MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The personal and business American Airlines credit cards are each offering 50,000 bonus miles after spending $3,000 in the first three months. Getting both cards and meeting their combined minimum spending requirement of $6,000 will earn you 106,000+ American Airlines miles, which you can use for up to four international roundtrips.

- How to Get the Cards (and Who Is Eligible)

- Meeting the Minimum Spending Requirements

- Redeeming the Miles for Family Vacations, Luxurious First Class, and More

How to Get the Cards

Some credit card offers in this post have expired, but they might come back. If they do they will appear –> Click here for the top current credit card sign up bonuses.

Right now the Citi® / AAdvantage® Platinum Select® MasterCard® and CitiBusiness® / AAdvantage® Platinum Select® World MasterCard® are each offering 50,000 bonus American Airlines miles after $3,000 in purchases made with your card in the first 3 months the account is open. Don’t be thrown off by the word “Platinum.” Both cards have no annual fee the first 12 months, and then $95.

A person can get both cards and can hold both cards simultaneously. You just have to make sure there is at least a week between your applications because the cards are issued by Citi, and Citi won’t approve more than one card in a week. To be safe, apply for the personal card one day, and the business card eight days later.

From the date of the personal card application, you’ll have 3 months plus 8 days to meet the total $6,000 spending requirements to get 106,000 total American Airlines miles. (Always confirm the exact date by which you have to meet a minimum spending requirement when activating a card.)

While meeting the minimum spending requirements, keep in mind the cards’ different category bonuses. The personal card offers 2 miles per dollar on American Airlines purchases and 1 mile per dollar on other purchases. The business card offers 2 miles per dollar on American Airlines purchases, telecommunications and car rental merchants, and after 11/15/15 at gas stations.

(Probably in exchange for its worse earning potential, the personal card offers 10% back on redeemed American Airlines miles up to 100,000 redeemed/10,000 back per calendar year.)

Who Is Eligible for the Bonuses

If you have never had a personal or business Platinum American Airlines card, you are in the clear to get these cards with their bonuses. If you have had Gold or Executive cards, that doesn’t matter. These are different products.

If you have had these Platinum cards before, you can get the bonuses again. According the received wisdom of dozens of FlyerTalkers, the rules are currently:

- Personal Platinum card: you can get the bonus again after your old personal Platinum card has been closed for 18 months.

- Business Platinum card: some people can get the bonus again after 95+ days from their last business Platinum application. Some people can never get the bonus again. “There is no telling into which bucket you fall prior to applying.”

What Can You Do with 106,000 American Airlines Miles?

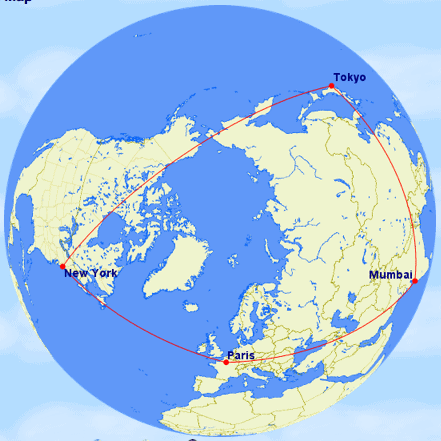

1. Take a Round-the-World Trip

a. For 87,500 miles, you can take a round-the-world trip with stops in Tokyo, Mumbai, and Paris.

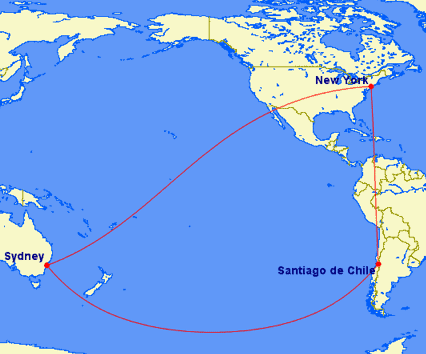

b. For 95,000 miles, you can take a trip to Chile, Australia, and back.

2. Take Your Friends or Family Somewhere

- 2 roundtrips to Europe (80,000 miles from October 15 – May 15 each year)

- 3 roundtrip to South America (90,000 miles to Peru, Ecuador, and Colombia most of the year)

- 2 roundtrips to Japan or Korea (100,000 miles October 1 – April 30 each year)

- 3 roundtrips to Hawaii (105,000 miles half the year)

- 4 roundtrips to the Caribbean or Alaska (100,000 miles to Alaska year round or Caribbean Sep 7 – Nov 14 each year)

South America is as little as 30k miles roundtrip, Europe 40k roundtrip, Asia 50k roundtrip, Africa and Australia 75k roundtrip, and the Middle East and India 90k roundtrip. For the full chart, see here.

3. Treat yourself to the world’s nicest First Class

- 67,500 miles is enough to fly one way from the United States to anywhere in East Asia in First Class on Cathay Pacific, which is my second best flight ever.

- 90,000 miles is enough for one way in First Class from the United States to the Middle East, Indian Subcontinent, or Maldives in Etihad First Class

4. Head to the South Pacific

American partners with Fiji Airways, Air Tahiti Nui, and Qantas, so it has the best miles for the South Pacific. American charges only 37,500 miles each way in economy, 62,500 miles each way in business class, and 72,500 miles each way in First Class. (Qantas First Class looks unreal.)

5. Machu Picchu in a Bed

60,000 miles is enough for a roundtrip from the United States to Northern South America in Business Class. That means you can fly to anywhere in Peru–like Machu Picchu–with both directions in fully flat beds on a 787 Dreamliner on American Airlines-partner LAN Airlines.

I talked more about this award in depth here. The only drawback with this award is that once you experience flying in a fully flat bed, you might not ever want to go back to economy!

American has the biggest route network from the United States to Latin America and partners with LAN and TAM, the biggest airlines in South America, so American has the most and best award space to South America

6. Europe in Business Class

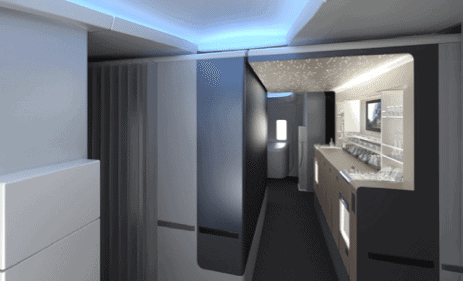

100,000 miles is enough for a roundtrip from the United States to Europe in business class. Several American Airlines partners fly to Europe with fully flat beds. I wrote about American’s Los Angeles to London route featuring flat beds in business class here. The newest planes feature an on-board bar in business class, pictured below.

Other Benefits Besides the Sign Up Bonuses

The Citi® / AAdvantage® Platinum Select® MasterCard® comes with my favorite feature by far of any airline credit card. While you’re a cardholder you’ll get a 10% miles rebate on all your American Airlines award redemptions up to 10,000 miles rebated per calendar year.

That means that if you booked a roundtrip award ticket to Tahiti with your American Airlines miles while you were a cardholder for 75k miles, you’d get 7,500 miles back for a total cost of only 67,500 miles roundtrip!

With these cards, you can mentally take a 10% discount on all award prices. Now Europe is only 18k miles each way, a business class bed to Machu Picchu is 27k miles each way, and Cathay Pacific First Class is 60,750 miles each way.

If you redeem the 106,000 miles next year, that’s another 10,000 miles rebated because of this benefit.

The benefit is automatic, no enrollment necessary. Here’s my experience with the rebate.

I value the 10,000 extra miles a year at about $180, so this is a huge ongoing benefit to me and one reason that I hold a Citi® / AAdvantage® Platinum Select® MasterCard®.

The 10% rebate on awards is in addition to a free checked bag for you and four companions when flying American Airlines, Group 1 boarding to get that overhead bin space, a 25% discount on in-flight purchases, and double miles on American Airlines purchases.

The CitiBusiness® / AAdvantage® Platinum Select® World MasterCard® comes with some duplicative benefits. Its unique benefit is its larger 2x category. You earn 2 miles per dollar on American Airlines purchases, telecommunications and car rental merchants, and after 11/15/15 at gas stations.

Both cards have no annual fee for the first 12 months, then $95.

RECAP

You can earn 106,000 American Airlines miles in the next few weeks by:

- Applying for the American Airlines personal and business Platinum cards at least eight days apart.

- Meeting the $3k minimum spending requirement on each card.

Once you have the cards, you can enjoy the 10% rebate on the miles needed for AAdvantage awards up to 10k miles per calendar year and other benefits like a free checked bag and priority boarding on both airlines.

Some credit card offers in this post have expired, but they might come back. If they do they will appear –> Click here for the top current credit card sign up bonuses.

Citi® / AAdvantage® Platinum Select® MasterCard® with 50,000 bonus American Airlines miles after $3,000 in purchases made with your card in the first 3 months the account is open

CitiBusiness® / AAdvantage® Platinum Select® World MasterCard® with 50,000 bonus American Airlines miles after $3,000 in purchases made with your card in the first 3 months the account is open

I recently completed spending on the Executive card to receive the 75,000 mile sign-up bonus. If I get the platinum card next, will the 10% rebate count for any AAdvantage miles (up to 100k) I redeem through American Airlines?

Yes

Does not the AA Platinum Business card also pay 2X at “certain” office supply stores?

Maybe your old one still does. The new offer has different 2x categories.

Hey Scott,

What do those two RTW tickets cost in business class? Does one book them as several one-way tickets or one big complex itinerary? Lastly what are the typical taxes on such tickets?

Here is the AA chart. All AA awards are one way awards, so add up the price of each one way. In 2015, the best RTW trips are a series of one way awards with many miles. See https://milevalu.wpengine.com/how-to-book-a-rtw-trip-in-2015-use-these-underpriced-awards-around-the-world/

Is there a specified minimum income for this card?

Maybe, but I have never seen a listed specified minimum income for any card.

Hello,

Back in July, 2013, I applied for 2 personal AA Select VISA nine days apart and got approved for both.. I cancelled one acct. after a year and kept the other one. Sometime this year,I rec’d notification my opened account will automatically convert to AA Select Mastercard version…I decided to convert to no fee Citi Thank You card. Here’s my question, am I eligible to apply and get bonus for the AA Select MC now? Would it be possible for me to apply for the same card 2x after 8 days apart?

On the business version of this same card, I had applied for one back in Feb.2014 and cancelled March 2015, am I eligible to apply & get the bonus again? I understand you said some may fall into a category that you can never get the bonus again. I did not usemuch the personal & business cards after meeting the minimum sped requirement, except on occasions.

Thank you for your reply.

I’d wait 18 months from conversion of personal card. As for business card, you read it correctly. I don’t know whether you can get the card again or not.

[…] The business version of this card also comes with 50,000 bonus miles after spending $3,000 in the first three months. Get both cards for over 100,000 American Airlines miles. […]

After one year what if I decide to cancel my citi business platinum card in order to avoid annual fee?

closing account affect my history right? What would you suggest?

Thanks! 🙂

A little bit. Your available credit would dip. To avoid that tiny hit, you could downgrade to a no annual fee card instead.

Scott: can i apply for 2 cards and my wife apply for 2 cards thereby getting 212,000 miles?

Yes!

Thanks for the heads-up about the coming devaluation! I just got both AA cards and am pondering how to use them for my first business class adventure. Any thoughts on the value of the following as a good use of 100k miles?

PDX –> LAX –> GRU

GRU –> MIA –> ORD –> PDX

There may be a way to do a more straightforward return, but I haven’t found it yet.

Fantastic value

Thanks. I used your referral links, btw. And I also recently booked a trip to SJD on Alaska using Avios. Had to call BA directly and it was easy. What amazes me is how you figured this stuff out in the first place, but I’m starting to get the hang of it…

I’ve spent a lot of time thinking and researching. Glad it helped you out!