MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

I’ve come to Colombia four times in the last year, and one thing I’ve learned is that leaving Colombia is a lot like redeeming Arrival miles.

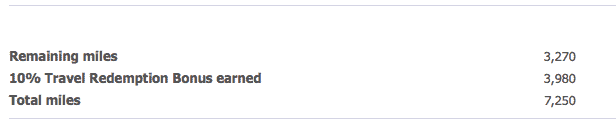

Every time you redeem Arrival miles for travel, you instantly get 5% of the points you just redeemed rebated back to your account.

I don’t turn down free miles, but I do find this “lock in” annoying. If it just cost 95 Arrival miles for every dollar of a travel purchase you wanted to remove from your statement, you could run your Arrival miles balance down to zero. Since it costs 100 Arrival miles per dollar, but then you get 5 miles back, you can never run down your balance to zero.

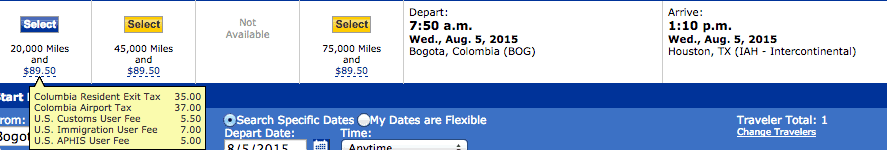

Leaving Colombia is the same way. If you book a one way award to Colombia, which I have on three of the occasions, you pay the Colombia Resident Exit Tax at the time of ticketing.

Then, as an American staying in the country less than 90 (I think) days, you are entitled to a refund when you board your flight exiting Colombia. If they just gave me $35 back each time, that would be great.

But instead, the last two times I’ve left the country, they’ve given me 74,000 Colombian pesos. (First, that’s annoying because 74k pesos equaled $31 last time and only $24 now, but this post isn’t about that scam.) What’s annoying is that the pesos are like a lock in to come back to Colombia.

Give me my dollars, and please let me run my Arrival miles and Colombian pesos balances down to zero, Barclaycard and Colombia.

At this rate, you won’t have to wory about the pesos as they’ll probably be worth nothing in dollars the next time you leave and receive them.

Jokea aside, can you pay with pesos instead of dollars?

Pay what? The tax at the time of booking? I don’t think so. It was a Singapore award that I actually paid in Singapore Dollars.

At this rate, you won’t have to wory about the pesos as they’ll probably be worth nothing in dollars the next time you leave and receive them.

Jokea aside, can you pay with pesos instead of dollars?

Pay what? The tax at the time of booking? I don’t think so. It was a Singapore award that I actually paid in Singapore Dollars.

I flew from Cartagena to JFK in July (on a one-way revenue ticket), and JetBlue refunded that departure tax directly to the credit card I used to buy the flight. I wonder if they will do the same thing if you pay for the award taxes, etc., with a credit card?

Avianca and AA haven’t offered me that option. That would be sweet.

I flew from Cartagena to JFK in July (on a one-way revenue ticket), and JetBlue refunded that departure tax directly to the credit card I used to buy the flight. I wonder if they will do the same thing if you pay for the award taxes, etc., with a credit card?

Avianca and AA haven’t offered me that option. That would be sweet.