MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Update 1/17/14: 35k offer is dead, but the 40k offer is alive!

FlyerTalkers are reporting success getting a 35,000 mile bonus and no annual fee for the first year on the Barclay’s US Airways MasterCard. That’s a higher sign up bonus than the current public offer of 30,000 miles and an $89 annual fee on the card.

The 35k offer comes with:

- 35,000 US Airways Dividend Miles on first purchase

- No annual fee the first year

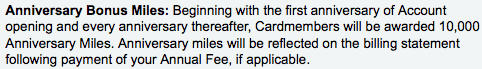

- 10,000 US Airways Dividend Miles on your anniversary after payment of the $89 annual fee

- One US Airways Club lounge pass

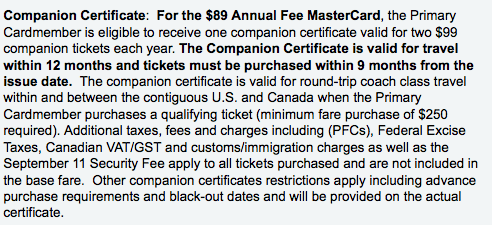

- Two $99 plus taxes companion tickets per year

Here are the steps to get the better offer:

1. First use this link to access the application. This is one of those famous offers without a landing page to describe it, but the details are all on the Terms and Conditions link.

2. Fill out the application. Many people are reporting an error message upon submission of the application. Some people have received: “We apologize for the inconvenience, but our website is experiencing technical issues. Please contact us at 1-866-419-6437 or try again later.”

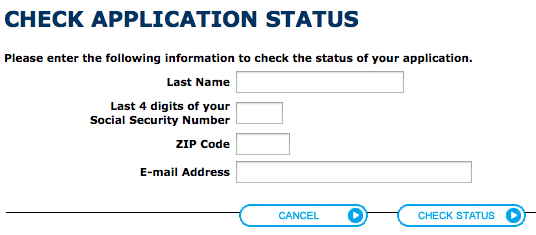

3. Don’t call. Instead check the status of your application at the Barclay’s Check Application Status page.

If the page says you’re approved, congrats! Move to step five. Otherwise, step 4:

4. Call Barclay’s at 866-408-4064 to inquire if they need any more information to process the application. For advice and a video of one of Rookie Alli’s “reconsideration” calls, see a Video of a Credit Card Reconsideration Call.

5. Once approved, you will receive the card in a week or two. Make one or more purchases and 35,000 Dividend Miles will post to your US Airways account within a few days of your first credit card statement.

I am recommending everyone get this card since it will almost certainly disappear during the US Airways/American Airlines merger. I am recommending everyone get it quickly, since you can get the card and its bonus two or more times, but the applications should be at least 91 days and preferably six months apart.

Screen shots of select terms and conditions:

Bonus

I am being emailed reports every few days of cardholders getting offered 15,000 US Airways miles if they spend $750 per month on the card for three consecutive calendar months. That works out to about 6 bonus miles per dollar and is a great deal to jump on.

Or thought of another way, that jumps the offer up to 50,000 miles after spending $2,250 over three months–not too bad!

If you get the offer I recommend taking advantage. Has anyone received the 15,000 bonus miles offer?

I got the offer this past week. It says to get the bonus I must spend $750 in April, May, and June.

I got this card on 12/21/12. My wife got here a few days later. About a month ago, she received the bonus offer (spend $750 3 months in a row and get 15,00 bonus miles). I have not. Grrr.

I have a couple related questions…

This (US Air MC) is the only Barclays card I’ve ever had. I was thinking of applying for another one of these now that 90+ days have elapsed. However, last week I applied for the Frontier Airlines Barclays MC (inspired by your coverage, BTW) – instant approval. My questions are about the timing or Barclays cards…

Does Barclays count all their cards on a single cycle, or do they keep a separate cycle for each branded card? That is, is there a single clock running for my US Air and Frontier cards, or separate clocks for each? Also, how do applications for business cards effect these clocks? Frontier has a personal and a business MC, and so does US Air? Does Barclays handle personal and business cards the way Chase does – that is, you can get Personal Card A and Business Card A and get the bonus for both? Is there some reasonably well established minimum time between ANY Barclays cards (for example, for citi cards, it’s widely alleged that you must always wait 65 days between applications for ANY city card). I’m looking to load up on Barclays cards, so need to know what the /recommended required intervals are.

Thanks!

I should have a post answering these questions soon. I don’t want to scoop myself! I would always wait 91 days between applications.

I received the offer on my Frontier card, spend 750 in April, May and June get 15,000 points.

That’s very exciting! I haven’t heard of this one.

DEAR

I love your web. I am Japanese.and live in japan.

so,I can not have a US Airways MasterCard. but,I got a offer buy mile 100%.

so,I had bought it(5000 mile *100%=10000 $1881.25)

Can I use it for my mother’s travel? from tokyo to PARI first class ?

I am looking for your advice.

thanks

Yes you can.

There’s still a 40k link out there, but no AF waiver…

I also received the 15, 000 mile offer via email & snail mail. I assumed its targeted since my wife did not get any notice.

I signed up for the 30,000 miles and non-waived $89 fee version of this card back on December 7. I received the special offer of 15,000 bonus miles for $750 spend during Feb., March, and April. Already met Feb. and March spend and will work on April spend soon. My question is can I also get the 35,000 mile, FY waived fee card you mentioned in your article while I still have the other version of the card?

Probably. Most people report getting two of these cards simultaneously and both bonuses. See https://milevalu.wpengine.com/easily-earn-110k-us-airways-miles-per-year/

When I applied online, I also got the error message as in call them. Instead, I logged on to my Barclays acct (I have had the LL Bean Visa for years) and to my surprise I saw that I had the USAir card setup on my acct already. next day got email saying I was approved and 5 days later had the card in my hand. Very odd but am glad I got it. Used the 35k link no annual fee, 10k on renewal…

Jan 22 got the US Airways card, spent a few dollars on it and threw it in the drawer. Last week got email offering the 15,000 mile bonus if I spend $750 in April, May and June.

Always thank you.

Will from japan to Bangkok and Paris be opened in first-class by TG?

and

The necessary mileage is 100,000 miles?

Found this site after a random google search, applied and got the error but checked the barclays link given and it showed accepted for $5k immediately after applying.

Thank you! Awesome deal, I was going to do the public deal, this is at least $100 better!

Nice. Keep poking around. You’ll get more value from the site.

So I just got churned this card last night using these instructions. Thanks! However, my existing usairways card annual fee posted a week ago. The annual bonus 10K miles have already shown up in my USAirways FF account. How ‘inappropriate’ would it be to cancel the old card and not pay the annual fee? Can they claw the miles back? If they were going to cancel my brand new card, then I wouldn’t do it. And if it is a good suggestion, I should probably call and try to transfer some of the credit line from the old card to the new card in an initial call, then cancel in a subsequent one? Not sure how good Barclays would be with all this .

Can you use US Airways miles with their alliance partners such as United?

If American merges with US Airway will the points be moved over to American?

Yes and yes.

Scott, thanks for your blogging. Instant approval today, using the above (with the “technical inconvenience” in Chrome). Can you email me your FT/MP handle? Cheers.

Thanks for the article! I wouldn’t have known about the status check site, otherwise. My wife and I were both approved today. My wife was also approved for a Citi AA card through one of your links, since 40,000 miles is the best signup bonus these days. I’m hoping you can merge US and AA accounts sooner rather than later because I would really like to take a trip to Asia on Cathay Pacific!

Followed your instructions and worked like a charm. Thanks man!

Do you know if the other perks of the fee-based card (ie-priority boarding, able to buy tickets w 5000 less miles, access to preferred seats) available with this no-fee card, as well?

Could I put my US Air frequent flier mile number in another individuals application for this card and receive the bonus miles?

I don’t think so.

[…] May be able to get a 35k offer as outlined in this post. […]

I spend about $40,000 per year on the US Air Barclays Card. Got my 10,000 preferred miles. I never received anything about $750 / month for 15,000 miles?? What’s the deal? Rather peeved about this.

No one ever knows why some are targeted/not targeted. I suspect they send that out to people who are not spending heavily. By the way, how much do you value 10k Preferred miles? I would not put $40k on the US card. The same $40k on the SPG card would be 40k Starpoints, which equal 50k US Airways miles. –> https://milevalu.wpengine.com/starwood-preferred-guest-primer-and-three-great-uses-for-the-starwood-30k-bonus-point-offers/

[…] like it much better than the 35k offer because this offer has a higher bonus and does not give a confusing error message upon […]

[…] There may even be an offer to get 5,000 more miles on this card! […]