MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

All these offers are expired. For the top current offers, click here.

There are five credit cards right now with limited time sign up bonuses between 50,000 and 80,000 points.

Chase Marriott (personal and business versions): 80,000 bonus Marriott pointsCiti® / AAdvantage® Executive World Elite™ MasterCard®: 75,000 bonus American Airlines milesCiti® Hilton HHonors™ Visa Signature® Card: 75,000 bonus Hilton pointsCiti Prestige® Card: 50,000 bonus ThankYou PointsCiti ThankYou® Premier Card: 40,000 bonus ThankYou Points

These are the best offers on the market for cards that can earn you some serious free travel.

- When do the bonuses end?

- How long have they been going?

- What are the “normal” bonuses on these cards?

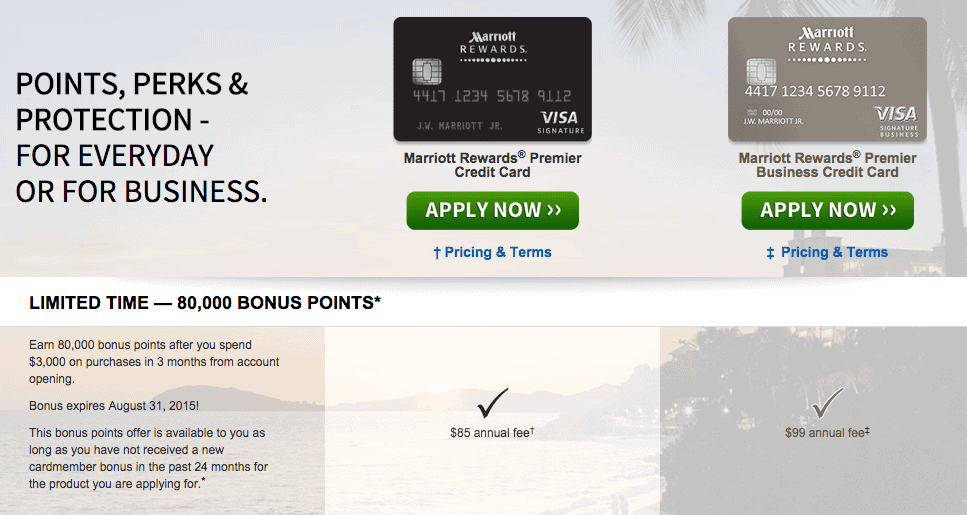

Chase Marriott

The Chase Marriott (personal and business versions) cards offer 80,000 bonus points after spending $3,000 in the first three months and paying an $85 or $99 annual fee.

These offers have been around since July 7, and there is a stated end date of August 31, 2015.

The normal offers have been 50,000 points after spending $1,000 in three months or 70,000 points after spending $2,000 in three months. Both those offers have the first year annual fee waived, so the difference in the limited time offer is more points for higher spending and payment of an annual fee.

American Airlines Executive Card

The Citi® / AAdvantage® Executive World Elite™ MasterCard® offers 75,000 bonus American Airlines miles after spending $7,500 in the first three months.

This offer has been around since July 2, and it has no stated end date.

The “normal” offer has been 50,000 bonus miles after $5,000 in spending, so the difference is 25,000 extra miles for $2,500 in extra spending in the first three months.

American Airlines miles are the best for super-cheap economy redemptions and ultra-luxury redemptions. The Citi® / AAdvantage® Executive World Elite™ MasterCard® also offers Admirals Club lounge membership, meaning you can access over 90 American Airlines Clubs in airports around the world whenever you’re flying–even if you’re not flying on American. Plus you can bring in any two guests for free OR your spouse and all children under 18 for free on each visit.

HHonors No Fee Card

The Citi® Hilton HHonors™ Visa Signature® Card comes with 75,000 bonus Hilton points after $2,000 in purchases within the first three months of account opening. The card has no annual fee ever.

This offer began July 7 and has no stated end date. The last limited time offer on the card, for only 50,000 bonus points, lasted about three weeks.

The “normal” offer has been 40,000 bonus miles after $1,000 in spending with occasional limited time offers for 50,000 bonus points plus a $50 statement credit. The current limited time offer is 25k to 35k more points for an extra $1,000 in spending in the first three months.

Hilton points are great for low category hotels and Points and Money stays.

Citi Prestige

The Citi Prestige® Card comes with 50,000 bonus ThankYou Points after $3,000 in purchases made with your card in the first three months the account is open.

This offer began April 9 and has no announced end date.

The “normal” offer had been 30,000 bonus points, so the new offer gets you 20,000 more bonus points.

Not that this card is even primarily about bonus points. My FAQ of the Citi Prestige Card explains its many benefits like $250 in airfare or airline fee credits per calendar year, access to the American Airlines Admirals Clubs and Priority Pass lounges, 3x points per dollar on air travel and hotels, and a $450 annual fee.

ThankYou Points can transfer to 11 airlines or be used like cash to book any flight.

Bottom Line

Mid-2015 has been a gold mine of improved credit card offers. Many are limited time offers with no listed end date, which makes planning a challenge.

Don’t miss out on the offer that appeals to you. Get these 50,000 to 80,000 point cards before they disappear.

Two hotel cards in 2 days (link) and 5 RTs air already so I’m set . The Marriott doesn’t care in KONA Hi cheap room or GREAT room same points like a $75 difference in cash price . Now with my Hotel/com Freebies 7 free nites there . Let’s hope the sharks are hungry .

May the UBER be with you !!

THANKs Scott

Enjoy the trip!

Two hotel cards in 2 days (link) and 5 RTs air already so I’m set . The Marriott doesn’t care in KONA Hi cheap room or GREAT room same points like a $75 difference in cash price . Now with my Hotel/com Freebies 7 free nites there . Let’s hope the sharks are hungry .

May the UBER be with you !!

THANKs Scott

Enjoy the trip!

not sure i understand the “…and their end dates” in the title – 4 out of 5 you say you don’t know the end date.

not sure i understand the “…and their end dates” in the title – 4 out of 5 you say you don’t know the end date.