MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

American Express is known for having a few restrictions when it comes to applying for their credit cards.

One is that you are limited to holding four to five American Express credit cards. Both personal and business count toward this limit. (AMEX Everyday, Delta, and SPG are credit cards.) Separately, you are limited to holding four to five American Express charge cards. Both personal and business count toward this limit. (AMEX Platinum is a charge card.) If you’re on the verge and contemplating a fifth credit or charge card, read this post–you can apply basically risk-free.

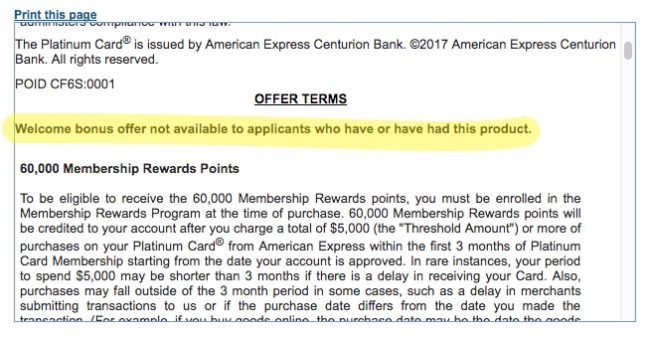

The other more publicized rule is that you can only get the bonus on an American Express card once per lifetime. There is a major loophole to this rule, however: If you were targeted for an American Express offer, you can still be approved even if you have had the card before, as long as any once per lifetime language is missing from the terms & conditions.

To specify, once per lifetime language, which is included in the offer terms of most public applications for Amex cards, looks like this:

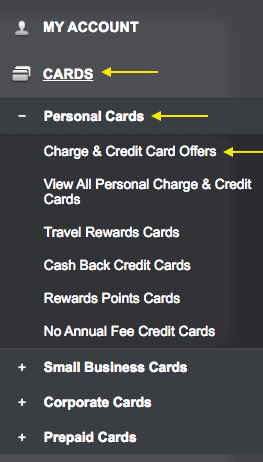

Targeted offers come in different forms. Some are sent in the mail, and some are available in the form of upgrades on existing cards, which you can access through your American Express online account.

A Different Angle

It’s common knowledge at this point that you can get the bonus again on a card as long as it’s targeted at you and lacks that “welcome bonus offer not available to…” line. But recently, we were asked a question on Twitter that made me ponder a different angle to targeted Amex offers:

@MileValue Have Gold Delta Amex -received offer to upgrade to Platinum w/ 25k bonus. Will accepting use my one-per-life bonus for that card?

— Sean Duff (@duffman1429) May 18, 2017

Sean’s situation is that he currently has the Gold Delta SkyMiles Card. One of the offers targeted at him within his Amex account online is the ability to upgrade to a Platinum Delta SkyMiles card, and the offer involves a 25,000 SkyMile bonus. He’s curious as to whether or not he would be able to apply for another Platinum Delta SkyMiles card separately/later down the line and still be eligible for its sign up bonus if he takes the upgrade he’s being offered (which makes sense since the Platinum Delta card currently has a 70k bonus on offer–wouldn’t want to forsake 70k miles for a meager 25k).

I found this to be a thought provoking question as it’s something I’ve never considered myself and never read a blog post about, but is probably a query that has crossed many minds that are trying to maximize their reward earning potential.

The fact of the matter is that the wording of the terms on public Amex applications does say a bonus is not available on a card to applicants who have or have had the product. Having an upgraded version of a card is probably still technically possessing a card. But it’s not totally clear. For example, this commenter on a Doctor of Credit post confirms that he upgraded a Hilton Amex card to a Hilton Surpass card, and then later opened and received the bonus on a separate Hilton Surpass.

How to Find Amex Upgrade Offers

- Log into your American Express account online

- Click the Menu button in the top left-hand corner of screen

- Select Cards, then Personal Credit Cards, then View All Personal Charge & Credit Cards

4. Find a card that is an upgrade to a card you already have, and there should be an option to “Apply for an upgrade”

Please, Share Your Experiences

Aside from the one commenter on Doctor of Credit, I couldn’t find another solid data point regarding whether or not you can collect a sign up bonus on an Amex card you’ve upgraded to in the past. I read some general, non-committal statements made by other bloggers, like “getting upgraded may not restrict you from earning a sign-up bonus down the road“. I understand this is most likely a YMMV situation, but help us form a more solid conclusion by sharing any experience you’ve had opening another Amex card you’ve already upgraded to.

I got caught with this while trying to gather additional MQMs and learned that I was unable to take advantage of the offer due to the fine print. AMEX is a great company and I have no issues with their customer service. It is top notch. As for the taking advantage of offers, always be careful to read the fine print because I called and asked and was told “sure, no problem” only to learn that was not the case. Good luck

So to be clear, you upgraded to a certain card and then tried to open that same card and couldn’t collect the bonus?

It’s a very good question. Many years ago I upgraded from Business Gold Rewards to Amex Platinum for 25,000 membership rewards. In hindsight I should have just closed the Gold and applied for the Plat but here I am.

I’ve never been targeted for a business platinum sign up bonus but I’ve always been curious if I could earn the bonus under a new EIN.

I just encountered a version of this issue. I applied for the Hilton Surpass and then subsequently upgraded my no fee Hilton card to the Hilton Surpass using the link without the once in a lifetime language. However, it appears that since I upgraded before getting the bonus on the first surpass, that I will not get the bonus. I asked through AMEX chat why I hadn’t received the bonus. They said it was because I already had the Hilton Surpass which I opened in 2016 (this was the no-fee card). I told them this card was upgraded to the Surpass after I was approved for the first Surpass. They are opening an inquiry for me but I am not hopeful. Should have completed the spend and got the bonus before upgrading. Let’s just hope I at least get the bonus for the upgraded card.

What ended up happening with the inquiry?

Upgraded Hilton no fee to Surpass about two years ago to generate upgrade bonus. Next a few months later I closed Surpass because I was told I had 4 cards and needed a vacant slot to open Everyday MR. I recently chatted with AMEX and found out that there is Surpass on record but no Hilton no fee. Therefore I can open Hilton no fee with 80k points even I opened one 3 years ago.

Interesting data point. Using that logic maybe I could get the Business Gold Rewards card again since it was the Amex I upgrade from. I will chat with Amex and see if they have the Gold on record.

Just had the same situation confirmed with Amex. Opened BGR and upgraded to Biz Platinum. They see the Platinum, but no record of Gold. Kind of crazy to me, but they confirmed if I apply for Gold card I would receive a sign up bonus. So best route is to get all the higher end cards FIRST, then the cheaper cards. Close out higher ones, upgrade lower to higher, then get the lower again.

https://www.reddit.com/r/churning/comments/6bhrug/last_couple_weeks_for_100k_surpass_upgrade/ lots of dps on here, seems like general consensus is you can’t get the bonus on a new card that you’ve previously gotten upgraded to.