MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

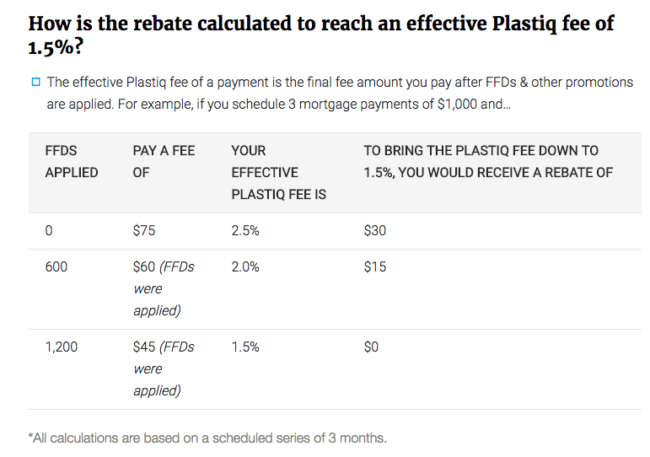

Plastiq is an online bill payment processing system that allows you to pay bills you’d normally pay in cash or with a check on a debit card (for a 1% fee) or credit card (for a 2.5% fee). Right now Plastiq is running a promotion to lower that credit card fee to 1.5% if you use your MasterCard to pay three mortgage payments before the end of 2017.

The cap you can save on fees is $200, which means the promo fee rate of 1.5% applies to just your first $20,000 in mortgage payments. To be clear–all three payments must be scheduled before the end of this year to count.

Pay 2.5% Upfront, Get 1% Rebated

The reduced fee works in the form of a rebate. You will originally be charged the full 2.5% fee, and you’ll get 1% back via check sent to your address (technically the address on file for the credit card you made the payment with). The rebate check shouldn’t be sent any later than January 5, 2018.

Make Sure You Are Targeted

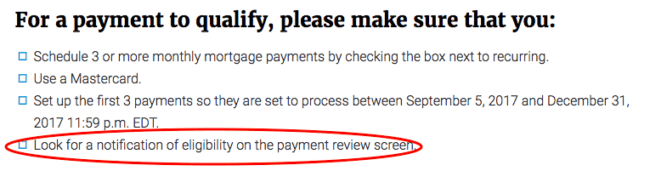

Apparently this promotion is targeted. In the conditions, it reads that you will see a notification of eligibility on the payment review screen if you are indeed targeted.

When it’s Worth it

If you are trying to a meet a minimum spending requirement on a MasterCard, there’s no doubt paying a 1.5% to process your mortgage payment is worth it. Otherwise, as long as your return is higher than 1.5% (like with the Citi Double Cash Card which gives 2% cash back) then it’s worth it.

How Plastiq Works

You simply specify who you want to pay, and Plastiq pays them either via check or electronic transfer depending on what the recipient accepts. You are notified once your payment is received.

Who and What You Can and Cannot Pay via Plastiq

Examples of Who and What You Can Pay

- Anyone providing a good or a service

- Tuition and housing fees

- Taxes (income and property)

- Rent

- Utilities

- Insurance

- Mortgages

- Car payments

- Home loan payments

- Home repairs/construction

Examples Who and What You Cannot Pay

- Yourself (cash advances)

- Recipients who have not provided a good or service (i.e. you can’t pay your friend back for lunch)

- Recipients that are located outside the United States or Canada (however the sender can be)

- Payments to savings accounts, trust accounts, retirement accounts, health savings accounts, or similar

- Payments to 529 Education Savings Programs

Read Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles to learn who and what you can and cannot pay via Plastiq.

Plastiq Referral Program

Fee Free Dollars are credits you earn to make payments without that fee when someone signs up and uses Plastiq through your referral link.

Basically, when someone signs up through your unique referral code and pays $500 of bills through Plastiq, you will earn $1,000 Fee Free Dollars and your friend will earn $500. Read more about how the referral program works here.

IMPORTANT NOTE: You probably shouldn’t stack Fee Free Dollars with this promotion as you won’t get the full rebate if you do…

Bottom Line

Schedule three mortgage payments on your MasterCard using Plastiq before 11:59 ET December 31 and you will only have to pay 1.5% credit card processing fees instead of the normal 2.5% fee (with 1% returned in the form of a rebate). If you are currently meeting a high minimum spending requirement on a MasterCard, this could be great news!

Just be sure to check if you were targeted on the payment review screen before confirming or you could end up without a rebate.

Hat tip Doctor of Credit

HELP

The lady next store has a HC son she used the SW card (points) to pay the monthly bill which they won’t take now just a check ect ..Post Link if u will to the way around this I gave her the AA aviator card link hope see gets it .

THANK YOU !!!!!

I do autopay but she doesn’t she calls every month I think huge $$$ so lots of points ..Thanks

What’s the problem exactly? Plastiq won’t accept her Southwest Visa so you want to recommend another card to her that Plastiq will accept?

Just don’t forget to turn off an automated plan after that…

Good point!

$1000 Fee Free Dollars at plastiq.com. Apply this coupon 573762 to avoid fees on $500 worth of payments made through Plastiq. You must first pay $500 worth of bills to qualifyShop these top sale items at plastiq.com and save while you are at it. Don’t be the last to find all these great bargains! Be the first. Expiration Date: Jan 01, 2020

Use my referral code & pay $500 worth of bills to get 500 fee-free dollars: https://www.plastiq.com/cardholder_ui/start?referralCode=737629&utm_medium=twitter

Used Frank’s link. Many thanks to anyone who uses mine!

https://try.plastiq.com/503340

Pay $500 worth of bills to get 500 fee-free dollars