MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Updated November 8, 2017

In the last four years, I’ve spent about 18 months total in Argentina, so I wanted to give a quick update on the money situation down there.

From 2010 until December 2015, Argentina had an official exchange rate that was a complete fiction. You could not buy dollars at the official rate.

The market exchange rate often offered 50-100% more pesos per dollar than the official rate, leading to a black market for dollars called the “dólar blue.” During the height of the dólar blue years, savvy travelers eschewed changing money in banks or using ATM cards or credit cards while in Argentina because those transactions were at the official rate. Instead, the play was to bring crisp $100 bills and change them in cuevas, illegal exchange houses.

In December 2015, Argentina’s new president got rid of the official exchange rate, meaning that the Argentine peso now floats freely in the market like pretty much every other currency on Earth. That means that dealing with money down here is almost completely normal, though not quite.

Despite the floating rate, for reasons I don’t completely understand, there is still a black market for dollars that generally offers about 3% more pesos per dollar than the official rate. (I assume it’s because many people in Argentina perform many transactions outside the legal banking system, and that there is a surplus of pesos in this parallel system, so it drives up the value of the dollar on the black market.)

ATMs

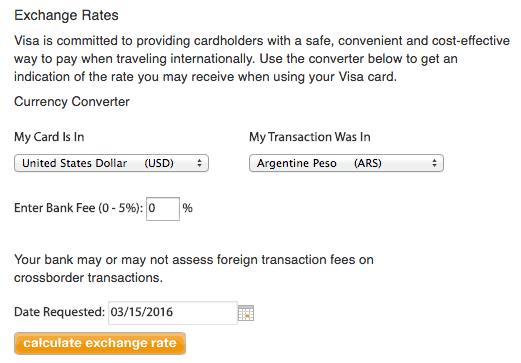

You can use your ATM card at Argentine ATMs, and you will get the fair interbank exchange rate based on the official rate. (If your ATM card has a Visa logo, you can find the rate you will get here; MasterCard here.)

Today the MasterCard rate is 17.67 pesos to the dollar. For comparison, at a bank today, I would have been given 17.53 pesos per dollar (0.8% less) and at a cueva 17.6-17.8 pesos per dollar (up to 0.7% more).

My Charles Schwab Visa card only seems to work in some ATMs, and I can’t figure out the pattern for which ones it works in and which ones it doesn’t work in. Dave and Daniel suggested that it works at ATMs in the Banelco network, and it is true that my go-to ATM is in that network. Here is where you can find the location of Banelco ATMs.

There is a 2,400 peso limit to ATM transactions ($154). You can pull out 2,400 pesos twice in a row without even removing your card, though you will have to pay the ATM fee twice.

There is a 90 peso ($5) fee at the ATM I use. Make sure to get this ATM card, which has no fees worldwide and even refunds the fees that other ATMs charge.

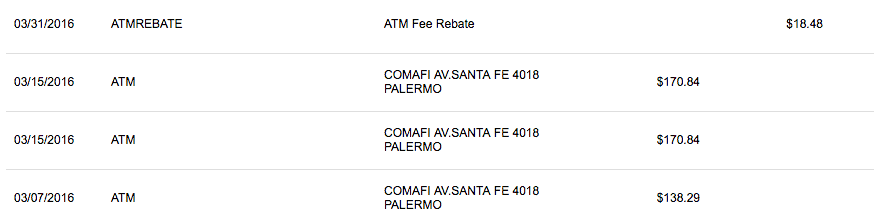

Last year (when the ATM situation was basically identical), each of my ATM withdrawals was for 2,090 or 2,490 pesos after the fee. The 2,490 peso withdrawals worked out to $170.84 according to the Visa exchange rate site above. At the end of the month, I was refunded the 270 pesos worth of ATM fees or about $18 at the time because I have the Charles Schwab card.

Banks

You can freely change dollars to pesos at banks, just bring your passport with you. You should get the rate listed on this site under “dólar oficial” and “compra.” I find the approximately 3% spread between the buy and sell prices to be annoyingly high, but not nearly as bad as at those money exchange places at most airports.

You need crisp $100 bills with no defects to get the best rates.

Cuevas

As mentioned above, I don’t understand why, but the illegal exchange places–cuevas–that existed during the blue dollar years are still operating.

They even offer a slightly different price than banks–sometimes better, sometimes worse, fluctuating between 0.5% and 4% difference recently–which you can check on this site under “dólar informal” and “compra.”

Where are these cuevas? They are throughout the city often “hiding” as gold buying places (“compro oro“). Logically these fixed-location places are safe because they don’t want to ruin their reputations by scamming you with a few fake bills.

There are also touts along Florida Street in the center offering to exchange money. I’d be a lot more hesitant about working with these guys. If they cruise along the streets, they have no reputation to protect.

There are also services that deliver pesos to your door, and in my experience offer the best rates, usually around the mid-point of the buy/sell of the informal dollar rate listed on this site.

I will not give out locations or contact information for any illegal change houses for obvious reasons. Not here, not by email. Don’t ask.

You need crisp $100 bills with no defects to get the best rates.

Credit Cards

In Argentina, cash is definitely king for every day transactions. Many shops and restaurants–including pretty much all the ones I patronize–don’t accept credit cards though major places like chain supermarkets and hotels do. Taxis are also cash only.

However, credit cards are now useful to rent cars or book domestic flights within Argentina at a fair exchange rate. During the blue dollar days, making plans of this nature was a huge hassle.

Uber

Uber started operating in Buenos Aires in April 2016, provoking many taxi protests. The app undercuts the flag drop of taxis by 25% and the per mile rate by 50%.

Because of the per-minute charge though I only find it to be about 20% cheaper than a taxi during the day time and 40% cheaper than a taxi from 10 PM to 6 AM when taxi fares are 20% higher, so I only use Uber with zero or low surge.

Ubers and taxis are both very plentiful in all areas of the city where you’re likely to be as a tourist.

Money Scams

Recently there weren’t any money-related scams that I was aware of, probably because the 100 peso note was the largest, and it is worth about $6, hardly worth bothering to counterfeit.

Now there are 200 ($11) and 500 ($28) peso notes. Soon there will be a 1,000 peso note. My friend who owns a restaurant here is using a pen to test 500 peso bills because he says people have tried to spend a few fakes at his restaurant. I imagine that means that this dormant taxi scam has also returned.

I am, overall, pleased that higher denomination notes are circulating. The good:

- It is ridiculous for the largest bill to be worth $6 if you want to carry hundreds or thousands of dollars-worth of pesos.

- It saves time counting out your ATM withdrawal, your rent payment, your personal trainer’s monthly fee, etc.

- ATM withdrawal limits should rise. They were so low because ATMs constantly ran out of money when they could only be filled with $6 bills.

The bad:

- It can be hard to get change for a 500 peso note in a taxi or businesses with small turnover.

Further Reading

- My Buenos Aires City Guide

- Five Best Restaurants in Buenos Aires

- Buenos Aires Every Night of the Week

- Bariloche Trip Report Part 1 and Part 2

Hey,

The Schwab limit is $2400 per ATM withdrawal and you can do that twice in one day. It appears that newer ATMs accept the Schwab debit card with chip, older ones do not. Galicia always seems to work fine for ,e

OK thanks.

Very helpful story. I’ve delayed visiting Argentina for years because I did not want to carry thousands in cash, even more than I didn’t want to pay a 150-200% premium by exchanging money from plastic at the official rate. If Argentina is like other Latin American countries, by the way, it’s impossible to over-emphasize just how perfect the US currency you bring needs to be. Bills still in the wrappers from the Bureau of Engraving and Printing are best, and my bank gets them for me that way with a few days’ notice.

That level of perfection is definitely not needed here. It is more than sufficient to take out regular $100s from your American bank, inspect each one at the teller’s counter, and ask for replacements for any that don’t look good. But that’s a great tip, and I wasn’t aware of the possibility.

I’ve been to and exchanged money in nearly every Latin country and have never heard of anyone needing bills in the wrapper. They just need to be in good shape with no tears.. If the tears are small then you’ll eventually find someone who will take it.

Thanks for the information. I was wondering about this very thing.

So, bottom line, how much are you making per US$ 100 when withdrawing in atm?

“Making” as in “earning”? $0

You get the interbank rate, which is about halfway between compra and venta on dolar oficial on the linked site.

[…] series of sane decisions by the newly elected government, like letting the currency float freely to eliminate the black market for dollars and terrible distortion to the economy and possibilities for theft by well-connected […]

[…] Mastercard was 0.2% better for Argentine peso transactions on Friday (changing $100 bills would have been another 0.2% better) […]

[…] to $2400 Argentinian pesos with a $6 USD fee. You can read more about using ATMs in Argentina here. There is also a bank located inside the airport that offers a fair exchange rate. There are two […]

[…] Argentina money situation 2017. Is there still a black (blue) market? […]

Hi, can you tell me where you can cash an American Express Travel®ers Check? Im looking for a legal place, but one I went to asked me for local work papers, which I dont have cause im on vacation.

Try this locator tool to find a place near to your location.

Wish what you said was true through the rest of Argentina. We entered on the road through Chile Chico and could get NO cash anywhere. Cards did not work in ANY atms and banks smiled and said go away we only handle member customers. Through all of southern Argentina we exchanged with bartenders and hotel clerks. It’s a really bad system.

Hello,

My husband returned from Argentina with 10,137 pesos. Any idea how we can exchange them back to USD here in the states? We have tried banks, money exchange kiosk etc.

Thanks,

Kristal

Hi Kristal: post on a forum in your city to find someone traveling to Argentina. Perhaps they will purchase them from you. I’m heading down late this year, and live in the Seattle area

I am heading to Argentina in mid February…I am in Asheville, NC now, but I’ll be in Chicago at the end of January. If you still want to exchange pesos and you are nearby either of those places at those times, email or message me and we’ll hash out a plan.

Thanks,

Gayle

Hi Scott and thanks a lot for the info.Do you know if there are ATMs in Buenos Aires where you can actually withdraw US dollars with your debit card?

Nope there aren’t. Much much easier just to bring cash. Been doing it for years now.

Hi, i need to buy two dollar checks in

Arg to pay back two loans i have in the States. The amounts are about $120m ea. The money comes from the sale of an apt.

Is ot possible to convert these $$320m into these two checks legally and safely?

Im not an Arg resident, although i owned this apt there for 9 years

Schwab D card is good usually works tried 4x in France and they replace the FEEs @ end of statement not right away .. I always bring 3cc and 2 debit cards I just use them to c if they work .

Great Tip I would HATE to use BMO ($$$) there .

Thanks SCOTT !!!!

Do the cuevas charge a commission? It looks like there’s only a 1.8% difference between the dólar blue rate and the MasterCard rate right now.

If there’s any sort of commission, it doesn’t even make sense to bring cash.

There is a buy/sell spread but no commission. Today it doesn’t make sense to bring dollars. At 3%, it will depend on the person.

Scott,

Do not lead people astray by saying do not bring dollars. Yes, that’s true (maybe) in Buenos Aires, but in the rest of Argentine (a very large place) it’s not true at all. If you don’t have USD$100 dollar bills to exchange you get no pesos.

Argentina’s financial system today, in December 2017, is still very messed up. In BA cards will work, but in other parts of the country they will NOT.

I was just there in October and when I came back I couldn’t even exchange my pesos (another problem) back into dollars here in airport exchanges because banks here feel the Argentine economy is too unstable.

The bottom line is, be prepared.

Tom

Can someone tell me what is the minimum amount of money embassy request to people stay 10 days in argentina please?

I just got back its not a big deal at all – exchange whatever currency you want to pesos in BA at a money exchange or some banks right downtown. We used ATMs in places other than BA when we ran out and most places took USD – we are Canadian that wasn’t as easy, I don’t think they wanted our CDN $ in Salta but they took USD as did most other places and we paid by credit card – we just budgeted so we didn’t bring pesos home. I think I have a couple hundred, we had a great trip.

1. Regarding the above section about Taxis vs Uber, it seems there are multiple scams where taxi drivers switch out fake bills on riders. To avoid cash transactions, wouldn’t it be better to take Uber so that all fares are charged to my cc card and I don’t have to worry about using up my cash or about fake money scams? I wouldn’t mind if Uber fares were equal to taxi fares, just simply to avoid using cash and all the complications that brings. What does everyone else with Argentine experience think?

2. How about Radio Taxis? Are they anymore honest?

3. What about a Remis? Is this a good option to taxis or Ubers, or has the Remis mostly disappeared with the rise of Uber?

1. I live in Buenos Aires for the majority of the year…made it my base over five years ago. As far as I know, I have never been ripped off by a cab driver in the way you describe (with getting fake change). You used to hear about that happening, and maybe it still does, but I don’t think I’ve heard anyone mention it in a long time. The bigger scam which has happened to me various times, in taxis all over South America, is getting the run around on where they’re taking you. As in, they drive an extra long route or take you to the entirely wrong location, just so they have to drive back in the other direction, to increase the fare. Obviously this was more of a problem when I first arrived to BA, as I am oriented in the city now and would stop them from doing it if they tried. In short, yes, using Uber avoids all of these types of problems.

2. People say Radio taxis are the more legit ones. I’ve never made an effort to chose one or another…though most seem to be Radio taxi anyways. In my personal experience the majority of taxi drivers are kind people here in BA. Not many negative experiences to report.

3. Getting the number of a trusted Remis can be good… I have one that I use to send to the airport to pick up visitors that otherwise would be tired, without cell service, and might find the whole Uber thing a bit confusing upon arrival. Ubers can’t come right up to the arrivals parking lot at any airport as there is long standing beef between taxi and Uber here (technically Uber is still illegal I think)…so you have to meet the in a lot a bit removed from the traffic. But in general, no, remis’ are not a better option than Uber. They are significantly more expensive and don’t provide all the protections/recourse that Uber does.

Thanks Sarah for your insight. I wasn’t planning to use Uber to and from the airport because my hotel arranged those 2 transportation needs. I was more thinking of when I want to travel in the city a distance too far to walk, or at night if I’m trying to get back to my hotel from another part of the city. Do you still think a taxi is as reliable as an Uber or a remis? I’m just preferring not having to use cash for the Uber since everything would get charged to my c card, even the tip too. One hears all the stories of handing taxi drivers cash and they switch the bills and cause a scene. Would I just be able to call a radio taxi or remis wherever I am? Are they quite fast? Do they accept a credit card? Or is it cash only?

I would just use Uber for ease. Easy Taxi is an app you can use to call city taxis, which is a backup in case Uber is surging too much. You can pay with credit card on the EasyTaxi app too.

if anybody would be interested in exchanging their house for my house in medellín part of the year, please contact me ulearnonline arroba gmail dot com

i am in a great laureles location. i am interested in seeing and living in argentina!

There is clearly fees with ATM and the casas de cambio apply unfavourable rate. Just discovered a new mobile app for my next trip Fairswap. It allows to exchange cash currency in real-time by meeting with each other at a pre-agreed location.

Widely, you can post your need in foreign currency and if there is someone nearby facing the reverse need, then he can contact you and you will meet him and make the swap.

Hi Sara, I would like to check in on the current situation with money in Argentina. I just got the Charles Schwab ATM card that you recommended in another post. We will be arriving in Buenos Aires by ferry from Colonia. Spending a few days in BA, then doing the “grand tour” Iguazu/Salta/Quebrada de Huamahaca/Bariloche/El Calafete/Ushuia and back to BA for a month. Not crazy about carrying a lot of cash on me. Any words of wisdom on both what we should do regarding money and cell phone service (I have an unlocked phone and a terrible US plan) would be GREATLY appreciated. We will need both money and a simcard as soon as possible upon arriving at the ferry dock.

Thanks!

When is your trip?

Hi does anybody know who or where I can get in contact with anybody to find out the Value of a old Argentinean bill I have. if so could please email me @ msbatella@gmail.com

Just emailed you.

[…] savvy traveler could fetch anywhere from 50% to 100% more pesos per dollar in these “illegal” exchanges. The elimination of that fixed exchange rate when Mauricio […]