MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Citi ThankYou Points transfer 1:1 to 12 types of airline miles. If you transfer your points to miles, they become those miles with all the related rules, restrictions, and award charts. Transferring ThankYou Points to miles is the main alternative to using them like cash toward any flight.

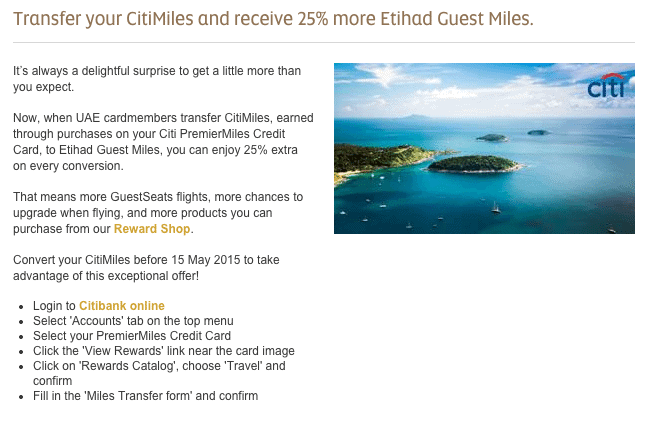

Two weeks ago, several blogs reported that transfers from Citi ThankYou Points to Etihad Guest miles made before May 15, 2015 would have a 25% bonus.

To me, this was huge news because this was the first transfer bonus of Citi ThankYou Points to airline miles. Citi’s competitor American Express runs several transfer bonuses per year to airline miles. Another competitor, Chase, has never run transfer bonuses.

I hoped this new Citi-to-Etihad transfer bonus would be a sign of many more to come from Citi ThankYou Points, hopefully to my favorite partners Singapore KrisFlyer and AirFrance FlyingBlue. I further hoped it would pressure on Chase to start offering transfer bonuses, since its two main competitors would now be in that game.

But there’s a problem.

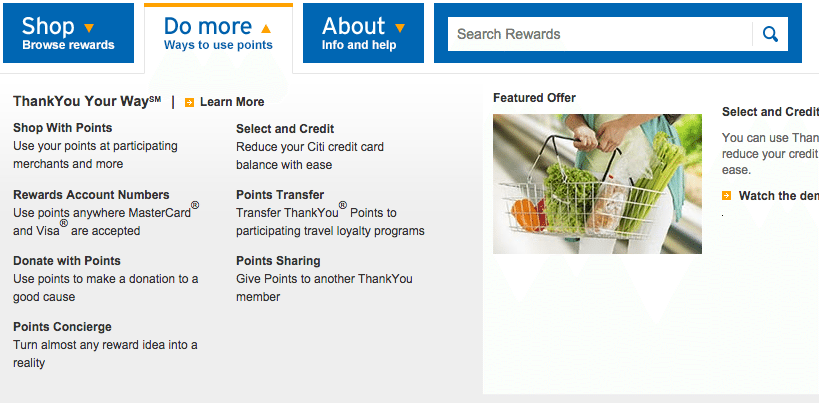

ThankYou.com

I went to thankyou.com to learn more about the transfer bonus. I clicked “Points Transfer” under “Do more” after signing in.

The Etihad Guest option still says “1,000 Guest Miles for 1,000 pts,” its normal rate.

Nowhere on thankyou.com mentions a transfer bonus.

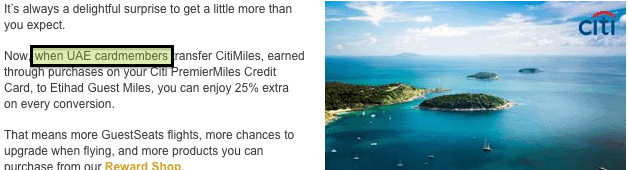

This Etihad page does mention the transfer bonus. But as you can see the second paragraph says the transfer bonus is only open to UAE Citi cardmembers.

But as you can see the second paragraph says the transfer bonus is only open to UAE Citi cardmembers.

This was not the original wording of the page. Here is part of a screenshot published by One Mile at a Time on April 23rd. As you can see, the bit about UAE cardmembers was not included originally.

What’s Going on Here?

It looks like Etihad–not Citi–was offering a transfer bonus. Etihad meant to only make the bonus available to UAE residents and updated the wording of the offer after the offer was given worldwide attention.

I am not sure whether an American transferring ThankYou Points to Etihad today would get the 25% bonus. (That’s kind of beside the point though because American Airlines miles are better to redeem Etihad awards.)

But the bigger news for me was that this first-of-its-kind transfer bonus might have heralded a new era of transfer bonus from Citi ThankYou Points and maybe even Chase Ultimate Rewards. Now that I see this bonus was only intended for UAE residents, it seems less likely to herald anything for Americans.

While transfer bonuses would be nice, even 1:1 transfers and the ability to use points toward American Airlines flights at a rate of 1.33 cents each makes it worth it to pick up a Citi Prestige® Card or a Citi ThankYou® Premier Card, each with a huge sign up bonus ThankYou Points after spending $3,000 in the first three months.