MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

There’s a weird tax that you pay on awards leaving Colombia that you get refunded at the airport. American Airlines takes advantage of this by not fully refunding to you the tax you’ve already paid.

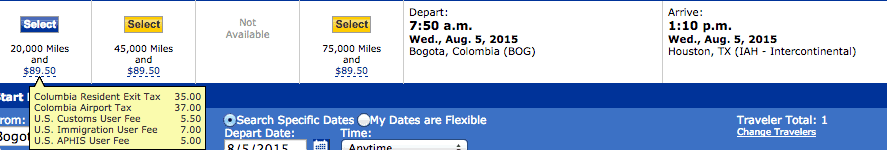

Check out this one way award from Bogota to Houston on united.com. The $89.50 in taxes includes a $35 “Columbia [sic] Resident Exit Tax.”

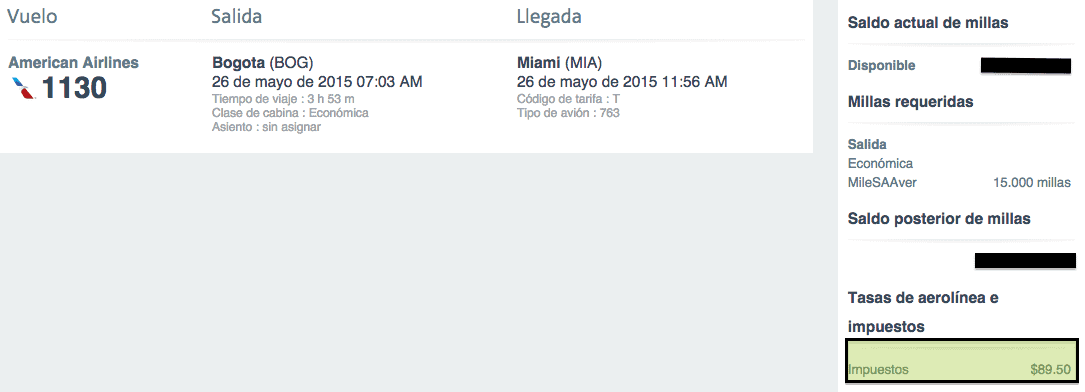

American collects the same $89.50 on a one way award from Bogota to Miami, so we can be confident it collects the same $35 Colombia Resident Export Tax.

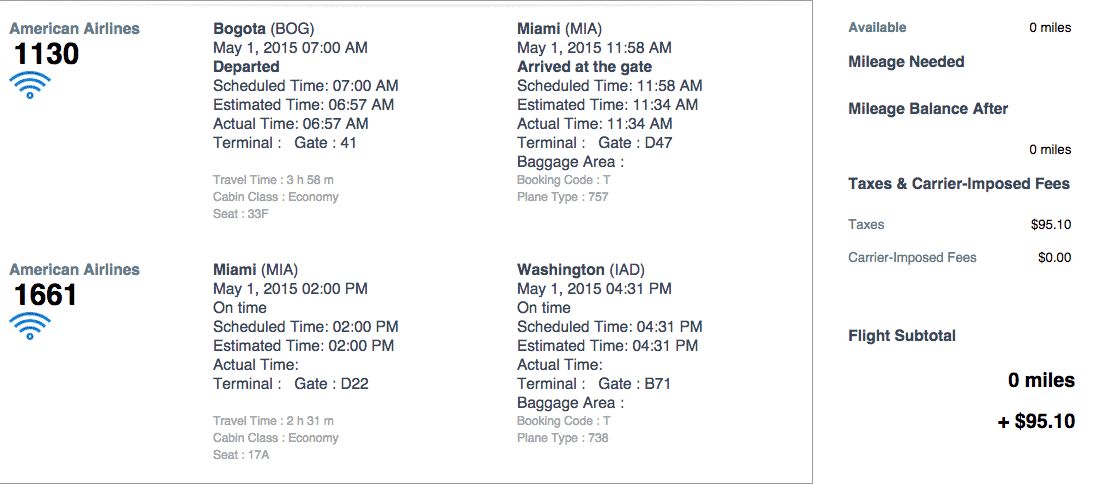

American collects the same $89.50 on a one way award from Bogota to Miami, so we can be confident it collects the same $35 Colombia Resident Export Tax. Here’s my receipt for the itinerary I am currently flying from Bogota to Washington DC via Miami on American Airlines. That $95.10 in taxes is the $89.50 from the itineraries above plus $5.60 for my take off in the USA.

Here’s my receipt for the itinerary I am currently flying from Bogota to Washington DC via Miami on American Airlines. That $95.10 in taxes is the $89.50 from the itineraries above plus $5.60 for my take off in the USA.

All this is to say that I paid a $35 “Colombia Resident Exit Tax” when I booked my award.

I don’t owe that tax.

I don’t know exactly what does and doesn’t trigger it, but Americans who stay in Colombia less than a certain number of days–I think its 60, my stays of 15 and 4 were both under the limit–do not owe the tax.

If you don’t owe the tax, you get it refunded at the airport.

First you go to your check in airline, and they hand you your itinerary and direct you to a desk at the airport set up for this purpose. The desk gives you a stamped paper that you bring back to the airline. During check in, the airline refunds your departure tax in cash in exchange for that stamped paper.

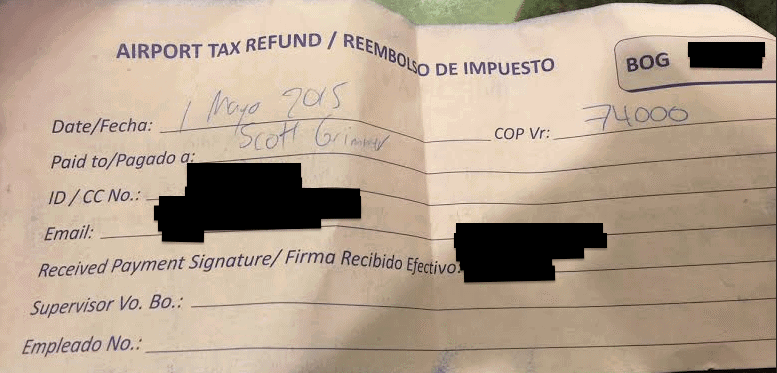

Except that American Airlines does NOT fully refund the erroneous tax. They handed me 74,000 Colombian pesos in cash.

That’s worth about $31, except that they’re handing $31 worth of pesos the people who least want them–Americans flying home. And if I changed 74,000 pesos at the airport, what would I get, $25? (I just pocketed the cash. I’ll probably be back in Colombia at some point, since I’ve been three times in six months.)

This is bogus. American Airlines should refund the erroneous $35 tax as $35 cash or as a refund to the credit card on file. Until they do that, they’re ripping people off.

To be clear, I am not particularly upset about losing $4-$10. I just find being ripped off for any amount very frustrating, and it looks to me like American Airlines is ripping off its customers to the tune of a few thousands of dollars per month. (They have 5+ daily flights from Colombia to the United States on which almost all their American passengers are getting a refund.)

At least someone is pocketing that few thousand bucks a month, and the only other possible candidate is the Colombian government if they are getting those $35 payments upfront and mandating the 74,000 peso devolution.

The next step for me is to ask American Airlines to make me good on the tax I didn’t owe. Here’s the American Airlines refund page, which doesn’t seem to cover my scenario, so I put a question out to the AA twitter team about where to file my refund request. They gave me this address to press my complaint. I’ll keep you posted.

@MileValue If you have the ticket number you can request a refund via http://t.co/xM8VkbQ07c.

— American Airlines (@AmericanAir) May 1, 2015

I once had a situation that British Airways charged me for a tax that they were not suppose to charge when booking an award ticket for Colombia. Well anyway, at the airport in Cali I was told by the AA people to file with BA to have that reimburse. BA finally sent me a check.

Interesting

Remember Scott that tax go’s to help the OLD ( as in ME ) the sick and the lame and the people who can’t afford food SO it’s a good tax … Email one of your attorney buddies and have them LOOK into this . I use to pay 28% on my c- phone on a city TAX that’s why you need to read your bills ..

Try a sample booking for a round trip and you won’t see that tax, but a tourist tax for about half that amount.

Good to know

It looks to me like the airline is “ripping you off” when you buy the ticket. I am pretty sure that the tax is actually 74000 pesos, but the airline does want to or cannot charge you in two different currencies when you buy the ticket, so they convert it to US dollars. They take a large spread on the conversion, either because they are greedy, or, more likely, because they have no idea if the conversion rate may move against them between the time they issue your ticket and the time that they issue your refund. I don’t think they are really scamming you, but they are making darn sure they don’t lose any money on currency conversions at your expense.

That tax is triggered when you get a one way ticket leaving Colombia. If you get a round trip ticket, it won’t be charged. I have had to get this refund at BOG several times. As to the difference between currencies, I haven’t a clue…. but the amount they refunded me has never been as far apart as what you have experienced. Perhaps it has something to do with how the dollar has appreciated against the peso in the last 6 months? Perhaps they are using an outdated exchange rate. They will never give me US dollars for that refund in Colombia… only pesos.

You will not be charged this ‘gringo tax’ (at least I was not) when booking an open-jaw itinerary where the return leg starts in Colombia. It does not matter where the inbound leg ends (could end in any other country).

Any updates, Scott?

[…] flying a similar award last year, and departing Colombia three times in the last year, I am expecting about $35 in taxes to be returned to me at the airport because I am not Colombian, and I was in the country for less than 90 days. That will make the […]

Any updates on this? I don’t think I am getting charged for this in a round trip.

It’s the Colombian government not AA. They are required by law to include it. Just tell them you want a refund at check-in and they’ll tell you where to go to get it. Just be warned that it will be in pesos, so you’ll either have to change them or spend them.