meet the $3,000 minimum spending requirement, you’ll have at least 43,000 ThankYou Points, and more if you hit some of the category bonuses like 3x for travel and gas. You can use those points to transfer to airline partners, or you can use them to book any cash ticket.

If you want to use your 43,000 ThankYou Points to book any cash ticket, you will get 1.25 cents of value per points for $537.50 in free flights. Not bad, but if you have a friend with the Citi Prestige® Card, you can share your points with him and do even better.

When you are ready to book a flight–and not before since shared points expire in 90 days–share your ThankYou Points with your friend with the Prestige. Have him book your American Airlines flights, using the ThankYou Points like cash. In his account, the points are worth 1.33 cents toward any flight.

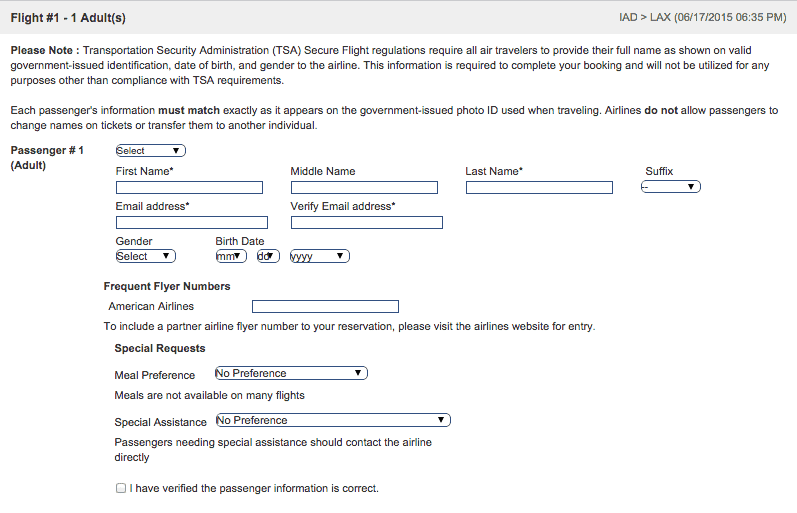

Before sharing, your 43,000 points were worth $537.50 in free flights in your account. In his account, they are worth $571 worth of free flights. He can book a ticket in anyone’s name because the name field is blank during a flight purchase on thankyou.com.

Sharing your ThankYou Points with someone who has a Citi Prestige® Card, so that he can book you American Airlines flights increases the value of each shared point by 7%.

Bottom Line

Citi ThankYou Points you earn from credit cards can be shared with anyone who has a Citi ThankYou account. The shared points expire 90 days after sharing, so make sure you are ready for the points to be used immediately when you share.

The two main reasons to share points are to turn your points into airline miles in someone else’s account or because you have a friend with a Prestige, and you want to use its higher valuation of ThankYou Points when using them like cash to book American Airlines flights.

Thanks for the info, the only downside is the 90 day time limit.

Now if only Citi could speed up actual delivery of the cards once approved. It’s been 11 days and counting, and I’m still waiting by my mailbox for my shiny new Premier card. We’re in 2015, and unfortunately still working with 80s style mail order in this regard. This is cutting into my 3 months to make the minimum spend!

Kind of but “3 months” usually means like 103 days from account approval to account for mail time. When you activate, ask by what day you need to meet a minimum spending requirement. I expect it will be more than 3 months in the future.

Thanks for the info, the only downside is the 90 day time limit.

Now if only Citi could speed up actual delivery of the cards once approved. It’s been 11 days and counting, and I’m still waiting by my mailbox for my shiny new Premier card. We’re in 2015, and unfortunately still working with 80s style mail order in this regard. This is cutting into my 3 months to make the minimum spend!

Kind of but “3 months” usually means like 103 days from account approval to account for mail time. When you activate, ask by what day you need to meet a minimum spending requirement. I expect it will be more than 3 months in the future.

Scott, if you have internal contacts with Citi, let them know this “split” between points simply doesn’t make sense. We have some points (earned from a checking account relationship) which can’t be transferred to partners and then we have points earned from credit card sign-ups and spend which can be. Not only is it someone convoluted when trying to figure out which points are transferable, but it simply makes no sense to have some points have less value (meaning they can’t be transferred to a partner.)

Thanks 🙂

I don’t, but I do wonder about that split. They might have some good reason for it. I notice that the other sources of points are called “taxable points.” I’m not sure why that would affect transferability, but it might.

Scott, if you have internal contacts with Citi, let them know this “split” between points simply doesn’t make sense. We have some points (earned from a checking account relationship) which can’t be transferred to partners and then we have points earned from credit card sign-ups and spend which can be. Not only is it someone convoluted when trying to figure out which points are transferable, but it simply makes no sense to have some points have less value (meaning they can’t be transferred to a partner.)

Thanks 🙂

I don’t, but I do wonder about that split. They might have some good reason for it. I notice that the other sources of points are called “taxable points.” I’m not sure why that would affect transferability, but it might.

someone = somewhat

someone = somewhat

[…] Citi allows you to combine all your ThankYou Points into one account or gift your points to anyone, and these are easy ways to increase the value of your ThankYou […]

[…] Citi allows you to combine all your ThankYou Points into one account or gift your points to anyone, and these are easy ways to increase the value of your ThankYou […]

[…] and when you want to redeem points earned on the AT&T Access More Card from Citi, you can share the points from that account to your Prestige or anyone else’s Prestige account for free…. The main drawback is that the shared points have to be redeemed within 60 days. (No flying has to […]

[…] and when you want to redeem points earned on the AT&T Access More Card from Citi, you can share the points from that account to your Prestige or anyone else’s Prestige account for free…. The main drawback is that the shared points have to be redeemed within 60 days. (No flying has to […]

Scott: do you know if the system is set to transfer out expiring points first? So if I have 70,000 points and transfer in 50,000 and then transfer out 110,000, which set of points is going to get drawn down first? Thanks!

I don’t know exactly. I hope the ones with shortest expiration are used first.

Scott: do you know if the system is set to transfer out expiring points first? So if I have 70,000 points and transfer in 50,000 and then transfer out 110,000, which set of points is going to get drawn down first? Thanks!

I don’t know exactly. I hope the ones with shortest expiration are used first.

I just transferred 50k from my wife into my account. I then transferred to Singapore. I specifically asked, which points come out first. My wife’s points which must be used within a few months come out first. does that answer the question?

I just transferred 50k from my wife into my account. I then transferred to Singapore. I specifically asked, which points come out first. My wife’s points which must be used within a few months come out first. does that answer the question?

@Paul, yes, it helps. Thank you! It becomes even more urgent because transferred points expire within 90 days.

@Paul, yes, it helps. Thank you! It becomes even more urgent because transferred points expire within 90 days.