MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This past February, I applied for a number of cards, including the Citi Hilton Reserve. I got the card for the free Hilton Gold status and the big benefit:

- Earn 2 weekend night certificates good at select hotels and resorts within the Hilton HHonors portfolio after $2,500 in eligible purchases within 4 months of account opening.

I am excited to report that I now have my free night certificates!

What was my experience? How did I receive the certificates? How quickly did they arrive? Where am I thinking of using them?

I originally applied for the card on February 16. I applied online, and after a quick call to Citi’s reconsideration line, I was approved. I received the card in the mail less than two weeks later and activated it.

In order to receive the two free weekend nights, I had to spend $2,500 within four months of the account opening. I met this spending requirement on my statement that closed on June 10. I met the requirement in about three-and-a-half months. Over that time period, I kept track of how much I had spent and how much more I had to go using my Citi online account. When I was sure that I had spent $2,500, I tucked the card away and moved my spending over to another card.

The Terms and Conditions for this card state, “Please allow 6-8 weeks after purchase requirements have been met to receive your certificate.” I received mine after only four weeks.

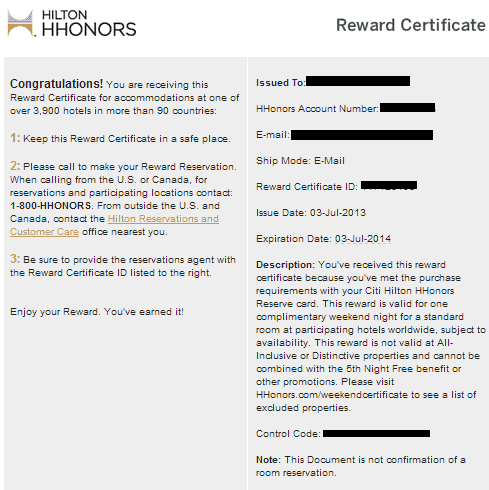

On July 12, I received two separate emails from Hilton HHonors that each contained the following e-certificate. Each certificate is good for one weekend night stay at select Hilton hotels.

Interestingly, the certificates were issued on July 3 but were not sent to me until July 12. They expire one year after the date of issue — July 3, 2014 in my case.

Because you earn two one-night certificates, you don’t have to use them consecutively or even at the same property.

I plan to use my free nights at top-tier Category 10 Hilton hotels that can go for up to $1,000 a night, so that the card can give me a little taste of luxury I otherwise could never afford.

In addition to the certificates, I have earned about 8,400 Hilton points by spending $2,800 on the card at its base earning rate of 3 Hilton points per dollar. This is actually enough points for a free night at a Category 1 hotel and almost enough for a night at a Category 2 hotel.

Recap

It took me a total of five months to receive the biggest perk that the Citi Hilton Reserve offers–two free weekend nights at Hilton hotels across the globe.

The only question is: Where am I going to redeem my two nights? Any suggestions?

Citi® Hilton HHonors™ Reserve Card with Two Free Nights worldwide at top tier Hiltons after spending $2,500 in four months

Application Link: Citi® Hilton HHonors™ Reserve Card

I applied April 29, and received the two certificate emails July 12 with the same July 3 2014 expiration date.

I applied April 29, and received the two certificate emails July 12 with the same July 3 2014 expiration date.

I just received mine too. Curious as to where there are some nice places to stay. Was thinking that I could use them in Paris on an upcoming trip, but Hilton has crap hotels there…Hyatt has the expensive ones there.

I’m checking out some options and will be posting about them soon!

I just received mine too. Curious as to where there are some nice places to stay. Was thinking that I could use them in Paris on an upcoming trip, but Hilton has crap hotels there…Hyatt has the expensive ones there.

I’m checking out some options and will be posting about them soon!

I’m planning to pick this card up to use in Moorea Aug ’14 (already have 4 nights booked in Bora Bora) . The timeline is good info as I was wondering how the expiration date.

I’m planning to pick this card up to use in Moorea Aug ’14 (already have 4 nights booked in Bora Bora) . The timeline is good info as I was wondering how the expiration date.

Have you considered a stay at the Conrad Koh Samui? Or perhaps Conrad Maldives?

Have you considered a stay at the Conrad Koh Samui? Or perhaps Conrad Maldives?

I’ll look into them! Thanks for the tip.

Using the certificates is quite easy, just call Hilton and they will reserve a room for you, assuming availability. I used mine for one night in Amsterdam and one ing in Vienna. Not cat 10 hotels, but the best places I could get before they expired. The weekend aspect is somewhat limiting, but I’m sure you will make it worthwhile.

Using the certificates is quite easy, just call Hilton and they will reserve a room for you, assuming availability. I used mine for one night in Amsterdam and one ing in Vienna. Not cat 10 hotels, but the best places I could get before they expired. The weekend aspect is somewhat limiting, but I’m sure you will make it worthwhile.

Sadly, I think the max redemption is cat 6 or 7

Sadly, I think the max redemption is cat 6 or 7

Luckily that’s not true, and we’re good up to Cat 10 –> https://milevalu.wpengine.com/was-the-citi-hilton-reserve-just-majorly-devalued/

Awesome! Glad I read this blog!

It took that long to spend $2500? I’ll chalk that up to you being in south America. Nowadays one 15min stop at a grocery / drug store can take care of that spending.

Being in South America forced me to get a little creative with my spending.

It took that long to spend $2500? I’ll chalk that up to you being in south America. Nowadays one 15min stop at a grocery / drug store can take care of that spending.

Being in South America forced me to get a little creative with my spending.

Inst Citi a very difficult card issuer to manufacture spend? I hear lots of people have been shutdown for doing this. I have used my card for my regular spend cause I am not sure how citi will view VR or Gift cards, since they are considered cash advances. Can someone elaborate how that is done. TIA !

I booked my two free night at the Conrad in Tokyo, and had no problems with the booking over the phone. Hopefully everything will be correct in their system when we actually arrive.

what is considered a weekend…..fri, sat, sun night or just fri, sat?

Fri, Sat, and Sun nights

Applied in Nov 2013 & used certificates @ Cavalieri in Jan. We’ll spend 10k on card this year (VRs) to generate another free night certificate.

Just used my certs. at the Grand Wailea on Maui. Not a bad use of for the rooms. Was also upgraded because Gold came with the card. Also, no resort fee, a $40 meal certificate, a bottle of Chateau St. Michelle Sparkling wine and a couple drink tickets worth $40.. Nice place for families in the summer but not for a couple.

I have yet to receive mine but should be notified soon since I just met my 2500. I have accumulated over 20k points in the last 3 months using honors points, Erewards 7000 transfers ( I have too many United miles). I expect to continue spending on this card as well ( have not manufactured a single cent to this day) since I think it has value for some properties. Thinking of Hong Kong hilton or Tokyo.

Neither my wife nor I received them automatically. Apparently this is quite common. Had to SM Citi for them.

How long did you wait?

How long did it take for gold status to post to your account?

Should be pretty much instantly after opening the card.

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]

[…] you’ll have one year after the free night certificates are issued to use them, and they are issued about six to eight weeks after you meet the minimum spending requirement. Read the full offer terms and […]

[…] When Will You Get Your Hilton Reserve Card’s Two Free Night Certificates? […]