MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

This is a living post, continuously updated over time as the miles and points hobby evolves. They change the rules and we have to stay on top of them.

Today I’ve updated the section about Citi cards to reflect the new sign up bonus eligibility timelines for their AAdvantage co-branded credit cards. If I’ve left something important out please feel free to let me know in the comments. I feel this is an important responsibility of miles bloggers to keep info of this nature updated for the sake of your credit scores!

Will you be approved for a new card? Will you get its bonus?

What if you’ve already had that card and gotten its bonus before?

The answers to these questions depend on the issuing bank of the credit card. The issuing bank is not the payment network like Visa, MasterCard, or American Express. The issuing bank is the bank that gives you the card, collects interest, and provides customer service. For rewards cards, the main issuing banks are Chase, Citi, American Express, Barclaycard, and Bank of America. I’ve included Capital One as well as they have some lucrative rewards cards.

Let’s look at the rules for each issuing bank, which vary widely. Note that many of these “rules” are not published, rather formed over time by people like us collaborating data points to establish patterns of bank behavior.

Chase

GENERAL CARD RULES

- 5/24: If you have 5+ new credit card accounts with any bank–yes, any bank, not just Chase–in the last 24 months, you will be denied most Chase personal and business credit cards.

- Note that most business cards do NOT count in your 5/24 total. Do not confuse that statement to think that you need not be under 5/24 to get approved for Chase business cards. You must be under 5/24 to get approved for ANY Chase credit card.

- You can only get the bonus on the same Chase card once every 24 months. This 24 month clock starts when you got the last bonus (which may be several months after you got the card). The exception to this rule is with the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card, as noted below, which you must wait 48 months between.

- You probably shouldn’t apply for more than two personal cards or one business card in a 30 day period. A safe limit is one business and one personal card within 90 days. Chase is known for denying people who apply for more than that.

CO-BRAND SPECIFIC CARD RULES

- Sapphire Cards (i.e. the Chase Sapphire Preferred® Card and Chase Sapphire Reserve®)

- New applicants will not be approved for another credit card in the Sapphire family if they already have one open. In other words, if you currently hold a Sapphire card, you’re not eligible for a Chase Sapphire Preferred® Card nor a Chase Sapphire Reserve®.

- You cannot earn the bonus on the Sapphire-family card until 48 months past when you earned the bonus on another Sapphire-family card.

- Southwest Cards: If you have the Southwest Rapid Rewards® Plus Credit Card, Southwest Rapid Rewards® Premier Credit Card, or Southwest Rapid Rewards® Priority Credit Card open, you are not eligible for another Southwest consumer card. You are also ineligible for the bonus on a Southwest consumer card if you have earned a bonus on another Southwest consumer card in the last 24 months. This rule doesn’t apply to the Southwest business cards. You can open and hold both business cards at the same time.

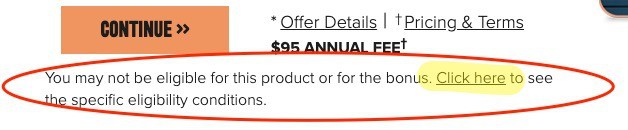

- Specific rules for the Marriott co-branded cards: There are lots of eligibility stipulations for all the Marriott-family credit cards, too many to detail here. And unlike most other card bonus rules, they cross over between consumer and business products, and even between banks! Both Chase and Amex issue Marriott co-branded cards. What I recommend before applying is reading each card’s eligibility terms, which thankfully they have easily linked for us on the application pages. This is what it looks like on the Marriott Bonvoy Boundless® Credit Card:

And zoomed in…

-

- Once you press click here, a pop-up will appear outlining all the conditions (having, or having had, a different Marriott) that render you ineligible for the bonus.

American Express

- You can only get the bonus on an American Express card once per lifetime, a lifetime being roughly seven years. However if you were targeted for an American Express offer, you can still be approved even if you have had the card before (just make sure the terms of the offer does not include once in a lifetime language).

- You can be approved for two Amex cards with no preset spending limits on the same day, but applying for two Amex credit cards will likely result in a pending response for the second application. It doesn’t necessarily mean the second card will be declined, but it’s unlikely they will both be instantly approved. Amex won’t look at the second application until five days after the first.

- You can be approved for no more than two Amex cards in a 90 day period. If you want more than two Amex cards, apply for them on days 1, 6, and 91.

- You are limited to holding five American Express credit cards. Both personal and business count toward this limit.

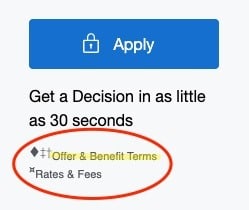

- Specific rules for the Marriott co-branded cards: Like I said above about the Chase Marriott cards, there are too many eligibility stipulations for the Marriott-family credit cards to detail here. Just like with Chase Marriott cards, you can check in the offer terms of Amex’s Marriott cards for these eligibility stipulations. This is where you can find the info for the Marriott Bonvoy Business® American Express® Card:

Click the Offer & Benefit Terms link in the bottom corner, and in the very beginning of the terms highlighted in bold it lists the bonus eligibility stipulations.

- Amex puts the following ambiguous language on many of their card applications: “We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility”. At this point, we don’t have enough reports from others to be able to spell out what this means exactly. One would assume if you follow the rules listed above, you would be ok.

- In case you forgot whether or not you’ve ever opened a specific Amex card, it looks like Amex is at least warning you before submission of the application (before a hard pull happens) if you’re eligible for the bonus or not.

Citi

- You can apply for no more than one consumer Citi card in an eight day period. If you want two Citi cards, get them on days 1 and 9.

- You can apply for no more than two consumer Citi cards in a 65 day period. If you want three Citi cards, get them on days 1, 9, and 66.

- You can apply for no more than one business Citi card in a 95 day period.

- *The numbers above are for the risk-averse. Technically, you should be able to get one consumer card in a seven day period (so applying on day 1 and 8 should be ok), two consumer cards in a 60 day period (so applying on day 1, 8, and 61 should be ok), and one business card in a day 90 day period (so applying on day 1 and 91 should be ok).

- You are only eligible to earn a repeat sign up bonus if you haven’t opened or closed the same card within the last 24 months.

- You are only eligible to earn a ThankYou Point sign up bonus (from the Citi Prestige or Premier cards, both not available to new applicants) if you haven’t opened or closed a card within the ThankYou Point-earning family within the last 24 moths.

- You are only eligible to earn an AAdvantage sign up bonus if you haven’t opened the same AAdvantage card within the last 48 months. This rule just changed in the beginning of July, 2019. In some ways it got stricter (clock changed from 24 months to 48 months), but in other ways became looser. Instead of applying to the entire co-brand, this rule only applies to each individual product. And closing an AAdvantage card doesn’t reset the clock like it used to. For example, you can open a Citi / AAdvantage Platinum Select MasterCard and Citi / AAdvantage Executive MasterCard at the same time.

Barclays

- Barclays is known for being the most inquiry-sensitive bank. Therefore if you’re on the verge of applying for multiple cards (from various banks), apply for the card from Barclays first. While there’s not a specific rule regarding same-day approvals, it’s not recommended to apply for multiple cards from Barclays on the same day.

- Applicants who apply for a repeat Barclaycard product will probably not be approved for another for at least six months since the last application, and you must cancel the existing card first.

- In regards to the Barclaycard AAdvantage Aviator cards, I have read a handful of reports that suggest waiting 24 months between applications, but I’m not willing to say that’s a hard and fast rule yet.

- NOT a rule, but a PRO TIP: Barclaycard denies people for having too many Barclaycards, not enough spending on existing Barclaycards, too much credit with Barclaycard, or too many accounts with other banks.

Bank of America

- For all Bank of America cards…

- Bank of America will not approve you for more than two new credit cards within a two month period

- Bank of America will not approve you for more than three new credit cards within a 12 month period

- Bank of America will not approve you for more than four new credit cards within a 24 month period

- All of that being said, I’ve also read the latest data points suggest no more than one approval every six months. If you’re conservative, stick to one every six months.

Capital One

- You can only apply for a Capital One card once every six months.

- You can only hold two consumer Capital One-branded credit cards at once. This doesn’t apply to business cards or co-branded cards. Example of Capital One-branded credit card: the Capital One Venture Rewards Credit Card. Example of a co-branded Capital One card: the GM BuyPower Business Card from Capital One.

Bottom Line

Every issuing bank has different rules on how often you can apply for its cards and how often you can get a new bonus on a card you’ve had previously. The rules are changing, and the general trend is toward a tightening of the rules. The rules are sometimes written down and sometimes figured out by aggregating data points on FlyerTalk and Reddit, or good, old-fashioned experimentation.

Bookmark this page if you haven’t already, and make sure you go over the rules for the appropriate issuing bank BEFORE applying for a new rewards card.

I had 1 or 2 existing cards from barclays and got approved for 2 new ones 3.5 months apart last year after an easy recon call. So it is possible, although maybe not likely.

Some recent developments regarding the Alaska cards, not so easy to get approved for multiple cards now and multiple reports of people getting there alaska mileageplan accounts closed and losing all their points after applying for multiple cards. Be careful with that.

You’re referring to multiple Alaska cards on the same day, correct? Or are you saying people are getting closed down for one Alaska card every 3+ months? Either way, do you happen to have a link to the report?

here you go:

http://www.flyertalk.com/forum/alaska-airlines-mileage-plan/1688010-my-account-got-shut-down-after-getting-sign-up-bonus-5.html

http://www.flyertalk.com/forum/alaska-airlines-mileage-plan/1675298-alaska-airlines-closing-accounts-accusations-fraud-brokering.html

My wife and I each have more than 4 AMEX cards.

Sorry, I mixed credit and charge cards – oops!

I think you’re missing a couple of key points in this update… the CIti Executive cards now all have the 18 month language. Alaska cards issued by B of A are in the process of being severely monitored for multiple apps. Both of your statements to the contrary are outdated.

Amex Gold is a charge card AFAIK.

On the Amex SPG personal card, if you got a low bonus (say 4,000 miles) many years ago, are you totally precluded from getting the current bonus (25,000 miles) now? Or can you get the difference if you re-apply?

According to the published rules, yes. I believe the published rules are enforced too.

[…] Continue reading…. […]

You do a top notch job compared to other deal killers so I’ll comment.

Churning is dead for citi. You must wait 18 mos now.

Only way around it is if you find a zombie link or some one makes one from spydering.

AFAIK this is not possible for time being. So for now citi is at the 18 mo minimum time frame between successive bonuses on same card pdc

Try 24 months. Not 18. They recently changed all of there cards to the language. DOH!

[…] Just make sure if you are getting more than one Citi card to get no more than one card in 7 days and no more than two cards in 65 days. […]

I applied for 2 Alaska Air cards on the same day. One was approved right away 16K limit, however the 2nd one was approved after 3-weeks with 16K limit.

Congrats!

[…] These cards are issued by Chase. You can get a Chase bonus again if it has been at least 24 months SINCE YOU GOT THE BONUS on the car… […]

[…] Fiji, USA to Southern South America in AeroMexico Business Class for 45,000 miles Get the Miles: Churnable personal and business cards. Transfer partner of SPG. Decent mileage sales around 2 cents […]

Citi Bank Rules:

Different cards have different rules for repeating the bonus. The Platinum and Gold AA cards require 18 months from closure of the identical card while the AA Executive card and Citi Prestige® Card allow you to get the bonus over and over without waiting (beyond the limit listed in the first two bullet points) or closing your other AA Executives.

Just finished calling Citi Bank re repeat bonus for AA Executives card. Citi denied bonus due to having had the card less than 18 months ago. The agent said they are strictly re-enforcing the 18months rule.

Really helpful data point. Thanks.

Scott, do you know how often, or even if, you can get the sign-up bonus on the Citi Premier card? I can’t seem to find any info in their Terms and Conditions. Thanks!

I think after it has been closed 18 months, you can get it again.

Scott, got denied 2x yesterday by Citi. I was inside the 8 day and 66 day limits. Will I be able to reapply once the 8 day limit is up, or does my denial put a kink in this? I had just gotten the Prestige card and was after the AA business card.

Considering the changes with Chase, you might want to update this post.

I will when the changes take effect. I don’t think the denials change anything.

When I reapply I will go from your links. I hope you get something when I do that.

I really appreciate your help and insight.

Scott,

I think I read somewhere where you said you can reapply for the citi platinum card bonus after 18 months, without cancelling your existing citi platinum card. Did I get that right????

[…] SPG transfers, there are churnable Alaska Airlines credit cards to pick up the […]

[…] this decision might be a bit easier considering you’re already probably waiting for the 2 year Chase bonus timer on getting each card’s bonus […]

[…] You can pursue both of the strategies outlined above simultaneously, the points strategy for a lot of free nights and the Hilton Reserve strategy for a few unforgettable nights at one of the best hotels in the world. Just make sure that if you get both the Citi® Hilton HHonors™ Visa Signature® Card and the Citi® Hilton HHonors™ Reserve Card, you get them at least eight days apart. (They are both Citi cards, and Citi will not approve two cards in a week.) […]

[…] had the Mercedes-Benz American Express Platinum, you are ineligible to get the bonus again because Amex now has a strict one-bonus-per-lifetime rule for each card. However this card is a separate product from the “regular” Amex Platinum personal and […]

[…] Also see: Issuing Banks’ Rules for Approvals and New Bonuses […]

What if you apply for the Chase Ink card in a branch? Does the 5/24 rule still apply. I heard a rumor that applying in person was a way around the 5/24 rule.

Does Amex have some sort of 5 cards in 24 months rule? The wording/content seems to belong only in the Chase restrictions, yes?

Scott,

Re the B of A Alaska cards, are you (and others) cancelling the already opened account before and/or after applying for a new one?

Thanks

I haven’t been. You can.

[…] You can only get the bonus on the same Chase card once every 24 months. This 24 month clock starts when you got the last bonus (which may be several months after you got the card). Read more about issuing bank rules for approvals and new bonuses here. […]

[…] what cards I currently have compared with the latest and best offers. Scott’s articles about issuing banks rules for approvals and new bonuses and the Top 10 Travel Credit Cards both really helped with the […]

[…] Issuing Banks Rules for Approvals and New Bonuses […]

[…] up for to preserve your credit score in the short term or your applications are only limited by how many new cards banks will approve, the absolute value method is right for […]

[…] This card is issued by Citi. Citi has a general rule that you can only be approved for one card in an eight day period and two cards in a 65 day period. So if you have gotten other Citi cards recently like the Citi Prestige® Card or Citi ThankYou Premier Card, space out your applications, so they are on day 1, day 9, and day 66. […]

[…] those of you getting tripped up by Chase 5/24, Citi’s new sign up bonus rule, or Amex’s once in a lifetime bonus rule, getting the Asiana card should still be pretty […]

[…] Issuing Banks Rules for Approvals and New Bonuses has all the bank rules mentioned throughout this post in an easy to digest, bulleted format. It’s great to bookmark for future reference in case you ever have a question when applying for cards. […]

[…] to take advantage of earning American Airlines miles for your personal and business spending, but you cannot be approved for both on the same day. The collected wisdom is to put at least 8 days between applications for cards issued by […]

[…] Issuing Bank Rules […]

[…] Benefit Related to Chase 5/24 Rule: American Express Business Cards don’t appear on your credit report, which means the cards don’t count toward your limit of five new cards in the last 24 months to get a new Chase card. […]

Does Citi consider downgrading an account the same as closing? I downgraded a Citi AA Executive to a Bronze less than 2 years ago. Can I get the 50k bonus on the AA Platinum? Thanks.

I have been denied the Alaska card for already having one open.

RE: Citi…..if you have an AA card that you opened over 2 years ago, should you leave it open and apply for another…can you? If I close it I have to wait 24 more months before applying again?

I’ve heard of people churning Alaska cards but is that still possible? I have a personal and business card. My wife has personal but we’d get more and keep them if possible? Can you get as many as you want as long as you wait 90 days? Thanks as we’d love to use more buddy passes

[…] to take advantage of earning American Airlines miles for your personal and business spending, but you cannot be approved for both on the same day. The collected wisdom is to put at least 8 days between applications for cards issued by […]

[…] These cards are issued by Chase. You can get a Chase bonus again if it has been at least 24 months SINCE YOU GOT THE BONUS on the car… […]

I had the arrival plus and then downgraded to the no-fee version of the card. Can i apply for the arrival plus and get the sign-up bonus with the no-fee version card open or must cancel it?

You must cancel your no annual fee Arrival card first.

How long do you think I should wait after cancelling to apply again.

[…] getting enough value from the card to continue holding it. Assuming you don’t need to close the card for churning purposes, here are the first two […]

[…] Eligibility: American Express once in a lifetime bonus rule […]

[…] Issuing Bank Rules for Approvals and New Bonuses before signing up for cards to plan your AAdvantage mileage accrual […]

[…] Amex Once in a Lifetime Rule applies (you can’t get the bonus if you’ve ever gotten the bonus before, but note eligibility […]

Not all Chase cards are restricted to 5/24 (i.e. IHG, Hyatt, Marriott Business)

Huh? re: your Chase comment that says “If you have 5+ new credit card accounts with any bank in the last 24 months, you will be denied all Chase personal and business credit cards…(unless targeted)”.

There are a number of Chase cards that aren’t 5/24 restricted and would be approved even if both (1) not targeted, and (2) over 5/24.

You’re correct, we’ve written about that many times on the blog as well. Those links were just left out but I have added them now for clarification.

You say that ” if you currently hold a Sapphire card, you’re not eligible for a Sapphire Preferred nor a Sapphire Reserve”. Does that apply if you are an authorized user on your spouses’s Sapphire card?

I am an authorized user on my husband’s Sapphire Preferred card. Can I get a Sapphire Reserved card?

Very valuable post. Please keep it updated.

What are the rules for the Ink preferred card? If I have another Ink card can i get it?

The numbers for Citi are incorrect. The numbers you use are the ones recommended on sites like flyertalk to make sure that the actual rules are not broken. The actual app rules are 1/7, 2/60, and 1/90 for biz cards.

Thanks, yes, I am aware. I added a bullet for the less risk-averse.

<>

Do you mean another SOUTHWEST consumer card, or ANY consumer card? Big difference! Please edit to clarify.

I meant another Southwest consumer card. Edited to clarify!

BOA turned me down on Alaska card and it has been over 6 months since closing. I have no other cards with BOA. Well above 800 FICO. Scatching my noggin on this one. Did not call recon.

Did that card you closed have a high credit limit?

You have not updated the Citibank new 48 month restriction

Yes I did, it’s the last bullet in the Citi section (only applies to AAdvantage card for now).

“Applicants who apply for a repeat Barclaycard product will probably not be approved for another for at least six months since the last application, and you must cancel the existing card first.”

I was approved for JetBlue Biz and AA Biz less than a month apart in Nov 2019.

That sentence is referring to churning the same card again. So for example, opening a JetBlue Biz and then opening another JetBlue Biz.