MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

American Express christened the Saturday after Thanksgiving, and the day after Black Friday, as Small Business Saturday in 2010. Every year since then, American Express has offered $10 to $30 in statement credits per American Express card for shopping at small businesses on Small Business Saturday. There are probably people who have racked up over $1,000 in free statement credits from American Express in the last five years.

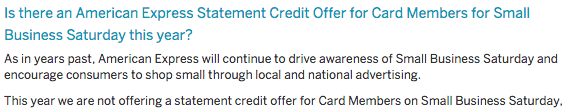

Well this gravy train is over, at least for this year, but I’d guess forever. American Express is not offering statement credits this Small Business Saturday.

Bummer!

As has been said on many blogs elsewhere and will probably be said here… “then what’s the point of having multiple AMEX cards?” And what’s really the point of the SBS?

“…and encourage consumers to shop small through local and national advertising” Where’s the encouragement?

When a store wants consumers to shop at there location, they offer an incentive – sale prices, % discounts, etc. But where’s the SBS incentive? Oh well.

Ideologically I don’t favor or disfavor small businesses, and I agree that because of losing the statement credit, I no longer have a reason to participate in SBS. I understand why AMEX dropped the credits thought. It must have cost them tons of money. Why keep multiple AMEX? https://milevalu.wpengine.com/should-i-keep-this-card-whether-to-hold-or-cancel-a-rewards-card-when-an-annual-fee-is-due/

The math problem is still the same, this just takes $25 or $30 away from the benefit side.

As has been said on many blogs elsewhere and will probably be said here… “then what’s the point of having multiple AMEX cards?” And what’s really the point of the SBS?

“…and encourage consumers to shop small through local and national advertising” Where’s the encouragement?

When a store wants consumers to shop at there location, they offer an incentive – sale prices, % discounts, etc. But where’s the SBS incentive? Oh well.

Ideologically I don’t favor or disfavor small businesses, and I agree that because of losing the statement credit, I no longer have a reason to participate in SBS. I understand why AMEX dropped the credits thought. It must have cost them tons of money. Why keep multiple AMEX? https://milevalu.wpengine.com/should-i-keep-this-card-whether-to-hold-or-cancel-a-rewards-card-when-an-annual-fee-is-due/

The math problem is still the same, this just takes $25 or $30 away from the benefit side.

I now feel less bad about my recent cancellation of an AMEX card, and the impending cancellation of two more (right before SBS). Last year I ended up with quite a haul, with $50 in movie theater gift cards, ~$50 in booze, ~$30 in frozen burgers and brats, and some toys for kids’ gifts.

Guess this is another lesson to get it when the getting’s good! Deals leave, pop up, and morph all the time, so there’s no time like the present… (except for SBS)

I now feel less bad about my recent cancellation of an AMEX card, and the impending cancellation of two more (right before SBS). Last year I ended up with quite a haul, with $50 in movie theater gift cards, ~$50 in booze, ~$30 in frozen burgers and brats, and some toys for kids’ gifts.

Guess this is another lesson to get it when the getting’s good! Deals leave, pop up, and morph all the time, so there’s no time like the present… (except for SBS)

[…] thought the days of freebies from American Express were over when they offered no incentive whatsoever last year to spend with Amex cards on “Small Business Saturday…— a promotion created by Amex themselves meant to funnel consuming towards small businesses […]

[…] thought the days of freebies from American Express were over when they offered no incentive whatsoever last year to spend with Amex cards on “Small Business Saturday…— a promotion created by Amex themselves meant to funnel consuming towards small businesses […]