MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

- Honeymoon Around the World: Part 1 (this post)

- Honeymoon Around the World: Part 2 (future post)

- Honeymoon Around the World: Part 3 (future post)

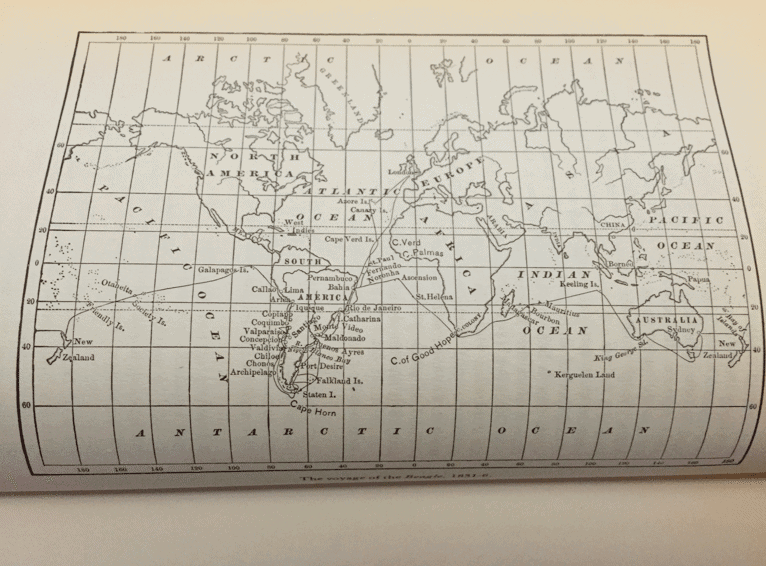

This story is a breakdown of our Round-the-World honeymoon, and how we did it using advice from MileValue! For a total of 345,000 miles and $802.20 dollars out of pocket, the two of us flew to all of these places over the course of two weeks:

- Phoenix to Los Angeles in American Airlines BusinessFirst

- Los Angeles to Abu Dhabi in Etihad First Class

- Abu Dhabi to The Maldives in Etihad Business Class

- The Maldives to Bangalore in Air India economy

- Bangalore to Abu Dhabi in Etihad Business Class

- Abu Dhabi to Sydney in Etihad Business Class (A380)

- Sydney to San Francisco in Qantas economy

- San Francisco to Phoenix in American Airlines BusinessFirst

How We Did It

Our honeymoon goals became apparent pretty quickly after some discussion with my then fiancé. We wanted to lounge on island and then explore Australia.

We love doing things in a value-chic fashion, so I was curious to see how we could stretch our miles to reach our desired destinations while also flying in style. While we usually always fly economy I thought it would be nice to splurge on the majority of the long haul flights since this was a special occasion.

Our Miles Balances

Our miles situation was not terrible, but not great either. We are both good savers and I had approximately 210,000 miles in my American Airlines AAdvantage account that I had garnered from US Airways flights and from the US Airways Barclaycard which is now the AAdvantage Aviator Card.

Our last big trip was the World Cup in Brazil, 2014, so I had been saving for a while. Through work I would take occasional international trips to destinations like China and India and made sure to always fly partners that would get me American Airlines miles. I’d book those flights using the US Airways Barclaycard to get 2X miles. I’d also make work expenditures using my personal card and would get reimbursed later, a great way for me to get miles without spending a dime. My fiancé does not travel for work and so only had 25,000 American Airlines miles in her account.

How I Found MileValue

Since the American Airlines/US Airways merger switched us from Star Alliance to oneworld I was suddenly left unfamiliar with the strategies needed to be successful within the new alliance now holding our miles. I decided to turn to the web by googling ‘American Airlines reward strategies’ or something similar, and found MileValue and the world of travel hacking! Specifically, I found Scott’s in-process compendium on redeeming American Airlines miles.

Pretty quickly into my MileValue experience I learned that there was another American Airlines co-branded credit card out there and we could both sign up for it to get a lot of miles in a hurry. My fiancée and I both signed up for the AAdvantage Platinum Select card by Citi. After meeting the minimum spending requirements we would receive infusions of 50K each, and the first year’s annual fee would be waived for us both.

Planning the First Portion of the Trip

I began heavier research into how we could stretch our miles to fly in style, and not long after Scott published this post that talked about luxury air travel.

I realized that luxury air travel between the US and Australia was tough to come by and at insane prices (sometimes 200k miles or more for one-way travel!), however, it looked like Etihad award space was pretty wide open and only 90k one way for first class. I had no clue where Etihad flew, but after a brief route map search I realized that they flew to the Maldives. This was an island (one of our goals) and my fiancé had shot down my other destination options as not being ‘Honeymoon-worthy’ so I was excited to see that the Maldives were ranked as the second best Honeymoon destination in the world according to some websites.

Award Searching and Booking

I had no clue how to search for availability since Etihad is a partner of American Airlines but not part of the One World Alliance. That’s where Scott came to the rescue again, with this post about redeeming American Airline miles on Etihad flights.

In the wee hours of the morning one day, I found two First Class seats open between Los Angeles and Abu Dhabi. Excitedly I called American and fed the agent the flight information. They were also able to create First Class routings from our home city, Phoenix. Unfortunately, they were only able to get us economy tickets from Abu Dhabi to the Maldives. I still booked the route with the understanding that I would be able to trade up if First Class tickets opened up to the Maldives from Abu Dhabi. I felt accomplished that I had at least set up the first portion of our trip via Etihad– one of the nicest carriers in the world– and in their Diamond First Class Suite product leaving on a Saturday!

All of this was 90k miles per person (180k total miles) and $7 each ($14 total) in taxes!!! I have no idea why the taxes were so little, but I did not complain!

With the miles in my coffer down to approximately 30k, I waited as I slowly built up credit card purchases to equal the minimum spending required to earn the sign-up bonus of 50K miles from the Citi AAdvantage Platinum Select card. Additionally, I had to spend more time focusing on wedding planning with my fiancé and unfortunately, we had a water leak at our home, which had me fighting with the insurance company for the majority of my free time. These things forced me to put down our honeymoon planning for a few months and when I returned, the landscape had suddenly changed.

[…] Honeymoon Around the World: Part 1 […]

[…] Honeymoon Around the World: Part 1 […]

[…] Around the World: Part 1, Part 2, Part […]