MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Business ExtrAA is an American Airlines program designed for small businesses to be rewarded for their loyalty to American, and it’s a great way for you to double dip your rewards on American flights, earning more free awards faster!

Right now, people who sign up for Business ExtrAA and meet minimum use requirements–more on those below–can earn 5,000 AAdvantage miles and 2,000 Business ExtrAA points. The offer page says the offer is targeted, so check your inbox for an email–mine came March 22–or try to sign up anyway.

You’re probably familiar with AAdvantage miles, and I would value 5,000 near $90. But 2,000 Business ExtrAA points are the real headline, since 2,000 Business ExtrAA points are enough for a roundtrip economy award within the USA (excluding Hawaii), Canada, and Mexico.

What is Business ExtrAA?

Business ExtrAA is a double-dipping program for businesses from American Airlines. It is a chance to double dip because the flyer of a paid fare still earns his elite qualifying miles and status miles like on any flight. And in addition, if a Business ExtrAA number is added to the reservation, the business earns Business ExtrAA points.

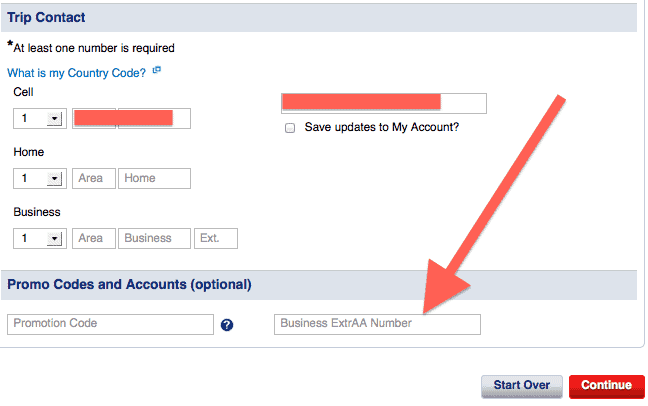

When you’re purchasing a ticket from aa.com, at the bottom, there is space to enter your Business ExtrAA number.

Business ExtrAA participation is open to companies–not individuals–with two or more travelers. There are a lot more Terms & Conditions to wade through too.

The ordinary earning rate of Business ExtrAA points is “2 points per $10” spent on American Airlines flights; American Eagle flights; and British Airways, Iberia, Japan Airlines, and Qantas flights with an American Airlines codeshare number.

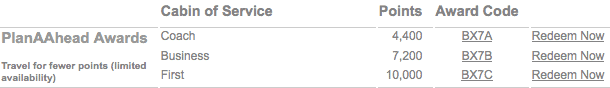

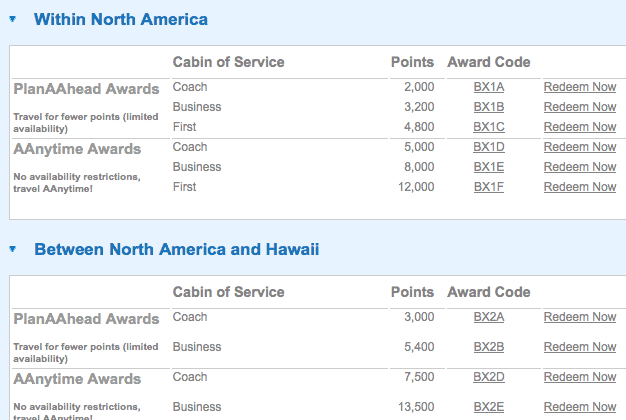

With such a tough earning structure, one point per $5, it’s easy to see why the award chart is so incredible! Roundtrips to Asia start at 4,400 points, and first class is only 10,000 points.

The full award chart is here if you’re signed into Business ExtrAA. The chart shows only regions where American Airlines flies since redemptions have to be on American metal, so no Australia, Africa, or Southeast Asia.

Beyond flight awards, other redemption options include an Admirals Club Day Pass for 300 points, AAdvantage Gold Status for 2,400 points, and flight upgrades.

A quick comparison between the flight award prices in Business ExtrAA points and AAdvantage miles shows that awards with AAdvantage miles cost at least 12 times more than awards with Business ExtrAA points.

For instance, a roundtrip from Chicago to Los Angeles in economy class is 25,000 AAdvantage miles or 2,000 Business ExtrAA points. A roundtrip in business from New York to Seoul is 100k AAdvantage miles or 7,200 Business ExtrAA points.

Let’s conservatively value one Business ExtrAA point at 12 AAdvantage miles. Twelve AAdvantage miles are worth 21.24 cents, which is the value I’ll assign to Business ExtrAA points.

That means this 2,000 point sign up bonus for Business ExtrAA is worth $424.80!

It also means that at the ordinary earning rate of one point per five dollars spent, Business ExtrAA is like a 4.2% rebate. And that’s on top of the miles earned by flying, the status earned by flying, and the credit card points earned by booking a flight.

Earning the Sign Up Bonus

Unfortunately earning the headline 5,000 AAdvantage mile sign up bonus and 2,000 Business ExtrAA points bonus isn’t so easy. Here’s what to do according to the offer page.

- Sign up for Business ExtrAA at businessextraa.com with code SME1Q13. You link the Business ExtrAA account to an existing AAdvantage account and get a new Business ExtrAA number generated. The terms and conditions say you need to have received an email with the offer to be eligible. I did receive the email. I don’t know if you truly need to have received the email.

- To earn the 5,000 AAdvantage miles, the person whose AAdvantage account is linked to Business ExtrAA and one other person must fly a paid flight using the new Business ExtrAA number.

- To earn the 2,000 Business ExtrAA points, people using your Business ExtrAA number must fly $3,000 in paid flights between now and June 30.

Even if you can’t reach the 2,000 Business ExtrAA points threshold, the 5,000 AAdvantage miles should be very easy to unlock.

And long term being enrolled in the Business ExtrAA program is free money, to the tune of 4.2% of your American Airlines (and select partner) tickets.

I’ll be adding MileValue’s Business ExtrAA number to my future paid flights on American.

Have you signed up for Business ExtrAA? What experiences have you had?

Thanks for the tip – just registered. Any way to add the Business Extra # to existing upcoming reservations with AA?

Yes. After I registered, I saw this message: If you already have a reservation with American Airlines, e-mail Business ExtrAA Customer Service or call 1-800-457-7072, 8:00 a.m. – 5:00 p.m. CDT, M – F to add your account number.

Nice, got my AA flight to FTU DC coming up this month. I will try to get that credited.

When you registered it said how. “If you already have a reservation with American Airlines, e-mail Business ExtrAA Customer Service or call 1-800-457-7072, 8:00 a.m. – 5:00 p.m. CDT, M – F to add Business ExtrAA number”

I just sign using your cose and without an email invitation and I was inmediately accept.

Thanks

I never received the 5K bonus after flying in April. Did anyone else?

Please help.

I signed up for BusinessExtraa in April. I believe that I used the code at the time (I had read this post). Met the 3k of spend and have been waiting for the 5k points +2k biz points to post. Decided to call today to check on the status of the points and I was informed that no such promotion was associated with my account. I explained that the promotion was the main reason I had signed up in the first place and it would be frustrating to receive no bonus after such substantial spend. They said that I wasn’t on the targeted list for the promotion and was therefore not eligible either way. They said that if I could forward them the email from AA that would have been sent to me had I been targeted, they may reconsider. Any advice? Do I have any shot at getting this?

Has anyone been successful at getting credit for past flights?

Warning: read the full terms and conditions, because the business/extraa points are not given on the ticket price passengers actually pay for the ticket, before taxes, but instead they are calculated under something called by American Airlines: “flown revenue”. In my own experience when I signed for the program the promotion included DOUBLE POINTS, but they calculated, to their convenience, such a low “flown revenue” that for a ticket that I paid over $1000, they calculated a “flown revenue” of only $360! I called them and ask them to explain such a difference and there was no explanation, only that they have to deduct taxes, in this case, unbelievably it seems taxes according to AA amounted to more than $640, for which I never got a receipt for such an amount! They just did not want to give the DOUBLE POINTS of the offer, so they lower the so called “flown revenue”. BE AWARE!