MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

According to the internet, a new round of people have been targeted for the 100k Amex Platinum offer. Time to check again! I still haven’t been targeted for this yet 🙁 but I hear of friends/family that do each time a new round of targeted customers surfaces. Hat tip to Doctor of Credit.

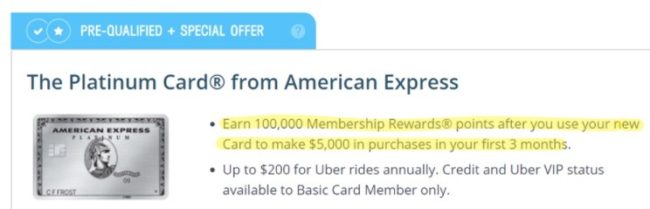

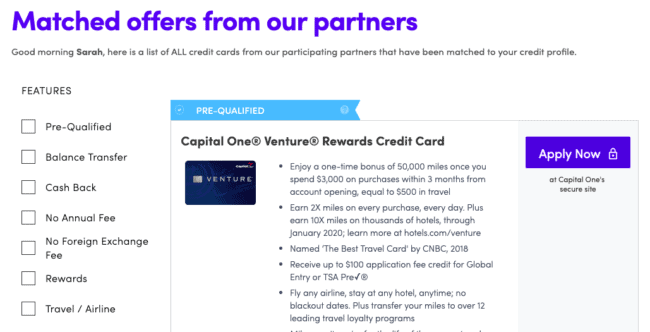

There is a targeted offer available through creditcards.com’s CardMatch Tool for 100,000 Membership Rewards for spending $5,000 on your new Platinum within three months of account opening. This 100k offer resurfaces pretty regularly, so while not uncommon, it is worth checking again if you weren’t targeted the last time as they seem to target different rounds of customers each time.

The current public offer is 60,000 Membership Rewards for spending $5,000 in three months, so this targeted offer is significantly better. I value Membership Rewards around 2 cents each, making it worth a whopping $800 more.

You can only get the bonus on an American Express card once per “lifetime”. Amex records seem to drop off for people around seven years, so in their terms a “lifetime” is about that long.

However if you were targeted for an American Express offer, sometimes you can still be approved even if you have had the card before. You’ll need to check the offer terms to see if it reads, “Welcome bonus offer not available to applicants who have or have had this product.” If it says that in the terms, then the loophole doesn’t apply. If it doesn’t say that in the terms, then it shouldn’t matter if you’ve had the card previously and you’re eligible for this offers’ bonus.

How to Check if You’re Targeted

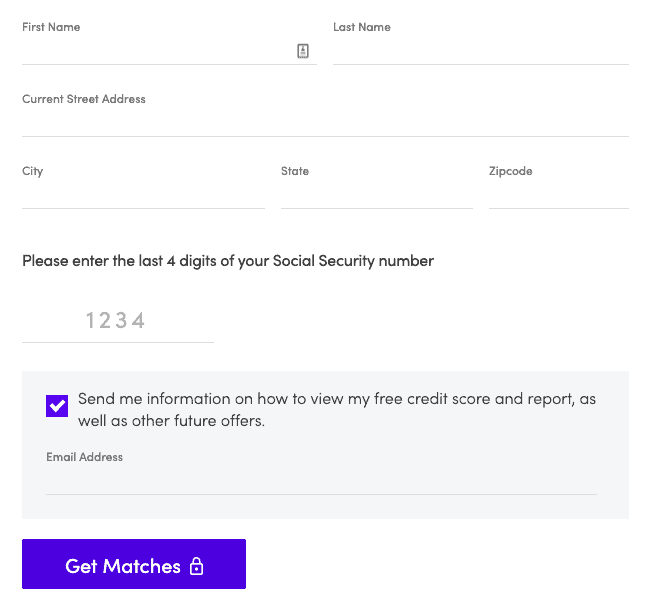

Click here to navigate to the CardMatch tool. Fill in the information requested on the landing page, and click GET MATCHES at the bottom of the form.

Don’t worry, the site specifically states that a hard credit score will not be performed (so your credit score will not be affected).

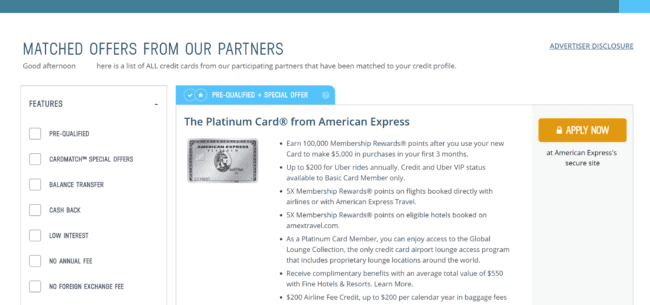

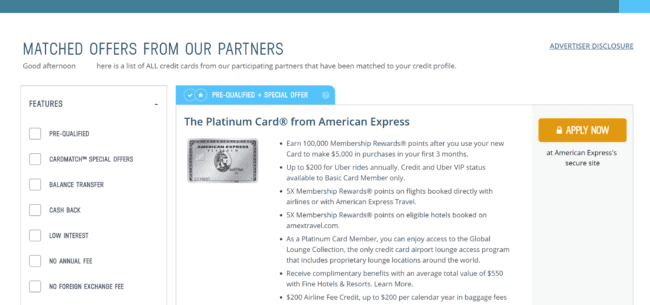

Hopefully you see something like this (note that creditcards.com reformatted their site since this screenshot was taken, so it looks a bit different)…

I was not targeted but have friends and family that are and have been in the past.

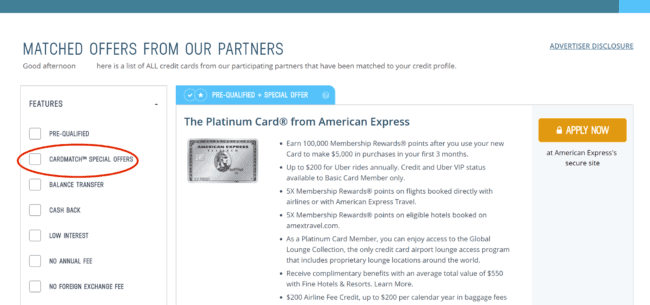

Some people’s 100k offer shows up right away on the landing page after clicking GET MATCHES, but some may need to click CARDMATCH SPECIAL OFFERS in the toolbar on the left side of the landing page in order to reveal the 100k Platinum offer. Note that not everyone will have the CARDMATCH SPECIAL OFFERS box to check, so if you don’t see it, doesn’t mean something’s wrong with yours. It just means you weren’t targeted.

I, for example, was not given the “CARDMATCH SPECIAL OFFERS” box in the FEATURES column on the left-hand side of my screen. Some people are, some people aren’t. This is what my Cardmatch Tool results screen looks like:

Current Public Offer

The Platinum Card from American Express comes with 60,000 Membership Rewards after spending $5,000 in the first three months. Membership Rewards transfer to around 20 hotel and airline programs including Delta, Singapore, Etihad, Virgin Atlantic, and British Airways.

Summary of Benefits

The card has a $550 annual fee. But it comes with huge benefits like airline fee reimbursement (which you can also use to buy airline gift cards), airport lounge access, hotel status, $200 in Uber credit, $100 in statement credits for Saks Fifth Avenue purchases, and a 5x category bonus for purchases directly from airlines and prepaid hotels booked on amextravel.com. For more info on setting up and maximizing the benefits, see Get the Most Out of Your Platinum Card.

The targeted 100k offer comes with the same benefits package.

A $550 annual fee sounds scary, but it shouldn’t phase you if you travel often. You’ll get $200 in airline incidental fee credit (or if you don’t spend on incidentals, buy an airline gift card(s)) in 2019, another $200 in airline incidental fees/gift cards in 2020 before your second annual fee is due, $200 in Uber credit per year doled out monthly, and access to American Express Centurion Lounges (which are the nicest domestic lounges), Priority Pass lounges, as well as International American Express lounges and Airspace lounges for a year for that price. Not to mention the 100,000 bonus Membership Rewards should be worth roughly $2,000 if you transfer them to partners for one or several high value awards.

Eligibility

As I said above, you can only get the bonus on an American Express card once per lifetime, a “lifetime” being roughly seven years. However, targeted offers are the one loophole to the Amex “Once in a Lifetime Rule”. Scan the offer terms and conditions to see if the loophole applies to your targeted offer. If you currently hold or have held this card before, the terms must not contain any language referencing ineligibility. Do not apply if it does.

There are a few other things to remember when considering your eligibility for Amex cards. Read Issuing Banks Rules for Approvals and New Bonuses to learn more.

Keep an Eye Out for the Amex Gold

There’s also an elevated bonus for the Amex Gold Card floating around on Cardmatch right now: 50,000 Membership Rewards for spending $2,000 within three month. You can check if you’re targeted the same way as outlined in this post.

Bottom Line

Check to see if you’re targeted for a 100,000 Membership Rewards bonus for the American Express Platinum Card or for a 50,000 Membership Rewards bonus for the Amex Gold Card. No hard credit pull is performed when using the CardMatch Tool.

Good luck! Post your application results in the comments.

Might be nice but the CardMatch site never works. Neither my wife nor me are found, despite trying three former addresses as well as the current one. I emailed them for help.

That’s too bad. I’ve come across two friends who have both been found/matched via CardMatch though. It does work, but of course YMMV.

Same here, the CardMatch site never works for me or my wife. Shows a bunch of worthless cards and sometimes Chase but never AMEX cards. Very strange and my FICO score is over 740.

” View from the Wing reported needing to click CARDMATCH SPECIAL OFFERS in the toolbar on the left side of the landing page in order to reveal the 100k Platinum offer.”

I do not get that on the left of my landing page.

Only “Features” and “Banks.”

Do I need to log in or something?

Meant to say “Features” missing that SPECIAL OFFERS” option.

I don’t get the CardMatch special offers drop-down either after I login. I think it just depends on the person.

The article mentions twice that you can only get the bonus on an American Express card once per lifetime but then goes on to say that targeted offers are a loophole to that rule. So, if targeted, you can get the 100k bonus even if you received it before?

Yes, it’s possible. Not guaranteed but possible.

I never had any luck with cardmatch, but I was able to get Amex Platinum 75000 MR point offer after 5K spend in 3 months today by using VPN routing to Dallas from my current location (Florida).

[…] applying for this offer, read 100k Amex Platinum Targeted Offer is Back! to learn how to check if you’re targeted for the 100,000 Membership Reward bonus offer on the […]

Thanks for alerting me to this targeted offer! I checked Cardmatch earlier today and found I was targeted, applied just now and got instant approval. A few DPs: I’ve never had this card, credit scores above 800 and at 4/24 prior to this approval on recent credit card applications which I know is more of a Chase thing than Amex thing. Not sure how much any of this came into play. I’ve purposely been slow-playing applications waiting for offers like this one to pop up.

Nice congrats!

Sarah,

Thank you very much for sharing this, I have been patiently waiting an offer on the Amex 100K and have never received anything except for the Blue Cash Rewards. I was googling and your site came up with this article. At first I was skeptical about using the CardMatch tool worried about a HP and not even get the offer I’ve been waiting, but I decided to pull the trigger and BoooM!!! I just got approved with the 100K instantly! Only 26 with a score of 787!

Thank you Ralph for your comment which indicated me that I still had a shot since you applied days ago!

Awesome! And seriously, using the CardMatch tool does NOT trigger a hard credit pull. I would not lie about that, and neither would their terms.

“You’ll get $200 in airline incidental fee credit (or if you don’t spend on incidentals, buy an airline gift card(s)), another $200 in airline incidental fees/gift cards in 2018,”

You will get two $200 credits in 2018, or should this say one in 2018 and one in 2019?

Oops, forget my comment. I found your other article that explains.

You’re right though…for complete clarity I updated that sentence to say 2019.

I checked and I was targeted this time around. Started application last night, 5/31 but got sidetracked. I went in this morning to finish… and offer had been removed. Poor decision by me to not think about month end!!!

Bummer! Keep checking cardmatch periodically. It comes and goes.

I went on the Amex 60 second Pre-Qualification site a few nights ago and got offered the Hilton no annual fee card, 100k points w/ $1,000 spend in three months.