MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Today Barclaycard announced the issuance of four new JetBlue credit cards.

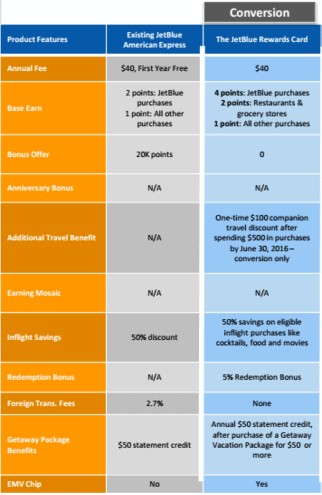

Until recently American Express issued the JetBlue credit card. Barclaycard has taken over the contract. When a contract like that switches, a number of transitions are possible. In this case, American Express JetBlue cards are being converted to Barclaycards called “The JetBlue Rewards Card,” a card for which no can directly apply. It keeps the same annual fee as the American Express version while adding benefits like more points for certain categories of spending, no foreign transaction fee, and a 5% rebate on redeemed JetBlue points.

Existing cardholders will be mailed new cards that they can activate starting at 6 AM ET on March 21.

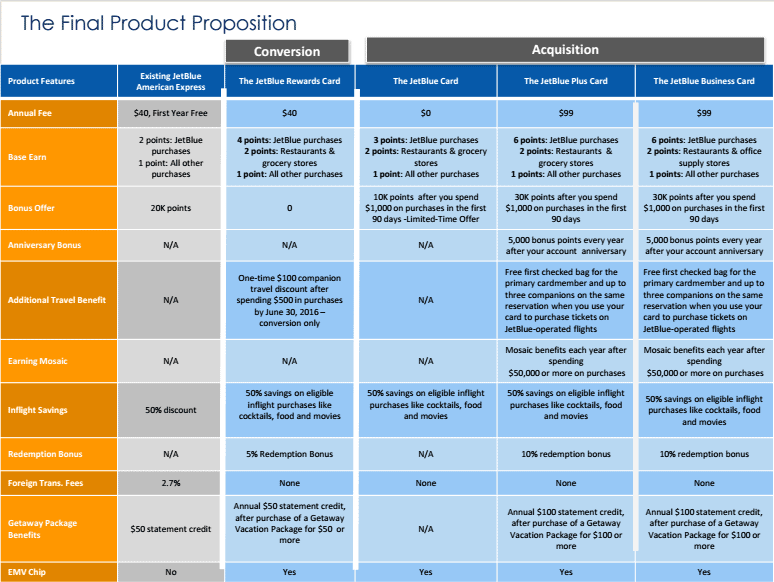

On top of that conversion, Barclaycard now offers three new JetBlue cards:

Here is a summary of their benefits:

Keep in mind that JetBlue points are worth 1 to 1.4 cents toward the purchase of any JetBlue flight with no blackouts, so the 30,000 point bonuses are worth around $400.

I don’t see any reason to get The JetBlue Card. Why waste a credit pull for only 10,000 points worth at most $140 on a card that doesn’t have very good earning power?

I do see reasons to get The JetBlue Plus Card or The JetBlue Business Card. If you fly JetBlue a lot, the 6x earning on JetBlue purchases is a huge rebate (8.4%), the 10% rebate on award redemptions will really add up, the free checked bag will save a lot of money, and the 50% discount on inflight purchases will really add up.

How do I define “a lot”? Maybe 3-4+ roundtrips per year make the cards and their $99 annual fee a good value.

Bottom Line

Barclaycard is taking over JetBlue credit card issuing from American Express. Existing American Express cardholders are getting a new Barclaycard with the same annual fee and better benefits.

Future cardholders are getting three options for JetBlue cards. Skip the no annual fee card, and get the JetBlue Plus Card or JetBlue Business Card if you are a regular JetBlue flyer.

Some airline credit cards like the United, Delta, and American Airlines cards make sense even if you never fly those airlines because you can use the miles on dozens of partners. The JetBlue cards are not like that. You will only get enough value to make the $99 annual fee make sense if you use benefits like 6x points on JetBlue purchases, a 10% rebate on award redemptions, a free checked bag, and a 50% discount on inflight purchases.