MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Through December 31, 2016, you can earn double the rewards on purchases that normally fall into the non-bonused category of spend when you use your Amex card at eligible small businesses. The only stipulation is that you register your card first. Tons of cards are eligible for this small business promotion, including but not limited to the:

- Premier Rewards Gold

- Business Gold Rewards

- Platinum Business

- Platinum Card Exclusively for Mercedes-Benz

- Gold Delta Skymiles

- Gold Delta Skymiles Business

- Platinum Delta Skymiles

- Platinum Delta Skymiles Business

- Blue Cash Everyday

- Blue Cash Preferred

- Hilton HHonors Surpass

- Starwood Preferred Guest

- Starwood Preferred Guest Business

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

For instance, if you registered your Gold Delta Skymiles card, you’d earn two Skymiles per dollar spent on all purchases that normally earn one Skymile per dollar. Or if you registered your Hilton HHonors Surpass card, you’d earn six HHonors points per dollar spent on purchases that normally earn three HHonors per dollar.

We thought the days of freebies from American Express were over when they offered no incentive whatsoever last year to spend with Amex cards in the spirit of “Small Business Saturday”— a promotion created by Amex themselves meant to funnel consuming towards small businesses the day after Black Friday. Thankfully they came back strong with a valid reason to put your Amex card back in rotation.

Eligible Small Business Where You Earn Double Points

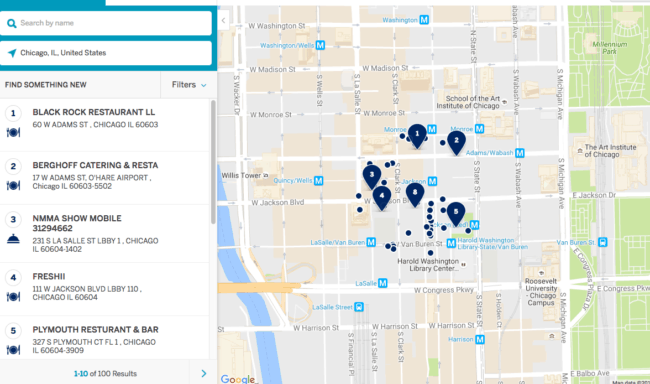

To see small business near you that qualify, check the Shop Small Now map tool.

For example, here is what comes up when I input Chicago.

Pertinent Terms & Conditions

- You must register each American Express card you wish to earn double rewards on individually

- Promotion is good on purchases through December 31, 2016

- Only the primary card holder can register, but both the primary card holder and any authorized card holders can earn double rewards when shopping with the registered account

- The amount of bonus points you can earn is capped at:

- the first $100,000 in purchases for each Personal Card

- the first $250,000 in purchases for each OPEN Small Business Card

- Bonus points should post in 10-12 weeks after December 31, 2016 (the end of the promotional period)

Ineligible Cards

Note that the following cards are not eligible to register for this promotion: Prepaid and Corporate Cards, American Express Cards issued by other financial institutions, The Plum Card®, Clear from American Express®, Blue Cash InStore, Blue Cash® Card, Cash Rebate Card, Blue for Students®, American Express® Platinum Cash Rebate Card, Optima, and One from American Express.

Bottom Line

If you have an eligible American Express card, register it for the small business promotion American Express is running for the rest of year. While it may not be worth going out of your way to shop at eligible small businesses solely for the extra point or so on each dollar, you might as well earn extra rewards passively.

If you value an MR point at 1.5 cents, that would require $666.67 worth of purchases to get $10 value out of that additional point per dollar spent. Definitely not a promo that generates excitement for me. Bring back the real Small Business Saturday promo!

Fair enough. But consider if you’re short a small amount of miles for a specific award… only having to spend half as much to reach the threshold you need could be very helpful.

Caveman

Thanks but no SB wants their card their fees are to high but they will give their card to anyone .

you might find this interesting… http://www.bloomberg.com/news/articles/2016-10-17/american-express-s-plan-to-dethrone-chase-sapphire-as-credit-card-king

Sarah

Thanks but NO it only matters where U or I shop I’m sure AMEX wants MORE SB but if SB doesn’t like them they don’t take them . I’m lucky I buy my gas @ Costco and I have a Rad Blu Visa card (KEEPER) so no big deal .

Ur doing a Great Job !!

CHEERs

Scott, on the one hand the Davinci-esque expression is extremely intriguing. On the other, one wonders if we’ll be seeing promo photos of you in a Costco or in the parking lot of a Hilton like on that other blog…?